Printable Employee Loan Agreement Form

Employee Loan Agreement - Usage Guidelines

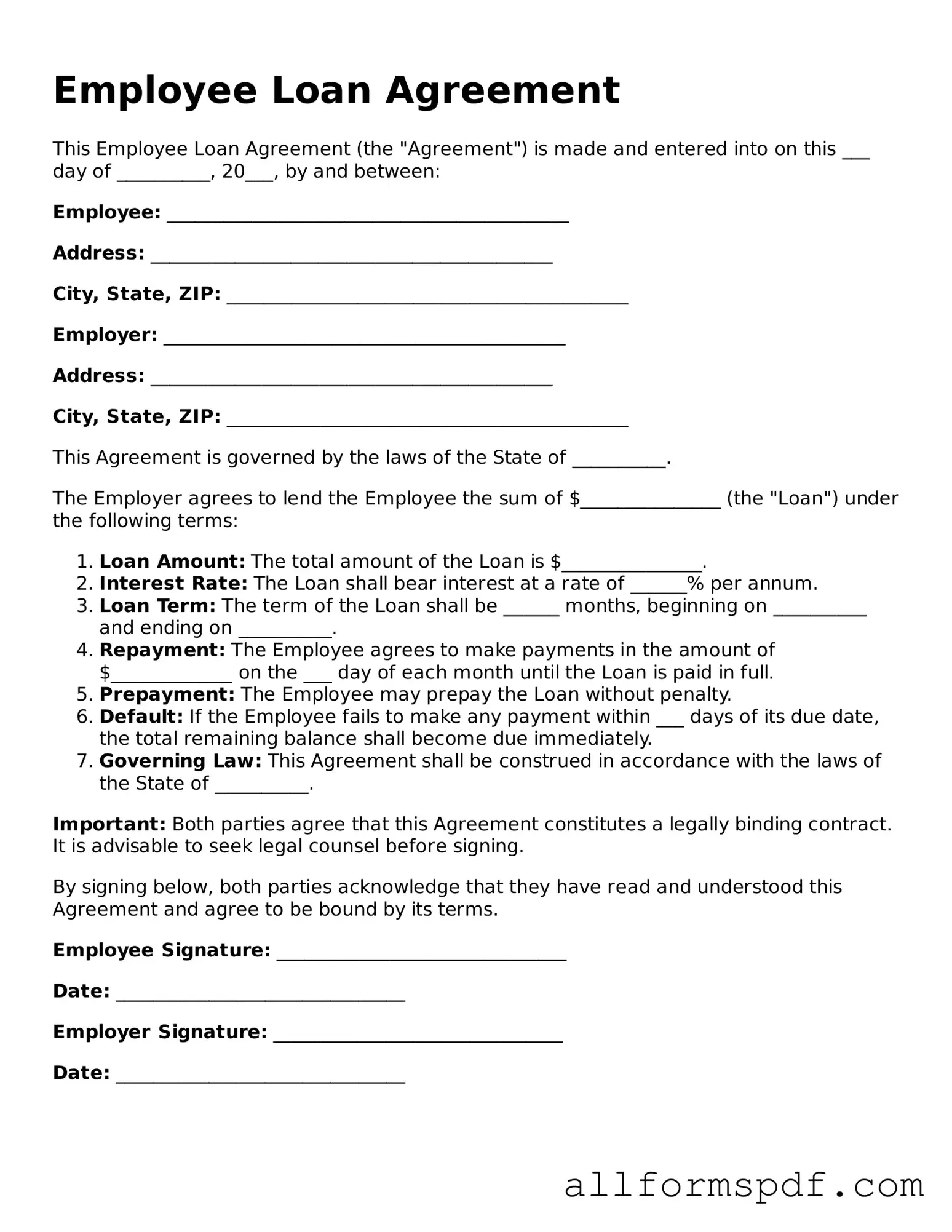

Filling out the Employee Loan Agreement form is a straightforward process. Make sure you have all the necessary information ready before you start. This will help you complete the form accurately and efficiently.

- Begin by entering your full name in the designated field.

- Provide your employee ID number, if applicable.

- Fill in the date when you are completing the form.

- Specify the loan amount you are requesting.

- Indicate the purpose of the loan in the appropriate section.

- List the repayment terms, including the amount you plan to pay back each pay period.

- Provide your signature to confirm your agreement to the terms.

- Finally, date your signature to complete the form.

