Fill Out Your Intent To Lien Florida Form

Intent To Lien Florida - Usage Guidelines

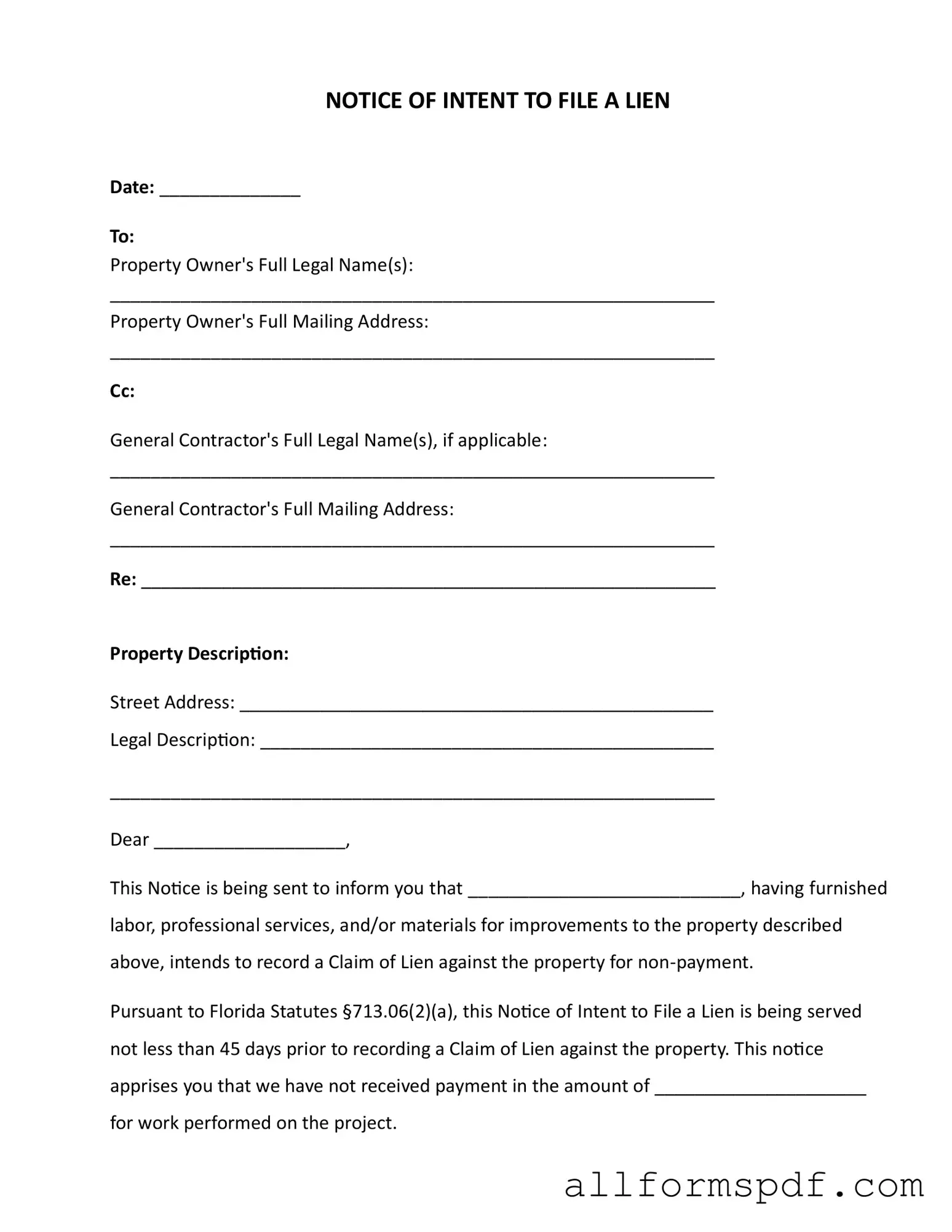

Once you have gathered the necessary information, filling out the Intent to Lien form is straightforward. It is crucial to ensure all details are accurate to avoid any delays or complications. After completing the form, you will need to serve it to the property owner and possibly the general contractor, depending on the situation. This step is vital to ensure compliance with Florida statutes.

- Date: Write the current date at the top of the form.

- Property Owner's Name: Fill in the full legal name(s) of the property owner(s).

- Property Owner's Mailing Address: Enter the complete mailing address of the property owner(s).

- General Contractor's Name: If applicable, include the full legal name(s) of the general contractor.

- General Contractor's Mailing Address: Provide the mailing address for the general contractor, if applicable.

- Re: Specify the subject or reference related to the lien.

- Property Description: Fill in the street address of the property.

- Legal Description: Include the legal description of the property.

- Dear: Address the property owner by their name.

- Furnisher's Name: State the name of the individual or company intending to file the lien.

- Amount Due: Indicate the total amount owed for labor, services, or materials provided.

- Signature: Sign the form with your name, title, phone number, and email address.

- Certificate of Service: Complete this section to certify that the notice was served, including the method of delivery.

