Fillable Articles of Incorporation Form for Illinois

Illinois Articles of Incorporation - Usage Guidelines

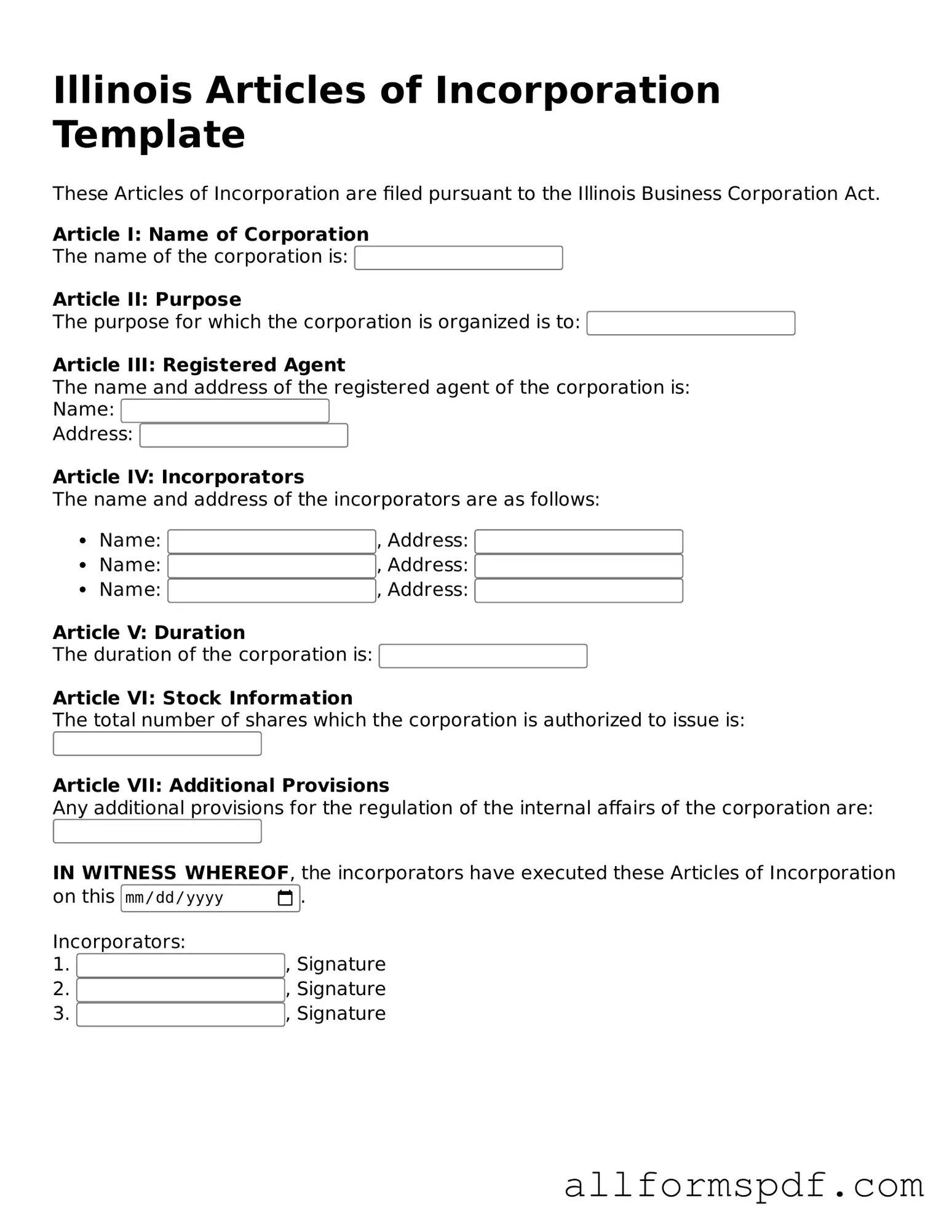

After you have gathered all necessary information, it's time to fill out the Illinois Articles of Incorporation form. This form is essential for establishing your business as a legal entity in the state. Make sure to provide accurate details to avoid any delays in the processing of your application.

- Begin by downloading the Illinois Articles of Incorporation form from the official state website.

- Read through the form carefully to understand each section that needs to be filled out.

- In the first section, enter the name of your corporation. Ensure it complies with Illinois naming requirements.

- Provide the purpose of your corporation. Be clear and concise about what your business will do.

- Fill in the registered agent's name and address. This is the person or business that will receive legal documents on behalf of your corporation.

- Enter the number of shares your corporation is authorized to issue. If you are unsure, consult with a professional.

- Complete the section for the incorporators. List the names and addresses of those who are forming the corporation.

- Review all the information you have provided for accuracy. Correct any mistakes before proceeding.

- Sign and date the form. Ensure that all incorporators have signed if required.

- Prepare to submit the form along with the required filing fee. Check the current fee amount on the state website.

- Submit the completed form either online or by mailing it to the appropriate state office.