Misconceptions

When it comes to the Employee Loan Agreement form, there are several misconceptions that can lead to confusion. Here are nine common misunderstandings:

- All loans are the same. Many people think that all employee loans are identical. In reality, terms can vary significantly based on the employer's policies and the specifics of the agreement.

- Only full-time employees can apply. Some assume that only full-time employees are eligible for loans. However, part-time employees may also qualify, depending on the company's policy.

- Loan repayment is always automatic. It is a common belief that repayments will be automatically deducted from paychecks. In some cases, employees may need to set this up themselves.

- Interest rates are fixed. Many people think that the interest rates on employee loans are always fixed. Some agreements may offer variable rates based on market conditions or company policies.

- Loan agreements are not legally binding. Some believe that these agreements are informal and not legally enforceable. In fact, they are binding contracts that both parties must adhere to.

- Employees can borrow any amount. It’s a misconception that employees can request any loan amount. Most companies have set limits on how much can be borrowed.

- Loan approval is guaranteed. Some think that submitting an application guarantees approval. However, loans are subject to review and approval based on various criteria.

- All loan agreements include a grace period. Many assume that all employee loan agreements come with a grace period before repayment starts. This is not always the case, and it varies by employer.

- Loan agreements are only for emergencies. While many use loans for emergencies, these agreements can also be used for other purposes, such as education or home repairs, depending on the employer’s policy.

Understanding these misconceptions can help employees navigate the Employee Loan Agreement process more effectively. Being informed leads to better decision-making and a smoother experience.

Dos and Don'ts

When filling out the Employee Loan Agreement form, it’s important to be careful and thorough. Here’s a list of things to keep in mind:

- Do read the entire form before starting. Understanding the requirements will help you fill it out correctly.

- Don't rush through the process. Take your time to ensure accuracy.

- Do provide all requested information. Missing details can delay the approval of your loan.

- Don't use abbreviations or shorthand. Clarity is key in legal documents.

- Do double-check your figures. Ensure that any financial amounts are correct.

- Don't forget to sign and date the form. An unsigned document may not be valid.

- Do keep a copy of the completed form for your records. This can be useful for future reference.

Common mistakes

Filling out the Employee Loan Agreement form can be straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is not providing accurate personal information. Ensure that your name, address, and contact details are correct. A simple typo can cause delays in processing your loan.

Another mistake is neglecting to read the terms and conditions thoroughly. Many individuals skim through the document without understanding the implications of the agreement. Take the time to read each section carefully. This will help you avoid surprises later on.

Some people fail to specify the loan amount they are requesting. This omission can lead to confusion and may result in the denial of your application. Always clearly state the amount you need, along with a brief explanation of why you are requesting it.

Inaccurate or incomplete financial information is another common pitfall. When detailing your income and expenses, be honest and thorough. Underreporting your income or failing to include all debts can jeopardize your loan approval.

Additionally, many forget to sign and date the form. Without your signature, the agreement is not valid. This step is crucial and should not be overlooked.

Some individuals also neglect to include supporting documentation. Depending on the lender's requirements, you may need to provide pay stubs, tax returns, or other financial documents. Failing to include these can delay the process.

Another mistake is misunderstanding repayment terms. Some borrowers do not fully grasp the repayment schedule or interest rates. Clarifying these details before signing can prevent issues in the future.

People often underestimate the importance of keeping a copy of the signed agreement. After submission, retain a copy for your records. This ensures you have a reference point if any disputes arise.

Lastly, many individuals rush through the process without asking questions. If anything is unclear, don’t hesitate to seek clarification. Taking the time to understand the agreement can save you from potential headaches later.

By being aware of these common mistakes, you can fill out the Employee Loan Agreement form more effectively and avoid complications that could arise from errors or misunderstandings.

Key takeaways

When filling out and using the Employee Loan Agreement form, keep these key takeaways in mind:

- Clarity is crucial. Ensure all terms are clearly defined. Ambiguity can lead to misunderstandings.

- Document all details. Include the loan amount, interest rate, repayment schedule, and any other relevant terms.

- Both parties must sign. The agreement is not valid until both the employee and employer have signed it.

- Keep a copy. Each party should retain a signed copy for their records. This helps in case of future disputes.

- Review regularly. Revisit the agreement periodically to ensure compliance with the terms and conditions.

- Consult a professional. If there are any uncertainties, seek legal advice to ensure the agreement meets all legal requirements.