Fill Out Your Employee Advance Form

Employee Advance - Usage Guidelines

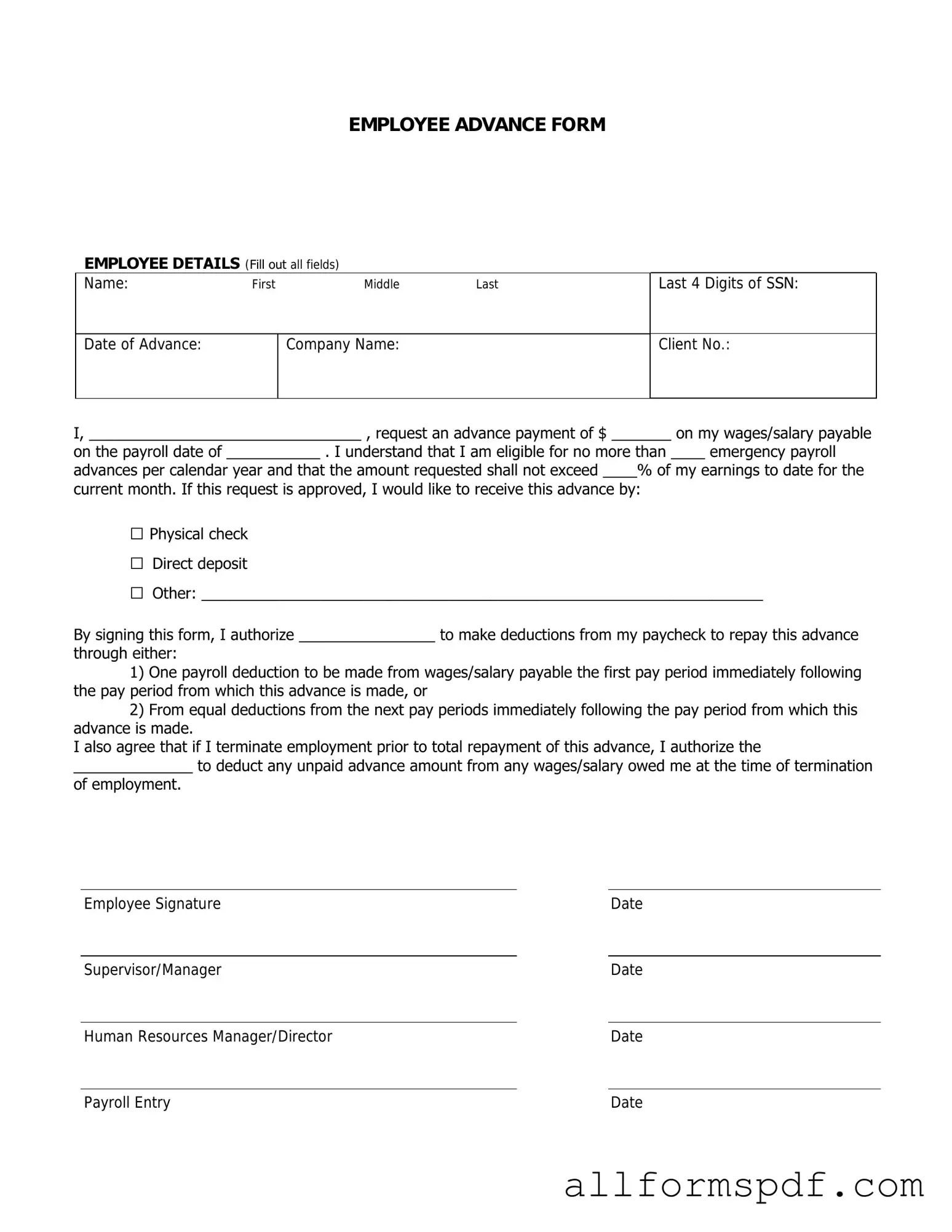

Once you have the Employee Advance form in hand, you are ready to begin the process of filling it out. This form is essential for requesting an advance on your salary or other related expenses. Follow the steps below to ensure you complete it correctly.

