Fillable Bill of Sale Form for Illinois

Illinois Bill of Sale - Usage Guidelines

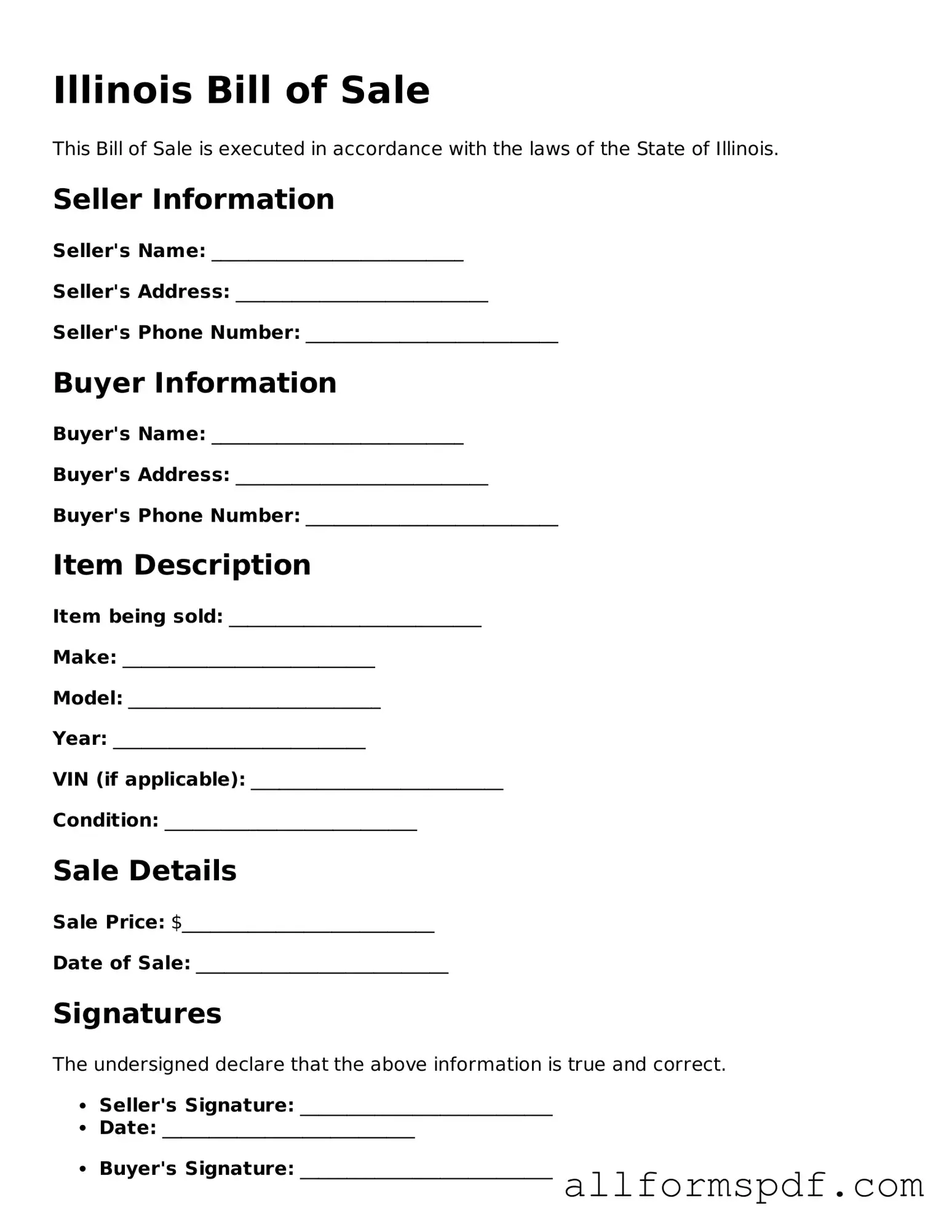

After obtaining the Illinois Bill of Sale form, you will need to provide specific information about the transaction. This includes details about the buyer, seller, and the item being sold. Follow these steps to complete the form accurately.

- Begin by filling in the date of the transaction at the top of the form.

- Next, enter the name and address of the seller. Ensure that all information is current and correct.

- Then, provide the name and address of the buyer. Double-check for accuracy.

- In the section for the item being sold, describe the item clearly. Include details such as make, model, year, and any identifying numbers, like a Vehicle Identification Number (VIN) if applicable.

