Fill Out Your IRS Schedule C 1040 Form

IRS Schedule C 1040 - Usage Guidelines

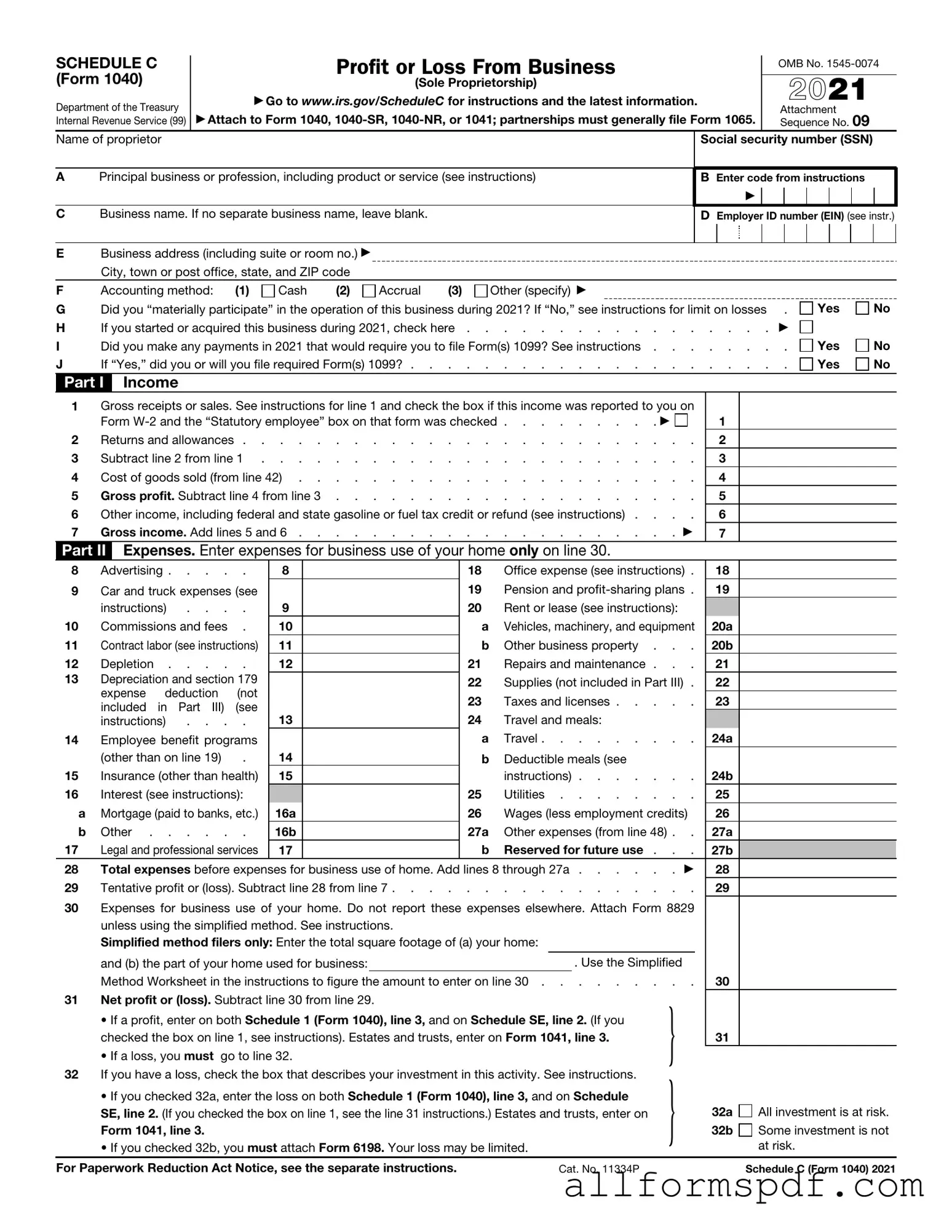

Completing the IRS Schedule C (Form 1040) is a crucial step for self-employed individuals reporting their business income and expenses. This form requires careful attention to detail to ensure accuracy and compliance with tax regulations. Follow these steps to fill out the form effectively.

- Begin with your personal information. Enter your name, Social Security number, and the name of your business if applicable.

- Indicate the principal business activity by describing what your business does. This helps classify your business correctly.

- Fill in your business address. Include the street address, city, state, and ZIP code.

- Provide your Employer Identification Number (EIN) if you have one. If not, leave this blank.

- Report your gross receipts or sales. This is the total income generated from your business before any deductions.

- List any returns and allowances. Subtract this amount from your gross receipts to determine your net sales.

- Calculate your cost of goods sold if applicable. This includes direct costs associated with producing your products or services.

- Deduct your business expenses. Categorize expenses such as advertising, car and truck expenses, and utilities. Use the appropriate lines for each type of expense.

- Determine your net profit or loss. This is calculated by subtracting total expenses from your gross income.

- Sign and date the form. Ensure all information is accurate before submitting it with your tax return.

After completing the Schedule C, you will attach it to your Form 1040 when filing your taxes. Keep a copy for your records, as it may be necessary for future reference or audits.

Misconceptions

Understanding the IRS Schedule C (Form 1040) can be challenging, and several misconceptions often arise. Here are eight common misunderstandings about this important tax form:

- Only Self-Employed Individuals Need to File Schedule C - Many believe that only those who run a business must file this form. However, anyone who earns income as a sole proprietor, including freelancers and independent contractors, should also complete Schedule C.

- All Expenses Can Be Deducted - It is a common myth that all business-related expenses are deductible. In reality, only ordinary and necessary expenses directly related to the business can be claimed.

