Fillable Transfer-on-Death Deed Form for Illinois

Illinois Transfer-on-Death Deed - Usage Guidelines

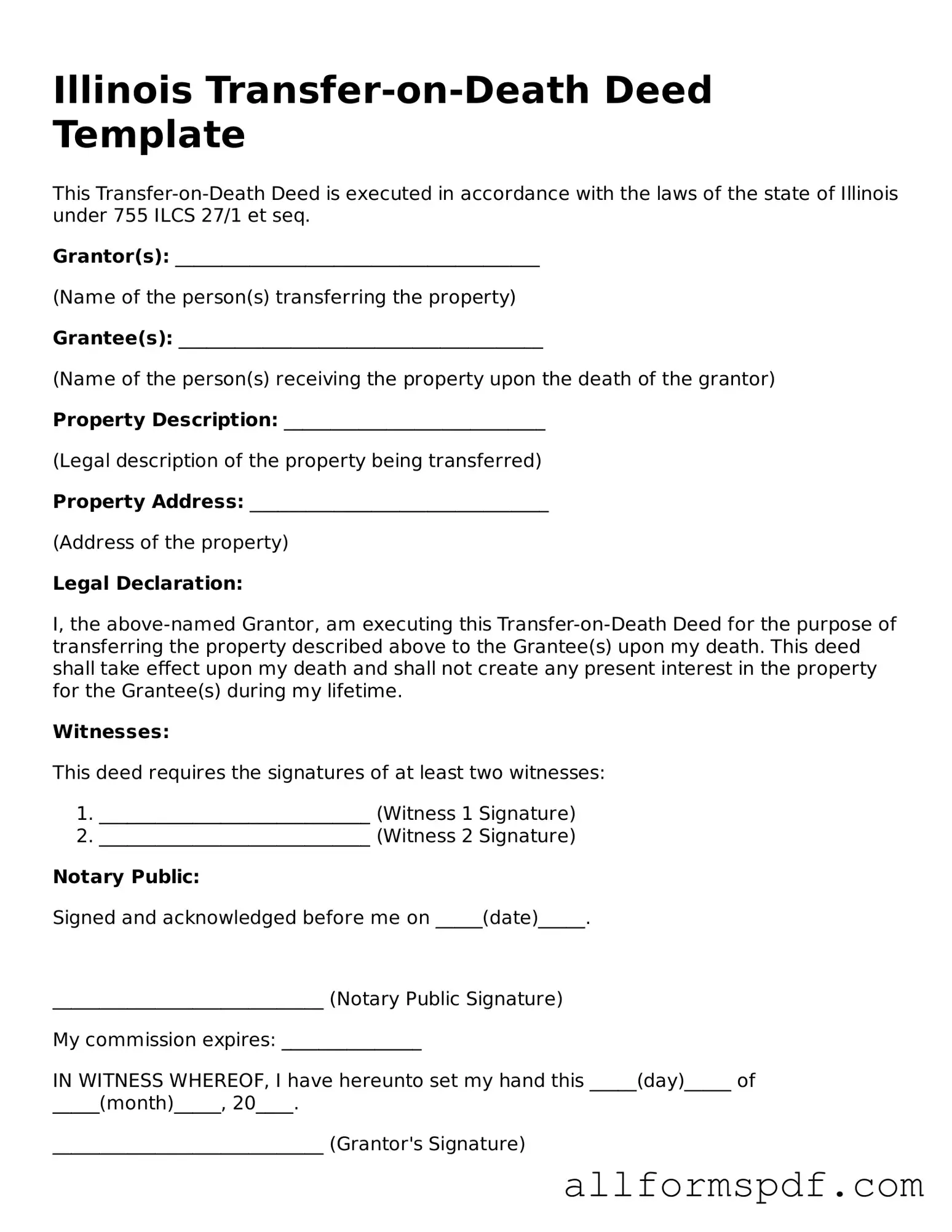

Once you have the Illinois Transfer-on-Death Deed form ready, you will need to complete it carefully to ensure it is valid. Follow these steps to fill out the form correctly.

- Begin by entering the name of the property owner(s) at the top of the form.

- Provide the address of the property that you wish to transfer.

- Clearly describe the property. Include details like the legal description, which can typically be found on the property’s deed.

- List the name(s) of the beneficiary or beneficiaries who will receive the property upon the owner's death.

- Include the address of each beneficiary to avoid any confusion later.

- Sign the form in the presence of a notary public. Ensure the notary signs and stamps the form as required.

- Make copies of the completed form for your records.

- File the original form with the county recorder’s office where the property is located.

After completing these steps, the deed will be officially recorded, and the transfer will take effect upon your death. This process helps ensure that your property is passed on to your chosen beneficiaries without the need for probate.

Misconceptions

The Illinois Transfer-on-Death Deed (TODD) is a tool designed to simplify the transfer of real estate upon a person's death. However, there are several misconceptions surrounding its use. Understanding these misconceptions can help individuals make informed decisions about their estate planning.

- Misconception 1: The Transfer-on-Death Deed is a will.

- Misconception 2: The deed must be filed with the court.

- Misconception 3: A TODD can only be used for single-family homes.

- Misconception 4: The property is transferred to the beneficiaries immediately upon signing the deed.

- Misconception 5: A TODD eliminates the need for a will.

- Misconception 6: Beneficiaries cannot be changed once the deed is executed.

