Fillable Lady Bird Deed Form for Michigan

Michigan Lady Bird Deed - Usage Guidelines

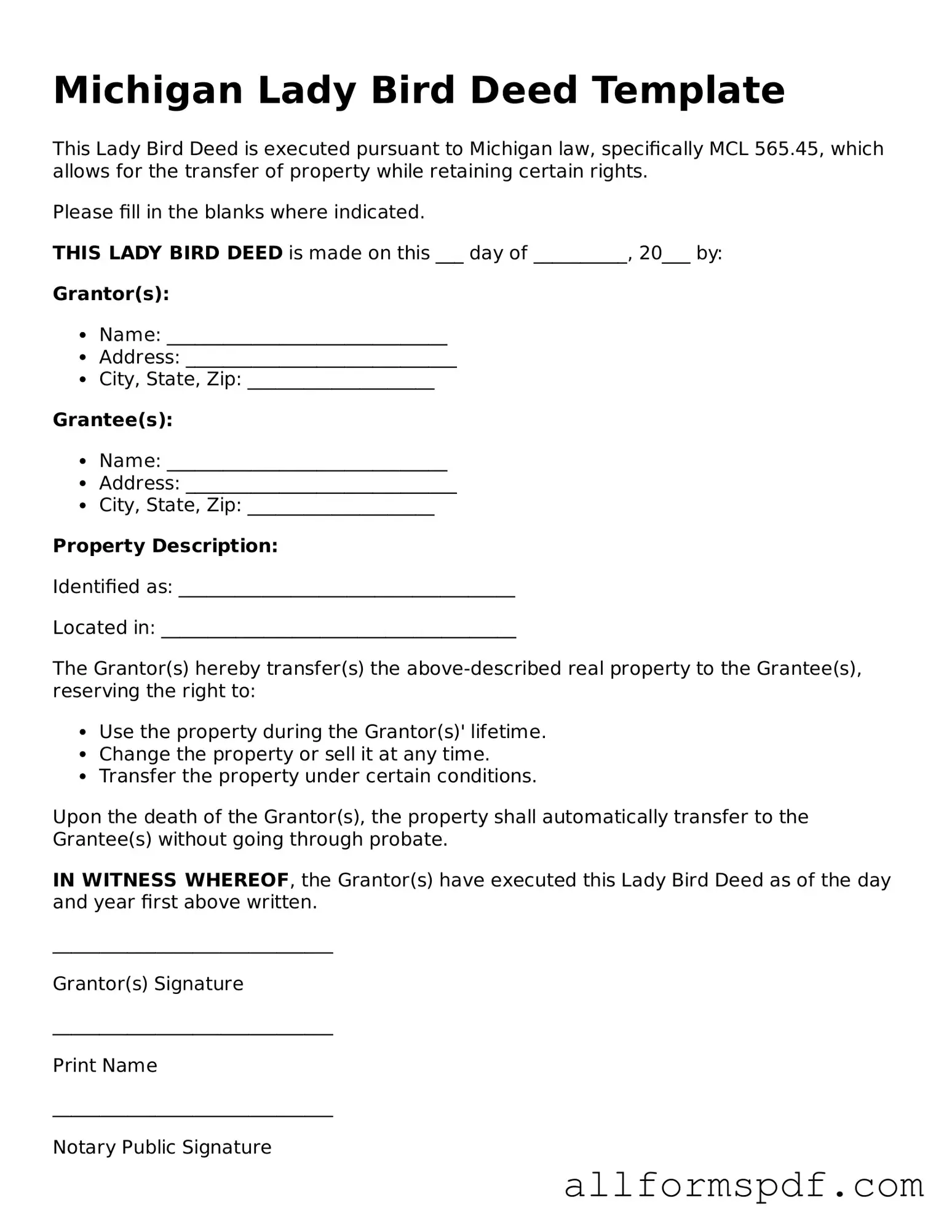

Filling out the Michigan Lady Bird Deed form is an important step in ensuring that your property is transferred according to your wishes. Once you complete the form, it will need to be signed and notarized before being filed with the appropriate county register of deeds. Here’s how to fill out the form step by step.

- Obtain the Form: Start by downloading the Michigan Lady Bird Deed form from a reliable source or obtain a hard copy from your local legal office.

- Property Description: Fill in the legal description of the property you are transferring. This can typically be found on your property deed or tax documents.

- Grantor Information: Enter your name as the current owner (the grantor). Include your address and any other required identifying information.

- Grantee Information: Next, provide the name and address of the person or persons who will receive the property (the grantee). Make sure to include all necessary details.

- Transfer Details: Specify the terms of the transfer. Indicate that the property will be transferred upon your death, retaining your rights during your lifetime.

- Sign the Form: Once all information is filled out, sign the form in the designated area. Your signature must be witnessed or notarized.

- Notarization: Have the form notarized by a licensed notary public. This adds a layer of authenticity to your document.

- File the Document: Finally, take the completed and notarized form to your county register of deeds office for filing. There may be a small fee associated with this process.

