Fill Out Your Membership Ledger Form

Membership Ledger - Usage Guidelines

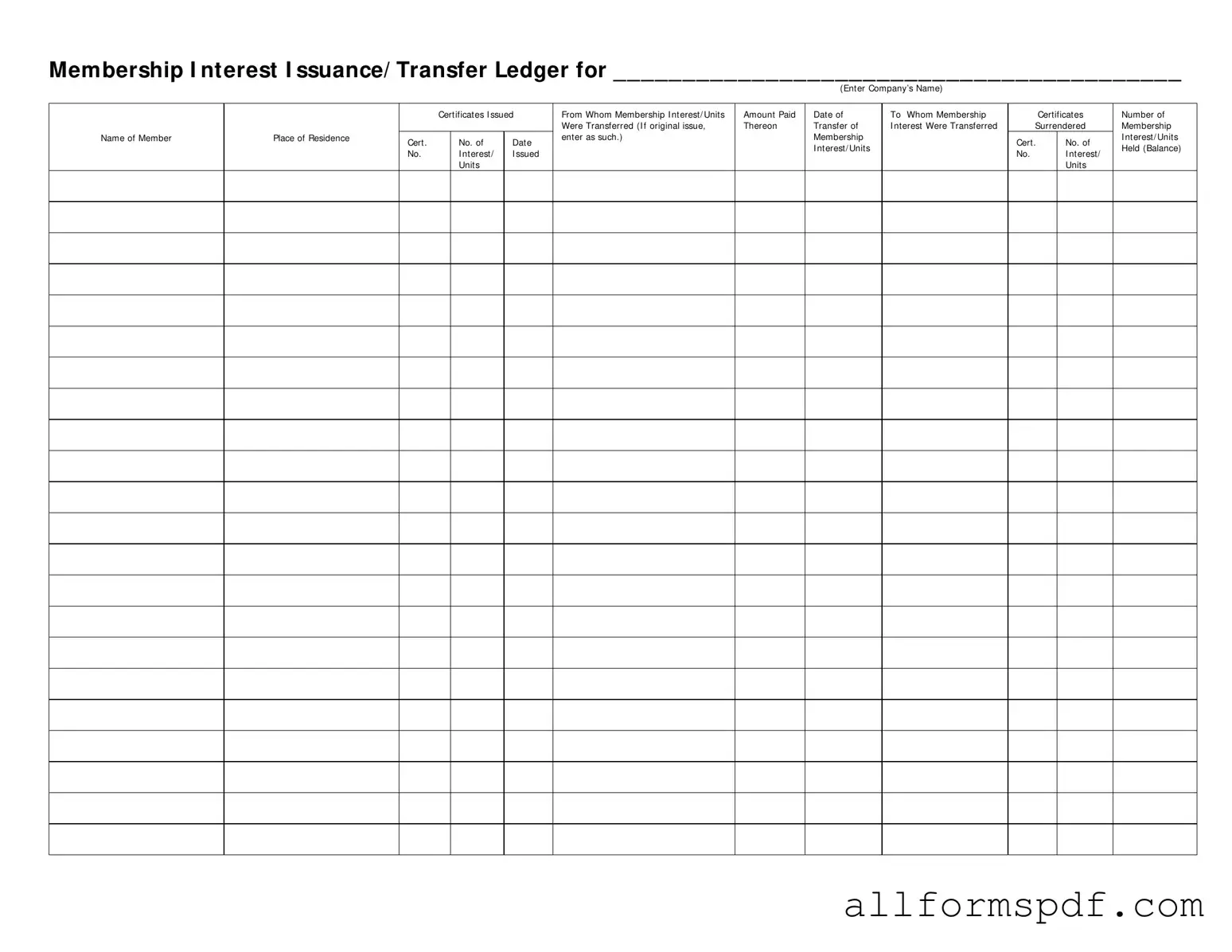

Filling out the Membership Ledger form is an important step in tracking the issuance and transfer of membership interests. After completing this form, you will have a clear record of transactions that can be referenced for future needs. Follow the steps below to ensure accurate completion.

- Start by entering the company’s name in the designated space at the top of the form.

- In the section labeled "Certificates Issued From Whom," write the name of the individual or entity that issued the membership interest.

- Next, fill in the "Membership Interest/Units" section with the specific number of units being issued or transferred.

- Indicate the "Amount Paid" for the membership interest or units in the corresponding field.

- Enter the "Date of Transfer" to document when the transaction occurred.

- In the "To Whom Membership Were Transferred" section, write the name of the individual or entity receiving the membership interest.

- For the "Name of Member" field, include the name of the member associated with the membership interest.

- Fill out the "Place of Residence" for the member, providing their address as required.

- In the "Cert. No." field, enter the certificate number associated with the membership interest being issued or transferred.

- Next, indicate the "Membership Interest/Units No." to specify the number of units being transferred.

- For the "Interest/Units Surrendered" section, provide details about any units that have been surrendered, if applicable.

