Fill Out Your Gift Letter Form

Gift Letter - Usage Guidelines

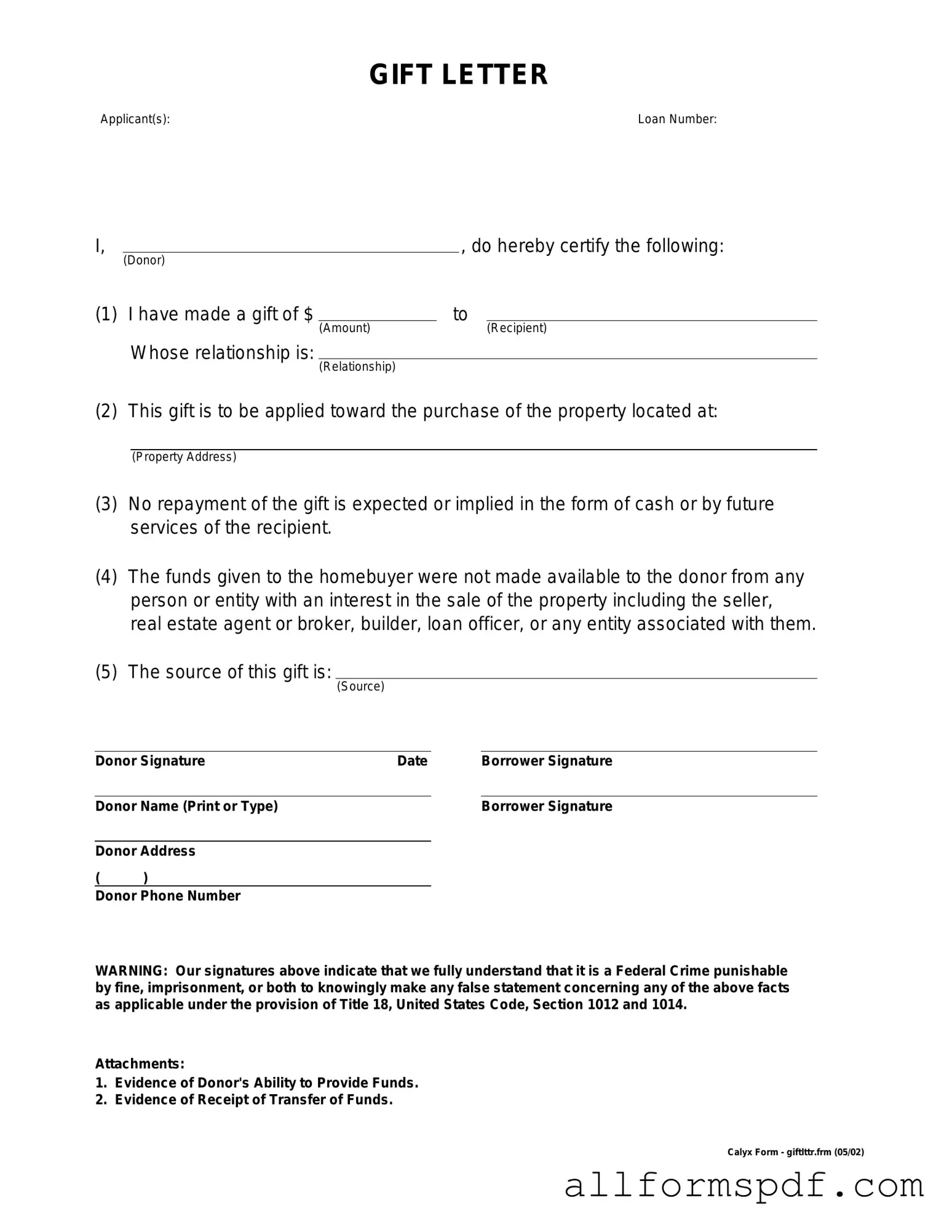

Completing a Gift Letter form is an important step when you are receiving a monetary gift, especially in relation to financing a home. This form typically serves as a declaration that the funds are indeed a gift and not a loan, which can affect your mortgage application. Following the steps below will help ensure that the form is filled out correctly.

- Begin by entering the date at the top of the form.

- Provide the full name and address of the donor (the person giving the gift).

- Clearly state the recipient's name (the person receiving the gift) and their relationship to the donor.

- Indicate the amount of the gift in the appropriate section.

- Include a statement confirming that the funds are a gift and do not need to be repaid.

- Have the donor sign and date the form to validate the information provided.

- Ensure that any additional required information is completed, such as the donor's contact details.

Once the Gift Letter form is filled out, it should be submitted along with your mortgage application. This will help clarify the source of your funds and assist in the overall approval process.

