Printable LLC Share Purchase Agreement Form

LLC Share Purchase Agreement - Usage Guidelines

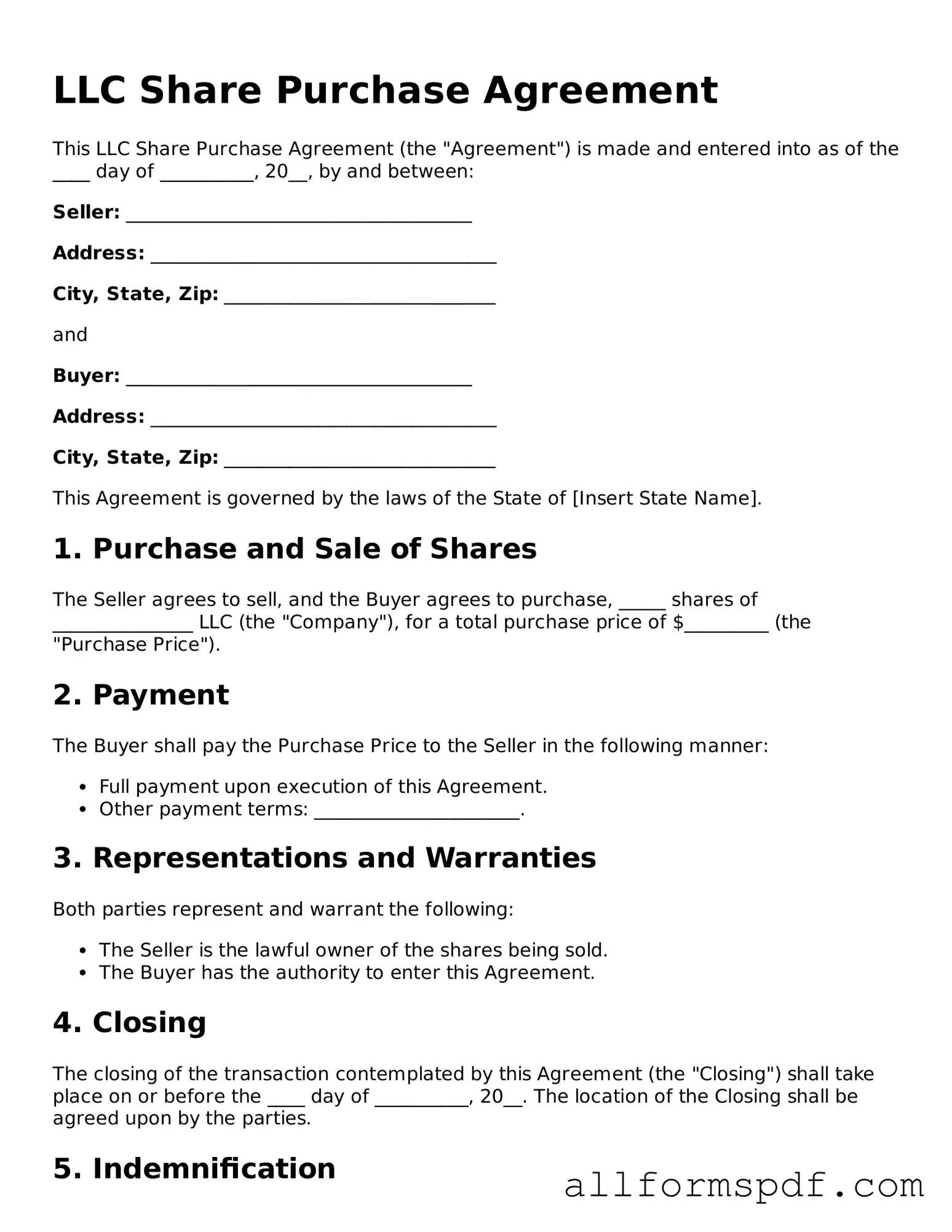

Filling out the LLC Share Purchase Agreement form is a straightforward process. This document is essential for formalizing the sale of shares in a limited liability company. Completing it accurately ensures that both the seller and buyer are clear on the terms of the transaction.

- Gather Information: Collect all necessary details about the LLC, the seller, and the buyer. This includes names, addresses, and the number of shares being sold.

- Fill in the Date: Write the date on which the agreement is being executed at the top of the form.

- Identify the Parties: Clearly state the full legal names of both the seller and the buyer. Include their addresses for clarity.

- Describe the Shares: Specify the type and number of shares being sold. Be precise to avoid any confusion.

- State the Purchase Price: Clearly indicate the total amount being paid for the shares. If applicable, mention payment terms.

- Include Representations and Warranties: If there are any promises or assurances made by either party, include them in this section.

- Signatures: Both the seller and buyer must sign the agreement. Make sure to include the date of each signature.

- Review the Document: Go through the completed form carefully to ensure all information is correct and that nothing is missing.

