Fillable Deed in Lieu of Foreclosure Form for Illinois

Illinois Deed in Lieu of Foreclosure - Usage Guidelines

After completing the Illinois Deed in Lieu of Foreclosure form, you will need to submit it to the appropriate parties. This typically includes your lender and possibly your local county recorder's office. Ensure you keep copies for your records and follow up to confirm receipt.

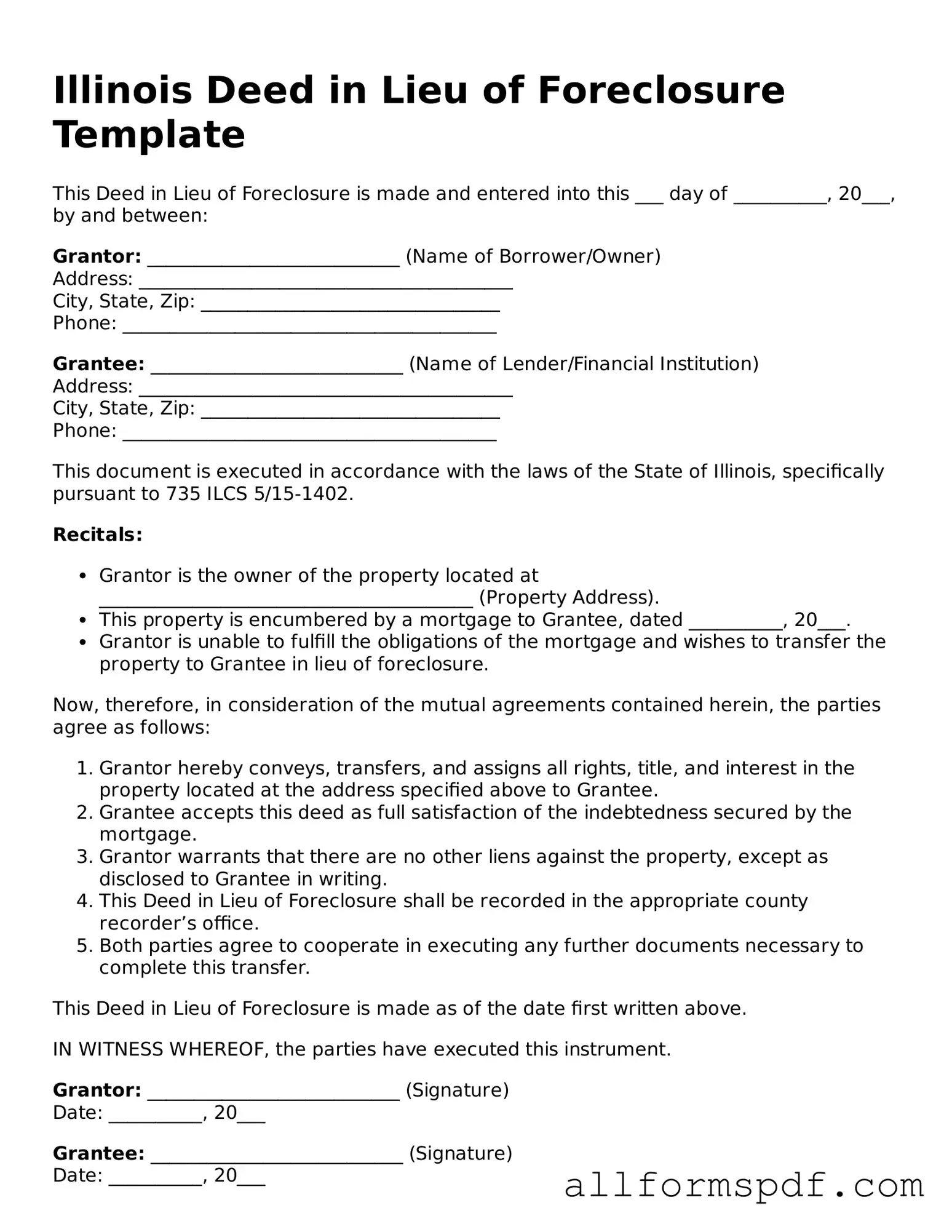

- Begin by downloading the Illinois Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the grantor’s information, including your full name and address. This is the person transferring the property.

- Provide the grantee’s information, which is usually the lender or financial institution receiving the property.

- Clearly identify the property involved. Include the legal description and address to avoid any confusion.

- State the consideration amount, if applicable. This is often $0, as the deed is part of the foreclosure process.

- Sign and date the form in the designated areas. Ensure that your signature matches the name listed as the grantor.

- Have the form witnessed and notarized. This step is crucial for the document to be legally binding.

- Make copies of the completed form for your records.

- Submit the original form to your lender and any required local authorities.

Misconceptions

Understanding the Illinois Deed in Lieu of Foreclosure form can be challenging, and several misconceptions often arise. Here are five common misunderstandings, along with clarifications to help clarify the process.

-

It eliminates all debt immediately.

Many people believe that signing a deed in lieu of foreclosure wipes out all mortgage debt instantly. However, this is not always the case. While it may relieve the borrower of the property, any remaining debt not covered by the property’s value may still exist.

-

It is a quick process.

Some assume that a deed in lieu of foreclosure is a fast solution to avoid foreclosure. In reality, the process can take time. Lenders often require extensive documentation and may conduct a thorough review before accepting the deed.

-

It has no impact on credit scores.

Another misconception is that a deed in lieu of foreclosure does not affect credit ratings. In fact, this action can negatively impact credit scores, similar to a foreclosure, and may remain on credit reports for several years.

-

It is always the best option for homeowners.

