Fillable Tractor Bill of Sale Form for Georgia

Georgia Tractor Bill of Sale - Usage Guidelines

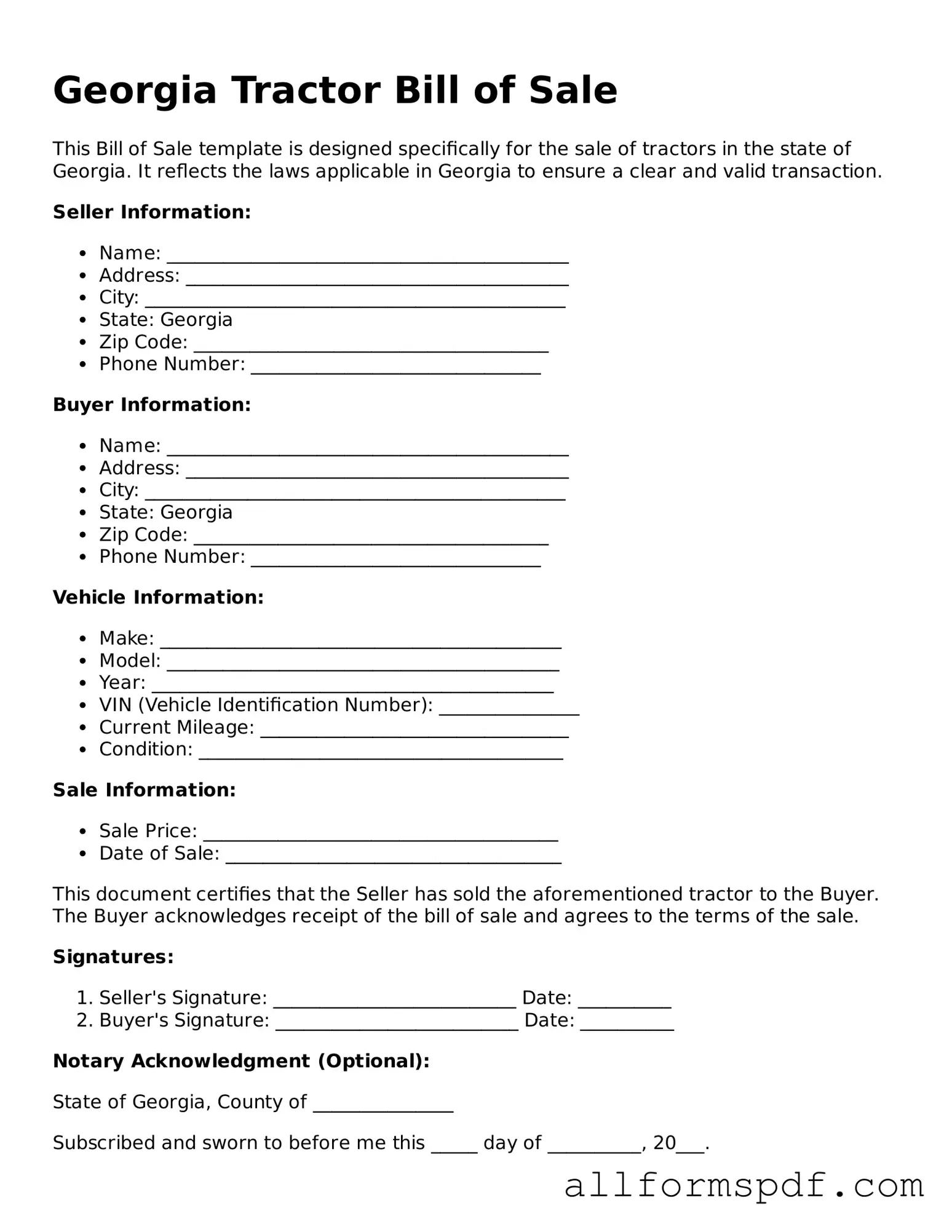

Once you have gathered the necessary information, you are ready to fill out the Georgia Tractor Bill of Sale form. This document serves as a record of the sale and transfer of ownership of a tractor. Completing it accurately is important for both the buyer and the seller, ensuring a smooth transaction and providing legal protection.

- Obtain the form: You can find the Georgia Tractor Bill of Sale form online or at your local county office.

- Fill in the date: Write the date of the transaction at the top of the form.

- Provide seller information: Enter the full name, address, and contact information of the seller.

- Provide buyer information: Enter the full name, address, and contact information of the buyer.

- Describe the tractor: Include details such as the make, model, year, Vehicle Identification Number (VIN), and any other identifying features.

- State the sale price: Clearly indicate the amount for which the tractor is being sold.

- Include any warranties: If applicable, specify any warranties or guarantees related to the tractor.

- Sign the form: Both the seller and buyer must sign and date the form to validate the transaction.

- Make copies: After completing the form, make copies for both the buyer and seller for their records.

