Fill Out Your Generic Direct Deposit Form

Generic Direct Deposit - Usage Guidelines

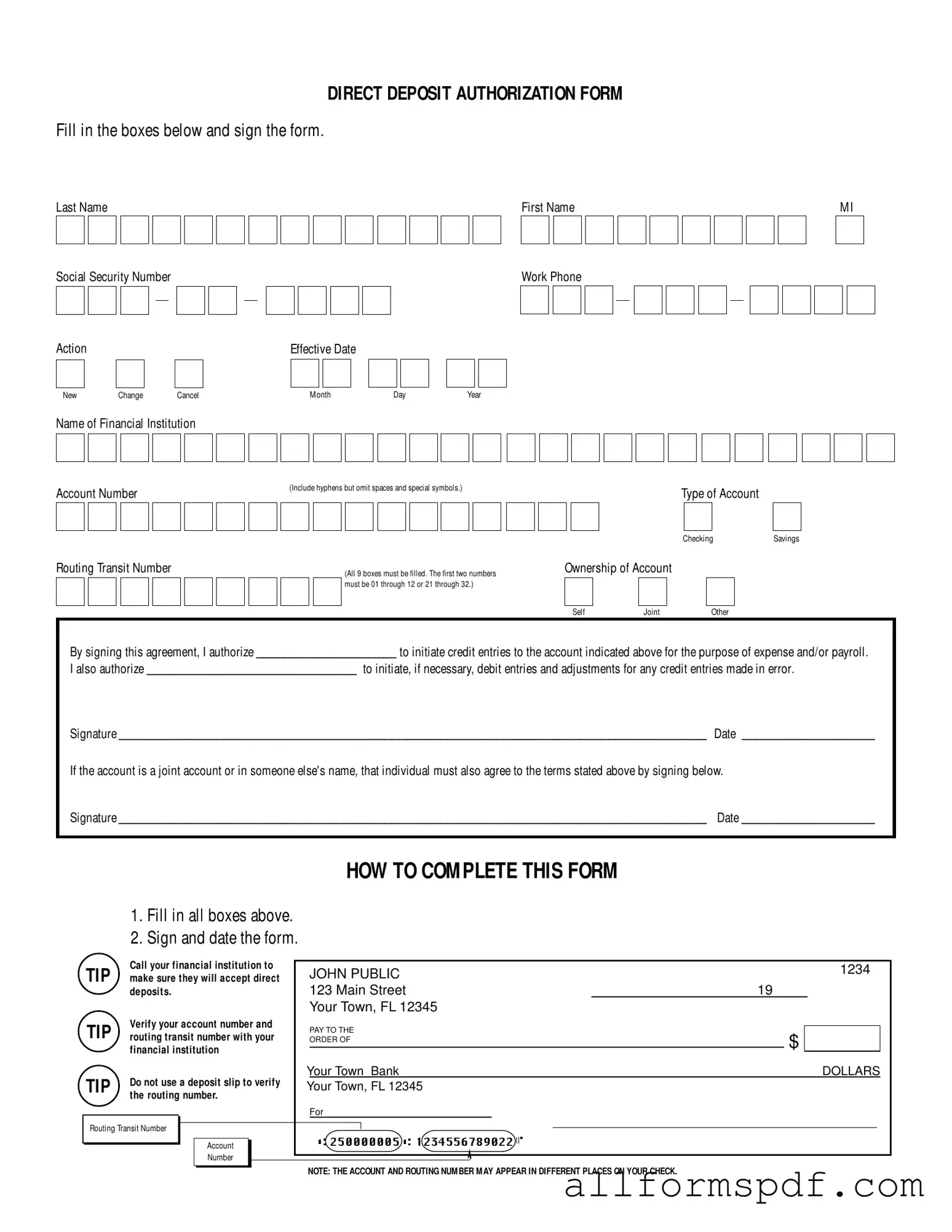

Filling out the Generic Direct Deposit form is a straightforward process. This form is essential for setting up direct deposits into your bank account. By completing it accurately, you ensure that your funds are deposited correctly and on time. Here’s how to fill it out step-by-step.

- Begin by entering your Last Name, First Name, and Middle Initial in the designated boxes.

- Next, provide your Social Security Number in the specified format.

- Indicate the Action you wish to take: New, Change, or Cancel, and fill in the Effective Date.

- Fill in your Work Phone Number as requested.

- Write the name of your Financial Institution clearly.

- Input your Account Number, ensuring to include hyphens and omit any spaces or special symbols.

- Select the type of account by checking either Savings or Checking.

