Fillable Last Will and Testament Form for Illinois

Illinois Last Will and Testament - Usage Guidelines

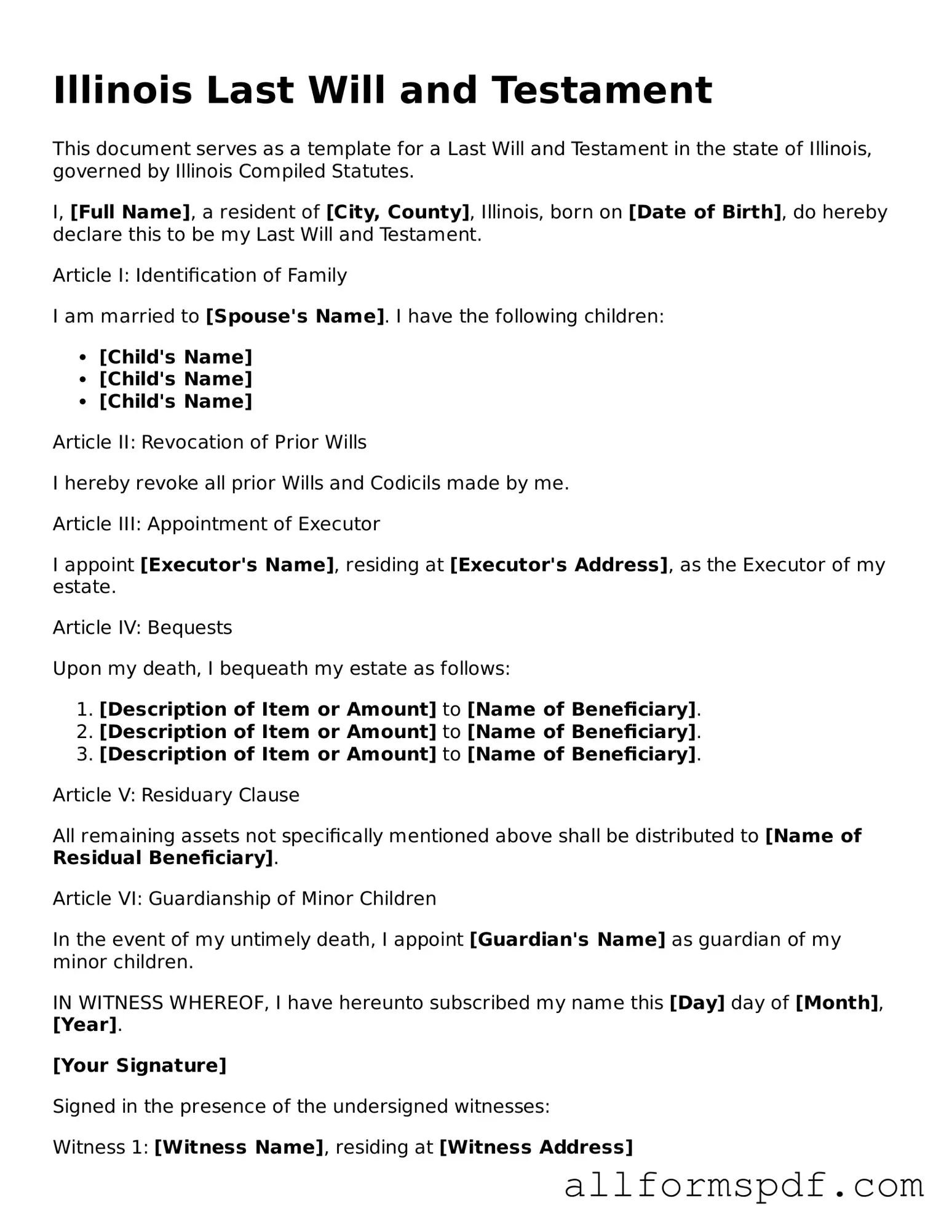

Completing the Illinois Last Will and Testament form is a crucial step in ensuring your wishes are honored after your passing. Properly filling out this document will help clarify your intentions regarding the distribution of your assets. Follow these steps carefully to ensure accuracy and compliance with Illinois law.

- Gather Necessary Information: Collect details about your assets, beneficiaries, and any specific bequests you wish to include.

- Start with Your Personal Information: Fill in your full name, address, and date of birth at the top of the form.

- Declare Your Intent: Clearly state that this document is your Last Will and Testament.

- Identify Beneficiaries: List the names and addresses of individuals or organizations you wish to inherit your assets.

- Specify Bequests: Detail any specific gifts you want to leave to your beneficiaries, including property or monetary amounts.

- Appoint an Executor: Choose a trustworthy person to manage your estate and name them as the executor.

