Fillable Loan Agreement Form for Georgia

Georgia Loan Agreement - Usage Guidelines

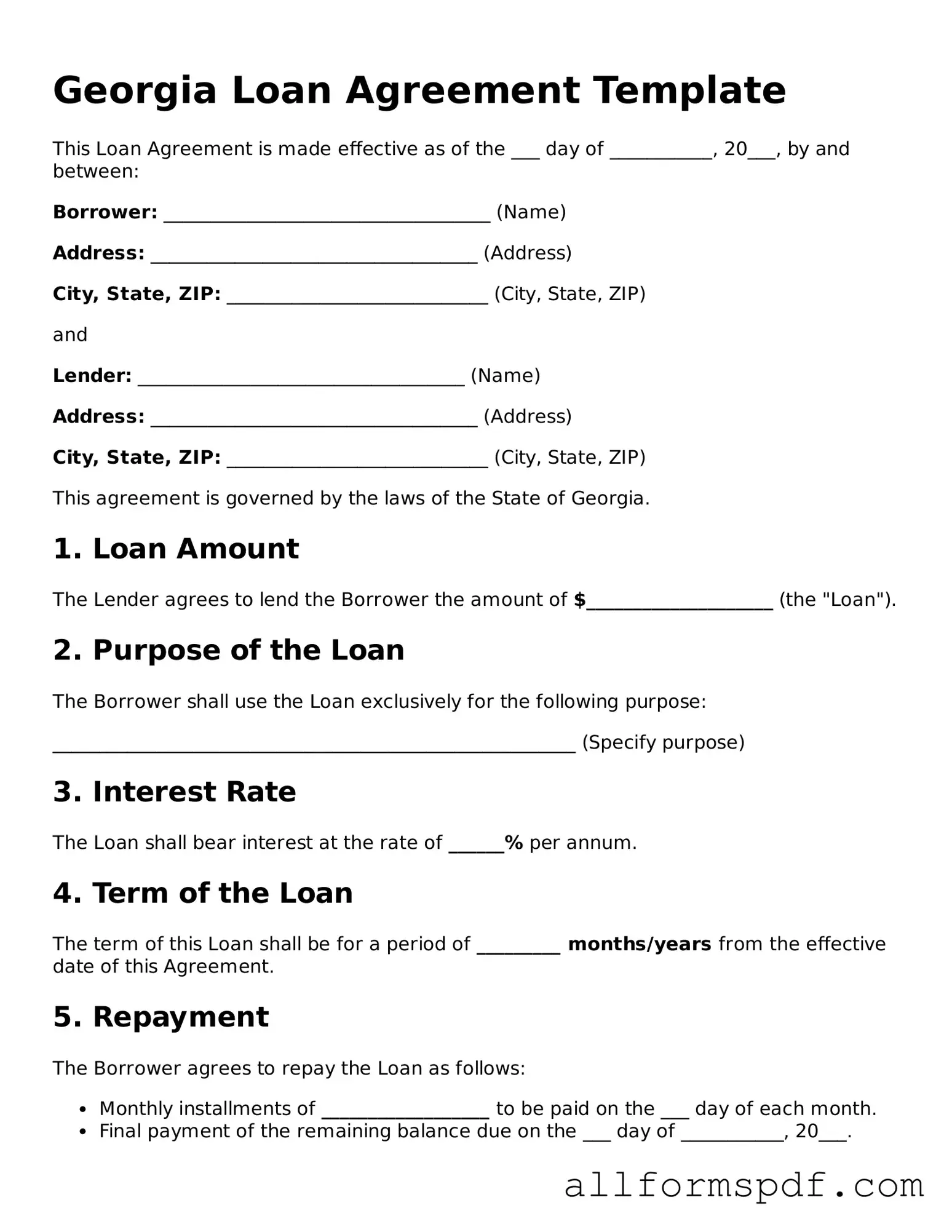

Filling out the Georgia Loan Agreement form is an important step in securing a loan. It requires careful attention to detail. Once you have completed the form, you will be ready to proceed with the next steps in the loan process.

- Begin by downloading the Georgia Loan Agreement form from the official website or obtain a physical copy.

- Read through the entire form to understand what information is required.

- Fill in your personal information at the top of the form, including your name, address, and contact details.

- Provide the loan amount you are requesting in the designated section.

- Indicate the purpose of the loan clearly and concisely.

- Enter the terms of repayment, including the interest rate and repayment schedule.

- Review any additional clauses or requirements specified in the form.

- Sign and date the form at the bottom to confirm your agreement.

- Make a copy of the completed form for your records before submitting it.

Misconceptions

Understanding the Georgia Loan Agreement form can be tricky, and many people hold misconceptions about it. Here’s a list of common misunderstandings that can lead to confusion:

- All loan agreements are the same. Many believe that all loan agreements follow the same format or rules. In reality, each state has its own regulations and requirements, making Georgia's Loan Agreement unique.