- Indicate the sale price of the item. This should be the agreed-upon amount between the buyer and seller.

- Both parties must sign and date the form. The seller’s signature confirms the sale, while the buyer’s signature acknowledges receipt of the item.

Once the form is completed and signed, it is advisable to keep a copy for both the buyer and seller. This document serves as proof of the transaction and may be necessary for future reference or legal purposes.

Misconceptions

When it comes to the Illinois Bill of Sale form, several misconceptions can lead to confusion. Here are four common misunderstandings:

- It’s only for vehicles. Many people think a Bill of Sale is exclusively for transferring ownership of vehicles. In reality, it can be used for a variety of personal property, including furniture, electronics, and even livestock.

- It doesn’t need to be notarized. Some believe that a Bill of Sale doesn't require notarization to be valid. While notarization isn't always necessary, having a notary can add an extra layer of authenticity and help avoid disputes later on.

- It’s just a formality. Some view the Bill of Sale as a mere formality that can be skipped. However, it serves as a crucial legal document that provides proof of the transaction, protecting both the buyer and the seller.

- It’s only needed for large transactions. Many think a Bill of Sale is only important for high-value items. In fact, it’s wise to use one for any sale, regardless of the amount, to ensure clear records and protect your interests.

Dos and Don'ts

When filling out the Illinois Bill of Sale form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do:

- Do provide accurate and complete information about the buyer and seller.

- Do include a detailed description of the item being sold, including any identifying numbers.

- Do specify the date of the sale clearly.

- Do ensure both parties sign the document to validate the transaction.

- Don't leave any sections of the form blank; incomplete forms can lead to issues.

- Don't use vague language; be specific about the terms of the sale.

Popular State-specific Bill of Sale Forms

Nc Bill of Sale Template - A Bill of Sale provides peace of mind, ensuring that both parties are satisfied with the terms of the deal.

Take advantage of our user-friendly guide to efficiently complete your California Boat Bill of Sale and ensure a smooth transaction when buying or selling a boat in California. Essential California Boat Bill of Sale resources are available to help you through the process.

Bill of Sale Ohio - A Bill of Sale is often used in real estate transactions for personal property.

Common mistakes

When filling out the Illinois Bill of Sale form, many individuals overlook critical details that can lead to complications down the line. One common mistake is failing to include all necessary information about the buyer and seller. Both parties must provide their full names, addresses, and contact information. Omitting any of these details can create confusion and hinder the transfer of ownership.

Another frequent error is neglecting to accurately describe the item being sold. The Bill of Sale should include a detailed description, including the make, model, year, and any unique identifiers such as VIN numbers for vehicles. Without this information, proving ownership or the specifics of the transaction may become problematic.

People often forget to sign the document. A Bill of Sale is not valid unless it is signed by both the buyer and the seller. This signature serves as a legal acknowledgment of the transaction. In some cases, witnesses may also be required, depending on the nature of the sale. Skipping this step can lead to disputes later.

Another mistake involves not providing the date of the transaction. The date is crucial for record-keeping and establishing the timeline of ownership. If the date is missing, it may create issues for both parties, especially if any disputes arise in the future.

Lastly, individuals sometimes fail to keep copies of the Bill of Sale. After completing the form, both the buyer and seller should retain a copy for their records. This document serves as proof of the transaction and can be essential for future reference, such as when registering the vehicle or filing taxes. Without a copy, one may find themselves in a difficult situation later on.

Key takeaways

When it comes to buying or selling personal property in Illinois, the Bill of Sale form is an essential document. Here are some key takeaways to keep in mind when filling out and using this form:

- Purpose: A Bill of Sale serves as a legal record of the transaction between the buyer and seller. It protects both parties by documenting the details of the sale.

- Information Required: Be sure to include important details such as the names and addresses of both the buyer and seller, a description of the item being sold, and the sale price.

- Signatures: Both the buyer and seller should sign the Bill of Sale. This step is crucial as it indicates that both parties agree to the terms of the sale.

- Notarization: While notarization is not always required in Illinois, having the document notarized can add an extra layer of authenticity and may be beneficial for certain transactions.

- Keep Copies: After the Bill of Sale is completed and signed, both parties should keep a copy for their records. This can be useful in case of future disputes or for tax purposes.

- State-Specific Requirements: Always check for any specific state laws or additional requirements that may apply to your particular transaction to ensure compliance.

By following these guidelines, you can ensure that your Bill of Sale is properly completed and serves its intended purpose in your transaction.