Misconceptions

Here are five common misconceptions about the Intent To Lien Florida form:

- It guarantees a lien will be filed. Many believe that submitting this notice automatically results in a lien being placed on the property. However, it is merely a notification that a lien may be filed if payment is not received.

- It can be sent at any time. Some think that this notice can be issued whenever they choose. In reality, it must be sent at least 45 days before a lien is recorded, as per Florida law.

- It only applies to contractors. While contractors often use this form, it is also applicable to subcontractors and suppliers who have not been paid for their services or materials.

- Sending the notice is the same as filing a lien. People may confuse the notice with the actual lien process. The notice serves as a warning, while the lien is a legal claim that must be formally recorded.

- Once sent, the matter is resolved. There is a misconception that sending the notice resolves the payment issue. It is important to follow up and communicate with the property owner to seek payment and avoid further actions.

Dos and Don'ts

When filling out the Intent To Lien Florida form, consider these important guidelines:

- Ensure all property owner information is complete and accurate.

- Clearly state the amount owed for services rendered.

- Send the notice at least 45 days before filing the lien.

- Keep a copy of the notice for your records.

- Contact the property owner promptly to discuss payment options.

Avoid these common mistakes:

- Do not leave any sections of the form blank.

- Avoid vague descriptions of the work performed.

- Do not ignore the 30-day response requirement for payment.

- Refrain from using unverified contact information for the property owner.

- Do not delay in sending the notice; act promptly.

Other PDF Forms

Form I983 - Employers are responsible for ensuring that training meets industry standards.

When to Renew Australian Passport - Cheques are not accepted for passport application payments.

Completing the FR44 Florida form is essential for those who must verify their adherence to Florida’s Financial Responsibility Law, which necessitates a specific level of vehicle liability insurance coverage. For individuals seeking to simplify their compliance process, it’s beneficial to explore resources like All Florida Forms, which provide necessary documentation and guidance to ensure that all requirements are met efficiently.

Written Estimate for Auto Repair - Provide a space for additional notes from the technician.

Common mistakes

Filling out the Intent to Lien form in Florida can be straightforward, but many people make common mistakes that can jeopardize their claims. One frequent error is failing to provide the correct date at the top of the form. This date is crucial as it marks the beginning of the 45-day notice period. Without it, the timeline for potential lien filing becomes unclear, potentially affecting legal standing.

Another mistake involves the property owner's name. The form must include the full legal name(s) of the property owner(s). Omitting middle names or using nicknames can lead to complications. A lien must be filed against the correct legal entity to be enforceable, so accuracy is essential.

In addition, people often neglect to include the full mailing address of the property owner. This oversight can result in failure to properly serve the notice, which is a critical step in the lien process. If the notice does not reach the intended recipient, the lien may be deemed invalid.

Another common issue is the lack of detail in the property description. The form requires both the street address and the legal description of the property. A vague or incomplete description can lead to confusion and may prevent the lien from being enforceable.

People also frequently forget to specify the amount owed in the notice. This figure should clearly state the total due for the work performed. Leaving this blank or providing an incorrect amount can undermine the seriousness of the claim and complicate future legal proceedings.

Many individuals do not realize the importance of the certificate of service. This section must be completed accurately to show that the notice was delivered to the property owner. Failing to fill this out correctly can lead to disputes about whether the notice was properly served.

Some filers make the mistake of not checking the box for the method of delivery. Whether it was sent via certified mail, hand delivery, or another method, this detail is important for establishing the notice's validity. Not indicating this can create ambiguity in the process.

Another error is using a generic salutation instead of addressing the property owner by name. Personalizing the notice adds a level of professionalism and clarity, which can be beneficial in resolving payment disputes amicably.

People often overlook the need for a signature on the form. The signature of the individual sending the notice is essential for validation. Without it, the notice may not be considered legitimate.

Finally, many individuals fail to keep a copy of the completed form for their records. Retaining a copy is vital for future reference, especially if legal action becomes necessary. Without documentation, it can be challenging to prove that the notice was sent and received.

Key takeaways

Filling out and using the Intent To Lien Florida form requires careful attention to detail. Here are six key takeaways to ensure the process goes smoothly:

- The form must be dated accurately to reflect the day it is sent. This date is crucial for compliance with statutory requirements.

- Include the full legal names and addresses of both the property owner and the general contractor, if applicable. This information ensures that all parties are properly notified.

- Clearly describe the property involved, including both the street address and the legal description. This specificity helps avoid any confusion regarding which property the lien pertains to.

- Specify the amount owed for the work performed. This figure should be precise, as it forms the basis of the lien claim.

- Understand the timeline: the notice must be served at least 45 days before filing a lien. Additionally, the property owner has 30 days to respond before further action is taken.

- Keep a record of how the notice was delivered. This includes marking the appropriate method of service, whether by certified mail, hand delivery, or another method, as this documentation may be important later.

By following these guidelines, you can navigate the process of filing an Intent to Lien with confidence and clarity.