Fillable Real Estate Purchase Agreement Form for Georgia

Georgia Real Estate Purchase Agreement - Usage Guidelines

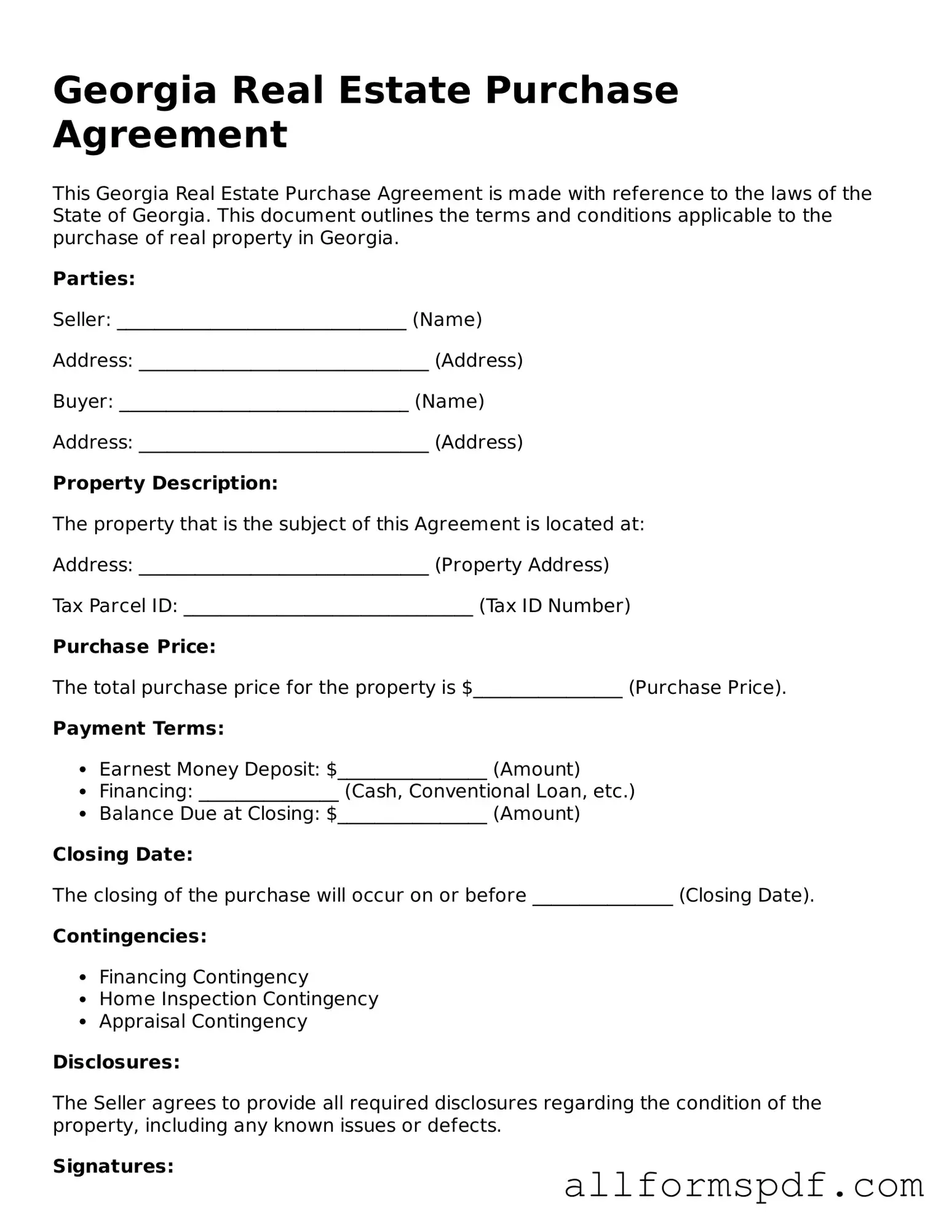

Once you have gathered the necessary information, you can begin filling out the Georgia Real Estate Purchase Agreement form. This form requires specific details about the transaction, including information about the buyer, seller, property, and terms of sale. Follow these steps to ensure that you complete the form accurately.

- Start with the date at the top of the form. Write the date when you are filling out the agreement.

- Enter the names of the buyer(s) in the designated section. Ensure that you include full legal names.

- List the seller(s) in the next section, using their full legal names as well.

- Provide the property address. Include the street address, city, state, and zip code.

- Fill in the purchase price. Clearly state the total amount the buyer agrees to pay for the property.

- Specify the earnest money deposit amount. This is the initial payment made to demonstrate the buyer's commitment.

- Indicate the closing date. Choose a date that works for both parties to finalize the sale.

- Outline any contingencies, such as financing or inspections, that must be met before the sale is finalized.

- Sign and date the agreement. Both the buyer and seller must sign to make the agreement valid.

After completing the form, review it for accuracy. Both parties should retain a copy for their records. Ensure that all necessary documents accompany the agreement when submitting it for processing.

Misconceptions

When it comes to real estate transactions in Georgia, many individuals encounter various misconceptions about the Real Estate Purchase Agreement (REPA) form. Understanding the truth behind these misconceptions can help buyers and sellers navigate the process more effectively. Here are six common misconceptions:

- The REPA is a legally binding contract from the moment it is signed. Many people believe that simply signing the REPA makes it legally binding. However, this is only true if all parties involved agree to the terms and conditions outlined in the agreement. Until all signatures are in place and any contingencies are satisfied, the contract may not be enforceable.

