Fill Out Your Louisiana act of donation Form

Louisiana act of donation - Usage Guidelines

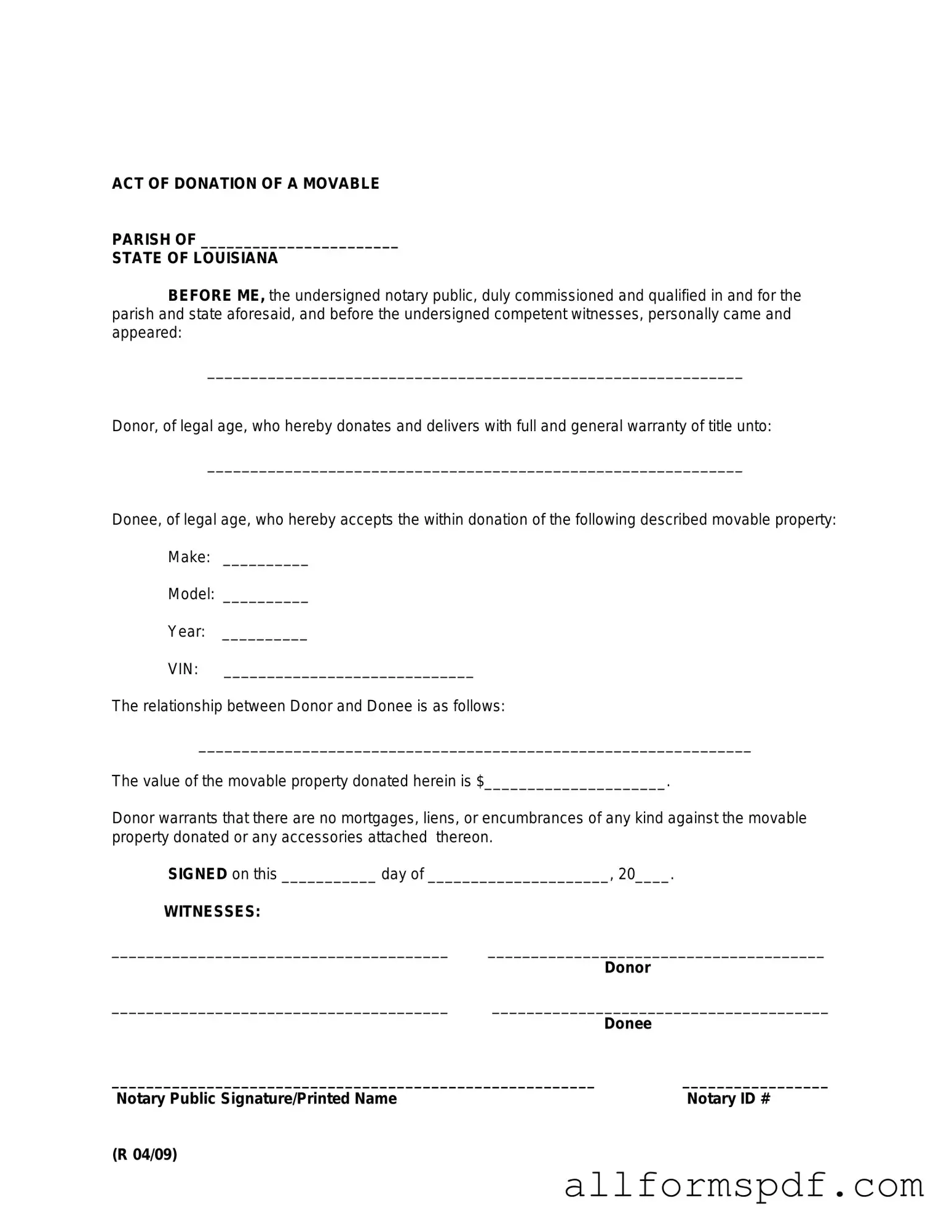

After obtaining the Louisiana Act of Donation form, you will need to complete it accurately to ensure that the donation is legally recognized. Follow the steps below to fill out the form correctly.

- Begin by entering the date at the top of the form. Ensure the date is accurate and formatted correctly.

- Provide the full name of the donor. Include any middle names or initials to avoid confusion.

- Enter the donor's address. Include the street address, city, state, and ZIP code.

- List the full name of the recipient. Again, include any middle names or initials.

- Provide the recipient's address, including street address, city, state, and ZIP code.

- Clearly describe the property being donated. Include details such as the type of property, its location, and any identifying information.

- Indicate if there are any conditions attached to the donation. If there are none, state that the donation is unconditional.

- Both the donor and recipient should sign and date the form at the designated spaces. Ensure that signatures are clear and legible.

- If applicable, have a witness sign the form. The witness should also print their name and provide their address.

- Review the completed form for any errors or omissions before submission.

