Fillable Articles of Incorporation Form for Michigan

Michigan Articles of Incorporation - Usage Guidelines

Filling out the Michigan Articles of Incorporation form is an important step in establishing your business. Once you have completed the form, you will need to submit it to the appropriate state office along with any required fees. This will officially register your corporation in Michigan, allowing you to operate legally within the state.

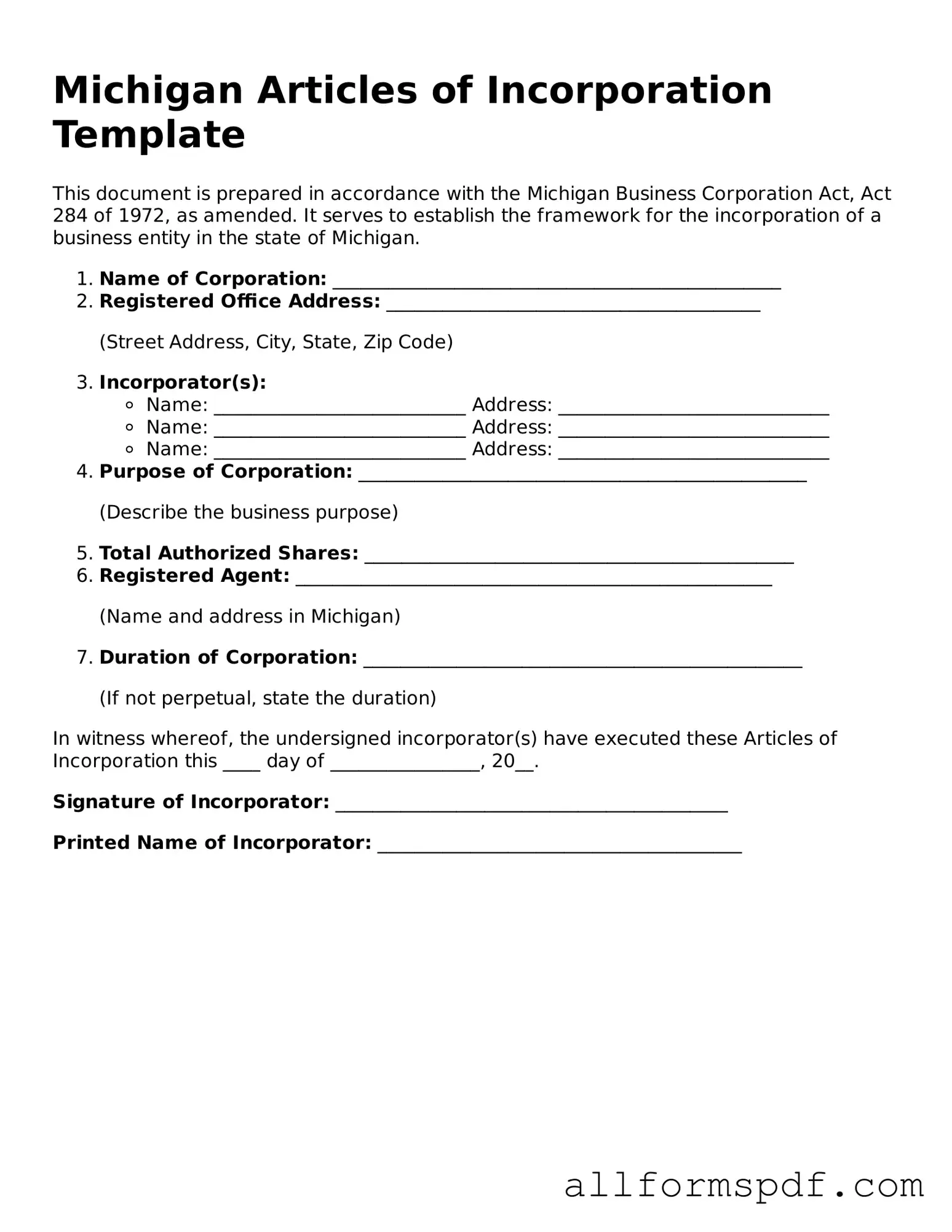

- Begin by downloading the Michigan Articles of Incorporation form from the Michigan Department of Licensing and Regulatory Affairs (LARA) website.

- Provide the name of your corporation. Ensure it complies with Michigan naming requirements and is unique.

- Indicate the purpose of your corporation. A brief description of what your business will do is sufficient.

- Fill in the registered office address. This must be a physical address in Michigan where official documents can be sent.

- List the name and address of the registered agent. This person or business will receive legal documents on behalf of your corporation.

- Specify the number of shares your corporation is authorized to issue. This is important for ownership and investment purposes.

- Include the names and addresses of the incorporators. These individuals are responsible for setting up the corporation.

- Sign and date the form. Ensure that all incorporators have signed where required.

- Review the completed form for accuracy. Double-check all information to avoid delays.

- Submit the form along with the required filing fee to the Michigan Department of Licensing and Regulatory Affairs.