Misconceptions

When it comes to LLC Share Purchase Agreements, there are several misconceptions that can lead to confusion. Understanding these common myths can help you navigate the process more effectively. Here’s a list of seven misconceptions about this important legal document:

- 1. An LLC Share Purchase Agreement is the same as a membership agreement. Many people think these two documents serve the same purpose, but they are distinct. A membership agreement outlines the rights and responsibilities of members, while a share purchase agreement specifically deals with the sale and purchase of shares in the LLC.

- 2. You don’t need a written agreement. Some believe that verbal agreements are sufficient for selling shares in an LLC. However, having a written agreement is crucial for clarity and legal protection.

- 3. Only large companies need an LLC Share Purchase Agreement. This is not true. Any LLC, regardless of size, should have a share purchase agreement when shares are bought or sold to ensure all parties are protected.

- 4. The terms of the agreement are set in stone. While the agreement outlines specific terms, it can be negotiated before signing. Flexibility is often possible, allowing both parties to reach a mutually beneficial arrangement.

- 5. Once signed, the agreement cannot be changed. Although it’s best to finalize terms before signing, amendments can be made later. However, these changes should be documented properly to avoid future disputes.

- 6. All LLCs are required to have a Share Purchase Agreement. Not every LLC is mandated to have this agreement, but it is highly recommended for those engaging in share transactions to protect their interests.

- 7. The agreement is only for the buyer’s benefit. This is a common misunderstanding. The share purchase agreement serves to protect both the buyer and the seller, ensuring that all aspects of the transaction are clear and agreed upon.

By clearing up these misconceptions, you can approach the LLC Share Purchase Agreement with a better understanding of its purpose and importance. Always consider seeking professional advice to ensure your agreement meets your specific needs.

Dos and Don'ts

When filling out an LLC Share Purchase Agreement form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are ten things to consider:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information about the parties involved.

- Do clearly specify the number of shares being purchased.

- Do include the purchase price for the shares.

- Do outline any conditions or contingencies related to the purchase.

- Don't leave any sections blank unless they are marked as optional.

- Don't use vague language; be specific in your descriptions.

- Don't forget to date and sign the agreement.

- Don't rush through the process; take your time to ensure everything is correct.

- Don't overlook the need for witnesses or notarization if required.

Following these guidelines can help ensure that the LLC Share Purchase Agreement is completed correctly, minimizing potential issues in the future.

Popular Documents

Is Corporation Number Same as Business Number - Preparation of the Articles requires careful consideration of details.

When engaging in a transaction, it's vital to utilize a reliable document such as a thorough General Bill of Sale. This form ensures both parties have a clear understanding of the ownership transfer involved and provides essential proof for future reference.

Bill of Sale for Business - It is advisable to consult professionals during this process for accuracy.

Common mistakes

Filling out an LLC Share Purchase Agreement can be a straightforward process, but many people make common mistakes that can lead to complications down the line. One frequent error is not including all necessary parties in the agreement. It’s crucial to list every buyer and seller involved. Omitting a party can create legal issues later, especially if disputes arise.

Another common mistake is failing to clearly define the shares being purchased. Ambiguities in the description can lead to misunderstandings. Buyers and sellers should ensure that the number of shares, class of shares, and any specific rights associated with those shares are clearly stated.

People often overlook the importance of including the purchase price. This may seem obvious, but vague terms like "fair market value" without a specific amount can lead to confusion. Clearly stating the purchase price helps to avoid disputes and provides clarity for both parties.

Additionally, some individuals neglect to outline the payment terms. It’s essential to specify how and when payment will be made. Will it be a lump sum, or will there be installments? Not detailing this can lead to misunderstandings about financial obligations.

Another mistake is not addressing the conditions of the sale. Buyers and sellers should include any contingencies that must be met before the sale is finalized. This could involve financing conditions, regulatory approvals, or other requirements that need to be fulfilled.

People sometimes forget to include signatures and dates. An unsigned agreement is not legally binding. Ensure that all parties sign the document and that the date is clearly indicated to confirm when the agreement was executed.

Lastly, many overlook the need for a legal review. Even if everything seems correct, having a professional review the agreement can catch mistakes that may have been missed. A second set of eyes can provide peace of mind and ensure that the agreement meets all legal requirements.

Key takeaways

When filling out and using the LLC Share Purchase Agreement form, keep these key takeaways in mind:

- Understand the Purpose: This agreement outlines the terms of buying and selling shares in an LLC. It protects both the buyer and the seller.

- Identify the Parties: Clearly state who is involved in the transaction. Include full names and addresses for all parties.

- Detail the Shares: Specify the number of shares being sold and their value. Be clear about the type of shares involved.

- Include Payment Terms: Outline how and when payment will be made. This can include methods of payment and any installment plans.

- Address Representations and Warranties: Both parties should make certain assurances about their ability to enter into the agreement and the condition of the shares.

- Consider Conditions Precedent: List any conditions that must be met before the sale can be completed, such as approvals or financing.

- Review Confidentiality Clauses: If sensitive information is involved, include terms to protect confidentiality during and after the transaction.

- Seek Legal Advice: It’s wise to consult with a legal professional before finalizing the agreement to ensure all aspects are covered and compliant.