Printable Lady Bird Deed Form

State-specific Guidelines for Lady Bird Deed Documents

Lady Bird Deed - Usage Guidelines

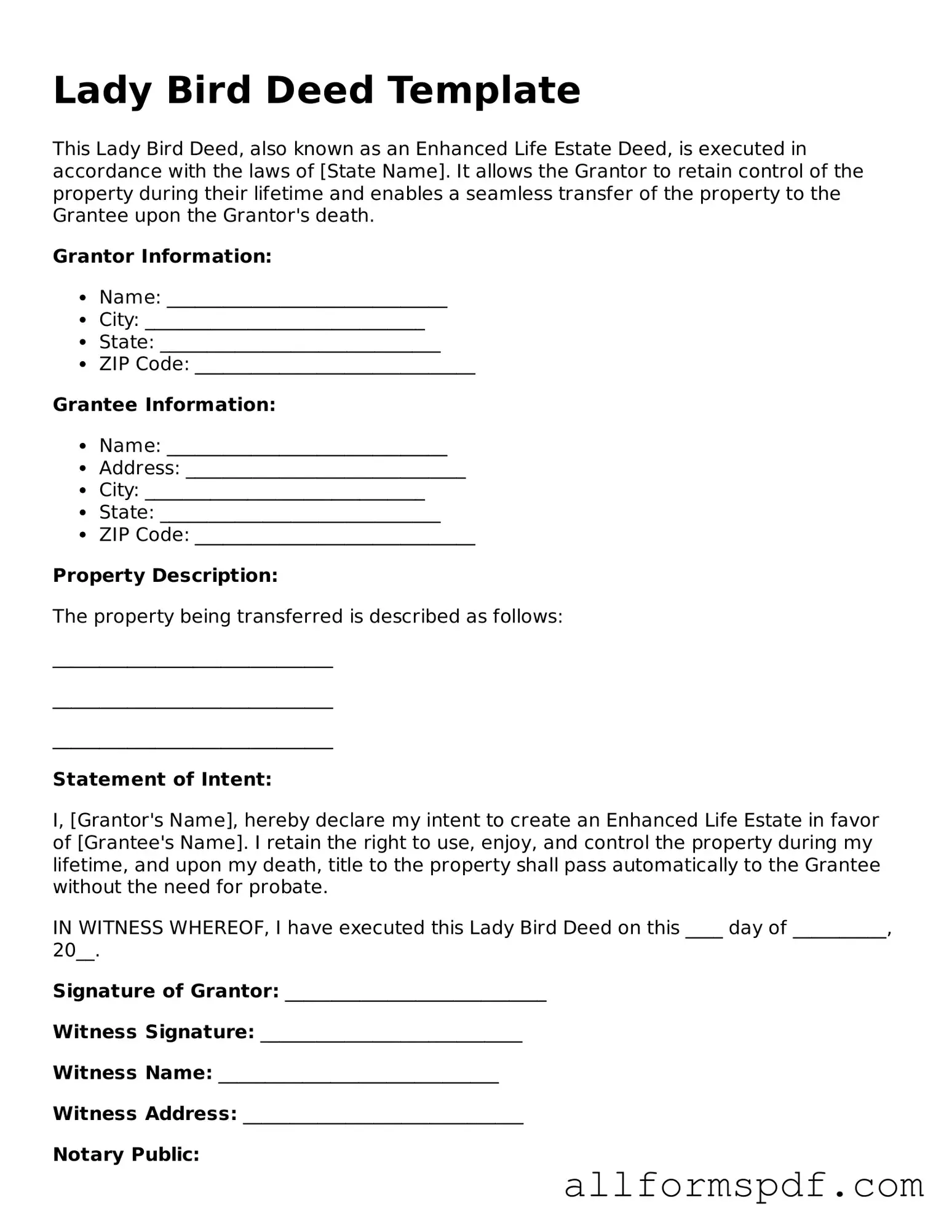

Once you've obtained the Lady Bird Deed form, you'll need to fill it out carefully to ensure all necessary information is included. This deed allows you to transfer property to a beneficiary while retaining certain rights during your lifetime. After completing the form, you will need to sign it in front of a notary and then file it with your local property records office.

- Begin by entering your name as the grantor (the person transferring the property).

- Provide your address, including city, state, and zip code.

- Identify the property being transferred. Include the full legal description, which can usually be found on your property tax statement or deed.

- List the name of the beneficiary (the person receiving the property) along with their address.

- Indicate whether you wish to retain the right to live in the property for the rest of your life.

- Sign the document in the designated area. Ensure that you are doing so in front of a notary public.

- Have the notary complete their section, which verifies your identity and signature.

- Make copies of the completed deed for your records.

- File the original deed with your local property records office to make the transfer official.

Misconceptions

The Lady Bird Deed, also known as an enhanced life estate deed, has garnered a fair amount of attention in recent years. However, many misconceptions surround this legal instrument. Here are eight common misunderstandings about the Lady Bird Deed form:

- It only benefits wealthy individuals. Many believe that only affluent people can utilize a Lady Bird Deed. In reality, this tool can benefit anyone looking to simplify the transfer of property upon death, regardless of their financial status.

