Fill Out Your Erc Broker Market Analysis Form

Erc Broker Market Analysis - Usage Guidelines

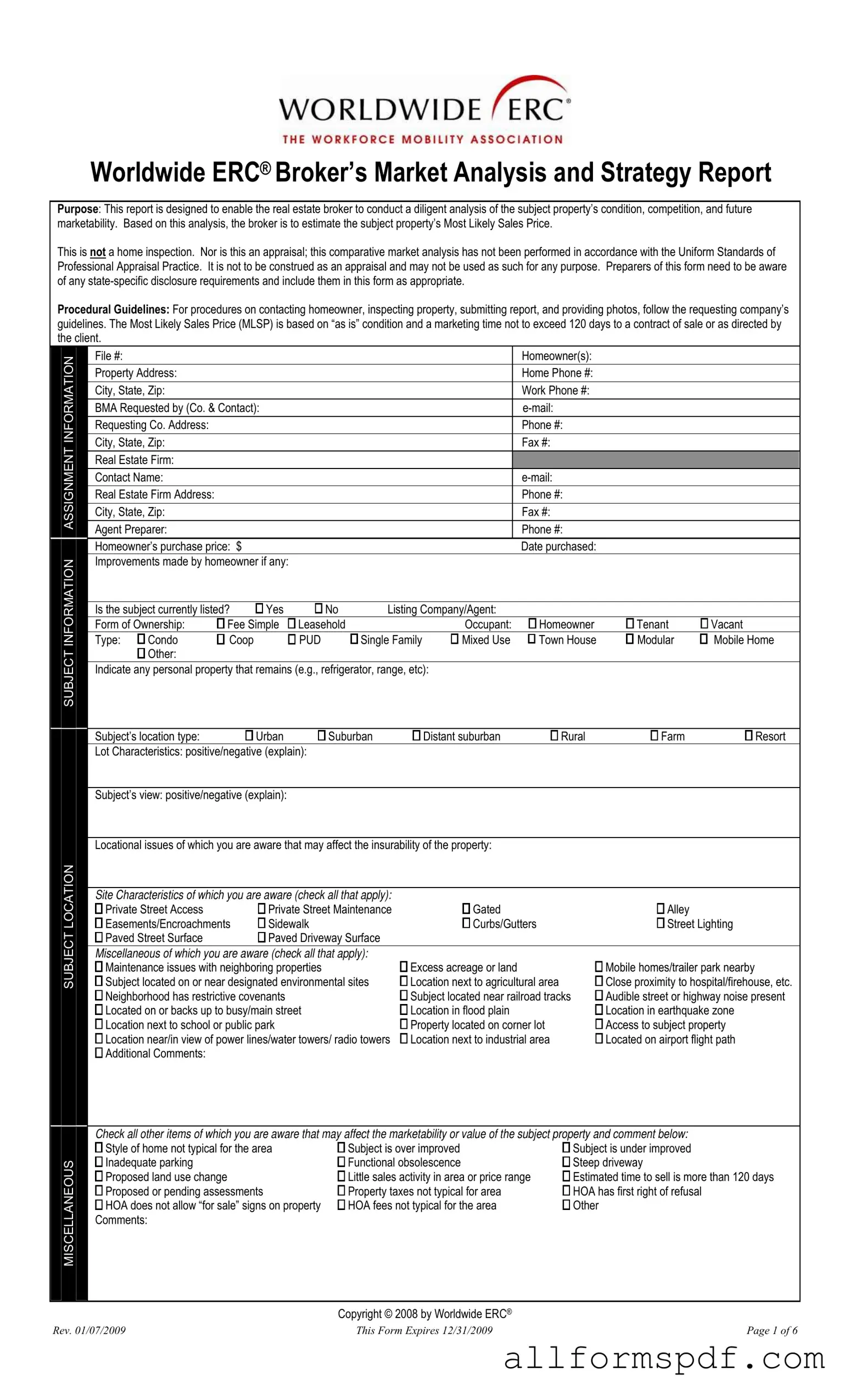

Completing the ERC Broker Market Analysis form requires careful attention to detail. This form will guide you through the necessary steps to gather and present information about the property in question. Make sure you have all relevant details at hand before starting.

- Begin by entering the File Number, Homeowner(s), and Property Address in the designated fields.

- Fill in the Home Phone Number, Work Phone Number, and Email of the homeowner.

- Provide the details of the Requesting Company, including Company Name, Contact Person, and Contact Information.

- Identify the Real Estate Firm and the Agent Preparer, including their contact details.

- Record the homeowner’s purchase price and the date purchased.

- Indicate any improvements made by the homeowner and whether the property is currently listed for sale.

- Describe the Form of Ownership (e.g., Fee Simple, Leasehold) and the Occupant Type (Homeowner, Tenant, Vacant).

- Specify the Type of property (e.g., Condo, Single Family, Town House) and note any personal property included in the sale.

- Assess the Subject’s Location Type and provide comments on Lot Characteristics and Subject’s View.

- Check all applicable Site Characteristics and Miscellaneous Issues that may affect the property.

- Document the Property Condition by checking the relevant boxes and providing comments where necessary.

- Estimate the costs for recommended repairs and improvements>, detailing each item and its estimated cost.

- List all required inspections and disclosures that apply to the property.

- Identify potential financing options and any concessions necessary for the sale.

- Describe the neighborhood, including property values and market conditions.