- Only banks can issue loans. Some think that only banks are authorized to provide loans. However, various lenders, including credit unions and private lenders, can offer loans under Georgia law.

- Signing a loan agreement is a guarantee of approval. Just because you sign the agreement doesn’t mean you will receive the funds. Lenders often require additional checks before finalizing the loan.

- Loan agreements are only for large amounts. Many assume that loan agreements only apply to significant sums of money. In fact, loans can be for small amounts, and a formal agreement is still necessary.

- Once signed, the terms cannot be changed. Some people think that once they sign a loan agreement, they are stuck with those terms forever. In truth, agreements can often be renegotiated if both parties consent.

- Interest rates are fixed and cannot change. A common belief is that interest rates in a loan agreement are always fixed. However, some loans may have variable rates that can change over time.

- Loan agreements only protect the lender. Many think that these agreements are solely for the lender's benefit. In reality, they also protect the borrower by clearly outlining rights and obligations.

- There’s no need to read the agreement thoroughly. Some people skim through the document, thinking it’s not necessary to read every detail. However, understanding the terms is crucial to avoid surprises later.

- All loan agreements are legally binding immediately. While many agreements are binding upon signing, some may have conditions that need to be met first before they become enforceable.

- You can use a generic template for any loan. Many believe that a one-size-fits-all template can be used for any loan agreement. However, it’s important to customize the agreement to comply with Georgia’s specific laws and requirements.

Being informed about these misconceptions can help you navigate the loan process more effectively and ensure that you understand your rights and responsibilities. Always consider seeking professional advice if you have questions or concerns about a loan agreement.

Dos and Don'ts

When filling out the Georgia Loan Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Below are some recommended actions and pitfalls to avoid.

- Do: Read the entire form carefully before starting to fill it out.

- Do: Provide accurate and complete information as requested.

- Do: Double-check all entries for spelling and numerical errors.

- Do: Sign and date the form in the designated areas.

- Don't: Leave any sections blank unless instructed otherwise.

- Don't: Use abbreviations or shorthand that may cause confusion.

- Don't: Alter the form in any way, such as crossing out or adding information.

- Don't: Submit the form without reviewing it one final time.

Popular State-specific Loan Agreement Forms

Free Promissory Note Template Illinois - It can also include conditions under which the lender can call for immediate payment.

A New York Lease Agreement form is a legally binding document between a landlord and tenant, outlining the terms and conditions of renting property in New York. This form covers various aspects such as rent amount, payment schedule, and lease duration. Understanding this agreement is crucial for both landlords and tenants to ensure their rights are protected. For more information, you can visit https://smarttemplates.net/fillable-new-york-lease-agreement.

Common mistakes

When filling out the Georgia Loan Agreement form, one common mistake is failing to provide accurate personal information. Borrowers often overlook the importance of entering their full legal name, current address, and contact details correctly. Inaccurate information can lead to delays in processing the loan or even complications in the event of a dispute.

Another frequent error involves the omission of financial details. Individuals may neglect to include their income, expenses, or other pertinent financial information. This lack of transparency can hinder the lender's ability to assess the borrower's creditworthiness and may result in loan denial.

Additionally, many people misinterpret the terms of the loan agreement. They might not fully understand the interest rates, repayment terms, or any fees associated with the loan. This misunderstanding can lead to financial strain later on, as borrowers may find themselves unprepared for the obligations they agreed to.

Lastly, some borrowers fail to sign and date the agreement correctly. A missing signature or date can render the document invalid. It is essential for individuals to double-check that all required signatures are present and that the dates are accurate to ensure the agreement is legally binding.

Key takeaways

When filling out and using the Georgia Loan Agreement form, understanding its components is crucial for both lenders and borrowers. Here are some key takeaways to keep in mind:

- Clear Identification: Ensure that both the lender and borrower are clearly identified. Include full names and addresses to avoid any confusion.

- Loan Amount: Specify the exact amount being borrowed. This should be clearly stated to prevent any misunderstandings later.

- Interest Rate: Clearly outline the interest rate associated with the loan. This can be a fixed or variable rate, but it must be explicitly stated.

- Repayment Terms: Detail the repayment schedule. Include how often payments are due and the duration of the loan.

- Late Fees: Mention any penalties for late payments. This helps set expectations and encourages timely payments.

- Default Conditions: Define what constitutes a default on the loan. This could include missed payments or failure to meet other terms.

- Governing Law: Note that the agreement is governed by Georgia law. This is important for legal enforcement and understanding rights.

- Signatures: Both parties must sign the agreement. This indicates that both understand and agree to the terms laid out.

- Witness or Notary: Consider having the agreement witnessed or notarized. This adds an extra layer of validity and can help in case of disputes.

- Keep Copies: Each party should retain a signed copy of the agreement. This ensures that both have access to the terms agreed upon.

By following these guidelines, both lenders and borrowers can navigate the loan process more smoothly and with greater confidence.