Fillable Operating Agreement Form for Illinois

Illinois Operating Agreement - Usage Guidelines

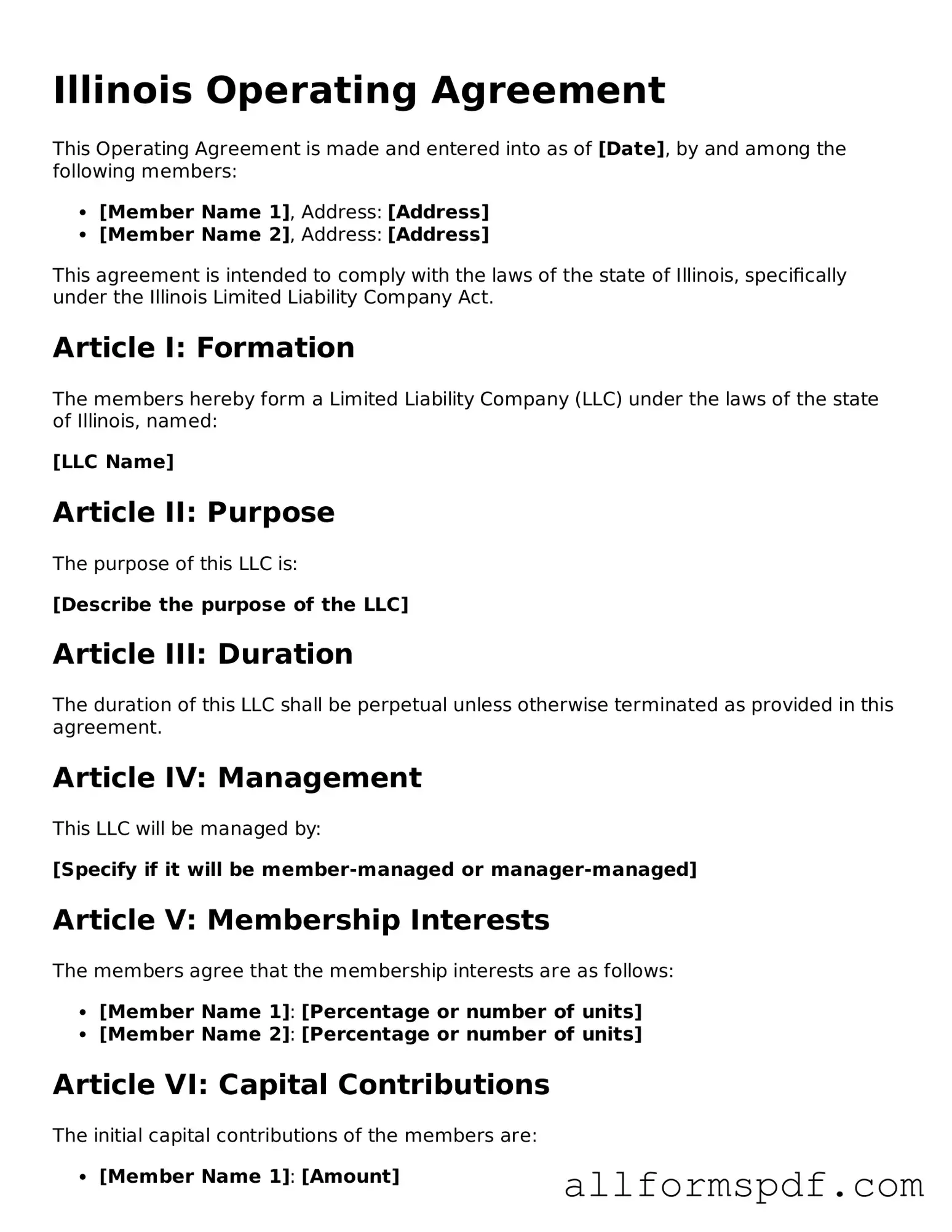

Filling out the Illinois Operating Agreement form is an important step for anyone looking to establish a limited liability company (LLC) in the state. This document outlines the management structure and operating procedures of your LLC. Once you complete the form, you will be ready to submit it along with any necessary documents to the appropriate state office.

- Begin by downloading the Illinois Operating Agreement form from the official state website or a trusted legal resource.

- Fill in the name of your LLC at the top of the form. Ensure it matches the name registered with the state.

- Provide the principal business address of your LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members of the LLC. Include their roles and responsibilities if applicable.

- Detail the management structure. Indicate whether the LLC will be managed by its members or by appointed managers.

- Outline the voting rights of each member. Specify how decisions will be made and what constitutes a quorum.

- Include provisions for adding or removing members. Clearly state the process for any changes in membership.

- Specify how profits and losses will be distributed among members. This should reflect the ownership percentages or any other agreed-upon method.

- Sign and date the form. Ensure all members sign as well, if required.

- Review the completed form for accuracy and completeness before submission.

After filling out the form, you can proceed to file it with the Illinois Secretary of State, along with any required fees. Make sure to keep a copy for your records.

Misconceptions

Understanding the Illinois Operating Agreement form is crucial for anyone involved in a business partnership or limited liability company (LLC). However, several misconceptions often cloud the reality of this important document. Here are ten common misunderstandings:

- It’s only necessary for large businesses. Many people believe that only large corporations need an operating agreement. In reality, even small LLCs benefit from having one to clarify roles and responsibilities.

