Fill Out Your IRS W-9 Form

IRS W-9 - Usage Guidelines

After completing the IRS W-9 form, it is essential to submit it to the requester who needs your taxpayer information. This could be an employer, a client, or any organization that requires your details for tax purposes. Ensure that the information provided is accurate to avoid any issues with tax reporting.

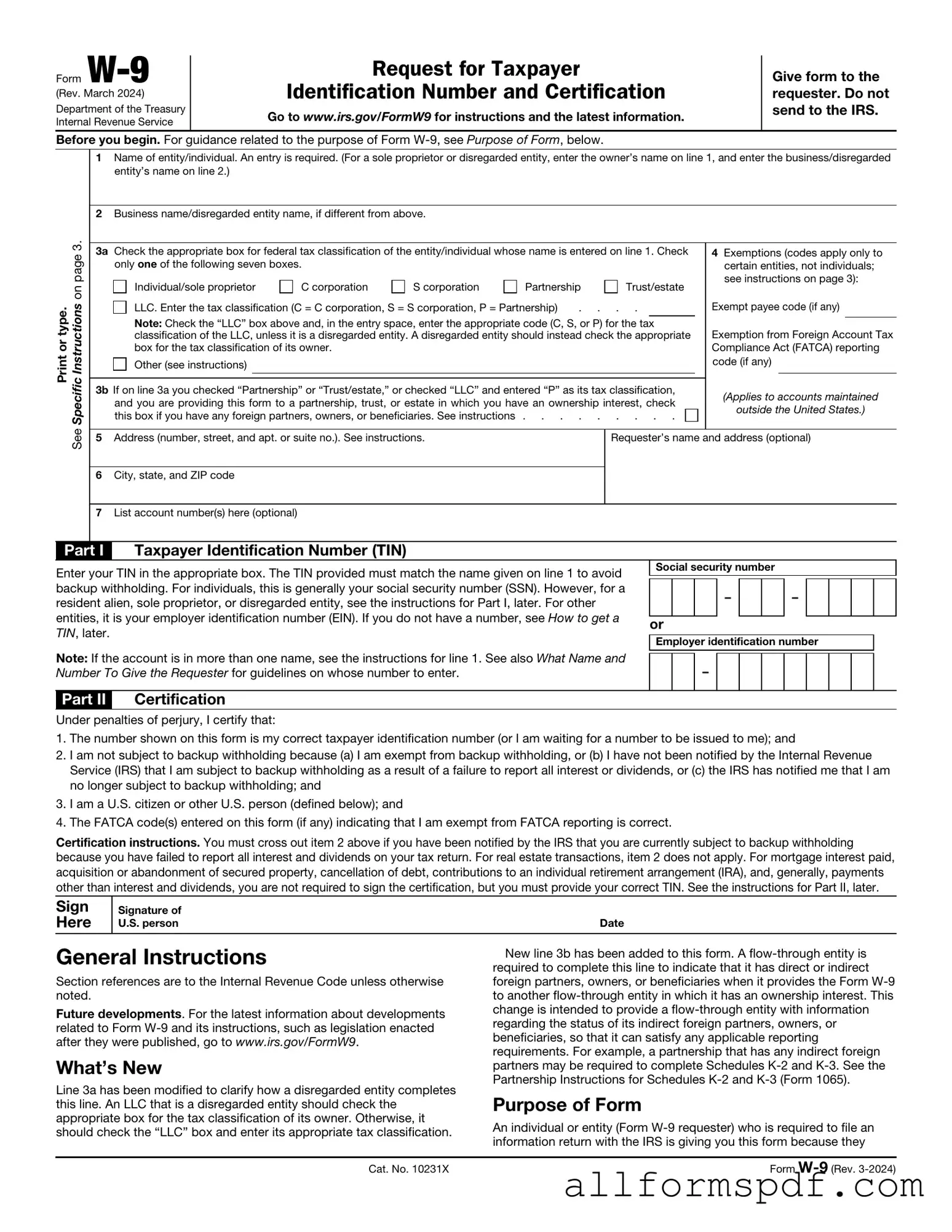

- Download the IRS W-9 form from the official IRS website or obtain a physical copy.

- At the top of the form, enter your name as it appears on your tax return.

- If applicable, provide your business name or disregarded entity name in the next line.

- Select the appropriate tax classification by checking the corresponding box (individual, corporation, partnership, etc.).

- Fill in your address, including street, city, state, and ZIP code.

- Enter your taxpayer identification number (TIN). This can be your Social Security Number (SSN) or Employer Identification Number (EIN).

- If you are exempt from backup withholding, indicate this in the appropriate section.

- Sign and date the form at the bottom. Ensure the date is accurate.

- Review all information for accuracy before submitting the form to the requester.