Misconceptions

Understanding the Michigan Articles of Incorporation form is essential for anyone looking to establish a business in the state. However, several misconceptions can lead to confusion. Here are seven common misunderstandings:

- All businesses must file Articles of Incorporation. Many people think that every type of business entity needs to file this document. In reality, only corporations need to file Articles of Incorporation. Sole proprietorships and partnerships do not require this form.

- Filing Articles of Incorporation guarantees business success. Some believe that simply filing the form will ensure their business thrives. While it is a necessary step, success depends on factors like market demand, management, and financial planning.

- Articles of Incorporation are the same as a business license. This is a common misconception. The Articles of Incorporation establish the corporation's existence, while a business license is a permit to operate legally in a specific location.

- Once filed, Articles of Incorporation cannot be changed. Many assume that these documents are set in stone. However, corporations can amend their Articles of Incorporation to reflect changes in structure, name, or purpose.

- There is no fee for filing Articles of Incorporation. Some individuals think that filing is free. In Michigan, there is a filing fee that must be paid to the state when submitting the Articles of Incorporation.

- All information in the Articles of Incorporation is confidential. This is misleading. Certain details, such as the names of the directors and registered agents, are public information and can be accessed by anyone.

- Filing Articles of Incorporation is a quick process. Many expect immediate results. While the filing itself can be done quickly, processing times can vary, and it may take several days or weeks for the state to review and approve the documents.

By clarifying these misconceptions, individuals can better navigate the process of incorporating their businesses in Michigan.

Dos and Don'ts

When filling out the Michigan Articles of Incorporation form, it is essential to approach the process with care. Here are ten important do's and don'ts to keep in mind:

- Do ensure that you have a clear understanding of your business structure before starting.

- Do provide accurate and complete information about your corporation's name and address.

- Do designate a registered agent who will receive legal documents on behalf of the corporation.

- Do check for name availability to avoid conflicts with existing businesses.

- Do include the purpose of your corporation, as this is a requirement in Michigan.

- Don't leave any sections blank; incomplete forms may lead to delays or rejection.

- Don't use a name that is too similar to an existing corporation, as this could cause legal issues.

- Don't forget to review the filing fees and payment methods before submission.

- Don't rush through the process; take your time to ensure accuracy.

- Don't neglect to keep a copy of the completed form for your records.

By following these guidelines, you can help ensure a smoother incorporation process in Michigan.

Popular State-specific Articles of Incorporation Forms

How Do I Get a Copy of My Articles of Incorporation in Georgia - Expresses the corporation's commitment to ethical practices.

To ensure a smooth rental process, familiarize yourself with the crucial aspects of completing a comprehensive Residential Lease Agreement that aligns both landlord and tenant expectations in Arizona. For more information or to access the required documents, you can visit this resource.

Llc Articles of Organization Nj - The Articles provide clarity on the management framework of the corporation.

Common mistakes

When filling out the Michigan Articles of Incorporation form, many individuals make common mistakes that can lead to delays or complications in the incorporation process. One frequent error is providing incomplete information. Each section of the form requires specific details, such as the name of the corporation, its purpose, and the registered agent's information. Failing to fill in any of these sections can result in the form being rejected. It is crucial to double-check that all necessary fields are filled out completely and accurately.

Another mistake often seen is the selection of an inappropriate corporate name. The name must be unique and not already in use by another entity in Michigan. Additionally, it must include a corporate designator such as “Incorporated,” “Corporation,” or an abbreviation like “Inc.” If a name does not meet these requirements, the state may deny the application. Conducting a thorough name search prior to submission can save time and frustration.

People sometimes overlook the importance of including the correct number of shares the corporation is authorized to issue. This detail is critical as it affects ownership structure and future fundraising capabilities. If the number of shares is left blank or inaccurately stated, it may lead to confusion or legal issues later on. It is advisable to consult with a knowledgeable source to determine an appropriate number of shares based on the corporation’s goals.

Lastly, many individuals fail to properly designate a registered agent. A registered agent is a person or business entity that is authorized to receive legal documents on behalf of the corporation. This agent must have a physical address in Michigan and be available during regular business hours. Neglecting to provide accurate and up-to-date information about the registered agent can result in missed communications and potential legal complications. Ensuring that this information is correct is vital for the corporation's compliance and operational success.

Key takeaways

When filling out and using the Michigan Articles of Incorporation form, keep these key takeaways in mind:

- Accurate Information: Ensure that all information provided is accurate and complete. This includes the name of the corporation, the registered agent, and the purpose of the business.

- Filing Fee: Be aware of the required filing fee. This fee must be submitted along with the form to the Michigan Department of Licensing and Regulatory Affairs.

- Submission Method: You can submit the Articles of Incorporation online, by mail, or in person. Choose the method that best suits your needs and timeline.

- Review Requirements: After submission, the state will review your application. If there are any issues, you will receive feedback. Be prepared to make necessary corrections promptly.