Fillable Transfer-on-Death Deed Form for Georgia

Georgia Transfer-on-Death Deed - Usage Guidelines

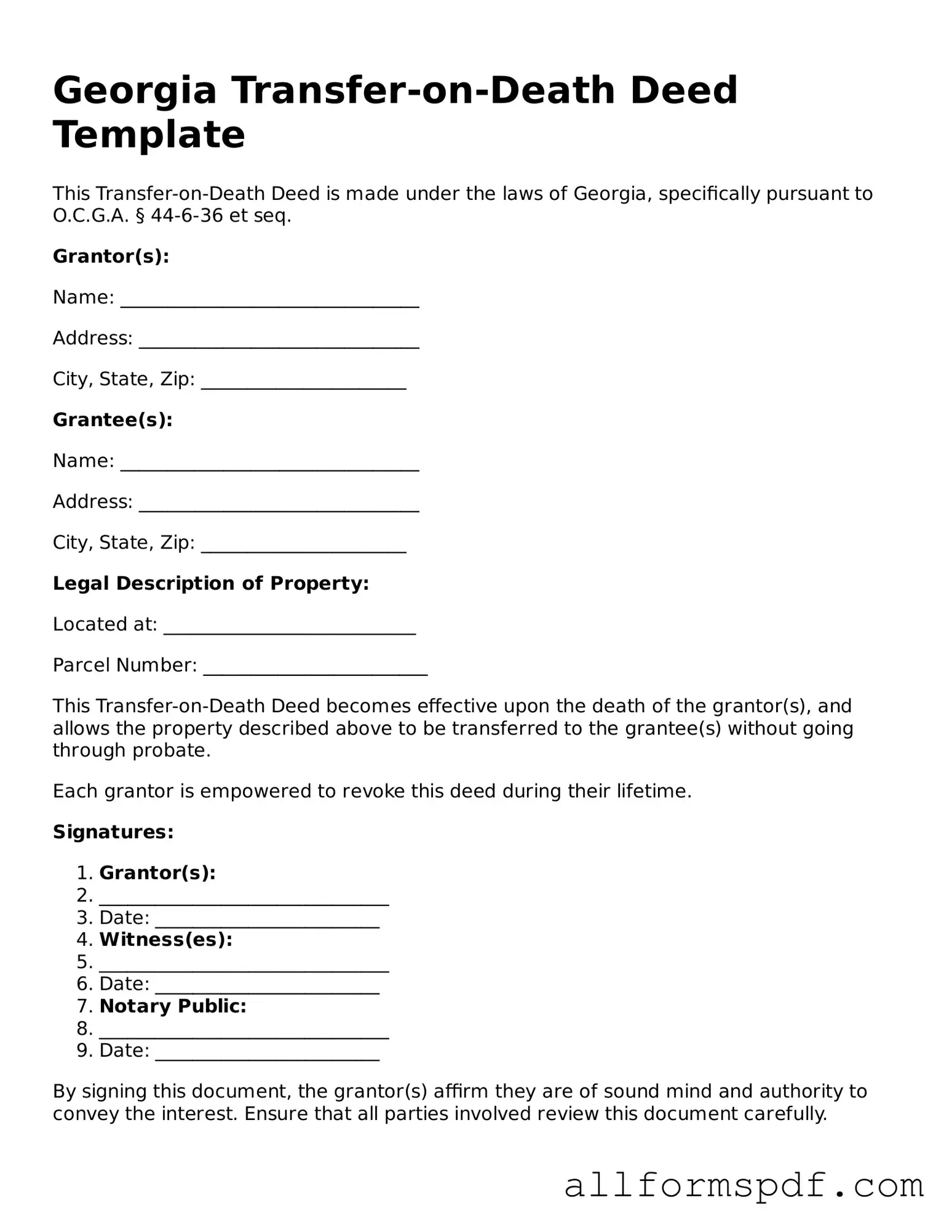

Filling out the Georgia Transfer-on-Death Deed form is a straightforward process that allows property owners to designate a beneficiary to receive their property upon their passing. After completing the form, it must be signed, notarized, and filed with the appropriate county office to ensure that the beneficiary's rights are protected.

- Obtain the Transfer-on-Death Deed form from the Georgia Secretary of State's website or your local county office.

- Enter the name of the property owner(s) in the designated section. Ensure that the names match the titles on the property deed.

- Provide the address of the property. This should include the street address, city, state, and zip code.

- Identify the beneficiary or beneficiaries. Include their full names and any relevant relationship to the property owner.

- Specify whether the transfer is to be made to one beneficiary or multiple beneficiaries. If multiple, clarify how the property will be divided.

- Include the legal description of the property. This information can usually be found on the current property deed.

- Sign the form in the presence of a notary public. This step is crucial for the validity of the deed.

- Have the notary public complete their section of the form, verifying your identity and signature.

- Make copies of the completed and notarized form for your records.

- File the original form with the county clerk's office where the property is located. Check for any local filing fees that may apply.

Misconceptions

When it comes to the Georgia Transfer-on-Death Deed, there are several misconceptions that can lead to confusion. Understanding these common myths can help individuals make informed decisions about their estate planning. Below are five prevalent misconceptions surrounding this legal tool.

-

It automatically avoids probate.

