Printable Last Will and Testament Form

State-specific Guidelines for Last Will and Testament Documents

Last Will and Testament Subtypes

Last Will and Testament - Usage Guidelines

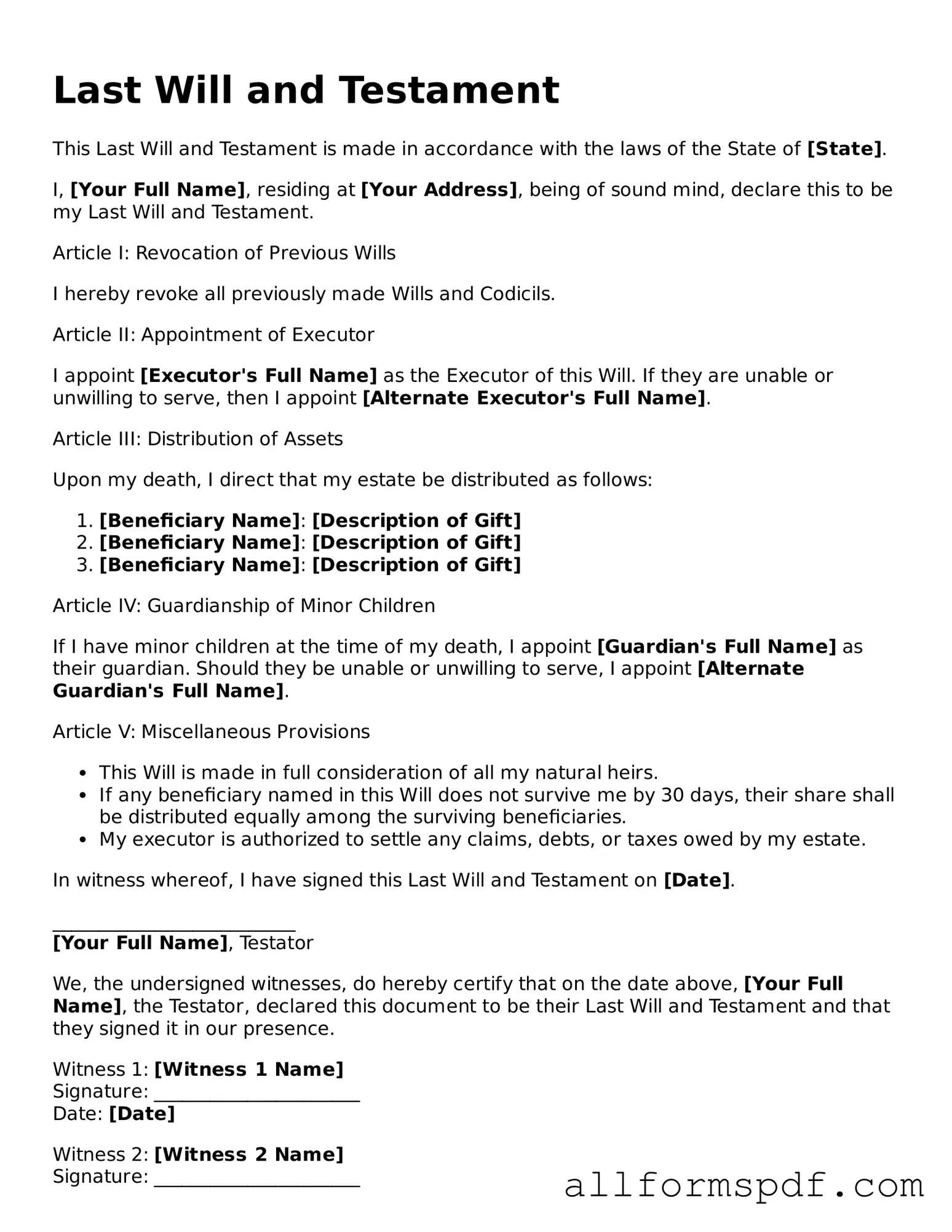

After obtaining your Last Will and Testament form, it’s time to fill it out carefully. This document will help ensure that your wishes regarding your assets and loved ones are respected. Follow these steps to complete the form accurately.

- Read the entire form before you start filling it out. Familiarize yourself with all sections and requirements.

- Provide your full name and address at the beginning of the document. This identifies you as the testator.

- State your intention to create a will. You can do this by including a statement like “This is my Last Will and Testament.”

- List your beneficiaries. Include their names and relationships to you. Specify what each person will receive.

- Choose an executor. This person will carry out your wishes as stated in the will. Include their name and contact information.

- Include any specific bequests. If you want to leave particular items or amounts of money to individuals, list those here.

- Address guardianship if you have minor children. Name a guardian for your children and provide their contact details.

- Sign the document at the bottom. Make sure to do this in front of witnesses, as required by your state’s laws.

- Have witnesses sign the will. Typically, two witnesses are needed. They should also provide their addresses.

- Store the will in a safe place. Inform your executor and loved ones where it can be found.

Misconceptions

Understanding the Last Will and Testament is crucial for anyone considering how to manage their estate. Unfortunately, several misconceptions can lead to confusion and mismanagement. Here are seven common misconceptions about the Last Will and Testament:

- A will only matters if you have a lot of money. Many people believe that only wealthy individuals need a will. In reality, a will is important for anyone who wants to ensure their wishes are carried out after their death, regardless of their financial situation.

- Handwritten wills are not valid. While it is true that formal requirements exist for wills, many states recognize handwritten wills, also known as holographic wills, as valid. However, these must meet certain criteria to be legally binding.