- Provide your Routing Transit Number, making sure all nine boxes are filled. Remember, the first two numbers must be between 01 and 12 or 21 and 32.

- Indicate the Ownership of Account by checking the appropriate box: Self, Joint, or Other.

- Sign the form in the space provided, and include the date.

- If the account is joint or in someone else’s name, that individual must also sign and date the form.

After completing the form, it’s wise to double-check all entries for accuracy. This will help avoid any delays or issues with your direct deposit. It’s also a good idea to contact your financial institution to confirm that they accept direct deposits and to verify your account and routing numbers. Taking these extra steps ensures a smooth process for your financial transactions.

Misconceptions

When it comes to the Generic Direct Deposit form, several misconceptions can lead to confusion. Understanding these common misunderstandings can help ensure a smooth process for setting up direct deposit.

- Misconception 1: You can skip filling out all the boxes.

- Misconception 2: You don’t need to verify your account information.

- Misconception 3: Only the account holder needs to sign the form.

- Misconception 4: A deposit slip is a reliable way to verify your routing number.

Many people believe that it’s acceptable to leave some boxes blank if they think the information is not relevant. However, all boxes must be filled out to avoid delays. Incomplete forms can lead to processing issues.

Some individuals assume that the bank will automatically know their account details. It is crucial to verify your account number and routing transit number with your financial institution. This step helps prevent errors that could disrupt your deposits.

If the account is a joint account or held in someone else's name, that individual must also sign the form. This requirement ensures that all parties involved agree to the terms of the direct deposit authorization.

Some people think they can use a deposit slip to confirm their routing number. However, it is advised to contact your financial institution directly for accurate information. Using a deposit slip can lead to mistakes, as the routing number may appear differently on various documents.

Dos and Don'ts

When filling out the Generic Direct Deposit form, there are important actions to take and avoid. Here’s a concise list of what to do and what not to do:

- Do fill in all boxes completely.

- Do sign and date the form before submission.

- Do verify your account number and routing transit number with your financial institution.

- Do call your financial institution to ensure they accept direct deposits.

- Don't use a deposit slip to verify the routing number.

- Don't leave any boxes blank on the form.

- Don't forget to include hyphens in your account number.

- Don't submit the form without a signature.

Other PDF Forms

Emergency Custody Order Minnesota - Aims to minimize disruption in the child's routine.

For those seeking to understand the role of this crucial document, the Arizona Power of Attorney form is vital for managing your personal and financial decisions effectively. Ensure you are prepared by familiarizing yourself with the process of drafting a comprehensive Arizona Power of Attorney.

Bol Meaning Shipping - Essential for accurate accounting and inventory management.

Common mistakes

Completing the Generic Direct Deposit form can seem straightforward, but several common mistakes can lead to delays or issues with your direct deposit. One frequent error is failing to fill in all required boxes. Each section, including your name, Social Security number, and account details, must be completely filled out. Omitting any information can result in the form being rejected by your employer or financial institution.

Another common mistake is incorrectly entering the routing transit number. This number is crucial for directing funds to your account. It consists of nine digits, and all boxes must be filled accurately. Double-checking this number with your bank is essential. If you mistakenly enter an incorrect number, your funds may be deposited into someone else’s account.

People often overlook the need to verify their account number. The form specifically instructs you to include hyphens and omit spaces and special symbols. Miswriting your account number can lead to significant delays in receiving your funds. It is advisable to refer to your bank documents to ensure the account number is accurate.

Finally, many forget to sign and date the form. The signature is a critical part of the authorization process. Without it, the form will not be valid. If the account is a joint account, both parties must sign. Neglecting this step can lead to complications in processing your direct deposit.

Key takeaways

When completing the Generic Direct Deposit form, several important steps and considerations can help ensure a smooth process. Here are some key takeaways:

- Complete All Required Fields: It is crucial to fill in every box on the form, including your name, Social Security number, and account details. Missing information may delay the processing of your direct deposit.

- Choose the Right Account Type: Specify whether your account is a checking or savings account. This distinction is important for your financial institution to process your deposits correctly.

- Verify Routing and Account Numbers: Before submitting the form, double-check your routing transit number and account number. Contact your financial institution to confirm these details, as errors can lead to missed deposits.

- Sign and Date the Form: Your signature is essential to authorize the direct deposit. Ensure that both you and any joint account holders sign and date the form where required.

- Consult Your Financial Institution: It's advisable to call your bank or credit union to confirm that they accept direct deposits and to understand any specific requirements they may have.

By following these guidelines, you can navigate the direct deposit process with confidence, ensuring timely and secure access to your funds.