Fillable Promissory Note Form for Illinois

Illinois Promissory Note - Usage Guidelines

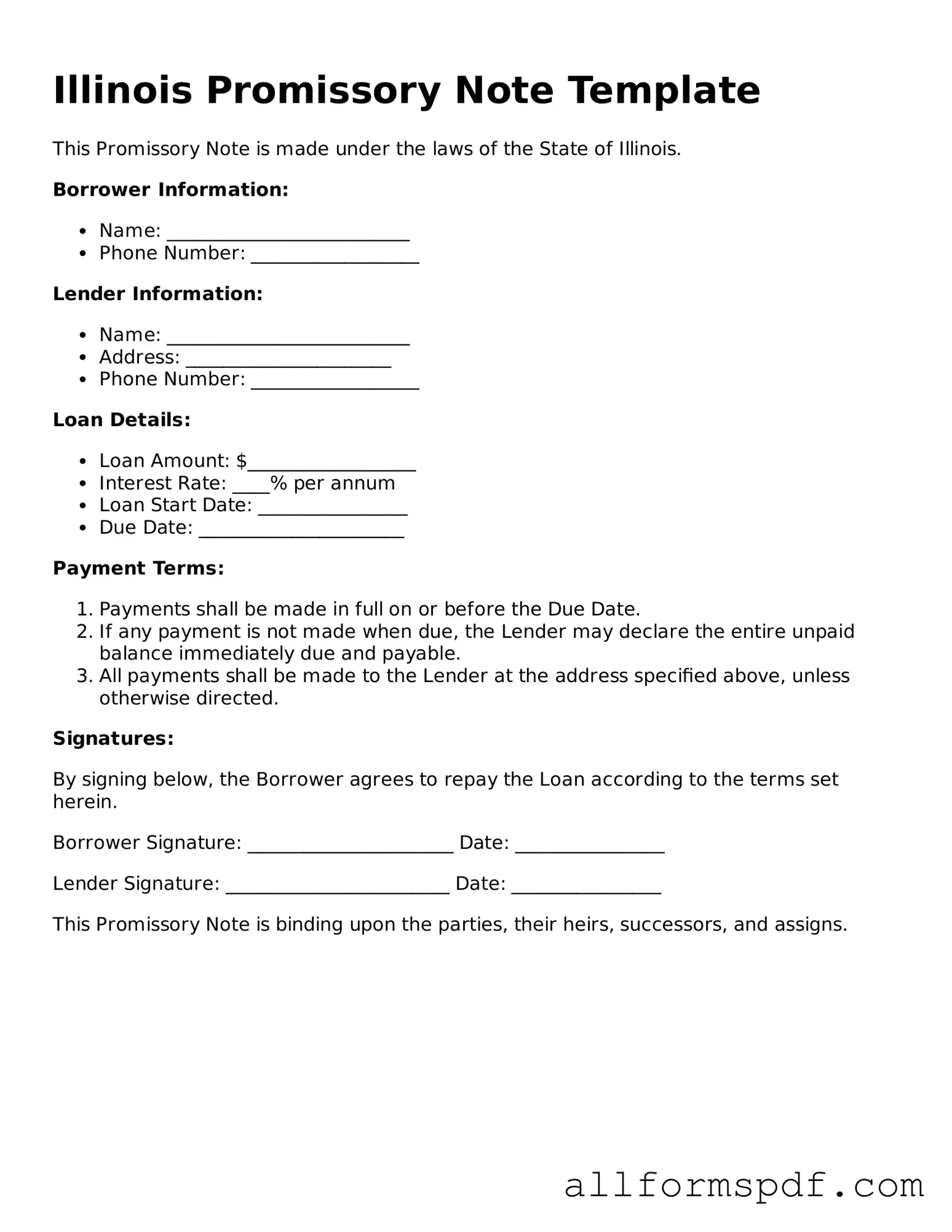

After obtaining the Illinois Promissory Note form, you will need to fill it out carefully to ensure all necessary information is included. This document will serve as a written promise to repay a loan, so accuracy is important. Follow the steps below to complete the form correctly.

- Begin with the date: Write the date on which the note is being created at the top of the form.

- Identify the borrower: Fill in the full name and address of the person or entity borrowing the money.

- Identify the lender: Provide the full name and address of the person or entity lending the money.

- Specify the loan amount: Clearly state the total amount of money being borrowed.

- Set the interest rate: Indicate the interest rate that will apply to the loan, if any. If there is no interest, you can write "0%."

- Outline the repayment terms: Describe how and when the borrower will repay the loan. Include details like the payment schedule (monthly, quarterly, etc.) and the due date for the final payment.

- Include any late fees: If applicable, specify any late fees that may be charged if payments are not made on time.

- Signatures: Both the borrower and lender should sign the form. Make sure to include the date of each signature.

- Witness or notarization: Depending on your needs, you may want to have the document witnessed or notarized for additional validity.

Once the form is completed and signed, both parties should keep a copy for their records. This ensures that everyone has access to the agreed-upon terms in the future.

