Fill Out Your Goodwill donation receipt Form

Goodwill donation receipt - Usage Guidelines

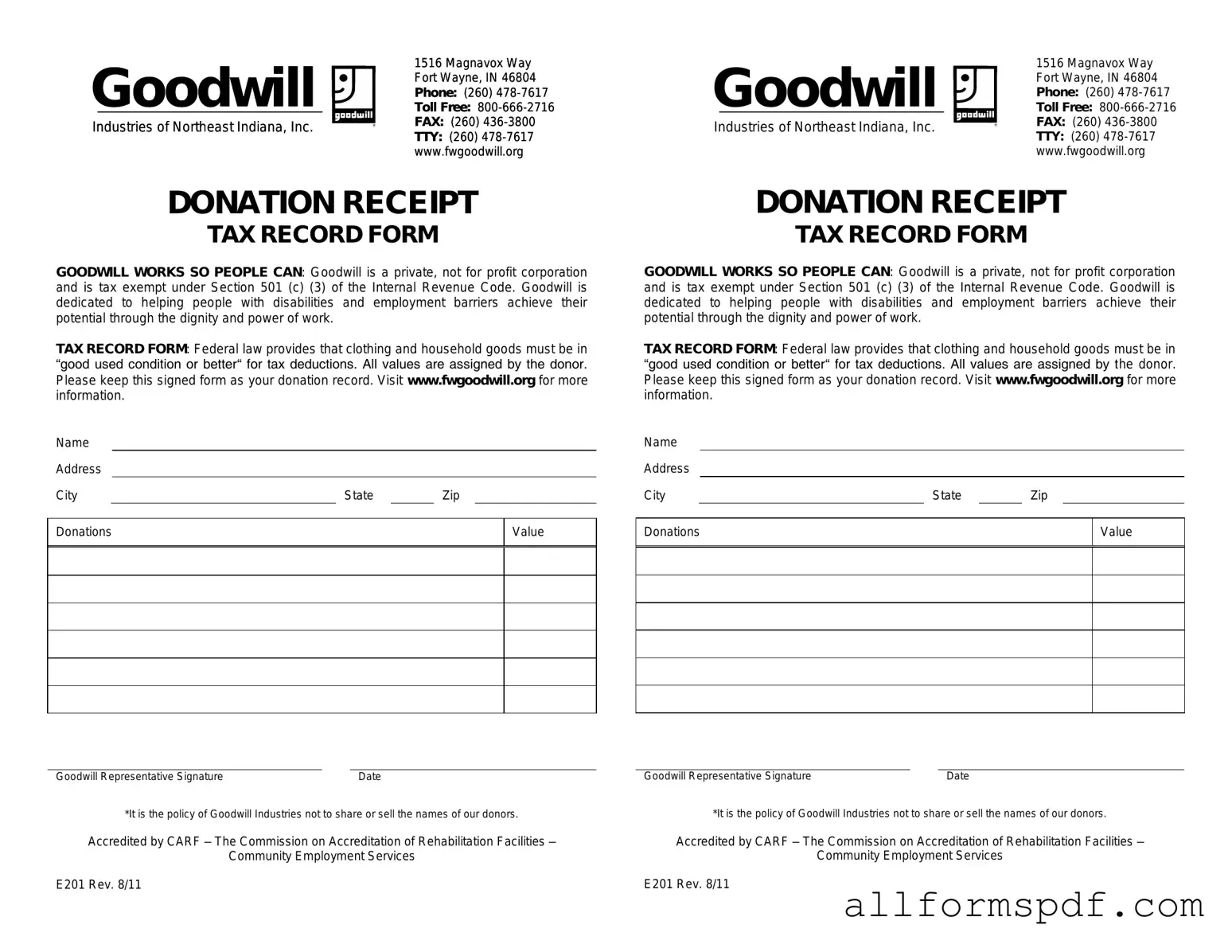

After gathering your items for donation, you will need to fill out the Goodwill donation receipt form to document your contribution. This receipt serves as proof of your donation for tax purposes and helps ensure that you receive appropriate credit for your generosity.

- Begin by entering the date of your donation at the top of the form.

- Provide your name and address in the designated fields. Ensure that all information is accurate.

- List the items you are donating. Be specific about each item, including quantity and condition.

- Estimate the fair market value of each item. This value should reflect what you believe the item could sell for in a thrift store.

- Sign and date the receipt at the bottom. This confirms your donation and serves as your acknowledgment.

- Keep a copy of the receipt for your records. This will be important when filing your taxes.

