Fillable Deed Form for Illinois

Illinois Deed - Usage Guidelines

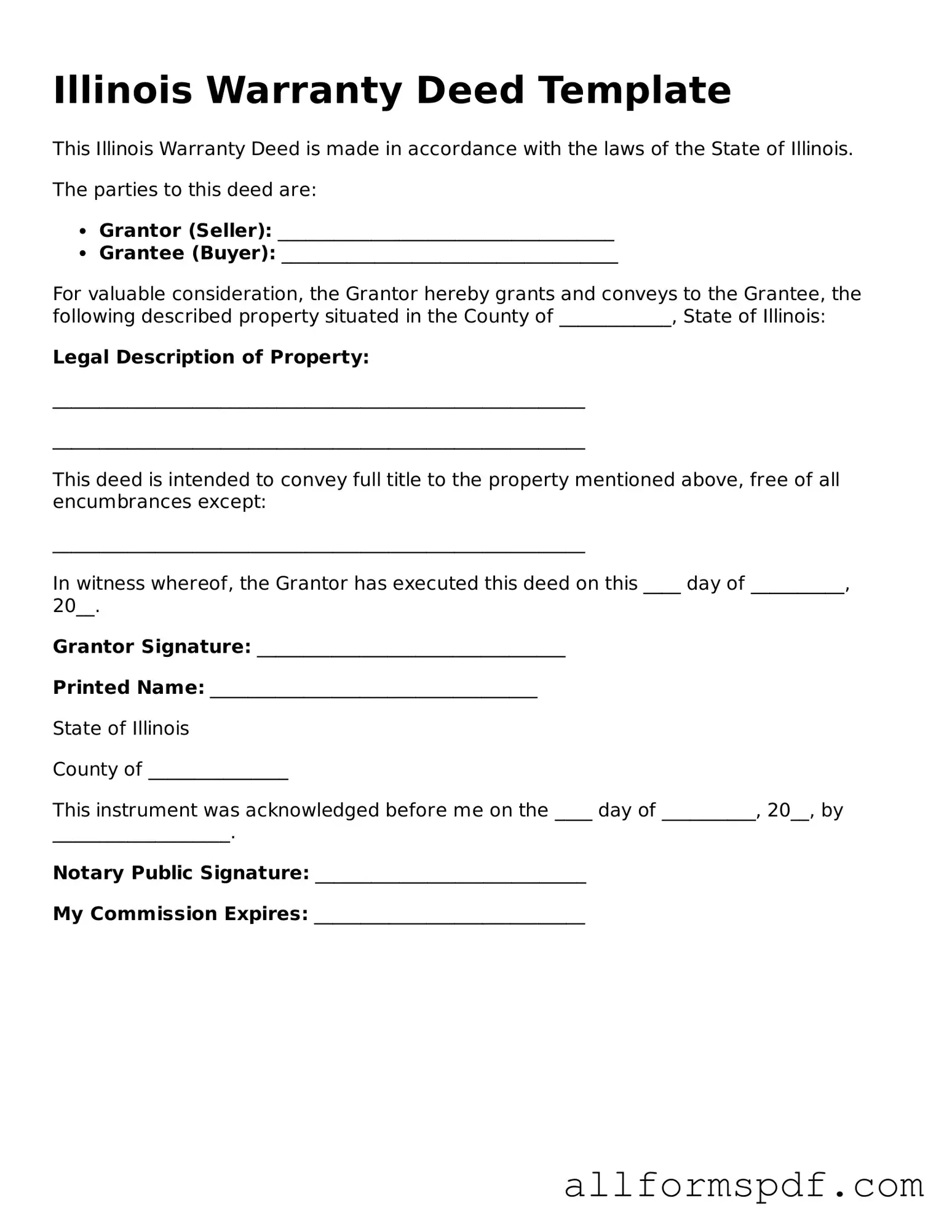

After obtaining the Illinois Deed form, you will need to complete it accurately to ensure proper transfer of property ownership. Follow these steps to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Provide the names of the grantor(s) (the person(s) transferring the property). Ensure the names match those on the title.

- List the names of the grantee(s) (the person(s) receiving the property). Again, ensure the names are accurate.

- Clearly describe the property being transferred. Include the address and legal description, if available.

- Indicate the consideration amount, which is the price or value exchanged for the property.

- Check the appropriate box regarding the type of deed being used (e.g., warranty deed, quitclaim deed).

- Have the grantor(s) sign the form in the designated area. Signatures must be notarized.

- Include the notary's information and signature in the appropriate section.

- Review the completed form for accuracy and completeness before submission.

Once the form is filled out, it will need to be filed with the appropriate county office to finalize the property transfer.

Misconceptions

Understanding the Illinois Deed form is essential for anyone involved in property transactions. However, several misconceptions can lead to confusion. Here are ten common misconceptions about the Illinois Deed form, along with clarifications.

- All deeds are the same. Many believe that all deed forms are interchangeable. In reality, different types of deeds serve different purposes, such as warranty deeds, quitclaim deeds, and special warranty deeds.

- A deed must be notarized to be valid. While notarization is often required for a deed to be recorded, it is not always necessary for the deed to be legally binding between the parties involved.