- Once a will is created, it cannot be changed. This is a common myth. Individuals can modify or revoke their will at any time as long as they are of sound mind. Regular updates are encouraged, especially after significant life events.

- Only lawyers can create a valid will. While having a lawyer can be beneficial, it is not a requirement. Many individuals create their own wills using templates or online resources. However, it is important to ensure that the will complies with state laws.

- A will avoids probate. Many people think that having a will means their estate will bypass the probate process. In fact, a will must go through probate, which is the legal process of validating the will and distributing the estate.

- All assets are distributed according to the will. Some assets may not be included in a will. For instance, assets held in joint tenancy or those with designated beneficiaries, like life insurance policies, pass outside of the will.

- Wills are only for the elderly. This misconception can be misleading. People of all ages should consider creating a will, especially if they have dependents or specific wishes regarding their assets.

Being informed about these misconceptions can help individuals make better decisions regarding their estate planning. A clear understanding of how a Last Will and Testament works is essential for ensuring that one's wishes are honored after death.

Dos and Don'ts

When filling out a Last Will and Testament form, it is essential to approach the process with care. Here are some important dos and don’ts to consider:

- Do ensure that you are of sound mind and at least 18 years old when creating your will.

- Do clearly identify yourself and your beneficiaries to avoid any confusion.

- Do specify how you want your assets distributed after your passing.

- Do sign your will in the presence of witnesses, as required by your state’s laws.

- Do keep your will in a safe place and inform your executor of its location.

- Don’t use vague language that may lead to misinterpretation of your wishes.

- Don’t forget to update your will after major life events, such as marriage or the birth of a child.

- Don’t rely solely on online templates without understanding your state’s specific requirements.

- Don’t leave out necessary details about your debts or obligations.

- Don’t forget to review your will periodically to ensure it reflects your current wishes.

Popular Documents

Release of Liability Ca Dmv - The Vehicle Release of Liability is necessary to clarify rights and duties between parties.

When engaging in a transaction for an all-terrain vehicle in California, it is important to utilize the California ATV Bill of Sale form to ensure that all necessary details are documented accurately. This form not only signifies the transfer of ownership but also protects both parties by clearly outlining essential information such as buyer and seller data, vehicle specifications, and the agreed purchase price. To facilitate this process, you can access a comprehensive ATV Bill of Sale form, ensuring that all legal requirements are met and helping to avoid potential disputes in the future.

Where to Sell Limited Edition Prints - A critical step in building an art collection.

Sample Employee Loan Agreement - It aims to ensure transparency and clarity in the lending process.

Common mistakes

Creating a Last Will and Testament is an essential step in ensuring that one's wishes are honored after passing. However, many individuals make common mistakes when filling out this important document. Understanding these errors can help prevent complications later on.

One frequent mistake is failing to clearly identify the beneficiaries. It is crucial to specify who will receive assets and property. Without clear identification, disputes may arise among potential heirs. Using full names and, if possible, including relationships can help avoid confusion.

Another common error involves not updating the will after significant life events. Major changes, such as marriage, divorce, or the birth of a child, can impact how assets should be distributed. Failing to revise the will accordingly can lead to unintended consequences.

People often overlook the importance of signing and dating the will. A will must be signed by the testator, the person creating the will, to be valid. Additionally, dating the document is essential to establish its relevance over time. A will without a signature or date may not hold up in court.

Some individuals neglect to include a residuary clause. This clause specifies what happens to any assets not explicitly mentioned in the will. Without it, any assets not addressed may be subject to state intestacy laws, which may not align with the deceased's wishes.

Another mistake is failing to appoint an executor. The executor is responsible for managing the estate and ensuring that the will is executed according to the testator's wishes. Not naming someone can lead to delays and complications during the probate process.

Many people also forget to consider tax implications. Certain assets may be subject to estate taxes, and understanding these can help in planning the distribution of the estate. Consulting with a financial advisor or attorney can provide clarity on potential tax liabilities.

Additionally, individuals sometimes do not account for digital assets. In today's digital age, online accounts, cryptocurrencies, and digital files can hold significant value. Explicitly mentioning these assets in the will ensures they are managed according to the testator's wishes.

Moreover, not having witnesses present during the signing of the will is a common oversight. Most states require at least two witnesses to validate a will. Without proper witnesses, the will may face challenges in probate court.

Finally, individuals may fail to keep the will in a safe and accessible location. A will should be stored securely but also be easily found by the executor or family members when needed. A locked safe or a designated attorney's office can be appropriate places for storage.

Key takeaways

Filling out a Last Will and Testament is an important step in ensuring that your wishes are honored after your passing. Here are some key takeaways to consider:

- Clarity is Crucial: Clearly state your wishes regarding the distribution of your assets. Ambiguities can lead to disputes among heirs.

- Choose an Executor Wisely: Select someone trustworthy and organized to carry out your wishes. This person will be responsible for managing your estate.

- Review Regularly: Life changes such as marriage, divorce, or the birth of a child may necessitate updates to your will. Regular reviews ensure it remains current.

- Witness Requirements: Most states require that your will be signed in the presence of witnesses. Ensure you follow your state’s specific laws regarding this.

- Consider Professional Help: While templates are available, consulting with an attorney can help ensure that your will meets all legal requirements and reflects your intentions.

- Communicate with Loved Ones: Discuss your decisions with family members. Open conversations can prevent misunderstandings and provide peace of mind.

By keeping these takeaways in mind, you can create a Last Will and Testament that reflects your desires and provides clarity for your loved ones.