- It’s a one-time document. Some think that once the operating agreement is created, it never needs to be updated. However, as businesses evolve, so should the agreement to reflect changes in ownership or management.

- It’s the same as a partnership agreement. While both documents serve similar purposes, an operating agreement is specifically tailored for LLCs, addressing unique aspects like member contributions and distributions.

- It’s not legally binding. There’s a misconception that operating agreements are merely suggestions. In fact, they are legally binding documents that can be enforced in court if disputes arise.

- All members must agree on every term. Some believe that unanimous consent is required for all provisions in the agreement. In reality, many terms can be established by a simple majority, depending on the agreement itself.

- It’s only for multi-member LLCs. Many assume that single-member LLCs do not need an operating agreement. However, having one can still provide clarity and protection for the sole owner.

- It’s unnecessary if the state has default rules. While Illinois does provide default rules for LLCs, relying solely on these can lead to misunderstandings. An operating agreement allows for customization to fit specific business needs.

- It doesn’t need to be filed with the state. Some people think that operating agreements must be filed with the state. In Illinois, this is not the case; the document is kept privately among the members.

- It can’t address future changes. There’s a belief that once an operating agreement is set, it cannot be modified. In truth, agreements can include provisions for future amendments, making them adaptable.

- Legal help is not necessary. Many individuals think they can draft an operating agreement without any legal assistance. While it is possible, consulting with a legal professional can ensure that the document is comprehensive and compliant with state laws.

By addressing these misconceptions, individuals and businesses can better appreciate the value of the Illinois Operating Agreement form and its role in fostering clear and effective business relationships.

Dos and Don'ts

When filling out the Illinois Operating Agreement form, it's important to approach the task thoughtfully. Here are five things you should do and five things you should avoid.

- Do read the entire form carefully before you start filling it out.

- Do provide accurate and complete information to avoid delays.

- Do consult with a legal professional if you have questions about specific sections.

- Do ensure that all members sign the agreement to make it valid.

- Do keep a copy of the completed agreement for your records.

- Don't rush through the form; take your time to ensure everything is correct.

- Don't leave any sections blank unless instructed to do so.

- Don't use unclear or vague language; be precise in your descriptions.

- Don't forget to check for any specific state requirements that may apply.

- Don't ignore the importance of having the agreement reviewed periodically.

Popular State-specific Operating Agreement Forms

How to Make an Operating Agreement - The agreement often includes confidentiality clauses, ensuring sensitive information is protected.

When engaging in the sale of a recreational vehicle in Texas, it is essential to complete the necessary paperwork to document the transaction, and the RV Bill of Sale form is critical for this process. This form serves to record all pertinent details between the buyer and seller, ensuring that the change of ownership is recognized by the state. For those looking to finalize their RV purchase or sale, it's important to utilize the RV Bill of Sale form to facilitate a smooth transaction.

Operating Agreement Llc New Jersey - Members can dictate the process for amending the agreement later on.

Common mistakes

Filling out the Illinois Operating Agreement form can be a straightforward process, but many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to clearly define the roles and responsibilities of each member. Without specific details, misunderstandings may arise, leading to conflicts in decision-making and operations. It’s crucial to outline each member's duties to ensure everyone is on the same page.

Another mistake often encountered is neglecting to include provisions for profit and loss distribution. Members may assume that profits will be shared equally, but this assumption can lead to disputes if not explicitly stated. Clearly specifying how profits and losses will be allocated among members helps to prevent confusion and potential disagreements in the future.

Some individuals overlook the importance of including a buyout clause in the agreement. This clause outlines the process for a member to exit the business, including how their share will be valued and transferred. Without this provision, the remaining members may face challenges if a member decides to leave, which can disrupt business operations.

Lastly, many people fail to update the Operating Agreement as their business evolves. Changes in membership, business structure, or operational procedures necessitate revisions to the agreement. Regularly reviewing and amending the document ensures it remains relevant and effective, protecting the interests of all members involved.

Key takeaways

When it comes to forming a Limited Liability Company (LLC) in Illinois, an Operating Agreement is a crucial document. It outlines the management structure and operating procedures of your LLC. Here are some key takeaways to consider when filling out and using the Illinois Operating Agreement form:

- Define Roles Clearly: Specify the roles and responsibilities of each member. This clarity helps prevent misunderstandings and ensures everyone knows their duties.

- Outline Decision-Making Processes: Establish how decisions will be made within the LLC. Will it be by majority vote, or does a specific member have the final say?

- Include Financial Arrangements: Detail how profits and losses will be distributed among members. This section is vital for financial transparency and fairness.

- Address Changes in Membership: Plan for future changes, such as adding new members or handling the departure of existing ones. This foresight can save time and conflict down the road.

- Consider Dispute Resolution: Include a process for resolving disagreements. Whether through mediation or arbitration, having a plan in place can help maintain harmony.

- Regular Updates: Review and update the Operating Agreement regularly. As your business evolves, so should your agreement to reflect new circumstances.

By keeping these takeaways in mind, you can create a comprehensive Operating Agreement that not only meets legal requirements but also supports the smooth operation of your LLC.