Fillable Quitclaim Deed Form for Georgia

Georgia Quitclaim Deed - Usage Guidelines

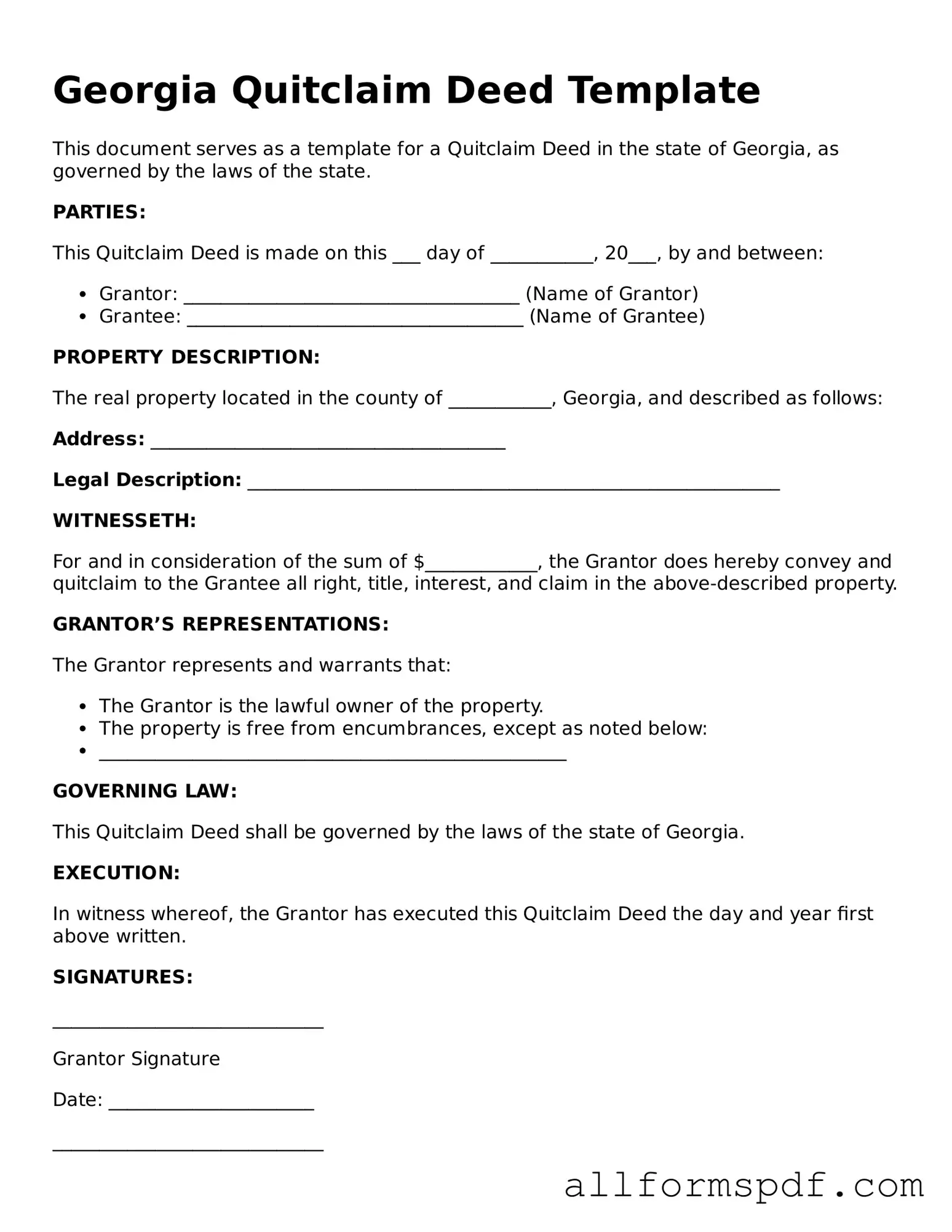

Once you have the Georgia Quitclaim Deed form in hand, it’s time to fill it out accurately. Completing this form correctly is essential for the transfer of property rights. Follow these steps to ensure you provide all necessary information.

- Obtain the Form: Download the Georgia Quitclaim Deed form from a reliable source or visit your local county clerk’s office to get a physical copy.

- Identify the Grantor: Fill in the name of the person transferring the property. This is the current owner of the property.

- Identify the Grantee: Enter the name of the person receiving the property. This is the new owner.

- Provide Property Description: Write a clear and accurate description of the property. Include the address and any legal descriptions if available.

- Include Consideration: State the amount of money or value exchanged for the property, even if it is nominal.

- Sign the Form: The grantor must sign the deed in the presence of a notary public.

- Notarization: Have the signature notarized. This step is crucial for the deed to be legally binding.

- Record the Deed: Submit the completed and notarized Quitclaim Deed to the county clerk’s office where the property is located for recording.

After completing these steps, the Quitclaim Deed will be officially recorded, and the transfer of property rights will be recognized by the state. Keep a copy for your records.