- Only attorneys can prepare a deed. Although hiring an attorney is advisable for complex transactions, individuals can prepare their own deeds as long as they follow the correct format and requirements.

- Deeds do not need to be recorded. Some people think that recording a deed is optional. However, failing to record a deed can lead to disputes over property ownership and may affect the rights of future buyers.

- All property transfers require a new deed. This is not always true. In some cases, property can be transferred through other legal means, such as a trust or an inheritance, without the need for a new deed.

- Once a deed is signed, it cannot be changed. While changing a deed after it has been executed can be complicated, it is possible to correct or amend a deed under certain circumstances.

- Deeds are only for real estate transactions. Many assume that deeds only apply to land and buildings. However, they can also pertain to other types of property, including personal property in some cases.

- All deeds transfer ownership equally. This is misleading. The type of deed used can affect the level of ownership and the rights granted to the new owner, such as warranties or claims against the property.

- Once a deed is recorded, it is permanent. While recording a deed provides public notice, it does not prevent future legal challenges or claims against the property.

- Illinois does not require a specific format for deeds. This is incorrect. Illinois has specific statutory requirements regarding the format and content of deeds, which must be followed to ensure validity.

Being aware of these misconceptions can help individuals navigate the property transfer process more effectively. Understanding the nuances of the Illinois Deed form is crucial for protecting one's property rights.

Dos and Don'ts

When filling out the Illinois Deed form, it’s important to follow certain guidelines to ensure everything is correct. Here are some things to do and some things to avoid.

- Do: Double-check all names and addresses for accuracy.

- Do: Use black ink and write legibly to ensure readability.

- Do: Include the correct legal description of the property.

- Do: Sign the deed in front of a notary public.

- Don't: Leave any fields blank; all sections must be completed.

- Don't: Use white-out or erasers on the form; it can cause issues.

- Don't: Forget to check local recording requirements.

- Don't: Submit the form without reviewing it for errors.

Popular State-specific Deed Forms

Ohio Property Deed - Providing full disclosure in a deed can prevent future conflicts.

Quit Claim Deed Georgia - Legal representation is often recommended when drafting a deed.

In addition to the essential details captured in the Florida Traffic Crash Report form, individuals seeking to complete this documentation can find the necessary resources and templates through various online platforms, such as All Florida Forms, ensuring that they have the proper guidance for accurately reporting their incident.

Transfer of Deed Document - Deeds must comply with state laws to ensure proper execution and validity.

What Does a Deed Look Like in Nj - Once recorded, a Deed becomes part of the public record, making it accessible to anyone interested.

Common mistakes

Filling out the Illinois Deed form can be a straightforward process, but many individuals make common mistakes that can lead to complications. One frequent error is failing to provide accurate property descriptions. A precise legal description is essential for identifying the property being transferred. Omitting details or using vague terms can create confusion and potentially invalidate the deed.

Another common mistake involves the names of the parties involved in the transaction. It's crucial to ensure that the names of both the grantor and grantee are spelled correctly and match their legal identification. A simple typographical error can result in legal issues down the line, complicating ownership transfers or disputes.

Many people also overlook the importance of signatures. The Illinois Deed form requires the grantor's signature to validate the transfer. Sometimes, individuals forget to sign or fail to have their signatures notarized. Without proper notarization, the deed may not be recognized as legally binding, which can hinder the transfer of property rights.

In addition, individuals often neglect to include the appropriate tax information. The Illinois Department of Revenue requires that certain taxes be paid when a property transfer occurs. Failing to include this information can lead to penalties or delays in the recording of the deed.

Another mistake is not providing the correct date of the transaction. The date is significant for establishing the timeline of ownership and can impact legal rights. If the date is missing or incorrect, it may create complications regarding the validity of the deed.

Lastly, many individuals do not check for specific local requirements. Different counties in Illinois may have unique rules regarding the recording of deeds. Ignoring these local regulations can result in additional hurdles, such as the rejection of the deed by the county clerk's office. Understanding and adhering to these requirements is vital for a smooth property transfer process.

Key takeaways

When filling out and using the Illinois Deed form, there are several important points to keep in mind. Understanding these can help ensure that the process goes smoothly and that the deed is legally valid.

- Identify the Type of Deed: There are different types of deeds in Illinois, such as warranty deeds and quitclaim deeds. Choose the one that fits your situation.

- Provide Accurate Property Information: Clearly describe the property being transferred. This includes the address and legal description.

- Include Grantor and Grantee Information: The names and addresses of both the person transferring the property (grantor) and the person receiving it (grantee) must be included.

- Signatures Matter: The deed must be signed by the grantor. If there are multiple grantors, all must sign.

- Notarization Requirement: A notary public must witness the signing of the deed to make it legally binding.

- Consider Recording the Deed: Once completed, it’s advisable to record the deed with the county recorder’s office. This protects your ownership rights.

- Understand Transfer Taxes: Be aware of any transfer taxes that may apply when transferring property in Illinois.

- Review for Errors: Before finalizing, double-check all information for accuracy to avoid future complications.

- Consult a Professional: If unsure about any part of the process, consider seeking legal advice to ensure compliance with local laws.

By keeping these key takeaways in mind, you can navigate the Illinois Deed form process with greater confidence and clarity.