- It eliminates the need for a will. Some think that by using a Lady Bird Deed, a will becomes unnecessary. While it can streamline property transfer, a comprehensive estate plan, including a will, is still essential for addressing other assets and wishes.

- It automatically avoids probate. A common myth is that all Lady Bird Deeds automatically avoid probate. While they do allow for direct transfer upon death, certain circumstances may still require probate proceedings.

- It is only for primary residences. Many assume that the Lady Bird Deed can only be applied to a primary residence. However, it can also be used for other real estate properties, such as vacation homes or rental properties.

- It is a complicated legal document. Some people think that the Lady Bird Deed is overly complex and difficult to understand. In truth, while it is important to ensure the deed is drafted correctly, the concept itself is quite straightforward.

- It cannot be revoked. A widespread misconception is that once a Lady Bird Deed is executed, it cannot be changed or revoked. In fact, the grantor retains the right to modify or revoke the deed at any time during their lifetime.

- It provides no tax benefits. Some believe that there are no tax advantages associated with a Lady Bird Deed. However, this deed can help avoid capital gains taxes for heirs, as the property receives a step-up in basis upon the grantor's death.

- It is the same as a traditional life estate deed. Many confuse the Lady Bird Deed with a traditional life estate deed. Unlike the latter, a Lady Bird Deed allows the grantor to retain more control over the property, including the ability to sell or mortgage it without needing consent from remaindermen.

Understanding these misconceptions can help individuals make informed decisions about their estate planning options. The Lady Bird Deed is a powerful tool, but like any legal document, it is essential to grasp its nuances fully.

Dos and Don'ts

When filling out a Lady Bird Deed form, it is important to approach the process with care and attention to detail. Here are some essential dos and don’ts to keep in mind:

- Do clearly identify the property being transferred. Include the full legal description.

- Don't leave any sections blank. Every part of the form should be completed to avoid delays.

- Do specify the names of all parties involved. This includes both the grantor and the grantee.

- Don't use vague terms. Be precise about the nature of the transfer and the rights being granted.

- Do ensure that the form is signed in the presence of a notary. This adds a layer of legal validity.

- Don't forget to check state-specific requirements. Laws can vary significantly from one state to another.

- Do keep a copy of the completed form for your records. Documentation is crucial for future reference.

- Don't assume that the form is sufficient on its own. Consider consulting with a legal expert if unsure.

- Do file the deed with the appropriate county office. This final step is necessary for the transfer to be official.

Discover More Types of Lady Bird Deed Documents

California Corrective Deed - Use a Corrective Deed for any discrepancies noticed after closing.

When engaging in a horse sale in Florida, it is important to utilize the Florida Horse Bill of Sale form, which not only formalizes the transaction but also ensures that all necessary details are accurately documented. To simplify this process, you can rely on resources like All Florida Forms to obtain the appropriate form and ensure all legal requirements are met.

Common mistakes

Filling out a Lady Bird Deed form can be a straightforward process, but there are common mistakes that people often make. One significant error is failing to include all necessary parties. When completing the form, it is essential to list all individuals who will be involved in the transfer of property. Omitting a name can lead to complications later on.

Another frequent mistake is not providing accurate property descriptions. The deed must clearly identify the property being transferred. If the description is vague or incorrect, it can create confusion and potential legal issues. It is crucial to ensure that the property address and any legal descriptions are precise.

Some individuals overlook the importance of signing the deed properly. All required signatures must be present for the deed to be valid. If a signature is missing, the deed may not hold up in court. Additionally, witnesses may be required, depending on state laws, so confirming local requirements is vital.

People sometimes forget to have the deed notarized. A notarized deed adds an extra layer of authenticity and can help prevent disputes in the future. Without notarization, the deed may be challenged, which could lead to unnecessary legal complications.

Another common mistake is not understanding the implications of the Lady Bird Deed itself. This type of deed allows for certain benefits, such as avoiding probate. However, if individuals do not fully grasp these advantages, they may not utilize the deed effectively. Consulting with a professional can help clarify these points.

Some individuals may also neglect to inform their heirs about the deed. Open communication is essential to prevent misunderstandings or disputes among family members. When heirs are unaware of the deed's existence or its terms, it can lead to confusion and conflict after the property owner passes away.

Lastly, failing to keep the deed in a safe place can be a significant oversight. Once the deed is completed and recorded, it is important to store it securely. Losing the deed or failing to keep track of it can create unnecessary challenges for heirs in the future.

Key takeaways

The Lady Bird Deed is a specific type of property deed used primarily in the United States. Here are some key takeaways regarding its use and completion:

- The Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining certain rights during their lifetime.

- This deed is often used to avoid probate, simplifying the transfer of property upon the owner's death.

- It enables the property owner to retain the right to live in and use the property for the rest of their life.

- Filling out the Lady Bird Deed requires accurate information about the property and the beneficiaries.

- It is important to check state-specific laws, as not all states recognize Lady Bird Deeds.

- The deed must be signed and notarized to be legally valid.

- Beneficiaries named in the deed receive the property automatically upon the owner's death, without the need for probate.

- Tax implications may arise from the transfer of property, so consulting a tax professional is advisable.

- It is recommended to consult with a legal expert to ensure that the deed meets all necessary requirements and accurately reflects the owner's intentions.