Misconceptions

Understanding the Goodwill donation receipt form can be tricky. Here are eight common misconceptions about it:

- It’s only for tax deductions. Many believe the receipt is solely for tax purposes. While it can help with deductions, it also serves as proof of donation.

- You need to itemize everything. Some think they must list every single item. In reality, a general description is often sufficient for most donations.

- Goodwill sets the value of donated items. Many assume Goodwill determines the value. Donors are responsible for assessing the fair market value of their items.

- The receipt is only valid for a year. There's a misconception that the receipt expires after a year. In truth, it remains valid as long as you need it for tax purposes.

- Only large donations qualify. Some believe only big donations matter. Small contributions can also be valuable and qualify for a receipt.

- You must donate in person. Many think donations must be made at a physical location. However, you can often arrange pickups for larger items.

- Donations are anonymous. While you don’t have to provide personal details on the receipt, Goodwill may track donations for record-keeping purposes.

- All items are accepted. Some believe that anything can be donated. Goodwill has specific guidelines on what items they can accept.

Clarifying these misconceptions can help you make the most of your donations and the benefits they provide.

Dos and Don'ts

When filling out the Goodwill donation receipt form, it's important to keep a few things in mind. Here’s a list of what you should and shouldn’t do:

- Do fill out the form completely. Include all necessary information.

- Do keep a copy for your records. This helps if you need to reference it later.

- Do accurately describe the items you are donating. This ensures proper acknowledgment.

- Do date the receipt. A date is essential for tax purposes.

- Do sign the receipt. Your signature confirms your donation.

- Don't leave any sections blank. Incomplete forms can lead to confusion.

- Don't overestimate the value of your items. Be honest to avoid issues later.

- Don't forget to check for any specific requirements from Goodwill. Each location may have different guidelines.

- Don't rush through the process. Take your time to ensure accuracy.

- Don't lose the receipt. It’s important for tax deductions and record-keeping.

Other PDF Forms

California Correction Deed - Reflects the ethical obligations of scriveners in their practice.

Ucc 1308 - Individuals can declare their non-domestic status without U.S. jurisdiction.

To create a comprehensive understanding of responsibilities, individuals often refer to forms such as the Florida Hold Harmless Agreement, which serves a vital role in protecting involved parties from potential liabilities. For those seeking to access this essential document, All Florida Forms provides a reliable resource to obtain the proper templates and guidance necessary to draft an effective agreement.

Lift Inspection Form - Verify that the vehicle registration is current and displayed.

Common mistakes

When donating items to Goodwill, many people rely on the donation receipt form to document their contributions for tax purposes. However, mistakes can occur during this process, leading to potential issues later on. One common mistake is failing to provide a complete description of the items donated. Without a clear and detailed list, it becomes challenging to establish the value of the donation, which could raise questions during tax filing.

Another frequent error is neglecting to assign a fair market value to the donated items. Many donors underestimate the importance of this step. It’s essential to research and determine what similar items are selling for in the market. This ensures that the value claimed on tax returns is accurate and justifiable. Misvaluing donations can lead to complications if the IRS decides to scrutinize the claim.

Additionally, some individuals forget to date the receipt. A date is crucial for record-keeping and tax purposes. Without it, the donation may not be considered valid for the tax year in which it was made. This oversight can result in missed deductions and potential financial loss.

People often overlook the need for a signature on the receipt. While it may seem trivial, signing the form confirms the authenticity of the donation. A signature serves as a personal acknowledgment of the items given, which can be vital if there are any disputes regarding the donation.

Another common mistake is not keeping a copy of the receipt for personal records. After donating, it’s important to retain a copy of the receipt for future reference. This can be particularly useful if the IRS requests documentation or if there is a need to verify the donation later on.

Lastly, some donors fail to check the receipt for accuracy before leaving the donation center. Simple errors, such as misspellings or incorrect values, can lead to confusion down the line. Taking a moment to review the information ensures that everything is correct and complete, making the donation process smoother and more efficient.

Key takeaways

When using the Goodwill donation receipt form, there are several important points to keep in mind. These key takeaways can help ensure that your donation is properly documented and recognized.

- Accurate Information: Fill in all required fields accurately. This includes your name, address, and the date of the donation.

- Item Description: Clearly describe the items you are donating. This helps both you and Goodwill keep track of what has been given.

- Value Estimation: Estimate the fair market value of the donated items. This is important for tax deduction purposes.

- Keep a Copy: Retain a copy of the receipt for your records. This is essential for tax filing and personal record-keeping.

- Tax Deduction: Understand that your donation may be tax-deductible. Consult with a tax professional for guidance specific to your situation.

Following these guidelines will help ensure that your donation experience is smooth and beneficial for both you and Goodwill.