Fill Out Your Free And Invoice Pdf Form

Free And Invoice Pdf - Usage Guidelines

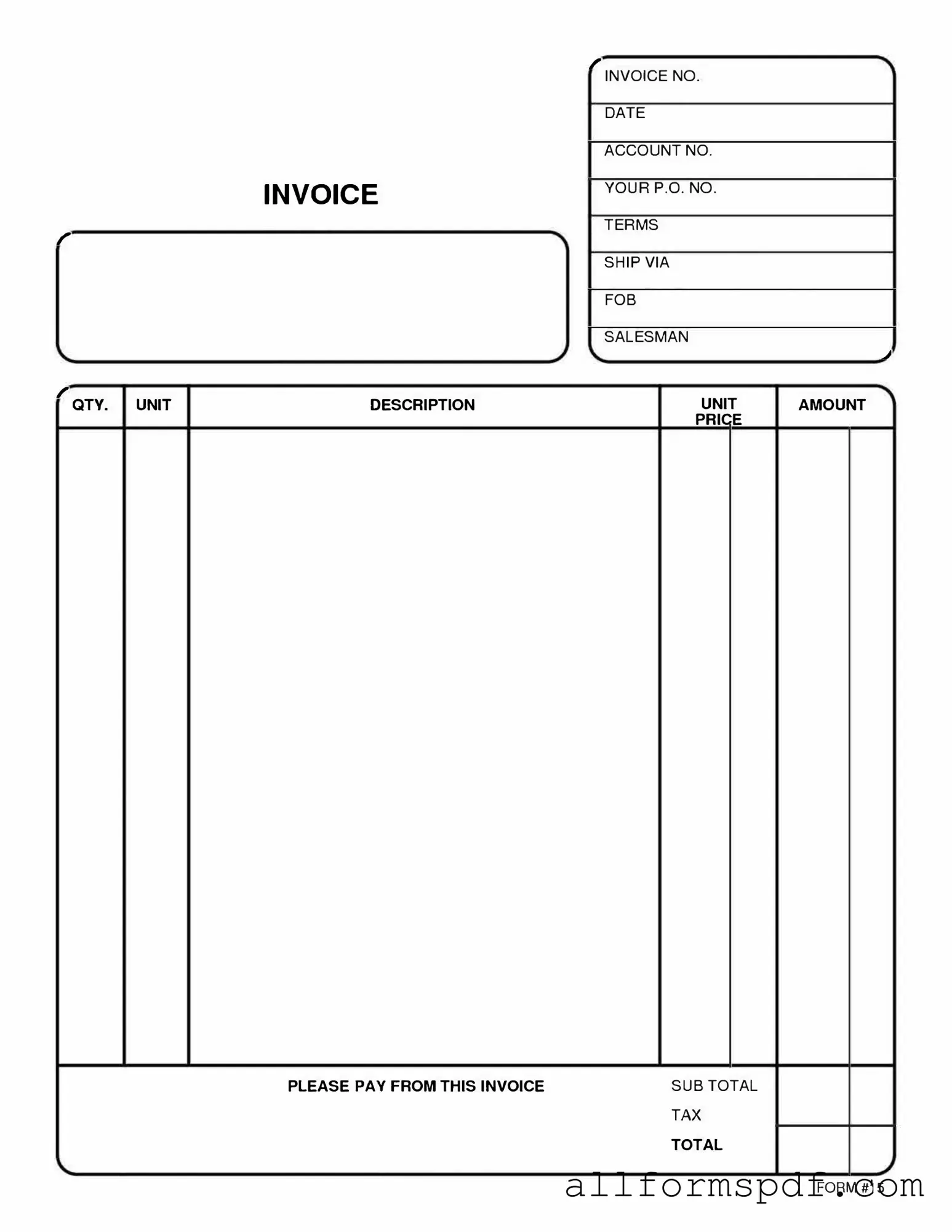

Completing the Free And Invoice PDF form is an important step in ensuring your transactions are documented accurately. Follow these steps carefully to fill out the form correctly and efficiently.

- Start by downloading the Free And Invoice PDF form from the designated source.

- Open the PDF using a compatible viewer that allows for form filling.

- Locate the section for your personal information. Enter your name, address, and contact details accurately.

- Proceed to fill in the details of the transaction. Include the date, description of goods or services, and the amount due.

- If applicable, indicate payment terms and any additional notes in the provided fields.

- Review all the information you have entered to ensure accuracy. Mistakes can lead to confusion later.

- Once satisfied, save the completed form to your device.

- Print the form if a hard copy is needed, or prepare to send it electronically as required.

By following these steps, you will have a completed Free And Invoice PDF form ready for your records or to send to your client. Ensure that all information is clear and legible to avoid any misunderstandings.

Misconceptions

The Free And Invoice PDF form is a useful tool for many individuals and businesses. However, several misconceptions surround its use and functionality. Below are ten common misconceptions, along with clarifications.

- It is only for businesses. Many people believe that the Free And Invoice PDF form is exclusively for businesses. In reality, freelancers and independent contractors can also benefit from using this form to keep track of their services and payments.

