Fill Out Your IRS 941 Form

IRS 941 - Usage Guidelines

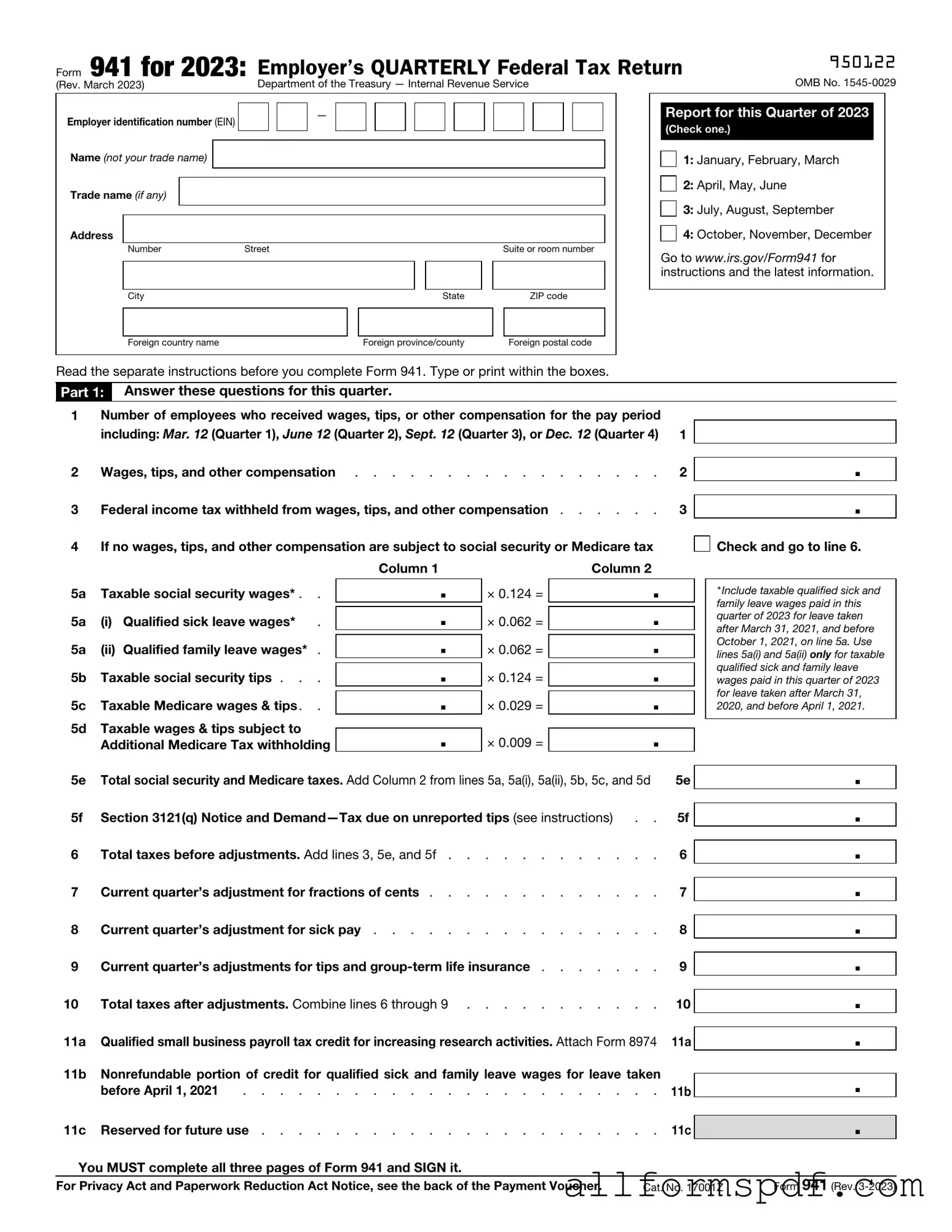

After gathering all necessary information, you are ready to fill out the IRS Form 941. This form is essential for reporting employment taxes, and accuracy is crucial. Follow these steps carefully to ensure you complete it correctly.

- Begin with your business name and address at the top of the form.

- Enter your Employer Identification Number (EIN) in the designated box.

- Fill in the quarter for which you are filing the form. The quarters are January to March, April to June, July to September, and October to December.

- Provide the total number of employees you had during the quarter.

- Report the total wages, tips, and other compensation paid to employees.

- Calculate the total tax liability for the quarter and enter it in the appropriate section.

