Fill Out Your IRS 1120 Form

IRS 1120 - Usage Guidelines

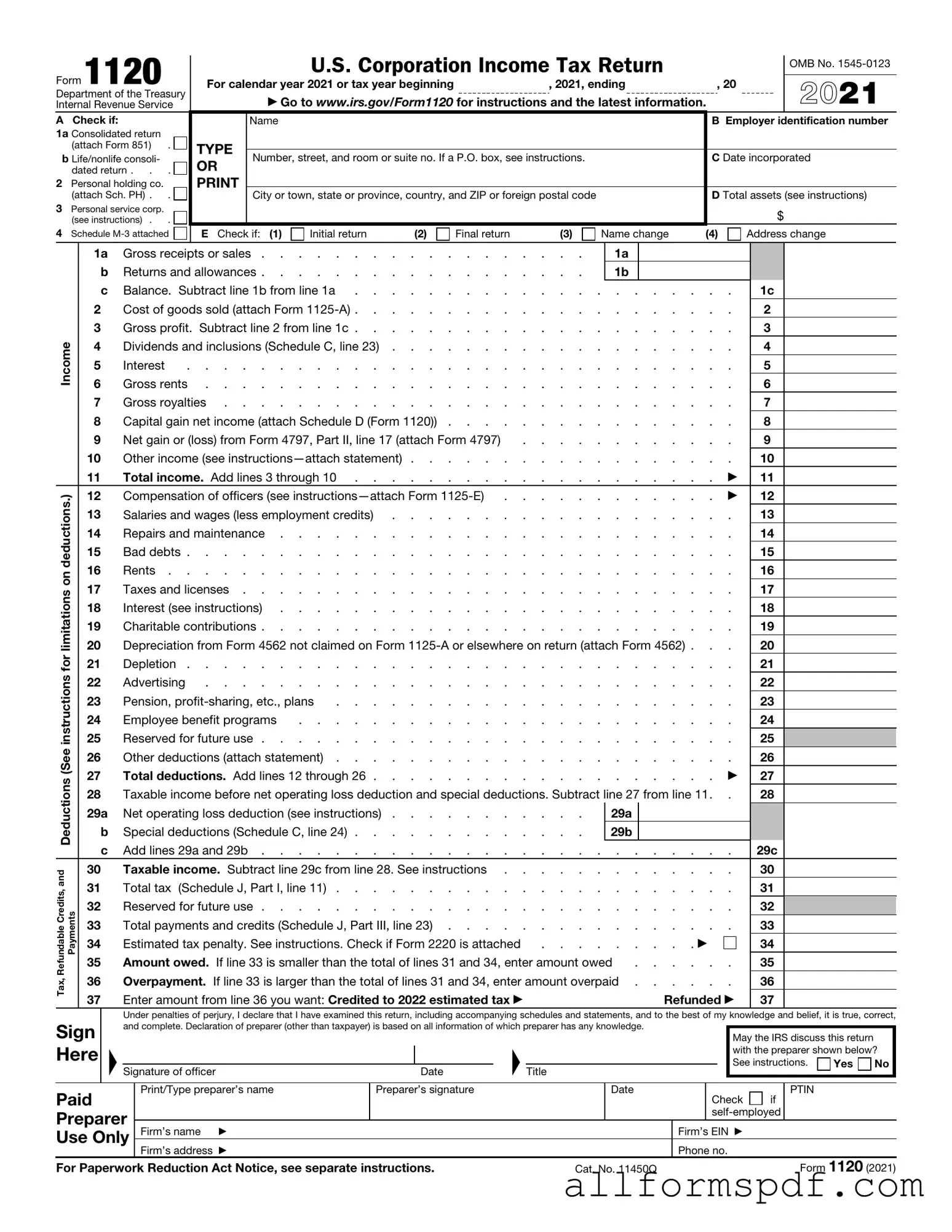

Completing IRS Form 1120 is an essential task for corporations in the United States. This form reports the income, gains, losses, deductions, and credits of a corporation. To ensure accuracy and compliance, follow these detailed steps to fill out the form correctly.

- Gather necessary documents. Collect financial statements, including income statements and balance sheets, as well as records of any deductions and credits your corporation may claim.

- Download the IRS Form 1120. You can find it on the official IRS website. Ensure you have the latest version of the form.

- Complete the corporation's name and address. This information should match what is on your corporation's articles of incorporation.

- Enter the Employer Identification Number (EIN). This unique number is assigned to your corporation by the IRS.

- Fill in the date of incorporation. This is the date your corporation was legally formed.

- Indicate the total assets. This figure should be taken from your balance sheet and represents the total value of the corporation's assets.

- Report income. Use the appropriate lines to enter gross receipts or sales, as well as any other types of income your corporation has earned.

- List deductions. Carefully itemize any allowable deductions, such as operating expenses, cost of goods sold, and other relevant expenses.

- Calculate taxable income. Subtract total deductions from total income to determine the taxable income for the corporation.

- Determine tax liability. Use the IRS tax tables or rates to calculate the amount of tax owed based on the taxable income.

- Complete additional schedules if necessary. Depending on your corporation's activities, you may need to fill out additional forms or schedules.