While a Transfer-on-Death Deed allows for the transfer of property outside of probate, it doesn’t eliminate the need for probate in all situations. For example, if there are debts or disputes, the estate may still go through the probate process.

-

It can be revoked easily at any time.

Although a Transfer-on-Death Deed can be revoked, the process must be done formally. Simply deciding to change your mind isn't enough; a new deed must be executed and recorded to ensure the previous one is invalidated.

-

It applies to all types of property.

This deed is specifically designed for real estate. Other types of assets, such as bank accounts or vehicles, cannot be transferred using this method.

-

It is only for wealthy individuals.

Many people believe that Transfer-on-Death Deeds are only beneficial for those with significant assets. In reality, this tool can be advantageous for anyone looking to simplify the transfer of their property upon death, regardless of their financial status.

-

It requires complex legal assistance.

While consulting a legal professional can be beneficial, creating a Transfer-on-Death Deed in Georgia is relatively straightforward. Many individuals can complete the form with a clear understanding of their intentions and the requirements.

By dispelling these misconceptions, individuals can better navigate the complexities of estate planning and make choices that align with their wishes for the future.

Dos and Don'ts

When filling out the Georgia Transfer-on-Death Deed form, it is essential to approach the task with care and attention to detail. Below is a list of important dos and don’ts to ensure the process goes smoothly.

- Do provide accurate information about the property being transferred.

- Do include the full legal names of all parties involved.

- Do sign the deed in the presence of a notary public.

- Do ensure that the deed is recorded with the county clerk's office.

- Don't forget to check for any outstanding liens or encumbrances on the property.

- Don't leave any sections of the form incomplete; all required fields must be filled out.

By following these guidelines, you can help ensure that your Transfer-on-Death Deed is completed correctly and effectively. Taking the time to do it right can provide peace of mind for you and your loved ones.

Popular State-specific Transfer-on-Death Deed Forms

How to Gift a House to a Family Member - The Transfer-on-Death Deed is an effective way to avoid probate court, saving your heirs time and potentially money.

Problems With Transfer on Death Deeds - You can specify conditions for the beneficiary, such as age or relationship to you.

Tod Form Ohio - This option may provide peace of mind knowing that assets will go directly to chosen beneficiaries.

In addition to the importance of the Florida Horse Bill of Sale form, it's beneficial for both buyers and sellers to have access to comprehensive resources related to the sale process; for instance, you can find various required documents, including templates and guidelines on the website All Florida Forms, which can aid in simplifying the transaction.

Transfer on Death Instrument - Transfer-on-Death Deeds do not affect the property owner’s tax responsibilities while alive.

Common mistakes

Filling out the Georgia Transfer-on-Death Deed form can be straightforward, but several common mistakes can lead to complications. One frequent error is failing to include the legal description of the property. This description is essential for identifying the property being transferred. Without it, the deed may be deemed invalid.

Another mistake involves not properly identifying the beneficiaries. It's crucial to provide the full names and addresses of all individuals receiving the property. Omitting this information or using nicknames can create confusion and may lead to disputes among potential heirs.

People often overlook the importance of signing the deed. The form must be signed by the property owner in the presence of a notary public. If the signature is missing or not notarized, the deed cannot be executed legally.

Some individuals fail to record the deed with the appropriate county office. Recording the deed is necessary for it to take effect. Without this step, the transfer may not be recognized by the state or could be challenged later.

Another common error is not updating the deed after significant life events, such as marriage, divorce, or the death of a beneficiary. Changes in personal circumstances can affect the validity of the deed. Keeping the information current is essential.

Many people also neglect to review the deed for accuracy before submission. Simple typographical errors can lead to misunderstandings or legal issues. It is advisable to double-check all entries for correctness.

Some individuals may not understand the implications of transferring property via a Transfer-on-Death Deed. It is important to recognize that this deed does not eliminate debts associated with the property. Beneficiaries may still be responsible for any outstanding obligations.

Another mistake is not considering tax implications. Transferring property can have tax consequences for beneficiaries. It is wise to consult with a tax professional to understand potential liabilities.

People sometimes fail to communicate their intentions with family members. Transparency can prevent disputes after the property owner’s death. Discussing plans with beneficiaries can help ensure everyone understands the arrangement.

Lastly, individuals may not seek legal advice when needed. While the form is designed for self-completion, consulting with an attorney can provide clarity and help avoid common pitfalls. Legal guidance can be especially beneficial for complex situations.

Key takeaways

Filling out and using the Georgia Transfer-on-Death Deed form can be a straightforward process if you keep a few key points in mind. Here are some essential takeaways to consider:

- The Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive the property upon their death, avoiding probate.

- To be valid, the deed must be signed by the property owner in the presence of a notary public.

- It's important to include a clear legal description of the property being transferred. This ensures that there is no confusion about which property the deed pertains to.

- The deed must be recorded in the county where the property is located. Failing to do so may render the deed ineffective.

- Beneficiaries can be individuals or entities, such as trusts or organizations. Make sure to specify full names and any necessary identifying information.

- Property owners can revoke the Transfer-on-Death Deed at any time before their death, providing flexibility if circumstances change.

- Consulting with a legal professional is advisable to ensure that the deed is filled out correctly and aligns with your overall estate planning goals.

- Keep a copy of the recorded deed in a safe place, and inform your beneficiaries about its existence and location to avoid confusion later.