- Complete the section for tax deposits made during the quarter.

- Determine any overpayment or amount owed and fill in that information.

- Sign and date the form. Ensure that the signature is from an authorized person.

Once you have completed the form, review it for any errors before submitting. Ensure that all figures are accurate and that the form is signed. This will help avoid delays in processing your submission.

Misconceptions

The IRS Form 941 is an important document for employers, but several misconceptions often surround its purpose and requirements. Here are four common misunderstandings:

- Misconception 1: Form 941 is only for large employers.

- Misconception 2: Form 941 must be filed monthly.

- Misconception 3: Filing Form 941 is optional if no taxes are owed.

- Misconception 4: Form 941 is the same as Form 940.

This is not true. All employers who withhold income taxes, Social Security, and Medicare taxes from their employees must file Form 941, regardless of the number of employees. Small businesses are just as responsible for this filing as larger corporations.

While some employers may choose to file monthly, Form 941 is typically filed quarterly. Employers are required to submit it four times a year, specifically for each quarter of the calendar year.

This misconception can lead to serious issues. Even if no taxes are owed for a particular quarter, employers must still file Form 941. Failing to file can result in penalties and complications with the IRS.

These forms serve different purposes. Form 941 is used for reporting income taxes, Social Security, and Medicare taxes withheld from employees, while Form 940 is specifically for reporting federal unemployment taxes. Understanding the distinction is crucial for compliance.

Dos and Don'ts

When completing the IRS Form 941, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid during the process.

- Do: Review the form instructions carefully before starting.

- Do: Ensure that all information is accurate and up-to-date.

- Do: Use black or blue ink to fill out the form.

- Do: Double-check your math calculations.

- Do: Sign and date the form before submission.

- Don't: Leave any required fields blank.

- Don't: Submit the form without keeping a copy for your records.

- Don't: Ignore deadlines for submission.

- Don't: Use correction fluid or tape on the form.

Following these guidelines can help ensure that the filing process goes smoothly and that you remain compliant with IRS regulations.

Other PDF Forms

How to Write a Lien Letter - The intention is to open a dialogue between the property owner and the service provider for resolution.

For those looking to properly handle their sales tax obligations, the Florida Sales Tax form, officially known as the Sales and Use Tax Return DR-15CS, is essential. It serves as a critical document for reporting sales, collecting tax, and submitting it to the Florida Department of Revenue. To aid in the completion of this form, it may be helpful to refer to various resources, including All Florida Forms, which provide comprehensive guidance and additional forms needed for accurate reporting and compliance.

Joint Tenancy in California - Surviving joint tenants can use this form to assert their ownership rights.

Common mistakes

Filling out the IRS Form 941 can be a straightforward process, but many individuals and businesses make common mistakes that can lead to complications. One frequent error is not reporting all wages accurately. It's essential to include all taxable wages paid to employees during the quarter. Omitting even a small amount can result in discrepancies that may trigger an audit.

Another common mistake is miscalculating the payroll taxes owed. This form requires precise calculations for Social Security and Medicare taxes. Errors in these calculations can lead to underpayment or overpayment, which can create issues with the IRS. Double-checking these figures is crucial to ensure compliance.

Many filers also neglect to sign and date the form. This is a simple yet critical oversight. Without a signature, the IRS may reject the form, causing delays in processing and potential penalties. It's important to remember that the form must be signed by an authorized individual who can certify the information provided.

Additionally, some people fail to keep proper records of their tax payments. The IRS may request proof of payment, and lacking documentation can complicate matters. Maintaining accurate records not only helps during the filing process but also provides necessary support in case of an audit.

Finally, submitting the form late is a mistake that can incur penalties. The IRS has strict deadlines for Form 941, and missing these can result in fines. Setting reminders for these due dates can help ensure timely submissions and avoid unnecessary costs.

Key takeaways

When filling out and using the IRS 941 form, there are several important points to keep in mind:

- Filing Frequency: The IRS 941 form is filed quarterly. Ensure that it is submitted by the due date to avoid penalties.

- Accurate Reporting: Report all wages paid, tips received, and any federal income tax withheld. Accuracy is crucial to prevent discrepancies.

- Calculating Taxes: Be sure to calculate the correct amount of Social Security and Medicare taxes owed. This includes both employee and employer contributions.

- Record Keeping: Maintain thorough records of employment tax payments and any correspondence with the IRS. This documentation can be vital for future reference.