Misconceptions

When it comes to the Illinois Articles of Incorporation form, several misconceptions can lead to confusion. Here are seven common misunderstandings:

-

Only large businesses need to file Articles of Incorporation.

Many believe that only big companies require incorporation. In reality, any business, regardless of size, can benefit from incorporating in Illinois.

-

The process is too complicated for small business owners.

While the process may seem daunting, it is quite straightforward. With the right guidance, small business owners can navigate the requirements easily.

-

Incorporation is only for for-profit businesses.

This is not true. Nonprofit organizations also need to file Articles of Incorporation to gain legal recognition.

-

Once filed, Articles of Incorporation cannot be changed.

In fact, amendments can be made to the Articles of Incorporation as needed. This allows businesses to adapt to changing circumstances.

-

Incorporation protects personal assets automatically.

While incorporation does provide a layer of protection, it is essential to maintain proper business practices to fully safeguard personal assets.

-

All states have the same requirements for Articles of Incorporation.

Each state has its own specific requirements. Illinois has unique forms and guidelines that must be followed.

-

Filing Articles of Incorporation is a one-time event.

Incorporation is an ongoing process. Businesses must comply with annual reporting and other regulatory requirements to maintain their status.

Understanding these misconceptions can help business owners make informed decisions about incorporating in Illinois.

Dos and Don'ts

When filling out the Illinois Articles of Incorporation form, it is important to follow specific guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do read the instructions carefully before starting the form.

- Do provide accurate information about the corporation's name and address.

- Do include the purpose of the corporation clearly and concisely.

- Do designate a registered agent and provide their contact information.

- Do ensure that the names and addresses of the incorporators are correct.

- Don't use a name for the corporation that is already taken or too similar to another entity.

- Don't leave any required fields blank; all information must be filled out.

- Don't forget to include the appropriate filing fee with your submission.

- Don't submit the form without reviewing it for typos or errors.

Popular State-specific Articles of Incorporation Forms

Michigan Articles of Organization - This document is often required when opening a business bank account.

Llc Articles of Organization Nj - Understanding the legal implications of the Articles is important for long-term success.

How Do I Get a Copy of My Articles of Incorporation in Georgia - Clarifies the process for notifying shareholders of corporate actions.

For those looking to streamline their rental relationships, our guide on the Residential Lease Agreement process can be invaluable. By utilizing the important Residential Lease Agreement resources, you can ensure that all necessary details are covered and understood between landlords and tenants.

Incorporate in North Carolina - Details any limitations on the transferability of shares.

Common mistakes

Filling out the Illinois Articles of Incorporation form can be a straightforward process, but many people make common mistakes that can lead to delays or rejections. One frequent error is failing to provide a clear and accurate name for the corporation. The name must be unique and not too similar to existing businesses. If the name does not comply with state regulations, it can result in the rejection of the application.

Another common mistake is neglecting to include the correct address for the corporation's registered agent. The registered agent is responsible for receiving legal documents on behalf of the corporation. If the address is incorrect or incomplete, it can create complications in communication and legal matters.

People often overlook the importance of specifying the purpose of the corporation. While it may seem simple, the purpose must be clearly defined. A vague or overly broad purpose can lead to questions from the state and may require further clarification, which can delay the incorporation process.

Inaccurate information about the incorporators is also a frequent issue. The form requires the names and addresses of the individuals forming the corporation. If any of this information is incorrect or missing, it can lead to complications in the approval process. Each incorporator must be properly identified to ensure legal compliance.

Another mistake involves the failure to sign the form. The Articles of Incorporation must be signed by at least one incorporator. A missing signature can result in the entire application being rejected. It is essential to double-check that all required signatures are present before submission.

Lastly, individuals often underestimate the importance of filing fees. The Articles of Incorporation require a filing fee, and failure to include the correct amount can lead to delays. It is crucial to verify the current fee and ensure that payment is made in accordance with state guidelines.

Key takeaways

Filling out the Illinois Articles of Incorporation form is a crucial step for anyone looking to establish a corporation in the state. Here are five key takeaways to keep in mind:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for your corporation. They outline essential details about your business, such as its name, purpose, and structure.

- Choose an Appropriate Name: Your corporation's name must be unique and distinguishable from existing businesses in Illinois. Ensure it complies with state naming regulations to avoid delays.

- Designate a Registered Agent: A registered agent is required for your corporation. This individual or entity will receive legal documents on behalf of your business, so choose someone reliable.

- Provide Accurate Information: When filling out the form, accuracy is paramount. Double-check all information, including the names and addresses of the incorporators, to prevent complications during processing.

- File and Pay the Required Fee: After completing the form, submit it to the Illinois Secretary of State along with the appropriate filing fee. Timely submission can expedite your corporation's approval.

Taking these steps seriously can streamline the process of establishing your corporation and set a solid foundation for future success. Act promptly and ensure all details are correct to avoid unnecessary hurdles.