Printable Letter of Intent to Purchase Business Form

Letter of Intent to Purchase Business - Usage Guidelines

Completing the Letter of Intent to Purchase Business form is an important step in the process of acquiring a business. After filling out the form, you will typically move on to negotiations and drafting a more detailed purchase agreement.

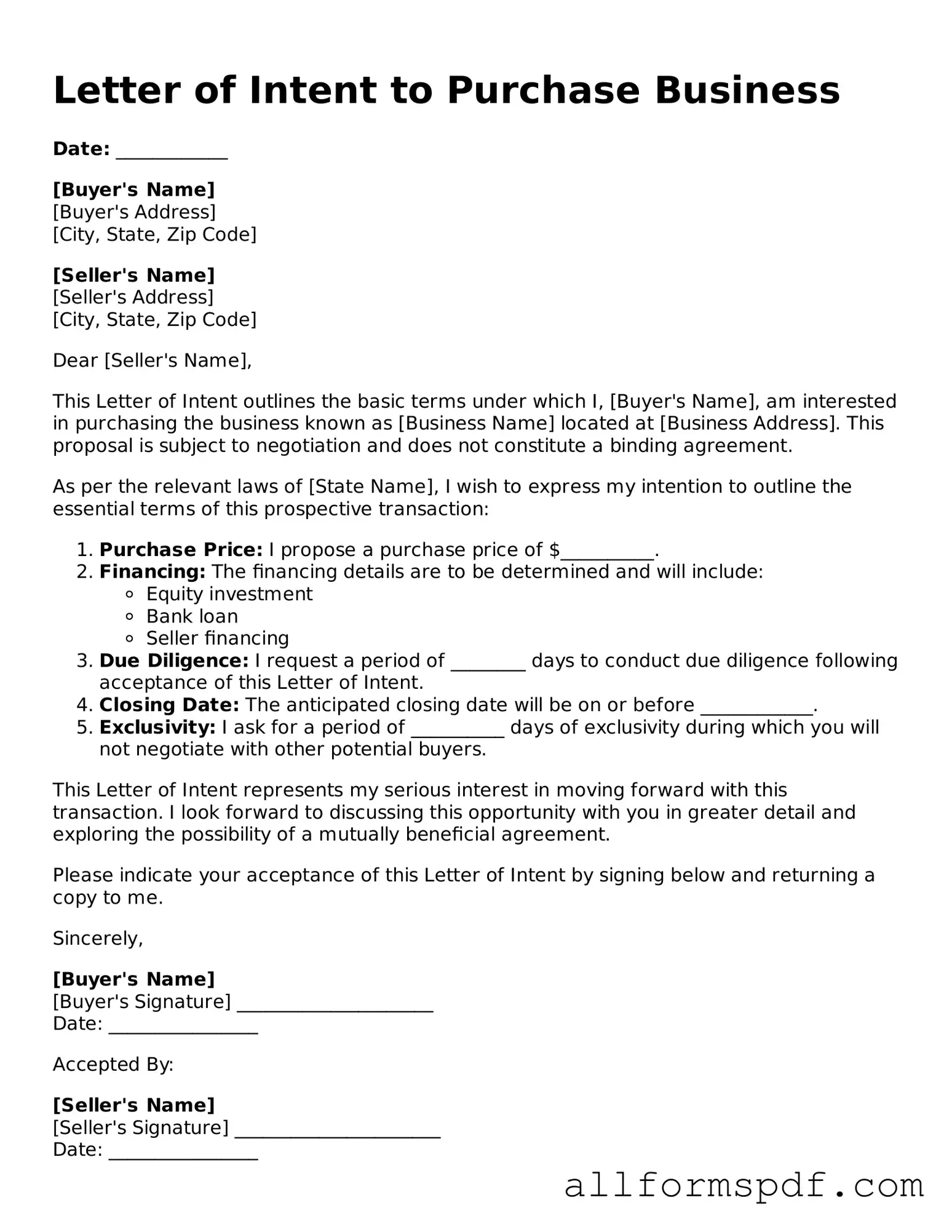

- Begin with your personal information. Fill in your name, address, phone number, and email at the top of the form.

- Provide the name and address of the business you wish to purchase. Ensure accuracy to avoid any confusion.

- Clearly state the proposed purchase price. Be specific about the amount you are willing to offer.

- Outline the terms of the offer. Include any conditions that must be met for the sale to proceed.

- Specify the timeline for the transaction. Indicate when you expect to finalize the purchase.

- Include any contingencies that may apply, such as financing or inspections.

- Sign and date the form at the bottom. Make sure to review all information for accuracy before signing.

Misconceptions

When it comes to the Letter of Intent (LOI) to Purchase a Business, many people have misconceptions. Understanding these can help clarify the process and set realistic expectations. Here are seven common misconceptions:

- 1. An LOI is a binding contract. Many believe that once an LOI is signed, both parties are legally bound to complete the sale. In reality, an LOI is usually non-binding and serves as a preliminary agreement outlining the intent to negotiate further.

- 2. An LOI guarantees the sale. Some think that signing an LOI guarantees that the sale will go through. However, it merely indicates interest and outlines key terms, leaving room for further negotiations.

