Fill Out Your Independent Contractor Pay Stub Form

Independent Contractor Pay Stub - Usage Guidelines

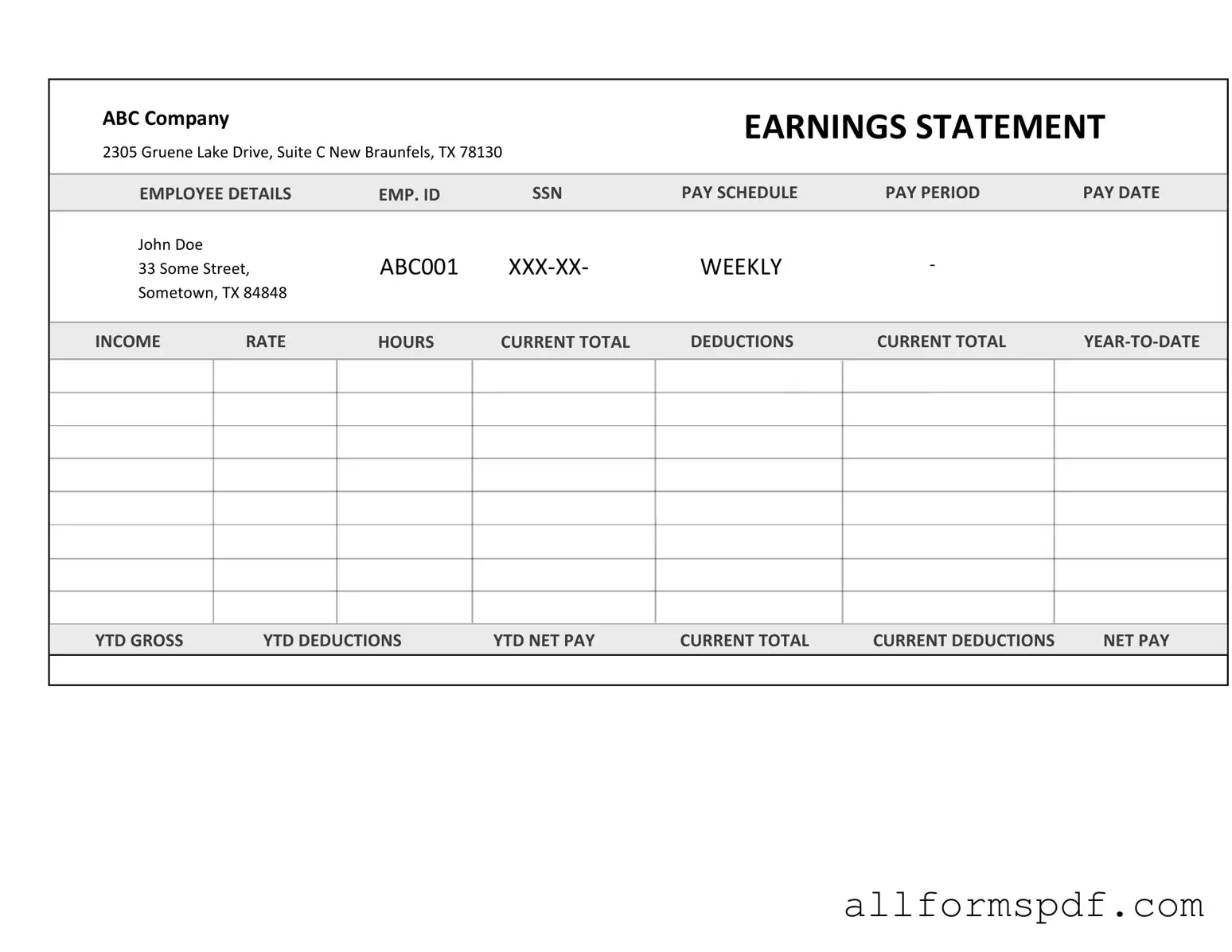

Filling out the Independent Contractor Pay Stub form is an important step in ensuring that you accurately document your earnings. This form will help you maintain clear records for both your personal use and for any tax obligations you may have. Below are the steps to guide you through the process of completing this form.

- Begin by entering your name in the designated field. Ensure that it matches your legal name.

- Provide your address. Include your street address, city, state, and ZIP code.

- Fill in the date of the pay stub. This should reflect the date you are completing the form.

- Enter the pay period. Specify the start and end dates for the work you are documenting.

- List the total hours worked during this pay period. Be accurate to reflect your actual hours.

- Input your hourly rate or total payment amount. If you are paid a flat fee, enter that total amount.

- Calculate the gross pay by multiplying the total hours worked by your hourly rate, if applicable.

- Deduct any applicable taxes or other withholdings. Clearly specify the amounts deducted.