Misconceptions

Understanding the Gift Letter form is crucial for both donors and recipients in the context of financial gifts, especially in real estate transactions. However, several misconceptions can lead to confusion. Here are nine common misconceptions about the Gift Letter form:

- Gift Letters Are Only for Large Amounts: Many believe that gift letters are only necessary for substantial gifts. In reality, any financial gift, regardless of size, can benefit from documentation to clarify intent.

- Gift Letters Are Optional: Some think that a gift letter is merely a formality. However, lenders often require it to confirm that the funds are indeed a gift and not a loan, which could affect the borrower's financial situation.

- Only Family Members Can Give Gifts: While gifts from family are common, friends and other individuals can also provide financial gifts. The key is to document the intent clearly.

- Gift Letters Must Be Notarized: A common belief is that notarization is mandatory. In most cases, notarization is not required, but it can add an extra layer of authenticity.

- Gift Letters Are the Same as Loan Documents: Some people confuse gift letters with loan agreements. Gift letters explicitly state that the money is a gift, while loan documents outline repayment terms.

- Gift Letters Are Only Relevant for Home Purchases: Although often associated with real estate, gift letters can be useful in various financial contexts, including education expenses or starting a business.

- All Gifts Are Tax-Free: While gifts under a certain amount may not incur taxes, larger gifts can have tax implications for the donor. Understanding the tax laws is essential for both parties.

- Gift Letters Can Be Written Informally: Some believe a simple note suffices. However, a well-structured gift letter that includes specific details about the gift is more effective and often required by lenders.

- Gift Letters Are Only for First-Time Homebuyers: This misconception overlooks the fact that anyone receiving a financial gift for any purpose can benefit from a gift letter, regardless of their homebuying status.

By dispelling these misconceptions, individuals can navigate the process of giving and receiving gifts more confidently, ensuring that all parties understand their rights and responsibilities.

Dos and Don'ts

When filling out a Gift Letter form, it’s important to ensure accuracy and clarity. Here’s a list of things you should and shouldn’t do to make the process smoother.

- Do provide accurate information about the donor and recipient.

- Do clearly state the amount of the gift.

- Do include the date of the gift.

- Do ensure that both parties sign the letter.

- Don’t leave out any required details.

- Don’t use vague language or ambiguous terms.

- Don’t forget to check for spelling and grammatical errors.

- Don’t submit the form without reviewing it first.

Other PDF Forms

Melaleuca Cancellation Form - Melaleuca’s supportive attitude is evident in their cancellation policy.

For Arizona residents needing reliable legal documentation, the customizable Power of Attorney options provide essential flexibility. These documents empower individuals to assign authority regarding important financial decisions, ensuring your wishes are upheld. Consider exploring the various forms available, including the user-friendly comprehensive Power of Attorney resources to facilitate your decision-making process.

Form I9 - This form can contribute to the onboarding of new hires.

Common mistakes

When filling out a Gift Letter form, many individuals unknowingly make mistakes that can lead to complications later on. One common error is failing to provide complete information about the donor. It's essential to include the donor's full name, address, and relationship to the recipient. Omitting any of these details can raise questions about the legitimacy of the gift.

Another frequent mistake is not clearly stating the amount of the gift. The Gift Letter should specify the exact dollar amount being gifted. If this is left vague or missing, it can create confusion and may even lead to delays in processing. Clarity is key in ensuring that all parties understand the nature of the transaction.

Many people also overlook the importance of signatures. Both the donor and the recipient must sign the Gift Letter. Without these signatures, the document lacks validity. This step is crucial for confirming that both parties agree to the terms of the gift.

Additionally, some individuals forget to date the form. Including the date is important as it provides context for when the gift was made. This can be particularly relevant for tax purposes and for any future financial documentation.

Another mistake is neglecting to mention whether the gift is a loan or a true gift. If there are any expectations for repayment, this must be clearly stated in the letter. Failing to do so can lead to misunderstandings and potential legal issues down the line.

People often assume that a simple statement of intent suffices. However, the Gift Letter should also outline that the funds are not expected to be repaid. This reassurance can help prevent any future disputes regarding the nature of the gift.

Lastly, individuals may not keep a copy of the completed Gift Letter. It’s advisable to retain a copy for personal records. This can be beneficial for future reference, especially if any questions arise regarding the transaction.

Key takeaways

When filling out and using the Gift Letter form, keep these key takeaways in mind:

- Ensure that all information is accurate and complete. This includes the donor's name, address, and relationship to the recipient.

- The letter should clearly state the amount of the gift. This helps clarify the intent and avoids misunderstandings.

- Include a statement confirming that the gift does not need to be repaid. This reassures lenders or other parties involved.

- Both the donor and recipient should sign the letter. Signatures validate the authenticity of the gift.

- Attach any necessary documentation, such as bank statements, to support the gift's legitimacy.

- Keep a copy of the completed Gift Letter for your records. This is important for future reference or if questions arise.