Fill Out Your Florida Financial Affidavit Short 12.902(b) Form

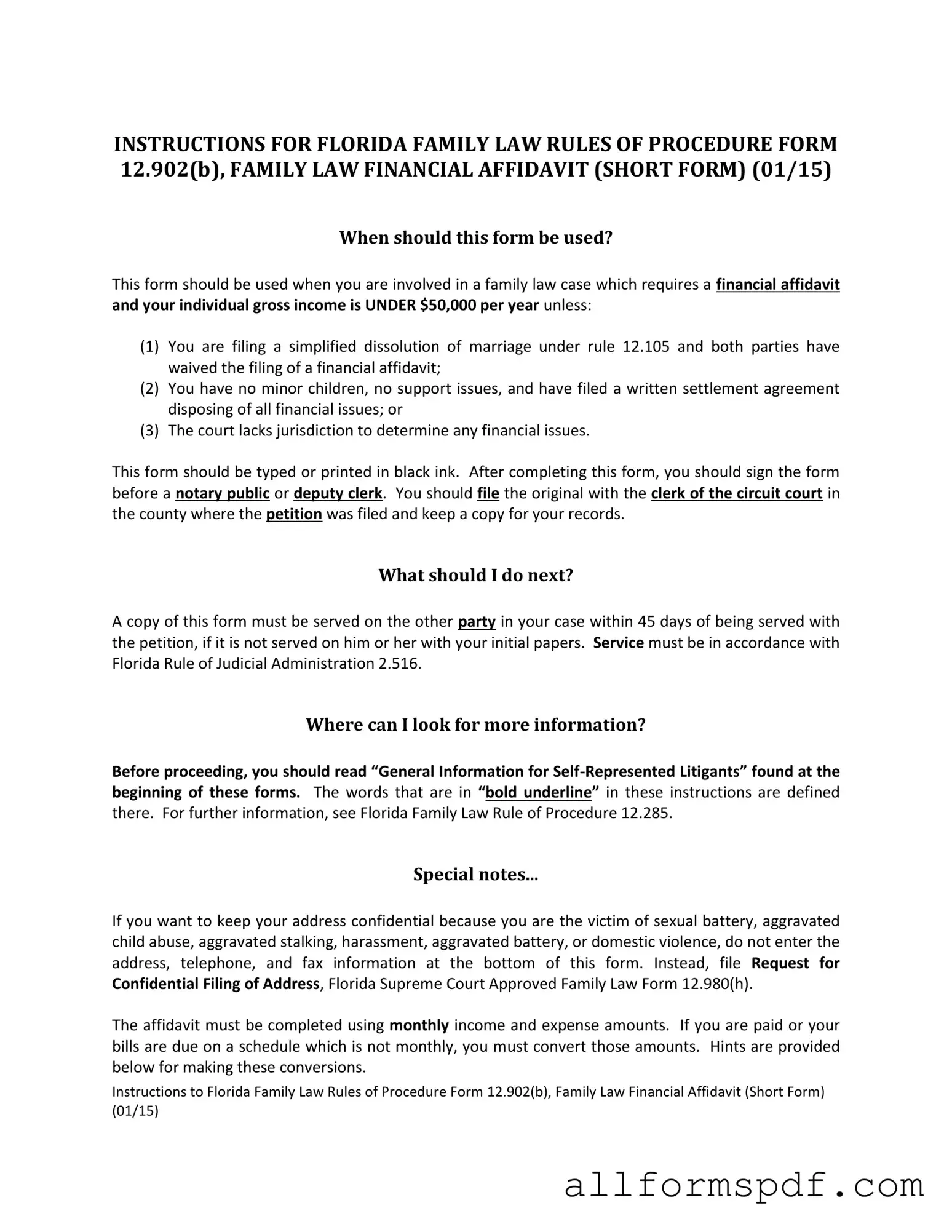

Florida Financial Affidavit Short 12.902(b) - Usage Guidelines

Filling out the Florida Financial Affidavit Short 12.902(b) form is an important step in your legal process. It helps provide a clear picture of your financial situation. Once you complete the form, you'll be ready to submit it to the court as part of your case.

- Begin by gathering all necessary financial documents. This includes pay stubs, bank statements, and bills.

- At the top of the form, fill in your name and contact information. Ensure it is accurate.

- Next, indicate your marital status. Check the appropriate box that applies to you.

- In the income section, list all sources of income. This includes wages, bonuses, and any other earnings.

- Move on to the expenses section. Write down all your monthly expenses, such as rent, utilities, and groceries.

- Fill in the section for assets. List any property, bank accounts, or investments you own.

- Now, detail your liabilities. Include all debts, such as loans and credit card balances.

