Fillable Gift Deed Form for Georgia

Georgia Gift Deed - Usage Guidelines

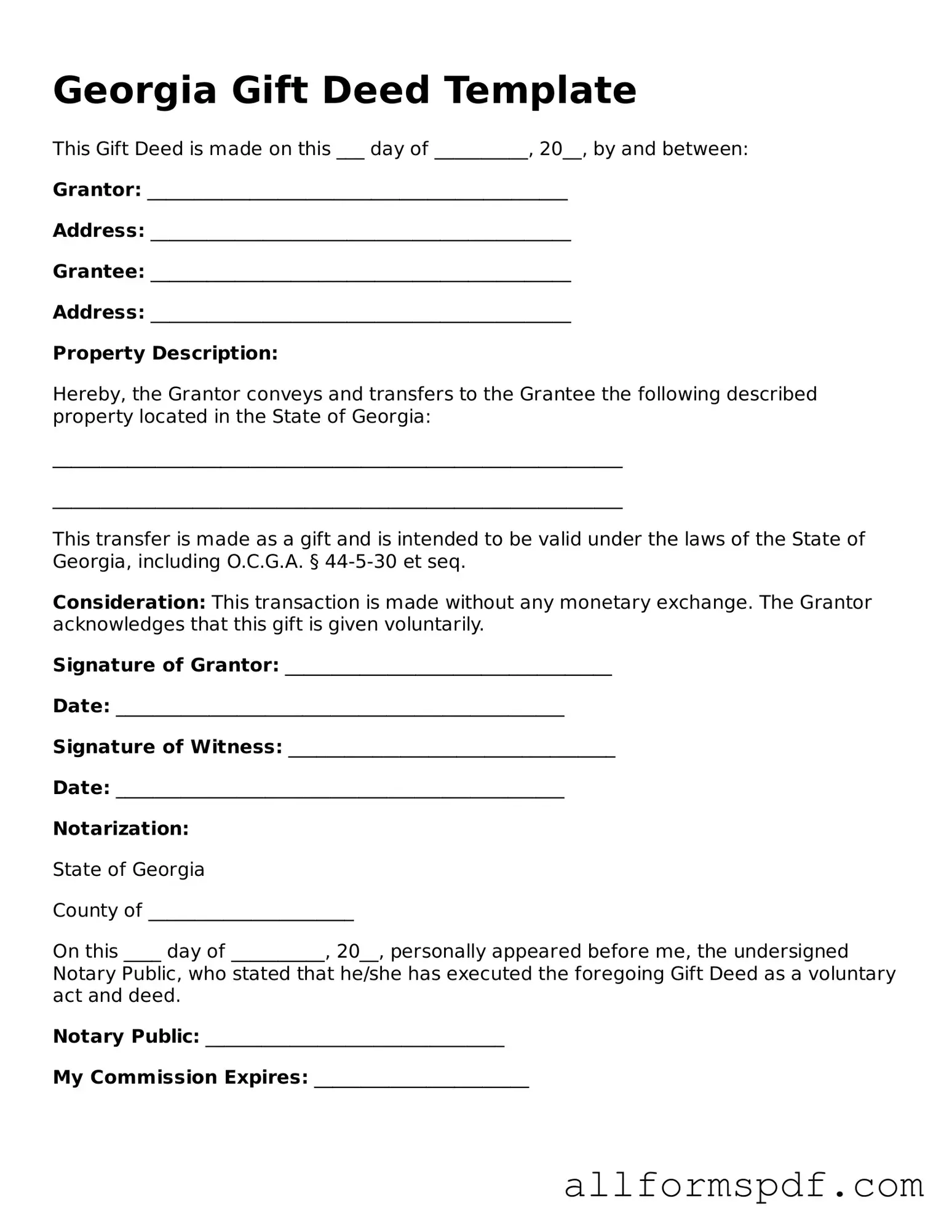

Once you have the Georgia Gift Deed form ready, it’s time to fill it out carefully. Make sure you have all the necessary information at hand. Completing this form correctly is important for ensuring that the gift is legally recognized.

- Start by entering the date at the top of the form.

- Fill in the names and addresses of the grantor (the person giving the gift) and the grantee (the person receiving the gift).

- Provide a description of the property being gifted. This should include the address and any relevant details to clearly identify the property.

- Indicate the type of interest being transferred. This could be a fee simple or other type of ownership.

- Sign the form in the designated area. The grantor must sign to validate the gift.

- Have the form notarized. A notary public will verify the identities of the signers and witness the signing.

- Make copies of the completed form for your records.

- File the original form with the appropriate county office to officially record the gift.

Misconceptions

Below is a list of common misconceptions about the Georgia Gift Deed form, along with explanations to clarify these misunderstandings.