- In the "Cert. No. of Interest/Units Surrendered" field, write the certificate number related to the surrendered interest or units.

- Finally, document the "Number of Membership Interest/Units Held (Balance)" to reflect the current balance after the transaction.

Misconceptions

Understanding the Membership Ledger form is crucial for accurate record-keeping and compliance. However, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- It is only for large companies. Many believe that only large organizations need to maintain a Membership Ledger. In reality, any entity with membership interests should keep this record, regardless of size.

- Membership Ledger is the same as a financial ledger. Some think these two ledgers serve the same purpose. The Membership Ledger specifically tracks membership interests and transfers, while a financial ledger records monetary transactions.

- Only the original member can fill it out. There is a misconception that only the original member can complete the form. In fact, authorized representatives can also manage this documentation.

- It’s not necessary for small transactions. Many assume that small transactions do not need to be recorded. However, all transfers should be documented to maintain accurate records.

- It only needs to be updated annually. Some believe that updating the Membership Ledger once a year is sufficient. Regular updates are essential, especially after any transfer of interests.

- It is a one-size-fits-all form. There is a belief that the Membership Ledger is universal. In reality, the form should be tailored to fit the specific needs of the company and its membership structure.

- It doesn’t require signatures. Some think that signatures are not necessary on the form. However, having the appropriate signatures adds legitimacy and accountability to the records.

- All members can access it freely. Many assume that all members have unrestricted access to the Membership Ledger. Access may be limited to protect sensitive information.

- It is only needed for legal compliance. While legal compliance is important, the Membership Ledger also serves as an internal tool for managing member relationships and interests effectively.

Clarifying these misconceptions can help ensure that the Membership Ledger is used correctly, fostering better management of membership interests.

Dos and Don'ts

When filling out the Membership Ledger form, it is important to follow specific guidelines to ensure accuracy and clarity. Here are four things you should and shouldn't do:

- Do enter the company’s name clearly in the designated space.

- Do provide accurate information regarding the membership interest or units.

- Don't leave any sections blank; ensure all required fields are completed.

- Don't use abbreviations or shorthand that may lead to confusion.

Other PDF Forms

What Information Must Be Listed on a Job Application? - Review your application before submitting to ensure everything is correct.

To ensure a smooth transaction when buying or selling a mobile home, it's essential to utilize a proper documentation process, which can be done using the New York Mobile Home Bill of Sale form. This form, available at smarttemplates.net/fillable-new-york-mobile-home-bill-of-sale, captures all necessary details of the sale, ensuring that both the buyer and seller are protected under New York law.

D1 Form Download - Ensure that all health-related questions are answered honestly to avoid complications.

Common mistakes

Filling out the Membership Ledger form can seem straightforward, but many people make common mistakes that can lead to confusion and errors. One frequent error is failing to enter the company's name correctly. This form is specific to a particular organization, and if the name is misspelled or incomplete, it can create issues when tracking membership interests. Always double-check the name to ensure accuracy.

Another mistake involves the certificates issued section. Some individuals neglect to record the correct certificate numbers or forget to include them altogether. This information is crucial for maintaining accurate records of membership interests. Each certificate number should be clearly noted to avoid any discrepancies in ownership.

People often overlook the amount paid for the membership interests. This detail is essential for financial records and for determining the value of the interests transferred. Failing to provide this information can lead to misunderstandings regarding the financial status of the membership interests.

The date of transfer is another critical piece of information that is sometimes omitted. Without this date, it can be challenging to establish a clear timeline of ownership changes. This can complicate matters if disputes arise or if the organization needs to verify ownership at a later date.

Additionally, some individuals mistakenly enter the place of residence of the member incorrectly. Accurate contact information is vital for communication and legal purposes. If the place of residence is not current or correctly stated, it can hinder the organization’s ability to reach out to its members when necessary.

Finally, many people forget to update the number of membership interests held after a transfer occurs. It’s important to keep this balance accurate to reflect the current ownership status. An outdated balance can lead to confusion and potential legal issues down the line.

Key takeaways

When filling out and using the Membership Ledger form, keep these key takeaways in mind:

- Accuracy is crucial. Ensure that all information entered is correct to avoid future complications.

- Company name matters. Clearly state the company’s name at the top of the form to identify the ledger properly.

- Document all transactions. Record every issuance and transfer of membership interests to maintain an accurate history.

- Include details for each entry. Provide the name of the member, place of residence, and certificate number for clarity.

- Track amounts paid. Note the amount paid for each membership interest to keep financial records in order.

- Record dates accurately. Include the date of each transaction to establish a timeline of ownership.

- Indicate transfers clearly. Specify if the membership interest was originally issued or transferred to avoid confusion.

- Surrendered certificates must be noted. Keep track of any certificates surrendered to maintain accurate records of outstanding interests.

- Balance matters. Regularly update the number of membership interests held to reflect current ownership accurately.