- It requires advanced software to use. Some assume that sophisticated software is needed to fill out the form. However, most PDF readers allow users to fill in forms easily without any additional software.

- It is not customizable. Many think that the form is fixed and cannot be changed. In fact, users can often customize fields to better suit their needs, including adding their logo or modifying the layout.

- It is only available in English. There is a misconception that the form is only available in English. Various versions exist in multiple languages, making it accessible to a wider audience.

- It is not legally binding. Some believe that invoices generated from this form lack legal standing. However, as long as they include necessary details and comply with local laws, they can be legally binding.

- It cannot be sent electronically. Many assume that the form must be printed and mailed. In truth, users can easily send the PDF via email or other digital platforms, streamlining the invoicing process.

- It is only for invoicing services. Some people think the form is limited to service invoicing. In reality, it can also be used for product sales, making it versatile for various transactions.

- It is free but lacks features. There is a belief that free forms are basic and lack essential features. However, many free versions offer comprehensive functionalities that meet the needs of users effectively.

- It is difficult to track payments. Some believe that using this form complicates payment tracking. On the contrary, many templates include sections for payment status, making tracking straightforward.

- It is not secure. A common misconception is that PDF forms are insecure. While security depends on how the file is shared, many PDFs can be password-protected to enhance security and confidentiality.

Dos and Don'ts

When filling out the Free And Invoice PDF form, it’s important to approach the task with care. Here are some things you should and shouldn’t do to ensure accuracy and efficiency.

- Do read the instructions carefully before starting.

- Do fill out all required fields completely.

- Do double-check your entries for accuracy.

- Do use clear and legible handwriting if filling out a paper form.

- Do save a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use abbreviations unless specified.

- Don't submit the form without reviewing it first.

- Don't forget to sign and date the form if needed.

Other PDF Forms

Can My Therapist Write an Esa Letter - This letter is not a guarantee of acceptance everywhere, so it’s important to confirm specific policies ahead of time.

For those looking to navigate the requirements of boat ownership, the informative California Boat Bill of Sale form is indispensable for ensuring a legally sound transaction. Access the form by following this link: find your California Boat Bill of Sale today.

Texas Odometer Disclosure Statement - Discrepancies in odometer readings come with serious legal ramifications.

Common mistakes

When individuals fill out the Free And Invoice PDF form, several common mistakes can occur. These errors can lead to delays in processing or even rejection of the form. Awareness of these pitfalls can help ensure a smoother experience.

One frequent mistake is incomplete information. Many people overlook sections of the form, leaving essential fields blank. This can include missing contact information or failing to provide necessary details about the transaction. Each field is designed to collect specific information, and omitting any part can hinder the processing of the invoice.

Another common error involves incorrect calculations. When totaling amounts or calculating taxes, individuals sometimes make arithmetic mistakes. A simple miscalculation can lead to discrepancies that may require additional time to resolve. Double-checking all figures before submission is crucial to avoid this issue.

Additionally, some individuals fail to review the form for clarity. Handwritten forms can be difficult to read, especially if the writing is messy or unclear. Legibility is essential for ensuring that the information is accurately interpreted by the recipient. Using a computer to fill out the form can help maintain clarity.

People also often neglect to include supporting documentation. Depending on the nature of the invoice, additional paperwork may be necessary. This could include receipts, contracts, or proof of delivery. Failing to attach these documents can lead to delays in processing or questions about the validity of the invoice.

Some individuals do not follow submission guidelines. Each form may have specific instructions regarding how and where to submit it. Ignoring these guidelines can result in the form being lost or not processed in a timely manner. It is important to read all instructions carefully before submission.

Lastly, a common mistake is not keeping a copy of the submitted form. Individuals often forget to retain a copy for their records. This can be problematic if questions arise later regarding the submission. Keeping a copy ensures that there is a reference point for any future inquiries.

Key takeaways

When it comes to filling out and using the Free And Invoice PDF form, there are several important points to keep in mind. Here are ten key takeaways:

- Understand the Purpose: The form is designed to help you create and send invoices easily, ensuring you get paid for your services or products.

- Gather Necessary Information: Before filling out the form, collect all relevant details, such as your business name, contact information, and client details.

- Be Clear and Concise: Provide clear descriptions of the products or services rendered. This helps avoid confusion and ensures prompt payment.

- Specify Payment Terms: Clearly outline payment terms, including due dates and accepted payment methods, to set expectations.

- Include an Invoice Number: Assign a unique invoice number for each invoice. This aids in tracking payments and maintaining organization.

- Review for Accuracy: Double-check all information for accuracy before sending the invoice. Errors can lead to delays in payment.

- Save a Copy: Always save a copy of the completed invoice for your records. This is useful for future reference and accounting purposes.

- Send Promptly: Send the invoice as soon as possible after the service is provided or the product is delivered. Timely invoicing can improve cash flow.

- Follow Up: If payment is not received by the due date, don’t hesitate to follow up with a polite reminder.

- Utilize PDF Format: Sending the invoice as a PDF ensures that the formatting remains intact, making it easy for clients to read.

By keeping these points in mind, you can effectively use the Free And Invoice PDF form to streamline your invoicing process and enhance your business operations.