Misconceptions

Understanding the Illinois Promissory Note form can be challenging. Here are six common misconceptions that people often have about this important financial document.

- 1. A Promissory Note is the Same as a Loan Agreement. Many people think these two documents are interchangeable. While both relate to borrowing money, a promissory note is a simpler document that outlines the borrower's promise to repay a specific amount, whereas a loan agreement includes additional terms and conditions.

- 2. Promissory Notes Must Be Notarized. Some believe that notarization is a requirement for a promissory note to be valid. In Illinois, notarization is not necessary for the note to be legally binding, although it can add an extra layer of authenticity.

- 3. Only Banks Can Issue Promissory Notes. This is a common misunderstanding. Individuals, businesses, and organizations can all create and issue promissory notes. It is not limited to financial institutions.

- 4. The Interest Rate Must Be Specified. While it is typical to include an interest rate in a promissory note, it is not mandatory. A note can be structured as interest-free if both parties agree.

- 5. A Promissory Note Cannot Be Transferred. Some people think that once a promissory note is signed, it cannot be sold or transferred to another party. In fact, promissory notes can often be endorsed or assigned to someone else, depending on the terms outlined in the document.

- 6. All Promissory Notes Are the Same. Not all promissory notes are created equal. They can vary significantly in terms of language, structure, and specific provisions. It's essential to tailor the note to fit the specific agreement between the parties involved.

By dispelling these misconceptions, individuals can better understand how to effectively use the Illinois Promissory Note form in their financial transactions.

Dos and Don'ts

When filling out the Illinois Promissory Note form, it's important to be thorough and accurate. Here are five things you should and shouldn't do:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate information regarding the borrower and lender.

- Do specify the loan amount clearly to avoid confusion.

- Do include the interest rate, if applicable, and ensure it complies with state regulations.

- Do sign and date the form in the appropriate sections.

- Don't leave any sections blank unless instructed to do so.

- Don't use vague language; be specific about the terms of the loan.

- Don't forget to keep a copy of the completed form for your records.

- Don't make any alterations or corrections without initialing them.

- Don't rush through the process; take your time to ensure accuracy.

Popular State-specific Promissory Note Forms

Promissory Note Template Georgia - The lender may offer favorable terms to encourage repayment.

Ensuring your healthcare decisions are honored is vital, and utilizing the appropriate form can make all the difference. For those seeking assistance in this regard, the important Medical Power of Attorney guidelines provide clarity and direction on how to effectively designate an agent for your medical decisions.

Michigan Promissory Note - This document can specify the jurisdiction for any legal proceedings related to the debt.

Common mistakes

Filling out the Illinois Promissory Note form can be straightforward, but many individuals make common mistakes that can lead to complications. One frequent error is failing to clearly specify the loan amount. Without a precise figure, it becomes challenging to enforce the agreement or prove the terms if a dispute arises. The amount should be clearly stated in both numeric and written form to avoid any ambiguity.

Another common mistake involves neglecting to include the interest rate. If the interest rate is omitted, it may lead to misunderstandings about the total repayment amount. This omission can create confusion and potentially result in legal issues down the line. It is essential to state the interest rate clearly, whether it is a fixed rate or variable, to ensure both parties have a mutual understanding of the financial obligations.

People often overlook the importance of signatures. A valid Promissory Note requires the signatures of both the borrower and the lender. Without these signatures, the document lacks enforceability. Additionally, it is advisable to include the date of signing. This detail is crucial for establishing the timeline of the agreement, especially if disputes arise regarding payment schedules.

Finally, many individuals fail to provide a clear repayment schedule. A vague repayment plan can lead to confusion regarding when payments are due and how much is owed at each interval. It is beneficial to outline specific due dates and payment amounts to create a clear framework for repayment. This clarity can help prevent misunderstandings and ensure that both parties are on the same page.

Key takeaways

When dealing with the Illinois Promissory Note form, it’s essential to understand its components and implications. Here are some key takeaways to consider:

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan to the lender under specified terms.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender to avoid confusion.

- Specify the Loan Amount: Clearly indicate the total amount of money being borrowed. This figure is crucial for both parties.

- Outline the Interest Rate: Include the interest rate, if applicable. Specify whether it is fixed or variable.

- Set the Repayment Terms: Detail how and when the borrower will repay the loan. Include payment frequency and due dates.

- Include Late Fees: If there are penalties for late payments, these should be clearly defined in the note.

- Consider Collateral: If the loan is secured, describe the collateral that the borrower offers to back the loan.

- Signatures Required: Both the borrower and lender must sign the document for it to be legally binding.

- Keep Copies: Each party should retain a signed copy of the promissory note for their records.

- Consult Legal Advice: If there are uncertainties about the terms, seeking legal counsel can provide clarity and ensure compliance with state laws.

By following these guidelines, individuals can effectively utilize the Illinois Promissory Note form, ensuring clarity and legal protection for both parties involved in the transaction.