Printable Investment Letter of Intent Form

Investment Letter of Intent - Usage Guidelines

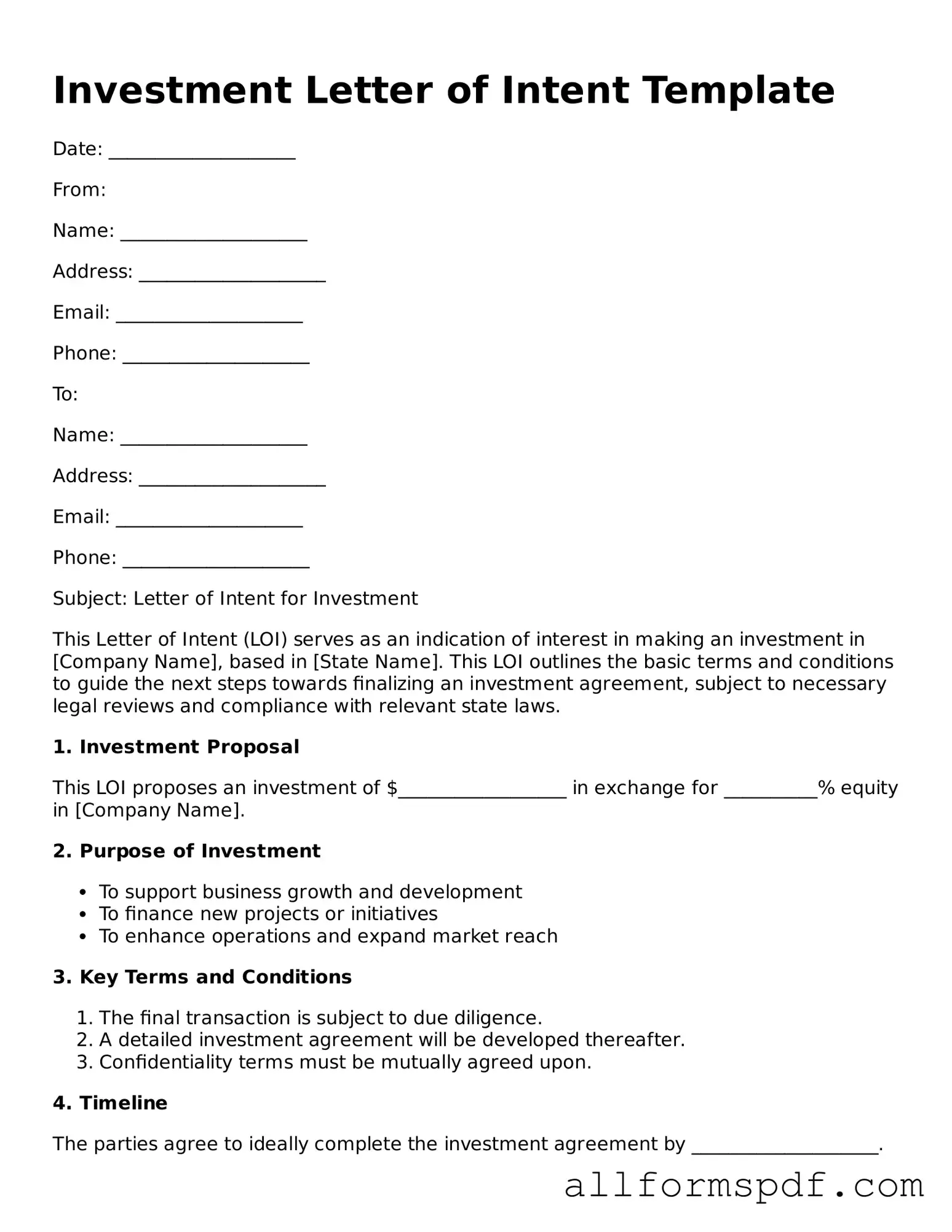

After obtaining the Investment Letter of Intent form, you will need to provide specific information to complete it. This process ensures that all necessary details are accurately captured for future reference. Follow these steps carefully to fill out the form correctly.

- Begin by entering your full name in the designated field.

- Provide your current address, including city, state, and zip code.

- List your contact number and email address for communication purposes.

- Indicate the date on which you are completing the form.

- Specify the amount you intend to invest.

- Detail the type of investment you are considering.

- Include any relevant information about your investment experience.

- Sign and date the form at the bottom to validate your intent.

Once you have completed the form, ensure that all information is accurate before submission. This will help facilitate the next steps in the investment process.