- 3. All terms must be finalized in the LOI. It’s a common misconception that an LOI must contain every detail of the transaction. In fact, it typically includes broad terms, with specifics to be worked out in later agreements.

- 4. An LOI is only for large transactions. Many assume that only large businesses use LOIs. However, they can be beneficial for businesses of all sizes, providing a framework for negotiations.

- 5. An LOI is not necessary. Some people think they can skip the LOI and go straight to a purchase agreement. An LOI can help clarify intentions and avoid misunderstandings before drafting a formal contract.

- 6. LOIs are the same as purchase agreements. There’s a belief that LOIs and purchase agreements serve the same purpose. They do not. An LOI is a preliminary document, while a purchase agreement is a detailed contract that finalizes the sale.

- 7. You don’t need legal help with an LOI. Many people think they can draft an LOI without professional assistance. While it’s possible, having a lawyer can ensure that the document accurately reflects intentions and protects interests.

Understanding these misconceptions can help you navigate the process of buying a business more effectively. Always consider seeking professional advice to guide you through the complexities of business transactions.

Dos and Don'ts

When filling out the Letter of Intent to Purchase Business form, it is important to approach the task with care. Here are nine essential dos and don’ts to consider:

- Do clearly state your intention to purchase the business.

- Do provide accurate contact information for both parties involved.

- Do outline the proposed terms of the purchase, including price and payment structure.

- Do specify any contingencies that must be met before the sale can proceed.

- Do ensure that the document is signed and dated by both parties.

- Don't use vague language that could lead to misunderstandings.

- Don't omit important details about the business or the transaction.

- Don't rush through the form; take your time to review each section.

- Don't forget to consult with a legal or financial advisor if needed.

Discover More Types of Letter of Intent to Purchase Business Documents

Rental Letter of Intent - Helps identify any special requirements the tenant may have.

The Alabama Homeschool Letter of Intent form is a document that parents must submit to officially notify the state of their decision to homeschool their children. This form serves as an essential step in the homeschooling process, ensuring compliance with Alabama's educational regulations. For more information on how to properly complete this process, parents can refer to the Homeschool Intent Letter, which provides guidance on shaping their children's educational journey.

Common mistakes

Filling out a Letter of Intent to Purchase a Business can be a crucial step in a business transaction. However, many people make common mistakes that can lead to confusion or even legal issues down the line. Here are ten mistakes to avoid.

One frequent error is failing to specify the terms clearly. Buyers often overlook the importance of detailing the purchase price, payment terms, and any contingencies. Without clear terms, misunderstandings can arise, leading to disputes later.

Another mistake is not including a timeline for the transaction. A Letter of Intent should outline key dates for due diligence, closing, and other important milestones. Without this, parties may have different expectations about the timeline, causing frustration.

People often neglect to address confidentiality. If sensitive information is shared during negotiations, it’s essential to include a confidentiality clause. This protects both the buyer and seller from potential leaks that could harm the business.

Some individuals fail to identify all parties involved. It’s important to clearly state who is buying and who is selling. Ambiguity about the parties can lead to complications if someone else becomes involved in the transaction.

Another common oversight is not outlining the conditions for withdrawal. A Letter of Intent should specify under what circumstances either party can back out. Without this, one party might feel trapped, leading to resentment.

Many people also forget to include a statement of intent. This should explain the purpose of the Letter of Intent and what both parties hope to achieve. A clear statement can set a positive tone for negotiations.

Overlooking the need for legal review is another mistake. It’s wise to have a lawyer review the Letter of Intent before signing. They can spot potential issues and ensure that the document complies with applicable laws.

Some individuals write the document in a way that is too vague. Specificity is key. General statements can lead to different interpretations, which can create conflict later on.

People sometimes omit important details about the business being purchased. This includes financial information, assets, and liabilities. Providing comprehensive information helps both parties make informed decisions.

Finally, not keeping a copy of the signed Letter of Intent can lead to problems. Both parties should retain a copy for their records. This ensures that everyone has access to the same information moving forward.

Key takeaways

When considering the Letter of Intent to Purchase Business form, it is essential to understand its purpose and the implications of the information it contains. Here are some key takeaways to guide you through the process:

- Clarify Your Intentions: The letter serves as a preliminary agreement that outlines your intention to purchase a business. Clearly stating your goals helps both parties understand the direction of the negotiation.

- Detail the Terms: Include specific terms such as the proposed purchase price, payment structure, and any contingencies. This clarity can prevent misunderstandings later in the process.

- Confidentiality is Key: If sensitive information will be shared during negotiations, consider including a confidentiality clause. This protects both parties and fosters trust.

- Outline Due Diligence: Specify any conditions under which the sale is contingent, such as the completion of due diligence. This allows you to assess the business thoroughly before finalizing the purchase.

- Consult Professionals: It is wise to seek advice from legal and financial professionals. Their expertise can help ensure that the letter is comprehensive and protects your interests.

- Non-Binding Nature: Remember that a Letter of Intent is typically non-binding. This means that while it expresses serious interest, it does not create a legal obligation to complete the purchase.

Using this form effectively can facilitate smoother negotiations and help establish a clear framework for the purchase process. Taking the time to prepare a thoughtful Letter of Intent can lead to a more successful transaction.