- Review the form for accuracy. Double-check all entries to ensure there are no mistakes or omissions.

- Sign and date the form. An authorized officer of the corporation must sign and date the form before submission.

- Submit the form. Mail the completed IRS Form 1120 to the appropriate address listed in the instructions or file electronically if eligible.

Once you have submitted the form, keep a copy for your records. Be aware of any deadlines for filing to avoid penalties. Understanding the process can help ensure that your corporation remains compliant with tax regulations.

Misconceptions

The IRS Form 1120 is a crucial document for corporations in the United States, but several misconceptions surround its purpose and requirements. Understanding these misconceptions can help businesses navigate their tax obligations more effectively.

- Misconception 1: Only large corporations need to file Form 1120.

- Misconception 2: Form 1120 is only for C Corporations.

- Misconception 3: Filing Form 1120 is optional if the corporation has no income.

- Misconception 4: Form 1120 can be filed at any time during the year.

This is not true. Any corporation, regardless of size, must file Form 1120 if it is recognized as a separate legal entity. This includes small businesses and even some non-profit organizations that operate as corporations.

While Form 1120 is primarily used by C Corporations, other types of corporations may also need to file it under certain circumstances. For example, certain entities classified as corporations for tax purposes may also be required to use this form.

This is misleading. Even if a corporation has no income or has incurred losses, it is still required to file Form 1120. Failing to file can result in penalties, regardless of the corporation's financial performance.

Corporations must adhere to specific deadlines when filing Form 1120. Generally, the form is due on the 15th day of the fourth month after the end of the corporation’s tax year. Missing this deadline can lead to late fees and interest charges.

Dos and Don'ts

When filling out the IRS 1120 form, it’s crucial to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do double-check your business information for accuracy.

- Do use the correct tax year for the filing.

- Do keep thorough records of all income and expenses.

- Do sign and date the form before submission.

- Don't leave any sections blank; fill in all required fields.

- Don't forget to include any necessary schedules or attachments.

- Don't ignore deadlines; file on time to avoid penalties.

- Don't make assumptions; consult a tax professional if unsure.

Following these guidelines can help streamline the process and reduce the risk of errors. Stay organized and proactive to ensure a smooth filing experience.

Other PDF Forms

Transfer of Shares Form - Captures vital data about stock issuance, providing clarity to stakeholders.

When navigating the complexities of tax compliance in Florida, it is essential to utilize the Florida Sales Tax form, also known as the Sales and Use Tax Return DR-15CS. This form serves as a crucial tool for accurately reporting sales and calculating the taxes owed to the Florida Department of Revenue. To further assist individuals in this process, resources like All Florida Forms can provide additional guidance and necessary documentation.

How to File a Mechanics Lien in California - Consider hiring a professional if you're uncertain how to complete the form.

Common mistakes

Filing the IRS 1120 form can be a complex process for many business owners. One common mistake is failing to report all income accurately. Businesses may overlook certain revenue streams or misclassify income, leading to discrepancies that can raise red flags with the IRS. It's crucial to ensure that every source of income is documented and reported correctly to avoid potential audits or penalties.

Another frequent error involves miscalculating deductions. Business owners might not fully understand which expenses are deductible, leading to either overestimating or underestimating deductions. This can significantly impact the taxable income reported on the form. Careful review of allowable deductions is essential to ensure compliance and optimize tax liability.

Many individuals also neglect to sign and date the form before submission. A missing signature can result in delays or rejections of the filing. It is important to double-check that all required signatures are present, as this simple oversight can lead to complications in processing the return.

Additionally, some filers may use outdated versions of the form. The IRS periodically updates its forms and instructions. Using an outdated version can result in incorrect filings, which may lead to penalties or a longer processing time. Always ensure that the most current version of the IRS 1120 form is being utilized.

Lastly, failing to keep accurate records can be detrimental. Incomplete or disorganized records may lead to errors in the information reported on the form. Maintaining thorough documentation not only helps in filling out the form accurately but also provides necessary support in case of an audit. Proper record-keeping is a fundamental aspect of the filing process.

Key takeaways

When filling out and using the IRS 1120 form, several key points are crucial for ensuring compliance and accuracy. Here are the essential takeaways:

- Understand the Purpose: The IRS 1120 form is used by corporations to report their income, gains, losses, deductions, and credits.

- Know the Filing Deadline: The form is typically due on the 15th day of the fourth month after the end of the corporation’s tax year.

- Gather Necessary Information: Collect all relevant financial documents, including income statements, balance sheets, and prior year tax returns.

- Accurate Reporting: Ensure all income and deductions are accurately reported to avoid penalties or audits.

- Use the Correct Version: Confirm that you are using the most recent version of the IRS 1120 form, as tax laws can change.

- Consider State Requirements: Be aware that some states have their own corporate tax forms and requirements in addition to the federal form.

- Review Before Submission: Double-check all entries for accuracy and completeness before submitting the form to the IRS.

- Keep Copies: Retain a copy of the completed form and all supporting documents for your records.

- Seek Professional Help: If unsure about any part of the process, consider consulting a tax professional for guidance.

Adhering to these takeaways will facilitate a smoother filing process and help ensure compliance with IRS regulations.