Fillable Promissory Note Form for Georgia

Georgia Promissory Note - Usage Guidelines

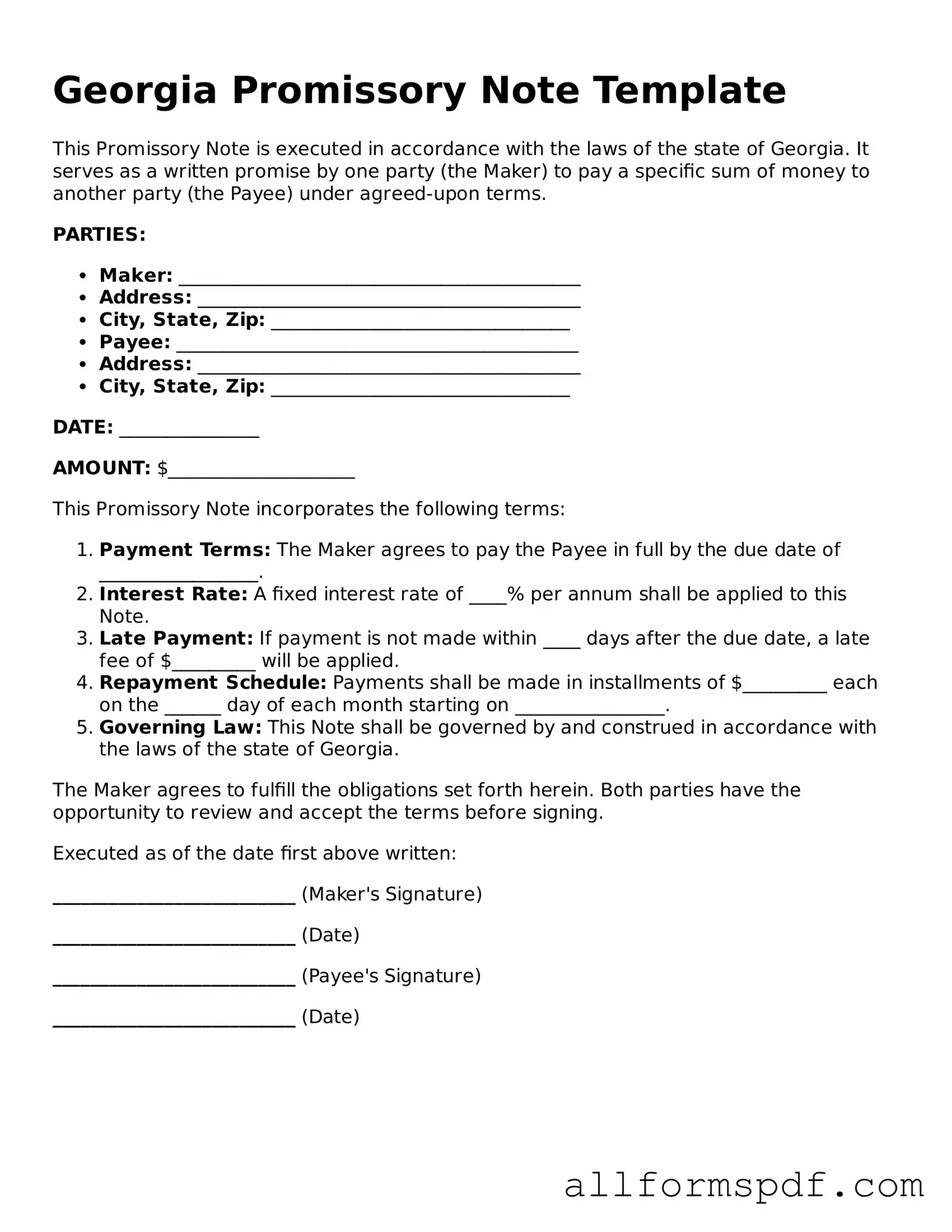

Once you have the Georgia Promissory Note form in hand, it’s time to fill it out carefully. Ensure you have all necessary information at hand, as this will make the process smoother. Follow the steps below to complete the form accurately.

- Begin by entering the date at the top of the form. Make sure to use the correct format.

- Next, write the name of the borrower. This should be the individual or entity that is borrowing the money.

- In the following space, include the address of the borrower. This should be a complete address, including city, state, and zip code.

- Now, indicate the name of the lender. This is the person or organization providing the loan.

- Provide the lender's address in the next section. Again, ensure it is complete and accurate.

- Specify the principal amount being borrowed. This is the total sum of money that the borrower will repay.

- Next, enter the interest rate. This is usually expressed as a percentage.

- Detail the repayment schedule. Indicate how often payments will be made (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees that may apply if payments are missed. Be clear about the amount and conditions.

- Finally, both the borrower and lender should sign and date the form at the bottom. This indicates agreement to the terms laid out in the note.

After completing the form, ensure that all information is correct and legible. Both parties should keep a copy for their records. If you have questions about the terms or need further assistance, consider consulting with a legal professional.

Misconceptions

Understanding the Georgia Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions often arise. Here are ten common misunderstandings:

- All promissory notes are the same. Many people believe that all promissory notes follow a standard format. In reality, they can vary significantly based on state laws and specific terms agreed upon by the parties involved.