Misconceptions

The IRS W-9 form is often misunderstood. Here are some common misconceptions about this important document:

- Misconception 1: The W-9 form is only for freelancers and independent contractors.

- Misconception 2: Completing a W-9 form means you will be audited by the IRS.

- Misconception 3: You must submit a W-9 form to the IRS directly.

- Misconception 4: Once you submit a W-9, your information is permanently stored with the IRS.

This is not entirely true. While freelancers and contractors commonly use the W-9 to provide their taxpayer information to clients, anyone who receives income that is subject to reporting may need to fill it out. This includes individuals who earn interest, dividends, or other types of income.

Filling out a W-9 does not automatically trigger an audit. The form simply provides your taxpayer identification information to the payer. Audits are based on various factors, and submitting a W-9 is a standard part of the income reporting process.

This is incorrect. The W-9 is not submitted to the IRS. Instead, you give it to the person or company that requests it. They will use the information to prepare the necessary tax forms, such as the 1099, which they will file with the IRS.

Your information on the W-9 is not stored by the IRS. It is kept by the payer who requested the form. If your information changes, you need to submit a new W-9 to the payer to keep their records up to date.

Dos and Don'ts

When filling out the IRS W-9 form, it's important to ensure accuracy and completeness. Here are some guidelines to follow:

- Do: Provide your correct name as it appears on your tax return.

- Do: Use your Social Security Number (SSN) or Employer Identification Number (EIN) accurately.

- Do: Sign and date the form to validate your information.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank; incomplete forms may lead to delays.

- Don't: Use someone else's information; this can result in serious penalties.

- Don't: Forget to update the form if your information changes.

- Don't: Submit the form to the IRS directly; it should be given to the requester only.

Other PDF Forms

Simple Shared Well Agreement Form - Annual fees for water usage are specified in the agreement for the supplied party to pay.

The ADP Pay Stub form is a document that summarizes an employee's earnings and deductions for a specific pay period. It provides essential details such as gross pay, net pay, and tax withholdings, helping employees understand their compensation. If you need to fill out the ADP Pay Stub form, you can find it by visiting the Adp Pay Stub form.

High School Transcript - Can provide insight into a student's strengths and weaknesses.

Common mistakes

Filling out the IRS W-9 form correctly is crucial for anyone receiving income that requires reporting to the IRS. However, many individuals make common mistakes that can lead to delays or complications. One frequent error is providing an incorrect taxpayer identification number (TIN). This number must match the name on the form. If there’s a mismatch, the IRS may impose penalties or withhold payments.

Another mistake is failing to check the correct box for the type of entity. Whether you are an individual, a corporation, or a partnership, selecting the wrong classification can cause issues. It is essential to accurately represent your business structure to avoid unnecessary complications.

Many people also overlook the importance of signing and dating the form. Without a signature, the W-9 is incomplete. The IRS requires this affirmation to validate the information provided. A missing signature can lead to delays in processing or even rejection of the form.

In addition, some individuals forget to update their W-9 when their information changes. If you move, change your name, or alter your business structure, it is vital to submit a new form. Failure to do so may result in incorrect tax reporting and potential penalties.

Another common error involves using outdated forms. The IRS periodically updates forms, and using an old version can lead to complications. Always ensure you are using the most current version of the W-9 to avoid any issues with the IRS.

Some people also neglect to provide additional information when required. For instance, if you are exempt from backup withholding, it’s important to indicate this on the form. Omitting this detail can lead to unnecessary withholding from payments.

Additionally, individuals sometimes misinterpret the instructions for filling out the form. Each section has specific requirements, and misunderstanding these can lead to incorrect information. It’s advisable to read the instructions carefully before completing the form.

Lastly, individuals may fail to keep a copy of the completed W-9 for their records. Retaining a copy is important for both personal record-keeping and for reference in case of any discrepancies in the future.

Key takeaways

The IRS W-9 form is an important document for anyone who needs to provide their taxpayer information to another party. Here are some key takeaways to keep in mind when filling out and using this form:

- Purpose of the W-9: The form is primarily used to provide your correct taxpayer identification number (TIN) to someone who is required to file an information return with the IRS.

- Who Needs to Fill It Out: Individuals and businesses that are receiving income, such as freelancers, contractors, and vendors, often need to complete a W-9.

- Accuracy is Key: Ensure that all information, including your name, address, and TIN, is accurate to avoid issues with tax reporting.

- Submission: The completed form should be sent directly to the requester, not the IRS. Keep a copy for your records.

- Tax Implications: The information provided on the W-9 may be used to prepare a 1099 form, which reports income to the IRS.

- Privacy Considerations: Be cautious about sharing your W-9, as it contains sensitive information that could lead to identity theft if mishandled.

Understanding these points can help ensure that you handle the W-9 form correctly and maintain compliance with tax regulations.