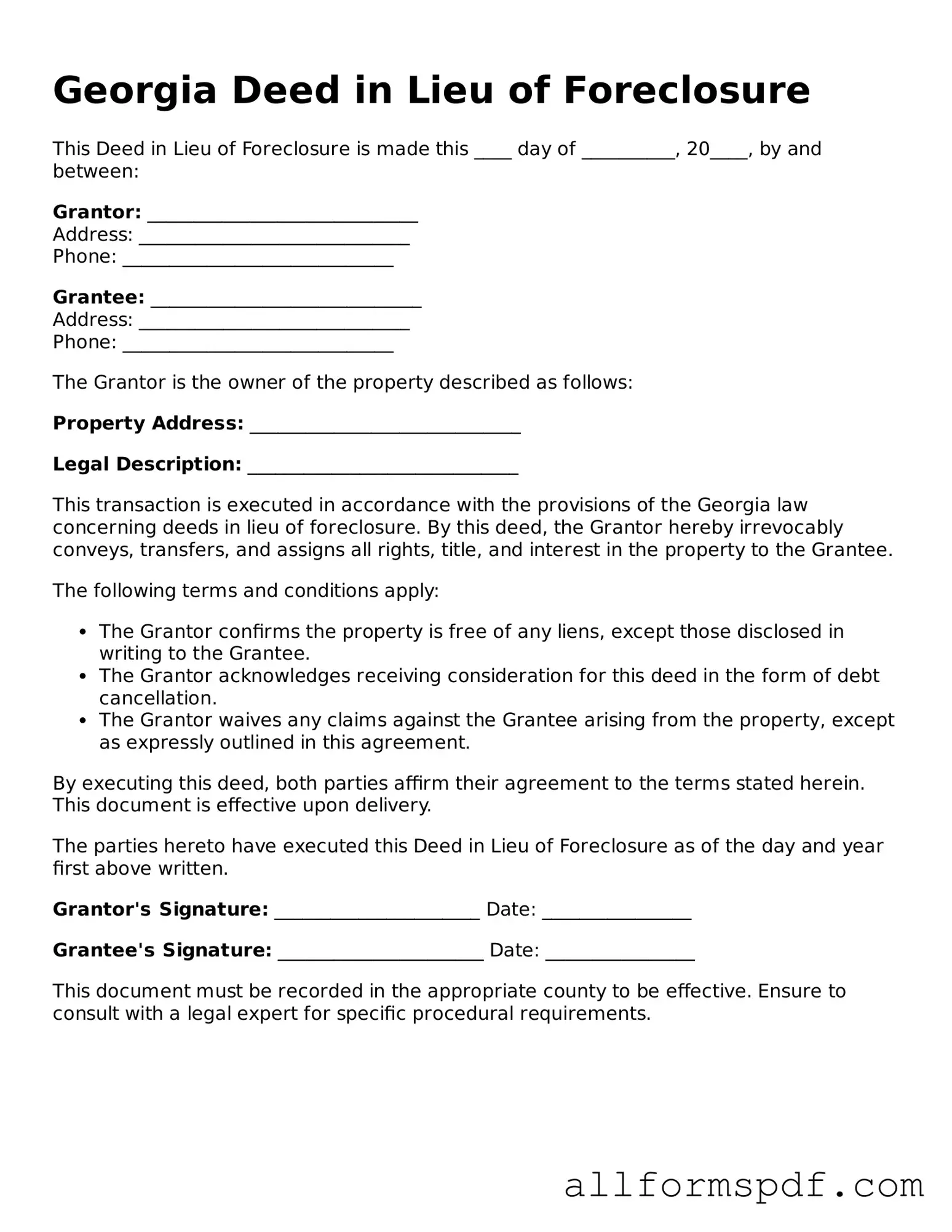

Fillable Deed in Lieu of Foreclosure Form for Georgia

Georgia Deed in Lieu of Foreclosure - Usage Guidelines

After completing the Georgia Deed in Lieu of Foreclosure form, the next step involves submitting the document to the appropriate parties. This typically includes the lender and may require additional steps such as notarization or recording the deed with the county. Ensure that all parties involved understand the implications of the deed.

- Obtain the Georgia Deed in Lieu of Foreclosure form from a reliable source or the lender.

- Fill in the name of the property owner(s) in the designated section.

- Provide the address of the property being conveyed.

- Include the legal description of the property. This can often be found on the original deed or tax documents.

- Indicate the lender's name and address as the party receiving the deed.

- Specify the date on which the deed is executed.

- Sign the form in the presence of a notary public to ensure it is legally binding.

- Make copies of the completed and notarized form for your records.

- Submit the original deed to the lender and follow any additional instructions they may provide.

- If required, record the deed with the county clerk's office to finalize the transaction.

Misconceptions

The Georgia Deed in Lieu of Foreclosure form is often misunderstood. Below are eight common misconceptions about this legal document, along with clarifications for each.

