Printable Gift Deed Form

State-specific Guidelines for Gift Deed Documents

Gift Deed - Usage Guidelines

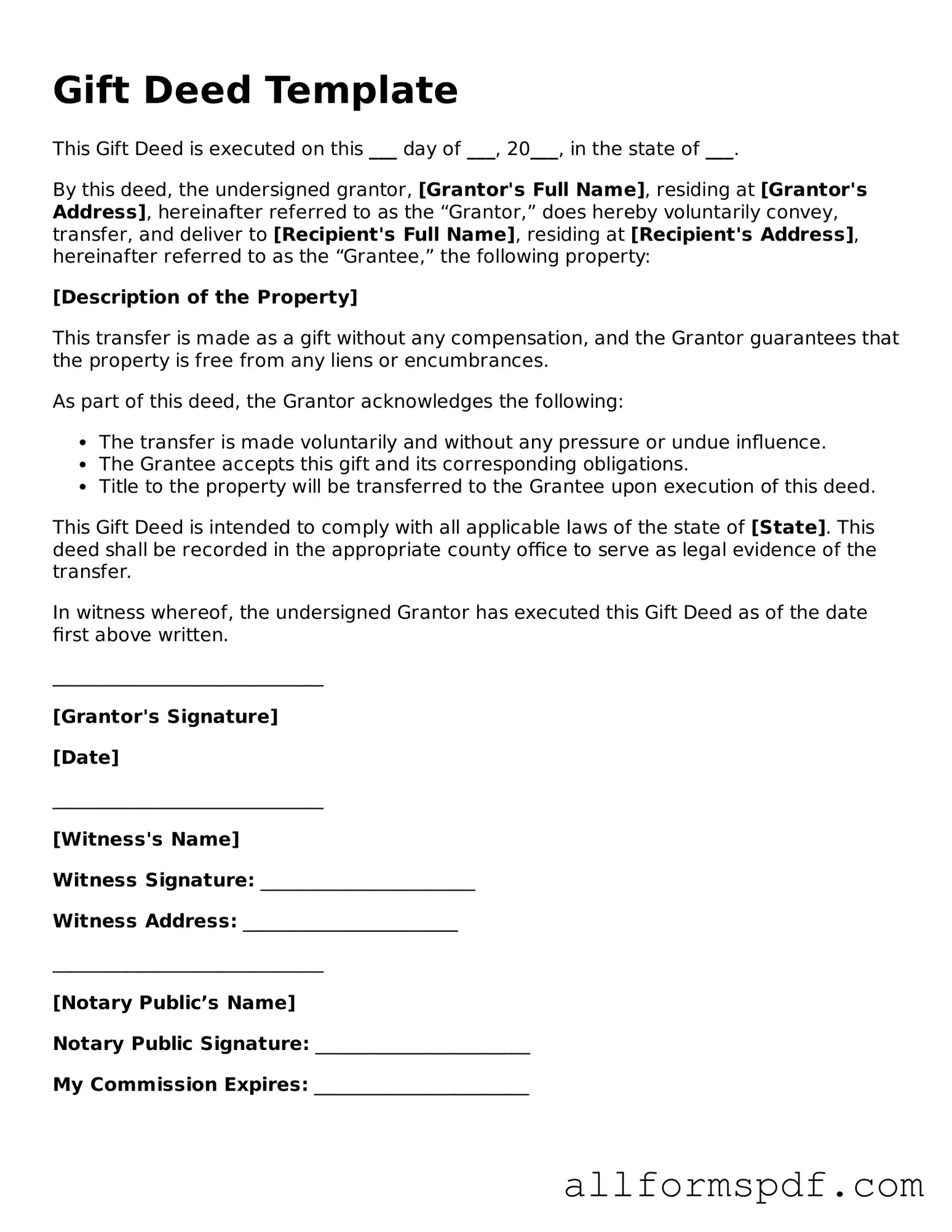

When you decide to transfer ownership of a property or asset as a gift, filling out a Gift Deed form is an essential step. This form serves as a legal document that outlines the details of the gift and ensures that the transfer is properly recorded. Below are the steps to guide you through completing the Gift Deed form.

- Gather Necessary Information: Collect all relevant details about the property or asset being gifted, including its legal description, address, and any identification numbers.

- Identify the Parties: Clearly write the full names and addresses of both the donor (the person giving the gift) and the recipient (the person receiving the gift).

- Describe the Gift: Provide a detailed description of the gift, specifying what is being transferred. Include any relevant details that clarify the nature of the gift.

- Include Consideration Clause: State whether the gift is being made with or without any consideration. Typically, a gift is made without consideration.

- Sign the Document: Both the donor and the recipient must sign the form. Ensure that the signatures are dated and that any required witnesses also sign if necessary.

- Notarization: Depending on your state’s requirements, consider having the document notarized to add an extra layer of authenticity.

- File the Form: Submit the completed Gift Deed form to the appropriate local government office, such as the county recorder or assessor’s office, to officially record the gift.

After completing these steps, you will have a properly filled out Gift Deed form ready for submission. It is important to keep a copy for your records, as it may be needed for future reference or verification of ownership.

Misconceptions

Many people have misunderstandings about the Gift Deed form. Here are seven common misconceptions:

-

Gift Deeds are only for family members. While it is common to use a Gift Deed to transfer property to family, anyone can give a gift to anyone else. Friends, colleagues, or even charitable organizations can be recipients.

