Printable Loan Agreement Form

Loan Agreement Subtypes

Loan Agreement - Usage Guidelines

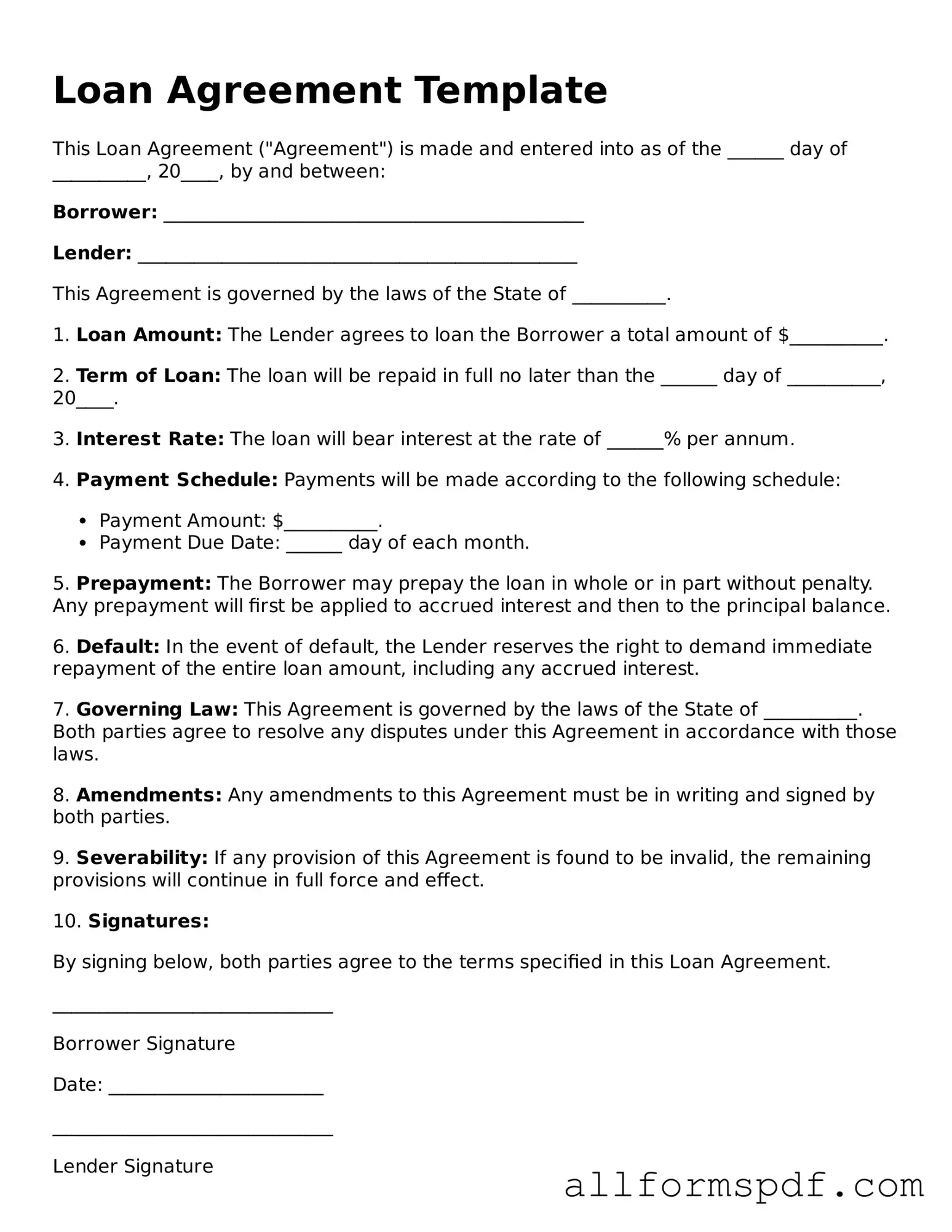

To complete the Loan Agreement form, follow the steps outlined below. Ensure that all information is accurate and clearly presented. After filling out the form, review it for any errors before submission.

- Begin by entering the date at the top of the form.

- Fill in the full name of the borrower in the designated field.

- Provide the borrower's address, including street, city, state, and zip code.

- Enter the full name of the lender in the appropriate section.

- List the lender's address, ensuring all components are included.

- Specify the loan amount in the section provided.

- Indicate the interest rate applicable to the loan.

- Fill in the repayment terms, including the duration and payment schedule.

- Include any additional terms or conditions as necessary.

- Sign and date the form at the bottom to finalize the agreement.