- Gather information on comparable sales and competing listings, entering their details as required.

- Complete the form by reviewing all entries for accuracy before submission.

Once you have filled out the form, ensure it is submitted according to the guidelines provided by the requesting company. This will help facilitate the analysis process effectively.

Misconceptions

Here are some common misconceptions about the Erc Broker Market Analysis form:

- This form is an appraisal. The Erc Broker Market Analysis form is not an appraisal. It is a comparative market analysis that helps estimate a property's Most Likely Sales Price based on various factors.

- It includes a home inspection. This form does not serve as a home inspection. It focuses on market conditions and property analysis rather than detailed inspections of the property's condition.

- All states have the same disclosure requirements. Disclosure requirements can vary by state. Preparers must be aware of and include any state-specific requirements in the form.

- The Most Likely Sales Price is guaranteed. The estimated Most Likely Sales Price is based on current market conditions and is not a guarantee of sale price or time on the market.

- Only real estate agents can complete this form. While real estate agents typically prepare the form, others with appropriate knowledge of the property and market can also fill it out.

- It is only applicable to residential properties. The form can be used for various types of properties, including commercial and mixed-use properties, not just residential homes.

- Once completed, the form is final and cannot be changed. The form can be updated as new information becomes available or as market conditions change.

- This form is only for buyers. The Erc Broker Market Analysis form is useful for both buyers and sellers as it provides valuable insights into property value and market conditions.

Dos and Don'ts

Things You Should Do:

- Read the form thoroughly before starting.

- Gather all necessary information about the property and homeowners.

- Follow the requesting company’s guidelines for inspections.

- Provide accurate descriptions of property conditions and any improvements.

- Document any locational issues that may affect insurability.

- Include all state-specific disclosure requirements.

- Estimate repair costs realistically based on observed conditions.

- List all necessary inspections that may be required.

- Identify the most probable means of financing for the property.

- Be honest and detailed in your comments about the property.

Things You Shouldn't Do:

- Skip any sections of the form; every part is important.

- Provide vague descriptions or estimates.

- Ignore state-specific regulations and disclosures.

- Make assumptions without verifying facts about the property.

- Neglect to document any potential issues that could affect marketability.

- Rely solely on outdated data for market analysis.

- Overstate or understate the condition of the property.

- Forget to check for any required inspections or assessments.

- Disregard the guidelines for contacting homeowners.

- Leave out any financing concessions that might be necessary.

Other PDF Forms

U.S. Corporation Income Tax Return - Corporations can report losses and carryovers on Form 1120.

A New York Lease Agreement form is a legally binding document between a landlord and tenant, outlining the terms and conditions of renting property in New York. This form covers various aspects such as rent amount, payment schedule, and lease duration. Understanding this agreement is crucial for both landlords and tenants to ensure their rights are protected, and you can find a comprehensive template at smarttemplates.net/fillable-new-york-lease-agreement/.

How to Create Payroll Checks - Payroll Check forms may include identification numbers for tax purposes.

Common mistakes

Filling out the ERC Broker Market Analysis form can be a complex task. Many people make common mistakes that can lead to inaccurate assessments. One major error is failing to provide complete contact information. Missing phone numbers or email addresses can hinder communication and delay the analysis process. It is essential to ensure that all fields are filled out correctly to facilitate smooth interactions.

Another frequent mistake involves overlooking state-specific disclosure requirements. Each state has its own rules regarding property disclosures. Not including these can lead to legal complications down the line. Brokers should familiarize themselves with local laws and ensure that all necessary disclosures are included in the form.

Inaccurate property descriptions are also a common issue. Some individuals may not provide a thorough account of the property’s condition or improvements made. This lack of detail can skew the analysis and affect the estimated Most Likely Sales Price. Providing clear, detailed information about the property helps create a more accurate market analysis.

Many people also forget to check the box for whether the property is currently listed. This simple oversight can lead to confusion about the property's market status. Brokers should double-check this section to confirm the listing status is accurately represented.

Another mistake is neglecting to comment on locational issues that could affect insurability. Issues such as proximity to noise sources or environmental hazards can significantly impact a property's value. Including these details is crucial for a comprehensive analysis.

Lastly, failing to update the information about competing listings can be detrimental. The real estate market is dynamic, and properties can change status quickly. Keeping this section current ensures that the analysis reflects the most accurate market conditions, which is vital for estimating the Most Likely Sales Price effectively.

Key takeaways

Filling out the ERC Broker Market Analysis form requires attention to detail and a clear understanding of the property and its market. Here are some key takeaways to consider:

- Purpose of the Form: This report aids brokers in analyzing a property's condition, competition, and potential marketability to estimate its Most Likely Sales Price (MLSP).

- Not an Appraisal: Remember, this analysis is not a home inspection or an official appraisal. It should not be used as such, and it must comply with state-specific disclosure requirements.

- Follow Procedural Guidelines: Adhere to the requesting company's guidelines for contacting homeowners, inspecting properties, and submitting reports, including necessary photos.

- Accurate Information: Fill in all relevant fields accurately, including property details, improvements made, and any unique characteristics that may affect marketability.

- Market Conditions: Analyze the broader market area and neighborhood statistics, including property values, average days on the market, and the supply of inventory to provide a comprehensive view.

- Financing Considerations: Identify potential financing issues that could arise, such as property condition or zoning, and describe any necessary concessions to facilitate the sale.