- All real estate transactions in Georgia require a REPA. While the REPA is a common form used for residential real estate transactions, it is not mandatory for every situation. Certain types of sales, such as those involving foreclosures or auctions, may follow different processes and utilize alternative forms.

- The REPA covers all aspects of the transaction. Some individuals think that the REPA addresses every detail of the transaction. In reality, while it provides a framework, additional documents may be necessary to cover specific aspects such as disclosures, financing, and closing procedures.

- Once the REPA is signed, there’s no turning back. A common belief is that signing the REPA locks parties into the agreement indefinitely. In fact, many contingencies allow buyers and sellers to back out under certain conditions, such as failing to secure financing or unsatisfactory home inspections.

- Real estate agents can alter the REPA without consent. Some assume that agents have the authority to modify the REPA on behalf of their clients. In truth, any changes to the agreement must be mutually agreed upon by all parties involved, ensuring transparency and consent.

- The REPA is the same for all types of properties. Many people think that a single REPA template applies universally to all properties. However, different types of properties, such as commercial real estate or vacant land, may require tailored agreements that address their unique characteristics and legal requirements.

By dispelling these misconceptions, buyers and sellers can approach their real estate transactions with greater confidence and clarity. It is always wise to consult with a knowledgeable real estate professional or legal advisor to ensure a smooth process.

Dos and Don'ts

When filling out the Georgia Real Estate Purchase Agreement form, it’s important to approach the task with care. Here are five things you should and shouldn't do to ensure the process goes smoothly.

- Do read the entire agreement thoroughly before filling it out.

- Do provide accurate and complete information about the property and parties involved.

- Do consult a real estate professional if you have questions about any section.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any required fields blank; incomplete forms can cause delays.

By following these guidelines, you can help ensure that your experience with the Georgia Real Estate Purchase Agreement is efficient and effective.

Popular State-specific Real Estate Purchase Agreement Forms

Nc Association of Realtors - It is essential in helping ensure both parties are aligned on their expectations and responsibilities.

Purchase Agreement Michigan for Sale by Owner - It can also address seller disclosures that must be made.

Sale Contract for House - A Real Estate Purchase Agreement includes contingencies for inspections and financing.

For those seeking guidance on the legal implications of healthcare decisions, the important Medical Power of Attorney process is vital. This document empowers individuals to appoint a trusted agent who will act in their best interest regarding medical treatment if they are unable to express their wishes.

Purchasing Agreement - Offers protections for both parties throughout the transaction process.

Common mistakes

When completing the Georgia Real Estate Purchase Agreement form, individuals often make several common mistakes that can lead to complications in the buying or selling process. Awareness of these pitfalls can help ensure a smoother transaction.

One frequent error is failing to provide accurate property descriptions. Buyers and sellers must ensure that the property’s address, legal description, and any relevant details are correct. A vague or incorrect description can lead to disputes or confusion later on.

Another mistake involves neglecting to include all necessary parties in the agreement. It is essential to list all individuals or entities involved in the transaction. Omitting a party can create legal complications and delay the process.

Many people also overlook the importance of specifying the purchase price clearly. While it may seem straightforward, ambiguity can arise if the price is not clearly stated or if there are additional terms that need clarification. This can lead to misunderstandings between the buyer and seller.

Additionally, failing to address contingencies is a common oversight. Contingencies are conditions that must be met for the sale to proceed. Without clearly defined contingencies, such as financing or inspection requirements, a party may find themselves in a difficult situation if those conditions are not met.

Some individuals forget to consider the closing date. It is crucial to specify when the transaction will be finalized. An unclear or missing closing date can lead to frustration and logistical challenges for both parties.

Another mistake is not including earnest money details. The agreement should specify the amount of earnest money and the conditions under which it may be forfeited. This helps protect both parties and ensures that there is a clear understanding of the financial commitment involved.

People often fail to read the fine print. The Georgia Real Estate Purchase Agreement contains important terms and conditions that must be understood. Ignoring these details can lead to unintended consequences.

Finally, neglecting to seek legal advice can be a significant misstep. Real estate transactions can be complex, and professional guidance can help navigate the nuances of the agreement. Consulting with a knowledgeable attorney can provide peace of mind and help avoid costly mistakes.

Key takeaways

When filling out and using the Georgia Real Estate Purchase Agreement form, it's important to keep several key points in mind. This ensures a smooth transaction and protects your interests.

- Accuracy is crucial: Ensure all information, including names, addresses, and property details, is correct to avoid disputes later.

- Understand the terms: Familiarize yourself with the terms of the agreement, including contingencies, closing dates, and earnest money deposits.

- Contingencies matter: Common contingencies include financing, inspection, and appraisal. These can protect you if conditions aren’t met.

- Earnest money: This deposit shows your commitment to the purchase. Know the amount required and the conditions for its return.

- Review deadlines: Pay attention to deadlines for inspections, financing, and closing. Missing these can jeopardize the deal.

- Legal advice is beneficial: Consider consulting a real estate attorney to review the agreement and provide guidance tailored to your situation.

- Keep copies: Always retain a copy of the signed agreement and any amendments. This documentation is essential for future reference.