Misconceptions

Understanding the Georgia Quitclaim Deed form is crucial for anyone involved in property transactions. However, several misconceptions can lead to confusion. Here are ten common misconceptions explained:

- Quitclaim Deeds Transfer Ownership Automatically: Many believe that a quitclaim deed automatically transfers ownership without any further action. In reality, the deed must be properly executed, signed, and recorded to be effective.

- Quitclaim Deeds Are Only for Family Transfers: While often used among family members, quitclaim deeds can be used for any type of property transfer, including sales between strangers.

- Quitclaim Deeds Provide a Guarantee of Title: A common misunderstanding is that quitclaim deeds come with a guarantee of a clear title. In fact, they transfer whatever interest the grantor has, without warranties or guarantees.

- All States Use the Same Quitclaim Deed Form: Some people assume that the quitclaim deed form is uniform across all states. However, each state, including Georgia, has specific requirements and forms.

- Quitclaim Deeds Are Only for Real Estate: While primarily used for real estate, quitclaim deeds can also transfer interests in other types of property, such as vehicles or personal belongings.

- Using a Quitclaim Deed Is Always Simple: Although the form is straightforward, the implications of using a quitclaim deed can be complex, especially regarding tax and liability issues.

- Quitclaim Deeds Eliminate Mortgage Liens: A misconception exists that transferring property via a quitclaim deed removes any existing mortgage liens. This is not true; liens remain attached to the property.

- Quitclaim Deeds Are Irrevocable: Some people think that once a quitclaim deed is executed, it cannot be changed or revoked. In fact, the grantor may revoke it under certain conditions.

- Quitclaim Deeds Are Not Legally Binding: There is a belief that quitclaim deeds lack legal weight. However, when properly executed and recorded, they are legally binding documents.

- Quitclaim Deeds Are Only for Transfers Within Georgia: Many assume quitclaim deeds are only applicable within Georgia. However, they can be used for property located in other states, provided they comply with those states' laws.

Clarifying these misconceptions can help individuals make informed decisions when considering the use of a quitclaim deed in Georgia.

Dos and Don'ts

Filling out a Quitclaim Deed form in Georgia can be straightforward if you know what to do and what to avoid. Here’s a handy list to guide you through the process.

- Do ensure that all parties involved are clearly identified. Include full names and addresses.

- Don't leave any blank spaces on the form. Every section should be completed to avoid delays.

- Do provide a legal description of the property. This is crucial for clarity and accuracy.

- Don't forget to sign the form. Without signatures, the deed won't be valid.

- Do have the document notarized. This adds an extra layer of authenticity.

- Don't use white-out or make any alterations. If you make a mistake, it's better to start fresh.

- Do keep a copy of the completed form for your records. It’s always good to have documentation on hand.

By following these tips, you can navigate the Quitclaim Deed process with confidence and ease. Happy filing!

Popular State-specific Quitclaim Deed Forms

Can I File a Quit Claim Deed Myself - This deed provides a transparent method to document property interests, albeit without guarantees.

For those looking to create their own ADP Pay Stub, the process can be made easier with resources such as Legal PDF Documents, which provides templates and guidance to ensure accuracy and compliance with payroll standards.

What Is a Quit Claim Deed Ohio - A quitclaim deed transfers ownership of property without any guarantees.

Common mistakes

Filling out a Georgia Quitclaim Deed form can seem straightforward, but many people make common mistakes that can lead to issues down the line. One frequent error is failing to include the correct legal description of the property. This description is essential because it identifies the exact boundaries of the property being transferred. Without it, the deed may not be valid.

Another mistake involves not properly identifying the parties involved in the transaction. The grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly named. Omitting a middle name or using an incorrect spelling can create confusion and potential legal challenges later.

People often overlook the requirement for signatures. Both the grantor and any witnesses must sign the deed for it to be legally binding. If the signatures are missing or if the wrong number of witnesses is present, the deed may not hold up in court.

In addition, individuals sometimes forget to notarize the Quitclaim Deed. A notary public must witness the signatures to verify their authenticity. Without notarization, the deed could be questioned, leading to complications in ownership claims.

Finally, many people fail to record the Quitclaim Deed with the county clerk's office. Recording the deed is a critical step that protects the new owner's rights. If the deed is not recorded, it may be difficult to prove ownership, especially if disputes arise in the future.

Key takeaways

Understanding the Quitclaim Deed is essential. This form allows a property owner to transfer their interest in a property to another person without guaranteeing that the title is clear.

Ensure that the property description is accurate. A clear and precise description helps avoid confusion and potential disputes in the future.

Both the grantor (the person giving up their interest) and the grantee (the person receiving the interest) must be clearly identified. Include full names and addresses to prevent any legal issues.

The Quitclaim Deed must be signed in the presence of a notary public. This step is crucial to validate the document and ensure its acceptance by the county clerk.

After signing, the deed should be filed with the local county clerk’s office. This filing makes the transfer official and part of public record.

Consider consulting a legal professional if you have questions. While the form is straightforward, legal advice can help clarify any uncertainties.

Keep a copy of the completed Quitclaim Deed for your records. This document serves as proof of the transfer of interest and can be important for future reference.

Be aware of any tax implications. Transferring property may have tax consequences, so it’s wise to check with a tax advisor to understand your obligations.