Many believe that a deed in lieu of foreclosure is the best choice when facing financial difficulties. However, it may not be suitable for everyone. Homeowners should consider all alternatives, such as loan modifications or short sales, before making a decision.

-

All lenders accept deeds in lieu of foreclosure.

Some individuals think that all lenders are willing to accept a deed in lieu of foreclosure. This is not true. Lenders have different policies, and some may prefer to proceed with foreclosure instead of accepting a deed.

By addressing these misconceptions, homeowners can make more informed decisions regarding their options when facing financial challenges.

Dos and Don'ts

When filling out the Illinois Deed in Lieu of Foreclosure form, it is important to approach the process carefully. The following list outlines essential dos and don'ts to ensure accuracy and compliance.

- Do ensure that all parties involved in the transaction are accurately identified.

- Do provide a complete and accurate description of the property.

- Do check for any outstanding liens or claims against the property.

- Do consult with a legal professional if you have any questions or concerns.

- Don't rush through the form; take your time to review each section.

- Don't leave any fields blank unless instructed otherwise.

- Don't forget to sign and date the document where required.

- Don't submit the form without making copies for your records.

By following these guidelines, you can help ensure that the Deed in Lieu of Foreclosure form is completed correctly, minimizing potential issues in the future.

Popular State-specific Deed in Lieu of Foreclosure Forms

Deed in Lieu of Foreclosure Sample - Homeowners are advised to seek legal advice before signing a Deed in Lieu of Foreclosure.

In order to ensure that all necessary information is collected after a traffic incident, it's important to use the Florida Traffic Crash Report form, which serves as a vital record for drivers who may not be required to file a law enforcement report. This form helps document crucial details, including driver and vehicle information, and can be submitted within 10 days of the crash. For those looking for further resources or related forms, you can visit All Florida Forms.

Georgia Foreclosure Laws - Borrowers should consider seeking legal advice to understand potential tax implications of giving up their property.

Common mistakes

Filling out the Illinois Deed in Lieu of Foreclosure form requires careful attention to detail. One common mistake is failing to provide accurate property information. This includes not only the legal description but also the correct address. Inaccurate information can lead to delays or even rejection of the deed.

Another frequent error is neglecting to include all necessary signatures. Both the borrower and the lender must sign the document. If one signature is missing, the deed may not be legally binding. It’s essential to ensure that all parties involved are present and have signed the form before submission.

People often overlook the importance of notarization. The Illinois Deed in Lieu of Foreclosure must be notarized to be valid. Failing to have the document notarized can invalidate the deed, causing further complications in the foreclosure process.

Additionally, many individuals do not read the instructions carefully. Each section of the form must be filled out according to the guidelines provided. Misinterpretation of the instructions can lead to incomplete or incorrect submissions.

Another mistake is not providing a clear statement of intent. The purpose of the deed must be explicitly stated to avoid confusion. A vague or ambiguous intent can result in misunderstandings and legal challenges down the line.

Some people also forget to include any additional documents that may be required. This could include a letter of authorization or other supporting materials. Missing documents can stall the process and create unnecessary hurdles.

Inaccurate dates are another common pitfall. The form requires specific dates, such as the date of the transfer and the date of signature. Errors in dating can lead to disputes or questions about the validity of the deed.

It’s important to consider the implications of the deed. Some individuals may not fully understand the consequences of signing a Deed in Lieu of Foreclosure. Consulting with a legal professional beforehand can prevent misunderstandings regarding rights and obligations.

Another mistake is neglecting to keep copies of the completed form. After submission, it’s vital to retain a copy for personal records. This documentation can be crucial in the event of future disputes or inquiries.

Finally, people often underestimate the importance of timelines. There are specific deadlines associated with the Deed in Lieu of Foreclosure process. Missing these deadlines can result in the loss of the opportunity to proceed with this option, forcing individuals to consider less favorable alternatives.

Key takeaways

Filling out and using the Illinois Deed in Lieu of Foreclosure form can be a crucial step for homeowners facing financial difficulties. Here are some key takeaways to consider:

- Understanding the Purpose: A Deed in Lieu of Foreclosure allows homeowners to voluntarily transfer their property to the lender to avoid foreclosure. This can be a less stressful alternative to foreclosure proceedings.

- Eligibility Criteria: Not all homeowners qualify for a deed in lieu. Lenders typically require that the homeowner is facing financial hardship and has exhausted other options, such as loan modifications.

- Consulting with Professionals: Before proceeding, it’s advisable to consult with a real estate attorney or a housing counselor. They can provide guidance tailored to individual circumstances and help navigate the process.

- Gathering Necessary Documentation: Homeowners must prepare various documents, including the mortgage agreement, proof of income, and any correspondence with the lender regarding financial hardship.

- Completing the Form: The Illinois Deed in Lieu of Foreclosure form must be filled out accurately. Ensure all information is correct, including the property address and the names of all parties involved.

- Reviewing the Terms: Carefully review the terms outlined in the deed. Understand any implications, such as potential tax consequences or impact on credit scores.

- Submitting the Form: After completing the form, submit it to the lender. This step typically involves sending it via certified mail or another secure method to ensure it is received.

- Awaiting Lender Response: Once submitted, the lender will review the deed. This process may take time, and homeowners should remain in contact with their lender for updates.

- Finalizing the Transfer: If approved, the lender will accept the deed, and the property will officially transfer ownership. Homeowners should ensure they receive confirmation of this transfer.

Taking these steps can help homeowners navigate the complexities of a Deed in Lieu of Foreclosure in Illinois, providing a pathway to relief from financial burdens.