-

It eliminates all debt associated with the mortgage.

A deed in lieu does not automatically eliminate all debts. If there are other liens on the property, the borrower may still be responsible for those debts.

-

It is the same as a foreclosure.

While both processes involve the transfer of property, a deed in lieu is a voluntary agreement, whereas foreclosure is typically a legal action initiated by the lender.

-

It guarantees a positive credit outcome.

Although a deed in lieu may be less damaging than a foreclosure, it can still negatively impact credit scores. The extent of the impact varies based on individual circumstances.

-

Only homeowners facing foreclosure can use it.

While it is often used by those in distress, homeowners who are not in foreclosure can also pursue a deed in lieu as a means to avoid the foreclosure process.

-

The lender must accept the deed in lieu.

Lenders are not obligated to accept a deed in lieu. They will evaluate the situation and determine if it is in their best interest.

-

It releases the borrower from all future liability.

A deed in lieu may release the borrower from liability for the mortgage, but it does not necessarily absolve them from other potential liabilities, such as taxes on forgiven debt.

-

It is a quick and easy process.

The process can be lengthy and complex. It requires negotiation and agreement between the borrower and lender, which can take time.

-

It has no tax implications.

There may be tax consequences associated with a deed in lieu, particularly if the lender forgives a portion of the debt. Borrowers should consult a tax professional for guidance.

Dos and Don'ts

When considering a Deed in Lieu of Foreclosure in Georgia, it is essential to navigate the process carefully. Here are some important dos and don'ts to keep in mind:

- Do ensure that you understand the implications of signing the deed. This can affect your credit and future homeownership.

- Do consult with a real estate attorney or financial advisor before proceeding. Their expertise can guide you through potential pitfalls.

- Don't ignore any outstanding liens or obligations associated with your property. These may not be resolved simply by signing the deed.

- Don't rush the process. Take the time to review all documents and agreements thoroughly.

By following these guidelines, you can make informed decisions during this challenging time.

Popular State-specific Deed in Lieu of Foreclosure Forms

Deed in Lieu of Foreclosure Sample - This agreement can be a sign of a responsible and proactive approach to financial difficulties.

To ensure a smooth transaction when buying or selling a dirt bike in New York, it is essential to utilize the New York Dirt Bike Bill of Sale form, which serves as an important record of the transfer of ownership. This document not only safeguards the interests of both parties but also prevents potential disputes that may arise after the sale. For more detailed information on obtaining this form, you can visit https://smarttemplates.net/fillable-new-york-dirt-bike-bill-of-sale.

Common mistakes

Filling out the Georgia Deed in Lieu of Foreclosure form can be a daunting task, and many individuals make mistakes that can complicate the process. One common error is failing to provide accurate property information. It's essential to ensure that the property address, legal description, and parcel number are correct. Inaccuracies can lead to delays or even rejection of the deed.

Another mistake is neglecting to obtain the necessary signatures. All parties involved in the property ownership must sign the document. This includes spouses or co-owners. Without the required signatures, the deed may not be legally binding, which can create further issues down the line.

Many individuals also overlook the importance of notarization. The Georgia Deed in Lieu of Foreclosure form must be notarized to be valid. Failing to have the document properly notarized can result in complications during the transfer of ownership. It’s crucial to have a notary public present during the signing process.

People often forget to review the form thoroughly before submission. Mistakes in the wording or missing information can lead to significant delays. Taking the time to double-check all entries can save a lot of time and frustration later.

Additionally, misunderstanding the implications of the deed can lead to poor decisions. A Deed in Lieu of Foreclosure may have tax consequences or affect credit scores. Consulting with a financial advisor or a legal professional can provide clarity and help individuals make informed choices.

Lastly, individuals sometimes fail to communicate with their lender. It is important to ensure that the lender is aware of the intent to execute a Deed in Lieu of Foreclosure. Open communication can help streamline the process and avoid misunderstandings that could derail the transaction.

Key takeaways

When considering a Deed in Lieu of Foreclosure in Georgia, it is essential to understand the process and implications involved. Here are six key takeaways to keep in mind:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer property ownership to the lender to avoid foreclosure.

- Eligibility Requirements: Not all homeowners qualify. Lenders typically require the borrower to be in default and unable to make mortgage payments.

- Review Your Mortgage Agreement: Check your mortgage documents for any clauses that may affect your ability to pursue this option.

- Seek Legal Advice: Consulting with a lawyer can provide clarity on the potential consequences and benefits of this process.

- Prepare Necessary Documentation: Gather all required paperwork, including the original mortgage, financial statements, and any correspondence with the lender.

- Consider Tax Implications: Transferring property can have tax consequences. It’s advisable to consult a tax professional for guidance.

By understanding these key points, homeowners can make informed decisions regarding a Deed in Lieu of Foreclosure in Georgia.