After filing, it’s wise to keep a copy of the deed for your records. This ensures you have documentation of the transfer and can reference it in the future if needed.

Misconceptions

The Michigan Lady Bird Deed is a specific estate planning tool that can often lead to misunderstandings. Below are some common misconceptions about this deed form, along with clarifications for each.

- It is only for married couples. The Lady Bird Deed can be used by any property owner, regardless of marital status. Single individuals, friends, or family members can also utilize this deed.

- It avoids probate in all situations. While a Lady Bird Deed generally helps avoid probate for the property it covers, other assets may still be subject to probate. It is important to consider the entire estate.

- It transfers ownership immediately. The Lady Bird Deed allows the current owner to retain control over the property during their lifetime. Ownership transfers only upon the owner's death.

- It eliminates property taxes. The Lady Bird Deed does not exempt property from taxes. The property will still be subject to local property taxes, which remain the responsibility of the owner.

- It is only beneficial for real estate. Although primarily used for real estate, the principles of a Lady Bird Deed can inform other estate planning strategies, but it specifically applies to real property.

- It cannot be revoked or changed. A Lady Bird Deed can be revoked or modified by the original owner at any time before their death, as long as they are mentally competent.

- It is the same as a traditional transfer on death deed. While both deeds allow for transfer upon death, the Lady Bird Deed offers additional benefits, such as retaining control over the property during the owner's lifetime.

- All states have the Lady Bird Deed. The Lady Bird Deed is specific to Michigan. Other states may have similar instruments, but the laws and regulations governing them can vary significantly.

Understanding these misconceptions can help individuals make informed decisions regarding estate planning and property transfer in Michigan.

Dos and Don'ts

When filling out the Michigan Lady Bird Deed form, it's essential to approach the process with care. Here are some helpful tips on what to do and what to avoid.

- Do ensure that you have the correct legal description of the property. This information is crucial for the deed to be valid.

- Do clearly identify the beneficiaries. Be specific about who will inherit the property to avoid any confusion later.

- Do sign the deed in the presence of a notary. This step adds an extra layer of legitimacy to your document.

- Do keep a copy of the completed deed for your records. Having a copy can be helpful in the future.

- Don't leave any sections blank. Incomplete forms can lead to delays or legal issues down the line.

- Don't use vague language. Clear and precise wording helps prevent misunderstandings regarding your intentions.

- Don't forget to check state-specific requirements. Each state may have unique rules regarding Lady Bird Deeds.

- Don't overlook the importance of consulting a professional. A legal expert can provide valuable guidance throughout the process.

Popular State-specific Lady Bird Deed Forms

Lady Bird Deed North Carolina - Generally, no court involvement is required, simplifying the inheritance process significantly.

Completing a Non-disclosure Agreement form is crucial for anyone in Arizona wanting to safeguard sensitive information and maintain confidentiality during business dealings. It serves as a protective measure for proprietary data and trade secrets, ensuring that all parties involved uphold privacy standards.

Common mistakes

Filling out the Michigan Lady Bird Deed form can be a straightforward process, but many people make mistakes that could lead to complications later on. One common error is failing to include all necessary parties. When you prepare the deed, ensure that all individuals who have an interest in the property are listed. This includes not just the current owner but also any co-owners or beneficiaries. Omitting someone can create disputes or even invalidate the deed.

Another frequent mistake involves incorrect property descriptions. The Lady Bird Deed requires a precise description of the property being transferred. This means you should provide the legal description as it appears on the current deed, not just the address. If the description is vague or inaccurate, it may cause issues in the future, especially when it comes to transferring the property or when the property is sold.

People often overlook the importance of signing and notarizing the deed correctly. The deed must be signed by the grantor in the presence of a notary public. If the signature is missing or the notary's acknowledgment is not properly completed, the deed may not be legally binding. Always double-check that the signatures are clear and that the notary has filled out their section appropriately.

Lastly, failing to record the Lady Bird Deed can lead to problems down the line. After completing the form, it must be filed with the county register of deeds. If you neglect this step, the deed will not be recognized by the public, which could result in confusion or legal issues regarding ownership. Recording the deed ensures that your intentions are clear and legally enforceable.

Key takeaways

When considering the Michigan Lady Bird Deed form, it is important to understand its purpose and how to use it effectively. Here are some key takeaways to keep in mind:

- The Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining the right to live in and control the property during their lifetime.

- This type of deed can help avoid probate, making the transfer of property smoother and more efficient after the owner's death.

- It is essential to ensure that the deed is properly executed and recorded with the county register of deeds to be legally valid.

- The form must include specific language to create a Lady Bird Deed; using a generic deed form may not suffice.

- Property owners can change their mind at any time and revoke the deed, as long as they are still alive and mentally competent.

- Beneficiaries named in the deed do not have any rights to the property until the owner passes away.

- Consulting with a legal professional is advisable to ensure that the deed meets all legal requirements and aligns with the owner's wishes.

- Consideration of tax implications is crucial, as the property may still be subject to estate taxes, depending on the overall estate value.

Understanding these points can help make the process of filling out and using the Michigan Lady Bird Deed form clearer and more manageable.