Misconceptions

When dealing with the Georgia Tractor Bill of Sale form, several misconceptions often arise. Understanding these misconceptions can help individuals navigate the process more effectively. Below is a list of common misunderstandings regarding this document.

- The form is only necessary for new tractors. Many believe that a Bill of Sale is only required for new purchases. In reality, it is essential for both new and used tractors to provide proof of ownership.

- A verbal agreement suffices. Some people think that a simple handshake or verbal agreement is enough. However, having a written Bill of Sale protects both the buyer and the seller in case of disputes.

- The form is only needed if the tractor is registered. This is a common misconception. Even if the tractor is not registered, a Bill of Sale is important for establishing ownership and for future registration purposes.

- Any format of the Bill of Sale is acceptable. While informal agreements may seem sufficient, using the correct Georgia Tractor Bill of Sale form ensures compliance with state laws and regulations.

- Only the seller needs to sign the form. Many individuals assume that only the seller's signature is required. However, both the buyer and seller should sign the document to validate the transaction.

- The form does not need to be notarized. Some believe that notarization is unnecessary. In Georgia, while notarization is not mandatory, it can add an extra layer of security and authenticity to the transaction.

- The Bill of Sale is not important for tax purposes. This misconception can lead to issues later on. A Bill of Sale serves as a record of the transaction and can be crucial for tax reporting and potential audits.

By clearing up these misconceptions, individuals can ensure they properly complete the Georgia Tractor Bill of Sale form, safeguarding their interests in the transaction.

Dos and Don'ts

When filling out the Georgia Tractor Bill of Sale form, it's important to be careful and thorough. Here are some guidelines to follow:

- Do ensure all required fields are completed accurately.

- Do include the correct Vehicle Identification Number (VIN).

- Do sign and date the form to validate the sale.

- Do keep a copy of the completed form for your records.

- Do verify that both the buyer and seller have their information clearly listed.

- Don't leave any fields blank unless specified.

- Don't use incorrect or outdated information.

- Don't forget to check for typos or errors before submitting.

- Don't rush through the process; take your time to ensure accuracy.

- Don't ignore state-specific requirements that may apply.

Popular State-specific Tractor Bill of Sale Forms

Bill of Sale for Tractor - A document to formalize the sale of a tractor.

For those facing lease issues, understanding the significance of the Notice to Quit form requirements is crucial. This document serves as a formal alert to tenants regarding the need to address violations, providing clarity on the next steps in the eviction process.

Tractor Bill of Sale Form - Using a Tractor Bill of Sale can help prevent misunderstandings about the condition and ownership of the tractor.

Tractor Bill of Sale Word Template - Can be tailored to include any specific conditions related to the sale.

Common mistakes

Filling out the Georgia Tractor Bill of Sale form can seem straightforward, but many people make common mistakes that can lead to complications later. One significant error is failing to include all necessary information. The form requires details such as the buyer's and seller's names, addresses, and signatures. Omitting even one piece of information can render the document incomplete and potentially invalidate the sale.

Another frequent mistake is not accurately describing the tractor being sold. It’s essential to include specific details like the make, model, year, and Vehicle Identification Number (VIN). If these details are vague or incorrect, it could create confusion or disputes down the line, especially if the buyer needs to register the tractor.

Many individuals also overlook the importance of the date of the transaction. This date is crucial as it establishes when the sale occurred. Without it, the bill of sale may not hold up in legal situations, such as disputes over ownership or payment. Always double-check to ensure that the date is clearly indicated.

Additionally, some people forget to provide the sale price. Leaving this section blank can lead to misunderstandings regarding the financial aspects of the transaction. The sale price is not just a formality; it can affect taxes and registration fees, making it vital to include this information accurately.

Lastly, failing to keep a copy of the completed bill of sale for personal records is a mistake that can have lasting consequences. Once the transaction is complete, both parties should retain a copy for their records. This serves as proof of the sale and can be useful for future reference, especially if any issues arise regarding ownership or payment.

Key takeaways

When filling out and using the Georgia Tractor Bill of Sale form, consider the following key takeaways:

- Accurate Information: Ensure all details about the tractor, including make, model, year, and Vehicle Identification Number (VIN), are correct.

- Seller and Buyer Details: Include full names and addresses of both the seller and buyer to establish clear ownership transfer.

- Purchase Price: Clearly state the sale price of the tractor. This is crucial for tax purposes.

- Date of Sale: Record the date on which the transaction takes place. This helps in tracking ownership history.

- Signatures: Both parties must sign the document. This signature verifies the agreement and transfer of ownership.

- Notarization: While not required, having the bill of sale notarized can add an extra layer of legitimacy to the document.

- Keep Copies: Both the seller and buyer should retain copies of the completed bill of sale for their records.

- Use for Registration: The bill of sale is often needed for registering the tractor with the Georgia Department of Revenue.

- Consult State Regulations: Familiarize yourself with any specific state regulations regarding tractor sales to ensure compliance.