Misconceptions

When it comes to loan agreements, many people hold misconceptions that can lead to misunderstandings or poor decision-making. Here are four common misconceptions:

- All loan agreements are the same. Many believe that every loan agreement follows a standard format. In reality, loan agreements can vary significantly depending on the lender, the type of loan, and the specific terms negotiated. Each agreement should be reviewed carefully to understand its unique provisions.

- Signing a loan agreement is a simple formality. Some individuals think that signing a loan agreement is just a routine step that requires little thought. However, this document is a legally binding contract. It outlines the responsibilities of both the borrower and the lender, and failing to understand its terms can lead to serious financial consequences.

- Once signed, a loan agreement cannot be changed. Many borrowers assume that once they sign a loan agreement, they are stuck with its terms forever. While it can be challenging, it is often possible to renegotiate certain terms or seek modifications if both parties agree. Open communication with the lender is essential in such cases.

- Loan agreements only matter if you default. Some people think that the details of a loan agreement only become important if they fail to make payments. In truth, the terms of the agreement govern the entire loan process, including interest rates, payment schedules, and penalties for late payments. Understanding these details from the start can help avoid complications later on.

Being aware of these misconceptions can empower borrowers to make informed decisions when entering into a loan agreement. Always take the time to read and understand the document before signing.

Dos and Don'ts

When filling out a Loan Agreement form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do read the entire agreement carefully before signing.

- Do provide accurate and complete information.

- Do ask questions if any part of the agreement is unclear.

- Do keep a copy of the signed agreement for your records.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any sections blank unless instructed to do so.

- Don't sign the agreement if you do not fully understand the terms.

Following these guidelines can help you avoid potential issues in the future.

Popular Documents

Rental Letter of Intent - Offers a preliminary timeline for property occupancy.

In addition to understanding the importance of a Florida Non-disclosure Agreement (NDA), parties should consider utilizing reliable resources for drafting these documents, such as All Florida Forms, which provide templates that adhere to state laws and help ensure compliance with legal requirements.

Farm Equipment Bill of Sale - Used to transfer ownership of a tractor.

Common mistakes

Filling out a Loan Agreement form can be a straightforward process, but many individuals make common mistakes that can lead to complications. One frequent error is providing inaccurate personal information. It is crucial to ensure that your name, address, and contact details are correct. Errors in this section can delay the processing of your loan.

Another common mistake involves leaving out important financial information. Applicants sometimes forget to include their income details or fail to disclose existing debts. This omission can result in a denial of the loan or unfavorable terms.

Many individuals also overlook the importance of reading the terms and conditions carefully. Skimming through this section can lead to misunderstandings about interest rates, repayment schedules, and fees. A thorough review is essential to avoid unexpected costs later on.

Additionally, some applicants fail to sign the form. A signature is often required to validate the agreement. Without it, the loan cannot be processed, leading to unnecessary delays.

Using outdated or incorrect forms is another mistake. Loan agreements can change over time, and using an old version can lead to discrepancies. Always ensure that you have the most current form from the lender.

Inconsistent information across different sections of the form can also create confusion. For example, if the income stated does not match the documentation provided, it may raise red flags. Consistency is key to a smooth application process.

Some people neglect to provide supporting documents. Lenders often require proof of income, identification, and other relevant documents. Failing to include these can result in a longer approval process or outright rejection.

Another mistake is not asking questions when unsure about any part of the form. If something is unclear, it is better to seek clarification than to make assumptions that could lead to errors.

Moreover, applicants sometimes rush through the process. Taking the time to carefully complete the form can prevent mistakes that may cause issues later. A meticulous approach can save time and stress in the long run.

Lastly, some individuals do not keep a copy of the completed form. Retaining a copy is important for reference and can be helpful if any questions arise during the loan process. Having your own record ensures that you can provide accurate information if needed.

Key takeaways

When filling out and using a Loan Agreement form, keep these key takeaways in mind:

- Identify the Parties: Clearly state the names and addresses of both the lender and the borrower.

- Loan Amount: Specify the exact amount of money being loaned. This should be a clear figure.

- Interest Rate: Include the interest rate that will apply to the loan. Make sure it’s expressed as an annual percentage.

- Repayment Terms: Outline how and when the borrower will repay the loan. Include due dates and payment frequency.

- Late Fees: State any penalties for late payments. This helps clarify consequences for the borrower.

- Default Terms: Define what constitutes a default on the loan and the lender's rights in such a situation.

- Signatures: Ensure both parties sign the agreement. This makes the document legally binding.

- Witnesses: Consider having a witness sign the agreement. This can add an extra layer of validity.

- Amendments: Specify how any changes to the agreement should be made. This helps avoid confusion later.

- Governing Law: Indicate which state’s laws will govern the agreement. This is important for legal clarity.

By following these takeaways, you can create a clear and effective Loan Agreement that protects both parties involved.