Misconceptions

The Louisiana act of donation form is an important legal document, yet several misconceptions surround it. Here are four common misunderstandings:

-

It is only for transferring property to family members.

This form can be used to donate property to anyone, not just relatives. Friends, charities, or organizations can also be beneficiaries.

-

It does not require notarization.

Contrary to popular belief, the act of donation must be notarized to be legally binding. This step ensures that the document is valid and enforceable.

-

It is permanent and cannot be revoked.

While the act of donation creates a strong legal obligation, it is possible to revoke the donation under certain circumstances, such as if the donor and donee agree to the revocation.

-

It only applies to real estate.

The act of donation can apply to various types of property, including personal belongings, vehicles, and financial assets, not just real estate.

Dos and Don'ts

When filling out the Louisiana Act of Donation form, it's essential to approach the process with care and attention to detail. Here’s a helpful list of things you should and shouldn’t do:

- Do ensure that you have the correct form for the type of donation you are making.

- Do provide accurate and complete information about both the donor and the recipient.

- Do include a clear description of the property being donated.

- Do sign and date the form in the appropriate sections.

- Don't leave any sections of the form blank; incomplete forms may be rejected.

- Don't use abbreviations or shorthand that could lead to misunderstandings.

- Don't forget to check the requirements for notarization, if applicable.

- Don't submit the form without reviewing it for errors or omissions.

By following these guidelines, you can help ensure that your donation is processed smoothly and correctly.

Other PDF Forms

Cash Reciept - A flexible form that can be adapted to specific business needs.

When dealing with vehicle management in Florida, understanding the importance of the Florida Vehicle POA form 82053 becomes essential. This document enables vehicle owners to delegate responsibilities such as registration, titling, and transactions to a trusted individual, ensuring that their vehicle affairs are in order even when they are unavailable. For those looking for more information or additional resources, All Florida Forms offers helpful guidance on this process.

Hosanna College of Health Transcript Request - Fax requests are noted as unofficial, which may affect their acceptance elsewhere.

Common mistakes

Filling out the Louisiana Act of Donation form can be a straightforward process, but many people make common mistakes that can lead to complications down the line. One prevalent error is failing to provide accurate descriptions of the property being donated. This may seem minor, but vague descriptions can lead to confusion or disputes later. Ensure that the property is described clearly and completely, including any relevant details that can help identify it.

Another mistake often seen is neglecting to include the necessary signatures. The form requires the signature of both the donor and the recipient. Without these signatures, the donation may not be legally valid. It’s essential to double-check that all required parties have signed before submitting the form.

Many individuals also overlook the importance of having the document notarized. In Louisiana, notarization is crucial for the Act of Donation to be enforceable. If you skip this step, you may find that your donation is challenged or deemed invalid. Always ensure that a notary public witnesses the signing of the form.

People sometimes fail to provide the correct date on the form. The date is significant because it establishes when the donation takes effect. An incorrect date can create confusion or even legal issues regarding the timing of the transfer. Always double-check that the date is accurate and clearly written.

In addition, not understanding the tax implications of the donation can lead to unexpected consequences. Donors should be aware that gifts above a certain value may have tax implications. Consulting a tax professional before completing the form can help clarify any potential liabilities.

Another common oversight is not keeping a copy of the completed form. After the form is filled out and submitted, it’s wise to retain a copy for personal records. This can be invaluable in case any questions arise in the future regarding the donation.

Many individuals also fail to communicate with the recipient about the donation. Clear communication can prevent misunderstandings and ensure that both parties are on the same page regarding the terms of the donation. Discussing the details beforehand can help to avoid disputes later on.

Lastly, people often underestimate the importance of reviewing the form thoroughly before submission. Rushing through the process can lead to simple mistakes that might be easily avoided. Taking the time to review each section can save you from potential headaches in the future.

Key takeaways

When filling out and using the Louisiana Act of Donation form, there are several important points to keep in mind. Here are key takeaways to ensure a smooth process:

- Understand the Purpose: The Act of Donation allows one person to give property to another without expecting anything in return.

- Eligibility: Both the donor and the recipient must be legally capable of entering into a contract.

- Complete Information: Fill in all required fields accurately, including names, addresses, and descriptions of the property being donated.

- Notarization: The form must be notarized to be legally valid. A notary public can help with this step.

- Witness Requirement: In some cases, having a witness sign the form can provide additional legal assurance.

- Property Description: Clearly describe the property being donated. This helps avoid any confusion later.

- Review Before Signing: Double-check all information for accuracy before signing the document.

- Keep Copies: After the form is completed and signed, make copies for both the donor and recipient.

- Consult Legal Advice: If unsure about any aspect of the donation, consider seeking legal advice to clarify your questions.

- File with Local Authorities: Depending on the type of property, you may need to file the form with local authorities for proper documentation.

Following these steps can help ensure that the donation process goes smoothly and that both parties are protected.