- A promissory note must be notarized. While notarization can add an extra layer of authenticity, it is not a requirement for a promissory note to be legally binding in Georgia.

- Promissory notes are only for large loans. This is a misconception. Promissory notes can be used for loans of any size, whether it's a few hundred dollars or thousands.

- Once signed, a promissory note cannot be changed. In fact, parties can amend the terms of a promissory note if both agree to the changes and document them properly.

- Interest rates on promissory notes are unrestricted. Georgia has laws that regulate maximum interest rates, so lenders must comply with these limits to avoid legal issues.

- Only banks can issue promissory notes. Individuals can create and issue promissory notes as well. It is not limited to financial institutions.

- A promissory note guarantees repayment. While it is a promise to pay, it does not guarantee that the borrower will have the funds to repay the loan. Default is still a possibility.

- Promissory notes are not enforceable in court. This is incorrect. If a borrower defaults, the lender can take legal action based on the terms outlined in the note.

- All promissory notes need to be in writing. While it's best practice to have a written document, oral agreements can also be considered valid in some cases, though they are harder to enforce.

- Once a promissory note is paid off, it is no longer important. Even after repayment, keeping a copy of the note is wise. It serves as proof of the transaction and can protect against future disputes.

By clarifying these misconceptions, individuals can better navigate the complexities of promissory notes in Georgia.

Dos and Don'ts

When filling out the Georgia Promissory Note form, it's important to ensure accuracy and clarity. Here’s a helpful list of things to do and things to avoid:

- Do read the entire form carefully before you start filling it out.

- Do provide clear and accurate information about both the borrower and the lender.

- Do specify the loan amount in both numbers and words to avoid confusion.

- Do include the interest rate, if applicable, and ensure it is compliant with state laws.

- Do state the repayment terms clearly, including due dates and payment amounts.

- Don't leave any sections blank; incomplete forms can lead to issues later.

- Don't use vague language; be specific about all terms and conditions.

- Don't forget to date and sign the document; an unsigned note is not legally binding.

- Don't rush through the process; take your time to ensure everything is accurate.

- Don't ignore state-specific requirements; familiarize yourself with Georgia's laws regarding promissory notes.

By following these guidelines, you can help ensure that your Georgia Promissory Note is completed correctly and is legally enforceable. Always consider consulting with a professional if you have questions or need assistance.

Popular State-specific Promissory Note Forms

Ohio Promissory Note Requirements - Interest calculations can be outlined to ensure borrowers understand their financial commitment.

To facilitate your vehicle transaction, it's vital to understand the intricacies of the important Motor Vehicle Bill of Sale steps involved in completing the required documentation.

Promissory Note Template Illinois - A promissory note is useful personal finance tool for individuals and businesses alike.

Common mistakes

Completing the Georgia Promissory Note form requires attention to detail. One common mistake is failing to include the correct names of the borrower and lender. Accurate identification is crucial, as any discrepancies can lead to legal complications. Ensure that the full legal names of both parties are clearly stated, avoiding nicknames or abbreviations.

Another frequent error is neglecting to specify the loan amount. The total amount borrowed must be clearly indicated in both numerical and written form. Omitting this detail can create confusion regarding the terms of the loan and may lead to disputes later on.

People often overlook the interest rate. It is essential to state whether the loan is interest-bearing and, if so, to specify the exact rate. Without this information, the terms of repayment may be unclear, potentially resulting in misunderstandings between the parties involved.

Additionally, many individuals forget to outline the repayment schedule. This includes the frequency of payments—whether they will be made weekly, monthly, or on another basis. Clearly defining the repayment terms helps to establish expectations and can prevent future disagreements.

Another mistake occurs when borrowers and lenders fail to include a maturity date. This date indicates when the loan must be fully repaid. Without a specified maturity date, the agreement lacks a crucial element that can lead to uncertainty regarding the loan's duration.

In some cases, individuals do not sign the document. A signature is essential for the enforceability of the note. Both parties must sign and date the form to validate the agreement, ensuring that both understand and accept the terms outlined.

Moreover, people sometimes neglect to have the document notarized. While notarization is not always mandatory, it can add an extra layer of protection. A notary public verifies the identities of the signers, which can be beneficial in the event of a dispute.

Lastly, failing to keep copies of the signed Promissory Note is a common oversight. Both parties should retain a copy for their records. This ensures that each party has access to the terms of the agreement and can refer back to it if needed.

Key takeaways

Filling out and using the Georgia Promissory Note form is an important step in formalizing a loan agreement. Here are some key takeaways to consider:

- Understand the Purpose: A promissory note is a legal document that outlines the terms of a loan between a borrower and a lender.

- Include Essential Details: Make sure to provide clear information such as the loan amount, interest rate, repayment schedule, and any late fees.

- Signatures Matter: Both the borrower and lender must sign the document for it to be legally binding.

- Keep Copies: After the note is signed, keep copies for both parties. This ensures that everyone has a record of the agreement.

- Consider Witnesses: While not required, having a witness sign the note can add an extra layer of validity to the agreement.

- Consult Legal Advice: If you have any doubts or specific concerns, consider seeking legal advice to ensure that the document meets all necessary requirements.