- Review your completed form for any errors or missing information. Make corrections as needed.

- Sign and date the form at the bottom. Your signature confirms that the information provided is true and accurate.

- Make copies of the completed form for your records before submitting it to the court.

Misconceptions

The Florida Financial Affidavit Short 12.902(b) form is a critical document in family law cases, particularly in divorce and child support matters. However, several misconceptions surround its purpose and usage. Here are seven common misconceptions:

- It is only for high-income individuals. Many believe that only those with substantial income need to file this form. In reality, it applies to anyone involved in family law proceedings, regardless of income level.

- It is optional. Some individuals think they can skip this form if they feel their finances are straightforward. However, filing the affidavit is often a requirement in divorce proceedings, especially when determining support obligations.

- It only needs to be filled out once. There is a misconception that the affidavit is a one-time requirement. In fact, it may need to be updated if financial circumstances change or if the case evolves.

- It is the same as a tax return. Many confuse the financial affidavit with a tax return. While both require financial disclosure, the affidavit focuses on current income and expenses, rather than historical data.

- It can be completed quickly without thought. Some believe that filling out the form is a simple task. In truth, it requires careful consideration and accuracy to ensure all financial details are correctly represented.

- Only one party needs to submit it. There is a common belief that only the spouse seeking support needs to file the affidavit. However, both parties may be required to submit their financial information to provide a complete picture.

- It does not affect the outcome of the case. Many underestimate the importance of the financial affidavit. In reality, it plays a significant role in determining alimony, child support, and asset division.

Understanding these misconceptions is crucial for anyone navigating the complexities of family law in Florida. Accurate financial disclosures can significantly impact legal outcomes.

Dos and Don'ts

When filling out the Florida Financial Affidavit Short 12.902(b) form, attention to detail is crucial. Below are ten important dos and don’ts to ensure accuracy and compliance.

- Do read the instructions carefully before starting the form.

- Do provide accurate and complete information about your income and expenses.

- Do double-check your calculations to avoid errors.

- Do sign and date the affidavit where indicated.

- Do keep a copy of the completed form for your records.

- Don’t leave any sections blank; if something doesn’t apply, indicate that clearly.

- Don’t exaggerate or understate your financial situation; honesty is essential.

- Don’t forget to include all sources of income, even if they seem minor.

- Don’t submit the form without reviewing it for accuracy.

- Don’t ignore deadlines for submission; timely filing is important.

By adhering to these guidelines, you can navigate the completion of the Florida Financial Affidavit Short 12.902(b) form more effectively.

Other PDF Forms

How to Gift a Car in Louisiana - The act of donation form provides clarity and assurance in property transfers.

When dealing with the Florida Sales Tax form, it is essential to have a comprehensive understanding of the reporting process, as inaccuracies can lead to penalties. For those seeking additional resources, you can find various templates and documentation at All Florida Forms, which can simplify the preparation and submission of the Sales and Use Tax Return DR-15CS.

Change of Duty Ncoer - The NCO’s overall potential is assessed by the senior rater.

Common mistakes

Completing the Florida Financial Affidavit Short 12.902(b) form can be a daunting task for many individuals. One common mistake is failing to provide accurate income information. People often underestimate their earnings or forget to include additional sources of income, such as bonuses or side jobs. This can lead to discrepancies that may impact the outcome of financial decisions in legal proceedings.

Another frequent error is neglecting to disclose all assets. Individuals sometimes overlook valuable items like retirement accounts, stocks, or even personal property that could significantly affect their financial standing. When assets are omitted, it can create complications and mistrust during the legal process.

Inaccurate expense reporting is also a prevalent issue. Many individuals either inflate or underestimate their monthly expenses, which can skew the financial picture. It's essential to provide a realistic view of living costs, including housing, utilities, and other recurring bills. This ensures that the court has a clear understanding of one’s financial obligations.

Finally, failing to sign and date the form is a simple yet critical mistake that can render the affidavit invalid. Many people rush through the process and overlook this crucial step. Remember, a signed and dated affidavit is necessary for it to be considered by the court. Taking the time to review the form thoroughly can prevent these errors and facilitate a smoother legal process.

Key takeaways

When filling out the Florida Financial Affidavit Short 12.902(b) form, keep these key takeaways in mind:

- Ensure all information is accurate. Double-check your income, expenses, assets, and liabilities to avoid discrepancies.

- Use clear and concise language. This helps ensure that anyone reviewing the form can easily understand your financial situation.

- Be thorough. Include all sources of income and all monthly expenses, even those that may seem minor.

- Sign and date the affidavit. An unsigned form may be rejected, delaying your case.

- Keep a copy for your records. Having a personal copy can be useful for future reference or if any questions arise.