-

A Gift Deed is the same as a Will. This is not true. A Gift Deed transfers ownership of property immediately, while a Will distributes assets after a person's death. A Gift Deed is effective as soon as it is executed.

-

You don’t need a witness for a Gift Deed. In many states, having a witness is necessary for the validity of the deed. A witness can help confirm the authenticity of the gift.

-

Gift Deeds incur no tax implications. This is misleading. While the recipient may not pay tax on the gift itself, the giver may face gift tax obligations if the value exceeds a certain threshold.

-

A Gift Deed cannot be revoked. This is incorrect. If certain conditions are met, a Gift Deed can be revoked. However, revoking a gift can be complicated and may require legal action.

-

All gifts require a Gift Deed. Not every gift needs a formal Gift Deed. Small gifts or personal items may not require documentation, but larger gifts, especially real estate, usually do.

-

Gift Deeds are only for real estate. This misconception overlooks that Gift Deeds can also apply to personal property, such as vehicles, jewelry, or artwork. Any valuable item can potentially be gifted through a deed.

Dos and Don'ts

When filling out a Gift Deed form, it's important to approach the task with care. This document can have significant legal implications, so following best practices will help ensure everything is completed correctly. Here’s a list of things you should and shouldn’t do.

- Do ensure that the names of the donor and recipient are clearly written.

- Do include a detailed description of the gift being transferred.

- Do sign the document in the presence of a witness, if required by your state.

- Do provide the date of the gift to establish the timeline of the transfer.

- Don't leave any sections of the form blank; incomplete forms can lead to legal complications.

- Don't use vague language when describing the gift; clarity is key.

- Don't forget to check your state’s specific requirements, as they can vary.

By following these guidelines, you can help ensure that your Gift Deed is valid and enforceable. Taking the time to fill out the form accurately will save you potential headaches in the future.

Discover More Types of Gift Deed Documents

Free Michigan Lady Bird Deed Pdf - Homeowners often turn to this deed for peace of mind regarding the future of their property.

In Florida, it is crucial for drivers to understand the significance of the Traffic Crash Report form, particularly when a law enforcement report is not obtained. This form is a vital tool for documenting the particulars of an accident, offering a clear structure for drivers to report damage to vehicles or property. To access this essential document, it's recommended to visit All Florida Forms, ensuring compliance with state regulations and facilitating the processing of insurance claims.

Problems With Transfer on Death Deeds California - This deed can be beneficial for individuals looking to minimize estate taxes.

California Corrective Deed - The form can be essential for loan processing or refinancing procedures.

Common mistakes

Filling out a Gift Deed form can be a straightforward process, but there are common mistakes that individuals often make. These errors can lead to confusion or even legal complications down the line. Understanding these pitfalls can help ensure that your intentions are clearly documented and legally sound.

One frequent mistake is not providing complete information about the donor and the recipient. It's essential to include full names, addresses, and any relevant identification numbers. Incomplete information can create ambiguity and may lead to disputes regarding the ownership of the gifted property.

Another common error is failing to describe the property being gifted in sufficient detail. Whether it’s real estate, personal property, or financial assets, a clear and thorough description is necessary. Without this clarity, it may become difficult to identify what exactly was intended to be transferred, which can lead to misunderstandings.

People often overlook the importance of signatures. Both the donor and the recipient should sign the Gift Deed to validate the transaction. If either party neglects to sign, the deed may not hold up in court, rendering the gift ineffective. Additionally, having a witness sign can add an extra layer of credibility.

Another mistake involves neglecting to check state-specific requirements. Different states may have unique regulations regarding gift transactions. Failing to comply with these requirements can invalidate the deed or create complications in the future.

Lastly, individuals may forget to consider tax implications. While many gifts are not subject to taxation, there are limits to how much one can gift without incurring tax liabilities. Consulting with a tax professional can help ensure that all financial aspects are appropriately addressed, preventing any unexpected surprises later on.

Key takeaways

When considering the use of a Gift Deed form, several important aspects should be kept in mind. These key takeaways can guide you through the process effectively.

- Understand the Purpose: A Gift Deed is a legal document that transfers ownership of property or assets from one person to another without any exchange of money.

- Identify the Parties: Clearly identify the donor (the person giving the gift) and the donee (the person receiving the gift) in the document.

- Specify the Gift: Clearly describe the property or asset being gifted. Include details like location, value, and any relevant identifiers.

- Consider Tax Implications: Be aware that gifts may have tax implications. Consult a tax professional to understand any potential gift tax liabilities.

- Signatures Required: Ensure that both the donor and donee sign the Gift Deed. In some cases, witnesses may also be required to validate the document.

- Notarization: Notarizing the Gift Deed can add an extra layer of legal protection and authenticity to the document.

- Record the Deed: After completion, consider recording the Gift Deed with the appropriate local government office to provide public notice of the transfer.

- Revocation Clause: If desired, include a clause that outlines the conditions under which the gift can be revoked, though this may complicate the gift’s intent.

- Legal Assistance: If unsure about any part of the process, seek legal advice to ensure that the Gift Deed meets all legal requirements and protects the interests of both parties.

By following these guidelines, you can navigate the process of completing and using a Gift Deed form with greater confidence and clarity.