- Schedule C is Only for Small Businesses - Some think that Schedule C is exclusively for small businesses. In fact, any sole proprietorship, regardless of size, must use this form to report income and expenses.

- Filing Schedule C Guarantees a Tax Refund - Many individuals assume that filing Schedule C will automatically result in a tax refund. Refunds depend on various factors, including total income, tax liability, and credits, not just the filing of this form.

- Income Reported on Schedule C is Taxed at a Lower Rate - There is a misconception that income reported on Schedule C is taxed at a lower rate. In reality, this income is subject to the same tax rates as other types of income, plus self-employment tax.

- Once You File Schedule C, You're Automatically Audited - Some fear that filing Schedule C increases the likelihood of an audit. While Schedule C may attract attention due to its complexity, it does not automatically trigger an audit.

- You Cannot Use Schedule C if You Have a Business Partner - It is often thought that Schedule C is only for sole proprietors. However, if you are in a partnership, you would file a different form, but sole proprietors with business partners can still use Schedule C for their individual income.

- Schedule C Can Be Filed Anytime - There is a belief that Schedule C can be filed at any time during the year. In truth, it must be filed by the tax deadline, typically April 15, unless an extension is granted.

By clarifying these misconceptions, individuals can better navigate their tax responsibilities and ensure accurate reporting of their income and expenses.

Dos and Don'ts

When filling out the IRS Schedule C (Form 1040), it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of dos and don’ts to keep in mind:

- Do gather all necessary documents, including income records and expense receipts.

- Do report all income earned from your business activities.

- Do clearly categorize your expenses to make deductions easier.

- Do use accurate figures from your bookkeeping records.

- Do keep a copy of your completed Schedule C for your records.

- Don’t underestimate your expenses; ensure all valid costs are included.

- Don’t mix personal and business expenses; keep them separate.

- Don’t ignore deadlines; file your form on time to avoid penalties.

- Don’t leave any sections blank; fill in all required information.

- Don’t forget to sign and date your form before submission.

Other PDF Forms

Employer's Quarterly Federal Tax Return - Employers are encouraged to file Form 941 electronically for faster processing.

Filing the Florida Sales Tax form is crucial for businesses operating in the state, as it ensures compliance with tax regulations set by the Florida Department of Revenue. To facilitate this process, resources are available for those seeking assistance in understanding the requirements and deadlines involved. For additional forms and information, visit All Florida Forms.

Pay Stub for 1099 Contractor - Outline the nature of the services provided by the independent contractor.

Tax Form for Mortgage Interest - Alerts to upcoming payment due dates to avoid late fees.

Common mistakes

Filling out the IRS Schedule C (Form 1040) can be daunting for many. One common mistake is failing to report all income. Every dollar earned from your business should be included. Omitting even a small amount can lead to issues down the line. It’s essential to keep accurate records of all revenue sources to ensure nothing gets overlooked.

Another frequent error is misclassifying expenses. Business expenses must be categorized correctly to avoid complications. For example, personal expenses should not be mixed with business costs. This can lead to an inflated deduction and potential penalties. Keeping a clear distinction between personal and business finances is crucial.

Many individuals also neglect to keep receipts and documentation for their expenses. The IRS requires proof of expenses claimed on your Schedule C. Without proper documentation, you risk losing out on legitimate deductions. Organizing receipts and maintaining a detailed record can save you headaches later.

Additionally, some people fail to take advantage of all available deductions. There are numerous deductions available for business owners, such as home office expenses, vehicle use, and supplies. Not being aware of these can result in paying more taxes than necessary. Researching and understanding all potential deductions can maximize tax savings.

Another mistake is not calculating the cost of goods sold accurately. If you sell products, it’s vital to understand how to calculate this correctly. Errors in this area can lead to incorrect profit reporting. A precise calculation ensures that your income reflects your actual earnings.

Some individuals also forget to sign and date their Schedule C. It may seem minor, but an unsigned form can lead to delays in processing and potential rejection. Always double-check that all necessary signatures are in place before submission.

Moreover, failing to report self-employment tax can be a significant oversight. Self-employed individuals must pay both income and self-employment taxes. Not accounting for this can lead to an unexpected tax bill. Understanding your tax obligations is essential for financial planning.

Many people also overlook the importance of filing on time. Late submissions can incur penalties and interest. Being aware of deadlines and planning ahead can help avoid these unnecessary costs.

Finally, not seeking professional help when needed can be a costly mistake. Tax laws can be complex, and it’s easy to make errors without proper guidance. Consulting with a tax professional can provide clarity and ensure compliance with IRS regulations.

Key takeaways

When filling out and using the IRS Schedule C (Form 1040), here are some important points to keep in mind:

- Understand the Purpose: Schedule C is used to report income or loss from a business you operated as a sole proprietor. It’s essential for tracking your earnings and expenses.

- Accurate Record Keeping: Maintain detailed records of all business income and expenses. This documentation will support the figures you report on the form.

- Deductible Expenses: Familiarize yourself with what expenses you can deduct. Common deductions include costs for supplies, business use of your home, and travel expenses.

- Self-Employment Tax: Remember that income reported on Schedule C is subject to self-employment tax. This tax helps fund Social Security and Medicare.

- Filing Deadlines: Be aware of the tax filing deadlines. Schedule C is typically due on April 15, alongside your Form 1040.

- Seek Professional Help if Needed: If you find the process overwhelming, consider consulting a tax professional. They can help ensure you complete the form correctly and maximize your deductions.