Fillable Loan Agreement Form for Illinois

Illinois Loan Agreement - Usage Guidelines

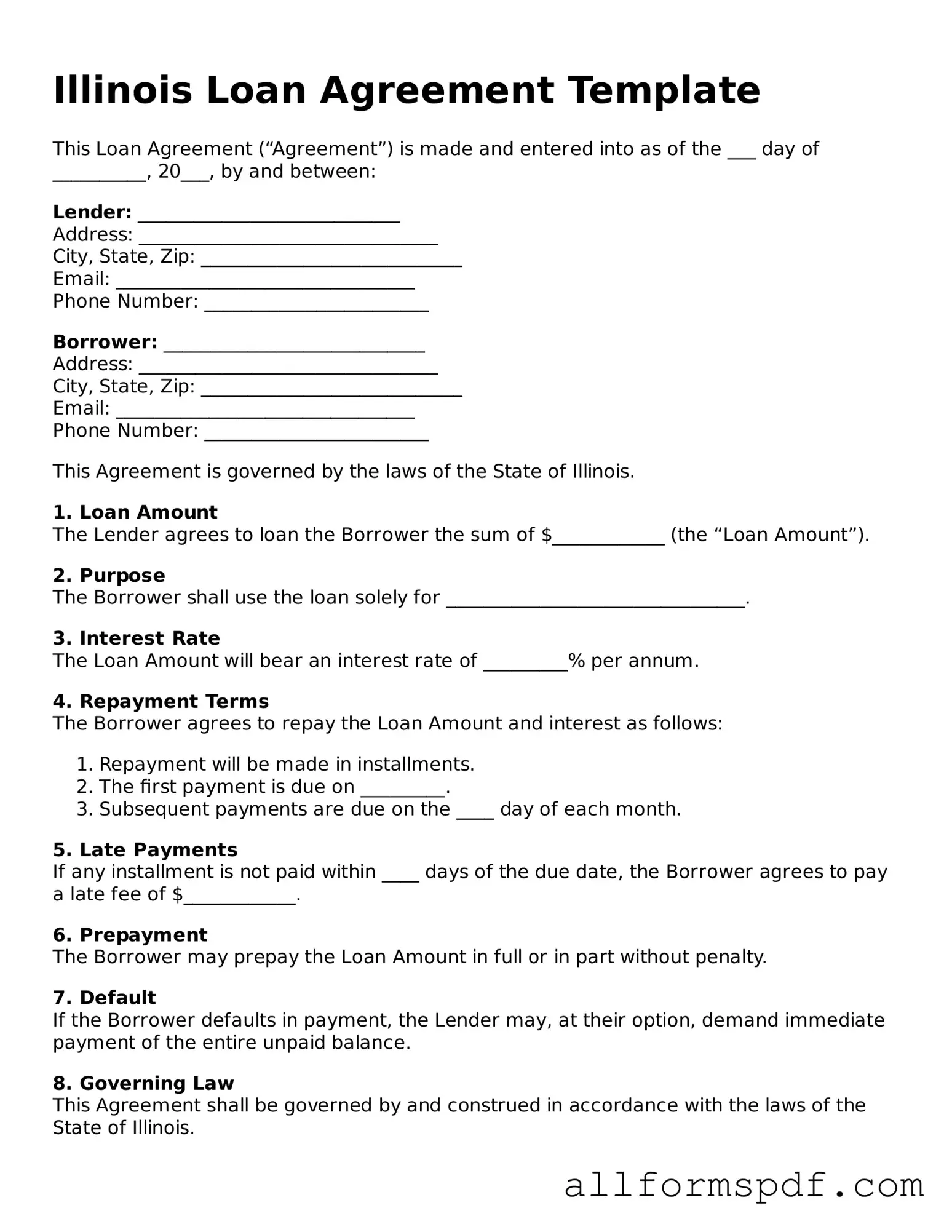

Filling out the Illinois Loan Agreement form is an important step in establishing the terms of a loan between a lender and a borrower. This form will guide you through the process of documenting the agreement clearly and effectively. Follow the steps below to ensure that all necessary information is provided accurately.

- Obtain the Form: Download the Illinois Loan Agreement form from a reliable source or obtain a physical copy.

- Enter the Date: Write the date when the agreement is being filled out at the top of the form.

- Identify the Parties: Fill in the names and addresses of both the lender and the borrower. Ensure that all details are accurate.

- Specify the Loan Amount: Clearly state the total amount of money being loaned.

- Outline the Terms: Describe the repayment terms, including the interest rate, payment schedule, and due dates.

- Include Additional Provisions: If applicable, add any additional clauses that pertain to the loan, such as late fees or prepayment options.

- Signatures: Both the lender and borrower must sign and date the form to make it legally binding.