- Gift Deeds are only for family members. Many believe that gift deeds can only be used to transfer property between family members. In reality, anyone can gift property to another person, regardless of their relationship.

- A gift deed must be notarized to be valid. While notarization is recommended for a gift deed to ensure authenticity, it is not a strict requirement for validity in Georgia. However, having it notarized can help avoid disputes.

- Gift deeds do not require any consideration. It is a common belief that gift deeds must involve no consideration at all. However, the law allows for nominal consideration, such as a token amount, to be stated in the deed.

- Once a gift deed is executed, the donor cannot change their mind. Some people think that once a gift deed is signed, the donor has no recourse to change their decision. In fact, a donor may revoke the gift if the deed does not include a clause stating that it is irrevocable.

- Gift deeds are the same as wills. There is a misconception that gift deeds serve the same purpose as wills. A gift deed transfers ownership during the donor's lifetime, while a will distributes property after death.

- All property types can be transferred using a gift deed. Many assume that any type of property can be gifted through a gift deed. However, certain properties, such as those subject to liens or encumbrances, may have restrictions.

- Gift deeds are only for real estate. While gift deeds are commonly associated with real estate, they can also be used to transfer personal property, such as vehicles or jewelry.

- There are no tax implications for gift deeds. Some believe that transferring property through a gift deed is entirely tax-free. However, the donor may be subject to gift tax if the value exceeds the annual exclusion limit set by the IRS.

- Gift deeds are not legally binding. There is a misconception that gift deeds lack legal enforceability. In fact, a properly executed gift deed is a legally binding document that can be enforced in court.

- Gift deeds can only be created with the assistance of an attorney. While legal assistance can be beneficial, it is not mandatory to create a gift deed. Individuals can prepare a gift deed on their own, provided they follow the necessary legal requirements.

Dos and Don'ts

When filling out the Georgia Gift Deed form, it’s important to be thorough and accurate. Here’s a helpful list of things to do and avoid:

- Do ensure that all names are spelled correctly.

- Do include the correct legal description of the property.

- Do sign the form in front of a notary public.

- Do check for any required witnesses, if applicable.

- Do provide the date of the gift clearly.

- Don't leave any fields blank; fill in all required information.

- Don't use abbreviations for names or addresses.

- Don't forget to keep a copy for your records.

- Don't submit the form without reviewing it for errors.

By following these guidelines, you can help ensure that your Gift Deed is completed correctly and efficiently.

Common mistakes

Filling out the Georgia Gift Deed form can seem straightforward, but many people make common mistakes that can lead to complications. One frequent error is failing to provide accurate property descriptions. The deed must clearly identify the property being gifted, including the correct address and legal description. Omitting or misdescribing this information can result in legal disputes or delays in the transfer process.

Another mistake involves not including the necessary signatures. Both the donor and the recipient must sign the deed for it to be valid. If one party neglects to sign, the gift may not be legally recognized. Additionally, witnesses may be required, depending on the specific circumstances. Always check local requirements to ensure compliance.

People often overlook the importance of having the deed notarized. A notary public's acknowledgment can provide an extra layer of authenticity and help prevent future challenges to the validity of the deed. Without notarization, the deed may be deemed invalid, complicating the transfer of ownership.

Inaccurate or incomplete information about the donor and recipient can also pose problems. The form should include full legal names and addresses. Any discrepancies can lead to issues with the transfer and may require additional legal steps to correct.

Another common error is failing to consider tax implications. While gifts are generally exempt from income tax, they may still trigger gift tax obligations if the value exceeds certain thresholds. It’s crucial to understand these limits and report the gift appropriately to avoid unexpected tax liabilities.

Lastly, many individuals neglect to keep copies of the completed Gift Deed form. Retaining a copy is essential for future reference and can serve as proof of the transaction. Without proper documentation, disputes can arise, leading to potential legal challenges down the line.

Key takeaways

Filling out and using the Georgia Gift Deed form requires attention to detail and an understanding of the process. Here are some key takeaways:

- Ensure the form is completed in its entirety. Missing information can lead to delays or complications.

- Clearly identify both the donor and the recipient. Full names and addresses are essential for clarity.

- Describe the property being gifted in detail. Include the legal description and any relevant identifiers.

- Sign the form in front of a notary public. This step is crucial for the deed to be legally binding.

- Consider including a statement of intent. This can clarify the donor's wishes regarding the gift.

- File the completed Gift Deed with the county clerk's office. This step ensures the transfer is officially recorded.

- Understand the tax implications. Consult a tax professional to discuss any potential gift tax liabilities.

- Keep copies of all documents for your records. Having a backup can be beneficial in case of disputes.

- Check for any local requirements. Some counties may have additional forms or procedures to follow.

By following these guidelines, you can navigate the process of using the Georgia Gift Deed form effectively.