- Misconception 7: There are no tax implications with a TODD.

- Misconception 8: All states have the same Transfer-on-Death Deed laws.

This is incorrect. While both a TODD and a will deal with the distribution of assets after death, a TODD specifically transfers real estate directly to beneficiaries without going through probate.

In fact, the TODD must be recorded with the county recorder’s office where the property is located, not filed with the court. This is crucial for the deed to be effective.

This is not true. The Transfer-on-Death Deed can be used for various types of real estate, including commercial properties and vacant land, as long as it is properly executed.

Actually, the transfer only occurs upon the death of the property owner. Until that time, the owner retains full control and ownership of the property.

This is misleading. While a TODD can simplify the transfer of specific real estate, it does not cover other assets. A comprehensive estate plan often includes both a will and a TODD.

This is incorrect. The property owner can revoke or change the beneficiaries at any time before their death, provided they follow the proper legal procedures.

This is a common misunderstanding. While the transfer itself may not incur immediate taxes, beneficiaries may face property tax assessments or capital gains taxes when they sell the property later.

This is false. Each state has its own laws and regulations regarding TODDs. It is essential to consult local laws to ensure compliance and understanding of how a TODD works in Illinois specifically.

Dos and Don'ts

When filling out the Illinois Transfer-on-Death Deed form, it is important to follow certain guidelines to ensure the document is valid and effective. Here are some key points to consider:

- Do: Clearly identify the property you wish to transfer. Include the full legal description to avoid any confusion.

- Do: Ensure all property owners sign the deed. Each owner must agree to the transfer.

- Do: Provide the names and addresses of the beneficiaries. This information is crucial for the transfer to take place smoothly.

- Do: File the deed with the appropriate county recorder’s office. This step is necessary to make the deed effective.

- Don't: Leave any sections of the form blank. Incomplete information can lead to delays or rejection.

- Don't: Use vague language. Be specific about the property and beneficiaries to avoid misunderstandings.

- Don't: Forget to check for any local regulations. Some counties may have additional requirements.

- Don't: Wait too long to file the deed. Timeliness is important to ensure your wishes are honored.

Popular State-specific Transfer-on-Death Deed Forms

Tod Form Ohio - The Transfer-on-Death Deed must be properly executed and recorded to be valid and effective.

When engaging in high-risk activities, it's essential to have the right legal protections in place. A Florida Hold Harmless Agreement form serves this purpose effectively, ensuring that one party cannot hold another liable for risks or claims that may arise. This agreement is particularly beneficial in scenarios such as events, construction projects, or professional services, allowing all parties to understand their responsibilities clearly. For those looking for a comprehensive resource, you can refer to All Florida Forms to access a suitable template for your needs.

Problems With Transfer on Death Deeds - This deed transfers only real estate; other assets may need different planning tools.

Common mistakes

Filling out the Illinois Transfer-on-Death Deed form can be a straightforward process, but many people stumble along the way. One common mistake is not clearly identifying the property being transferred. It's crucial to provide an accurate and complete legal description of the property. A vague description can lead to confusion and potential disputes in the future.

Another frequent error is failing to include all required signatures. The form must be signed by the property owner, and if there are multiple owners, each must sign. Omitting a signature can render the deed invalid, leaving your intentions unfulfilled.

Many individuals overlook the importance of notarization. The Transfer-on-Death Deed must be notarized to be legally binding. Skipping this step can result in the deed being challenged or deemed unenforceable.

Some people neglect to record the deed with the appropriate county office. Even if the deed is filled out correctly, if it’s not recorded, it won’t take effect. This oversight can lead to complications when the time comes to transfer the property.

Another mistake is not considering the implications of transferring property upon death. Some individuals fail to think about how this decision affects their heirs and any potential tax consequences. It’s wise to consult with a financial advisor or estate planner before making this choice.

In addition, people sometimes forget to update the deed after significant life changes, such as marriage or divorce. Failing to revise the deed can lead to unintended beneficiaries receiving the property, which might not align with the owner's wishes.

Misunderstanding the beneficiary designation is another pitfall. It's important to clearly name the beneficiaries and ensure that their information is accurate. Errors in names or addresses can complicate the transfer process.

Some individuals may not take the time to inform their beneficiaries about the deed. It’s essential for those who will inherit the property to know about the Transfer-on-Death Deed. This communication can prevent confusion and ensure a smooth transition.

Lastly, people often rush through the process without reviewing the form thoroughly. Taking a moment to double-check all entries can save a lot of time and trouble later. Attention to detail is key in avoiding mistakes that could impact the transfer of your property.

Key takeaways

Filling out and using the Illinois Transfer-on-Death Deed form is a straightforward process, but it's important to understand the key aspects to ensure it is done correctly.

- Purpose of the Deed: The Transfer-on-Death Deed allows property owners to transfer their real estate to beneficiaries without going through probate after their death.

- Filling Out the Form: Ensure that all required fields are completed accurately, including the names of the property owner and the beneficiaries.

- Signing and Notarizing: The deed must be signed in the presence of a notary public to be valid. This step is crucial for the legality of the document.

- Recording the Deed: After signing, the deed must be recorded with the local county recorder's office to take effect. This step ensures that the beneficiaries’ rights are protected.

Understanding these key points will help ensure that the Transfer-on-Death Deed serves its intended purpose effectively.