- Make Copies: After completing the form, make copies for both parties to retain for their records.

Misconceptions

Understanding the Illinois Loan Agreement form can be challenging. Here are seven common misconceptions about this important document, along with clarifications for each:

-

All loan agreements are the same.

Many people believe that all loan agreements follow a standard format. In reality, each agreement can be tailored to fit the specific needs of the lender and borrower.

-

Only banks can issue loan agreements.

This is not true. While banks do issue loan agreements, private lenders, credit unions, and even individuals can also create legally binding loan agreements.

-

Signing a loan agreement means you have to accept the terms.

Some think that signing a loan agreement is a done deal. However, it is crucial to read and understand the terms before signing. You can negotiate the terms with the lender.

-

You cannot change a loan agreement once signed.

Many believe that once a loan agreement is signed, it cannot be altered. In fact, both parties can agree to modify the terms after the initial signing, but this should be documented properly.

-

Loan agreements are only for large amounts of money.

Some people think loan agreements are only necessary for significant loans. However, even small loans can benefit from a written agreement to clarify expectations and responsibilities.

-

Loan agreements do not need to be in writing.

There is a misconception that verbal agreements are sufficient. While verbal agreements can be legally binding, having a written loan agreement is always recommended for clarity and protection.

-

Once the loan is paid off, the agreement is irrelevant.

Some individuals believe that once the loan is repaid, the agreement no longer matters. However, it is important to keep a copy of the agreement and any payment records for future reference.

Being informed about these misconceptions can help you navigate the loan process with greater confidence and understanding.

Dos and Don'ts

When filling out the Illinois Loan Agreement form, it's important to be thorough and careful. Here are some guidelines to help you navigate the process smoothly.

- Do: Read the entire form carefully before starting.

- Do: Provide accurate and complete information.

- Do: Double-check all figures and calculations.

- Do: Sign and date the form where required.

- Don't: Leave any sections blank unless instructed.

- Don't: Use abbreviations or slang in your responses.

- Don't: Forget to keep a copy of the completed form for your records.

- Don't: Rush through the process; take your time to ensure accuracy.

Popular State-specific Loan Agreement Forms

Georgia Promissory Note - This document safeguards both parties’ interests with clear, written terms.

Filling out the Florida Traffic Crash Report form is crucial for drivers involved in accidents that do not necessitate a law enforcement report but result in vehicle or property damage. By completing this form, which requires detailed information about the parties involved, vehicles, and any witnesses, drivers can ensure that they are complying with Florida Statute 316.066(1)(e). For those looking for the necessary documentation, resources such as All Florida Forms can be invaluable in obtaining the correct paperwork quickly and efficiently.

Common mistakes

When completing the Illinois Loan Agreement form, individuals often overlook critical details that can lead to complications. One common mistake is failing to provide accurate personal information. Borrowers and lenders must ensure that names, addresses, and contact details are correct. Any discrepancies can cause delays in processing the agreement or even result in legal issues later on.

Another frequent error is neglecting to specify the loan amount clearly. The agreement should explicitly state how much money is being borrowed. Ambiguity in this section can lead to misunderstandings between the parties involved. It is essential to write the amount in both numerical and written form to eliminate any potential confusion.

Additionally, many people forget to outline the repayment terms adequately. This section should include the payment schedule, interest rates, and any late fees. Without clear terms, borrowers may struggle to meet their obligations, and lenders may face difficulties in enforcing the agreement. Clarity in this area protects both parties and ensures that expectations are aligned.

Lastly, signatures are often overlooked. Both parties must sign the agreement for it to be legally binding. Some individuals may assume that a verbal agreement suffices, but this is not the case. A signed document provides proof of the terms agreed upon and can be crucial in case of disputes. Failing to obtain signatures can render the agreement unenforceable.

Key takeaways

When dealing with the Illinois Loan Agreement form, understanding its key components is essential for both lenders and borrowers. Here are some important takeaways to keep in mind:

- Clarity is Crucial: Ensure that all terms are clearly defined. Ambiguities can lead to misunderstandings later on.

- Interest Rates: Specify the interest rate and how it will be calculated. This information is vital for both parties to understand their financial obligations.

- Repayment Terms: Outline the repayment schedule. Include details such as the due dates and the method of payment to avoid confusion.

- Default Consequences: Clearly state what happens if the borrower fails to repay the loan. This section should outline any penalties or legal actions that may follow.

- Signatures Required: Both parties must sign the agreement for it to be legally binding. Ensure that all signatures are dated and witnessed if necessary.

- Legal Compliance: Familiarize yourself with Illinois laws regarding loan agreements. Compliance with state regulations is essential to avoid legal issues.

By keeping these points in mind, individuals can navigate the loan process more effectively and foster a transparent lending relationship.