- Calculate the net pay by subtracting the total deductions from the gross pay.

- Finally, sign and date the form to certify that the information provided is accurate.

Misconceptions

Misconceptions about the Independent Contractor Pay Stub form can lead to confusion for both contractors and employers. Understanding the realities behind these misconceptions is crucial for ensuring clarity in the contractor-client relationship. Here are eight common misconceptions:

- Independent contractors do not need pay stubs. Many believe that because independent contractors are not employees, they do not require pay stubs. However, pay stubs can help contractors track their earnings and expenses for tax purposes.

- All independent contractors receive the same type of pay stub. This is not true. Pay stubs can vary widely depending on the nature of the work and the agreement between the contractor and the client.

- Independent contractor pay stubs are optional. While it is true that they are not legally required, many contractors find them beneficial for maintaining accurate financial records.

- Pay stubs are only for employees. This misconception overlooks the fact that independent contractors can also benefit from having a detailed record of their payments.

- Independent contractors are paid only after submitting invoices. Some clients may pay contractors on a regular schedule, similar to how employees are paid. This can be outlined in the contract.

- Pay stubs must include taxes and deductions. Unlike employees, independent contractors typically handle their own taxes. Therefore, their pay stubs may not reflect tax withholdings.

- All pay stubs look the same. The format and information included on pay stubs can differ significantly. Each contractor may have their own preferred layout or requirements.

- Independent contractors cannot dispute pay stub errors. Contractors have the right to address discrepancies in their pay stubs, just as employees do. Open communication with clients is essential for resolving such issues.

By addressing these misconceptions, both independent contractors and clients can foster a more transparent and effective working relationship.

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, it's important to be thorough and accurate. Here are some tips on what to do and what to avoid:

- Do: Ensure all personal information is correct, including your name and address.

- Do: Clearly itemize the services provided and the corresponding payment amounts.

- Do: Include the correct tax identification number, if applicable.

- Do: Double-check the total amount to ensure it matches your calculations.

- Do: Keep a copy of the completed pay stub for your records.

- Don't: Leave any sections blank; fill in all required fields.

- Don't: Use vague descriptions for services rendered; be specific.

- Don't: Forget to sign the pay stub if required.

- Don't: Provide false information; accuracy is crucial.

- Don't: Submit the form without reviewing it for errors.

Other PDF Forms

Electrical Panel Schedule Template - Essential for understanding three-phase and single-phase systems.

When engaging in a mobile home transaction, it is essential to utilize the appropriate documentation, such as the New York Mobile Home Bill of Sale form, to ensure clarity and protection for both buyer and seller; for a comprehensive template to streamline this process, you can visit smarttemplates.net/fillable-new-york-mobile-home-bill-of-sale/.

Simple Shared Well Agreement Form - Written notice must be provided if party wishes to terminate their participation in the agreement.

Roof Estimate Template - Receive a customized roofing quote tailored to your specific needs.

Common mistakes

When filling out the Independent Contractor Pay Stub form, individuals often overlook critical details that can lead to confusion or errors in payment processing. One common mistake is failing to accurately report the hours worked. Contractors should carefully track their hours and ensure that the total reflects the actual time spent on projects. Inaccurate reporting can result in underpayment or disputes with clients.

Another frequent error involves miscalculating the pay rate. It’s essential for contractors to confirm their agreed-upon rate before entering it on the form. Sometimes, individuals mistakenly use a previous rate or forget to account for any adjustments that have been made. This can lead to discrepancies that might require additional time to resolve.

Additionally, many people neglect to include necessary deductions. Independent contractors often have various expenses that can affect their take-home pay, such as taxes or insurance contributions. Failing to account for these deductions can result in receiving a higher payment than expected, which may lead to tax complications later on.

Finally, a common oversight is not providing complete contact information. It's important for contractors to ensure that their name, address, and other relevant details are accurate and up-to-date. Missing or incorrect contact information can hinder communication and create issues if any questions arise regarding the payment or services rendered.

Key takeaways

When using the Independent Contractor Pay Stub form, it's essential to keep a few key points in mind. These takeaways will help ensure that you fill out the form correctly and use it effectively.

- Accurate Information: Always provide accurate details about the contractor, including their name, address, and Social Security number or Employer Identification Number (EIN).

- Payment Details: Clearly outline the payment amount, the date of payment, and the payment method. This transparency helps maintain good relationships.

- Tax Deductions: If applicable, include any tax deductions taken from the payment. This is crucial for both the contractor and for tax reporting purposes.

- Record Keeping: Keep a copy of each pay stub for your records. This documentation can be vital for future reference, especially during tax season.

- Compliance: Ensure that the pay stub complies with state and federal regulations. Staying informed about legal requirements can save you from potential issues down the line.