- Include a Residual Clause: Indicate how any remaining assets should be distributed after specific bequests are made.

- Sign the Document: Sign and date the will in the presence of at least two witnesses, who should also sign the document.

- Store Safely: Keep the signed will in a secure location, such as a safe or with a trusted attorney, and inform your executor of its location.

After completing the form, review it carefully to ensure all information is correct. It may be wise to consult with a legal professional to confirm that your will meets all legal requirements in Illinois. Taking these steps will help protect your wishes and provide peace of mind for you and your loved ones.

Misconceptions

-

Misconception 1: A handwritten will is not valid in Illinois.

This is incorrect. Illinois recognizes handwritten wills, also known as holographic wills, as valid provided they are signed by the testator and the material provisions are in the testator's handwriting. However, it is advisable to use a formal will to avoid potential disputes.

-

Misconception 2: You do not need witnesses for a will to be valid.

In Illinois, a will must be signed in the presence of at least two witnesses who are not beneficiaries. This requirement helps to ensure the authenticity of the document and the testator's intent.

-

Misconception 3: A will can be created and finalized without any legal advice.

While it is possible to create a will without legal assistance, consulting with an attorney can help ensure that the will complies with state laws and accurately reflects the testator's wishes. Legal advice can also help address complex family dynamics or specific assets.

-

Misconception 4: A will can distribute assets that are not in the testator's name.

This is not true. A will only governs assets that are owned solely by the testator at the time of death. Jointly owned assets or those with designated beneficiaries, such as life insurance policies, will not be affected by the will.

Dos and Don'ts

When completing the Illinois Last Will and Testament form, it's important to approach the task with care and attention to detail. Here are some things to keep in mind:

- Do: Ensure that you are of sound mind and at least 18 years old when creating your will.

- Do: Clearly identify yourself and state that this document is your Last Will and Testament.

- Do: List your beneficiaries and specify what each person will receive.

- Do: Sign your will in the presence of at least two witnesses, who should also sign the document.

- Don't: Avoid using vague language that may lead to confusion about your wishes.

- Don't: Do not leave out important details, such as debts or specific bequests.

- Don't: Refrain from making changes without properly updating the will and having it re-signed.

- Don't: Do not forget to keep your will in a safe place and inform your executor of its location.

Popular State-specific Last Will and Testament Forms

New Jersey Last Will and Testament Pdf - Important to review and revise to reflect significant life changes.

For those navigating rental agreements, understanding the importance of a Notice to Quit letter template is crucial, as it outlines the necessary steps for landlords to initiate eviction proceedings when a lease is breached, offering tenants a chance to address the issue before action is taken.

Writing a Will in Nc - Indicates preferences for personal property distribution beyond just financial assets.

Common mistakes

Filling out a Last Will and Testament form is an important step in ensuring that your wishes are honored after you pass away. However, many people make common mistakes that can lead to confusion or even invalidate their will. One major mistake is not being clear about their intentions. When writing a will, it’s crucial to specify who gets what. Vague language can lead to disputes among heirs, so being precise is essential.

Another frequent error is failing to properly sign and date the document. In Illinois, a will must be signed by the testator, the person making the will, and it should ideally be witnessed by at least two individuals. If the will isn’t signed or dated correctly, it might not hold up in court. This simple oversight can cause significant problems for loved ones left behind.

People also often overlook the importance of updating their will. Life changes such as marriage, divorce, or the birth of a child can affect how you want your assets distributed. If you don’t revise your will to reflect these changes, it may not represent your current wishes. Regularly reviewing and updating your will ensures that it stays relevant to your life circumstances.

Lastly, many individuals forget to communicate their plans with their family members. While it’s not legally required, discussing your will with your loved ones can help prevent misunderstandings and disputes down the line. Open communication can provide peace of mind for both you and your heirs, making the process smoother when the time comes.

Key takeaways

When preparing your Illinois Last Will and Testament, it is important to keep several key points in mind. Understanding these takeaways can help ensure that your wishes are clearly communicated and legally recognized.

- Clarity is essential. Clearly outline your wishes regarding the distribution of your assets. Use simple language to avoid any confusion.

- Witnesses are required. In Illinois, you must have at least two witnesses present when you sign your will. Their signatures validate the document.

- Consider updating your will. Life changes such as marriage, divorce, or the birth of a child may necessitate updates to your will. Regular reviews are advisable.

- Keep it accessible. Store your will in a safe yet accessible location. Inform trusted family members or friends about its whereabouts.

By following these key takeaways, you can help ensure that your Last Will and Testament reflects your intentions and provides peace of mind for you and your loved ones.