Misconceptions

Many people have misunderstandings about the Investment Letter of Intent (LOI) form. Here are four common misconceptions:

- It is a legally binding contract. Many believe that signing an LOI creates a binding agreement. In reality, most LOIs are non-binding and serve as a preliminary outline of terms for negotiation.

- It guarantees an investment. Some think that submitting an LOI guarantees that funds will be invested. However, it simply expresses interest and outlines potential terms, leaving room for further discussions.

- All LOIs are the same. Not every LOI follows a standard format. Each LOI can vary significantly based on the specific circumstances and the parties involved, which means customization is often necessary.

- Only large investors use LOIs. While institutional investors frequently use LOIs, individual investors and smaller firms also find them useful. They can help clarify intentions and terms regardless of the investment size.

Understanding these misconceptions can help investors navigate the process more effectively.

Dos and Don'ts

When filling out the Investment Letter of Intent form, it is important to approach the task with care. Here are six key actions to take and avoid:

- Do: Read the entire form carefully before starting to fill it out.

- Do: Provide accurate and truthful information to ensure the integrity of your application.

- Do: Double-check your entries for any errors or omissions before submission.

- Do: Seek assistance if you have questions or need clarification on any section.

- Don't: Rush through the form; take your time to ensure completeness.

- Don't: Leave any sections blank unless instructed to do so.

By following these guidelines, you can enhance the clarity and effectiveness of your Investment Letter of Intent form.

Discover More Types of Investment Letter of Intent Documents

Letter of Intent for Employment - Candidates receive this form to understand their prospective employment and related terms before signing an official contract.

Rental Letter of Intent - Offers a written record of what’s been discussed so far.

Letter of Intent to Purchase Property - This document can signal to other parties that negotiations are in progress.

Common mistakes

Filling out an Investment Letter of Intent form can be a straightforward process, but many individuals make common mistakes that can lead to delays or complications. One of the most frequent errors is providing incomplete information. When sections are left blank, it creates confusion and may require additional follow-up. Always double-check that every required field is filled out completely.

Another mistake often seen is failing to read the instructions carefully. Each form has specific guidelines that must be followed. Ignoring these can result in incorrect submissions. Take the time to review the instructions before starting the form to ensure compliance with all requirements.

People sometimes misinterpret the purpose of the form. An Investment Letter of Intent is not a binding contract but rather an expression of interest. Misunderstanding this can lead to unrealistic expectations. It's important to grasp the intent behind the document to avoid future misunderstandings.

Additionally, some individuals overlook the importance of accuracy in their financial details. Providing incorrect figures can lead to significant issues later on. It's advisable to verify all financial information before submitting the form to ensure that it reflects true and accurate data.

Another common pitfall is neglecting to sign and date the form. A signature is often required to validate the document. Without it, the form may be considered incomplete, causing unnecessary delays. Always ensure that you have signed and dated the form before submission.

People also tend to forget about the importance of contact information. Providing outdated or incorrect contact details can hinder communication. Make sure to include your current phone number and email address, ensuring that you can be reached easily for any follow-up.

Some individuals rush through the process, leading to typographical errors. These small mistakes can change the meaning of the information provided. Take your time to review your entries carefully to catch any errors before submitting the form.

Another frequent error is failing to keep a copy of the submitted form. It's crucial to have a record for your own reference. Keeping a copy can help you track your submission and provide necessary information in case of any discrepancies.

Lastly, many people do not follow up after submitting the form. Checking in can help confirm that your application is being processed and that all information is correct. A simple follow-up can provide peace of mind and ensure that everything is on track.

Key takeaways

When filling out and using the Investment Letter of Intent form, keep these key points in mind:

- Understand the Purpose: The form outlines your intent to invest, serving as a preliminary agreement between you and the investment opportunity.

- Provide Accurate Information: Ensure all personal and financial details are correct. Mistakes can lead to misunderstandings later.

- Be Clear About Your Intent: Clearly state the amount you intend to invest and the terms you expect. Clarity helps in setting the right expectations.

- Review All Terms: Take time to read through the terms and conditions associated with the investment. This helps in making informed decisions.

- Seek Professional Advice: If uncertain, consult with a financial advisor or legal professional. Their insights can be invaluable.

- Keep a Copy: After submitting the form, retain a copy for your records. This can be useful for future reference.

- Follow Up: After submission, follow up with the recipient to confirm receipt and discuss any next steps.

- Be Aware of Deadlines: Pay attention to any deadlines associated with the form. Timeliness can affect your investment opportunity.

- Stay Informed: Keep yourself updated on any changes regarding the investment. This ensures you are always in the loop.