- Begin by entering your full name in the designated field at the top of the form.

- Next, provide your employee ID number to help identify your record in the system.

- Fill in the date of your request. This should be the current date when you are submitting the form.

- In the section labeled amount requested, write down the total amount you wish to advance.

- Clearly state the reason for the advance in the provided space. Be specific to help the reviewer understand your need.

- Sign the form in the signature section to authenticate your request.

- Finally, submit the completed form to your supervisor or the designated HR representative for processing.

After submission, your request will be reviewed. You will receive further instructions or confirmation regarding the status of your advance shortly.

Misconceptions

Understanding the Employee Advance form can be tricky. Many people hold misconceptions about its purpose and usage. Here are seven common misunderstandings:

-

It is a loan that must be paid back immediately.

Many believe that advances are loans requiring immediate repayment. In reality, these advances are often deducted from future paychecks, allowing employees to manage their finances more comfortably.

-

Only certain employees can request an advance.

Some think that only specific roles or seniority levels can access this form. However, most companies allow all eligible employees to request an advance, provided they meet certain criteria.

-

Filling out the form guarantees approval.

While submitting the form is necessary, it does not guarantee that the advance will be approved. Employers consider various factors, including the employee's work history and the company's financial situation.

-

Employee advances are only for emergencies.

Some individuals assume that advances are reserved for emergencies. In fact, they can be used for a variety of reasons, including planned expenses or unexpected bills.

-

The process is the same across all companies.

Each organization has its own policies and procedures regarding employee advances. What works at one company may not apply to another, so it’s essential to understand the specific guidelines of your workplace.

-

There are no tax implications for receiving an advance.

Many people overlook the fact that advances can have tax consequences. Depending on how the advance is structured, it may be considered taxable income, impacting your overall tax situation.

-

Once the form is submitted, there is no follow-up needed.

After submitting the form, it is important to follow up. Keeping communication open with your supervisor or HR can help clarify any questions and expedite the process.

By clearing up these misconceptions, employees can better navigate the Employee Advance process and make informed decisions about their financial needs.

Dos and Don'ts

When filling out the Employee Advance form, it’s essential to follow certain guidelines to ensure the process goes smoothly. Here are seven things to keep in mind:

- Do provide accurate personal information. Double-check your name, employee ID, and department.

- Don't leave any required fields blank. Incomplete forms can delay processing.

- Do specify the purpose of the advance clearly. This helps in understanding the request better.

- Don't submit the form without the necessary approvals. Ensure you have the required signatures.

- Do attach any supporting documents, if applicable. This can include receipts or invoices.

- Don't wait until the last minute to submit your request. Allow time for processing.

- Do keep a copy of the submitted form for your records. This can be useful for future reference.

Following these guidelines will help facilitate a smoother approval process for your Employee Advance request.

Other PDF Forms

Agreement Lease - The lease format helps standardize landlord-tenant relationships.

Understanding the implications of a Florida Hold Harmless Agreement form is crucial for anyone involved in high-risk activities. This legal document not only delineates the responsibilities of each party but also minimizes liabilities by ensuring that one party will not hold another accountable for any potential legal claims. For those looking to obtain a sample or more information regarding this essential agreement, they can visit All Florida Forms, which provides comprehensive resources on various legal forms.

What Is Immunization Records - Involvement in your child's immunization schedule is crucial.

D1 Form Download - Informing the DVLA about past disqualifications is essential for a valid application.

Common mistakes

Filling out the Employee Advance form can seem straightforward, but many people make common mistakes that can delay the approval process. One frequent error is failing to provide accurate personal information. Ensure that your name, employee ID, and department are correct. Any discrepancies can lead to confusion and unnecessary delays.

Another mistake is not specifying the purpose of the advance clearly. Employers want to understand why the advance is needed. Be concise but thorough in explaining your situation. A vague description may lead to questions and a longer review time.

Some individuals forget to include the exact amount requested. This can be a significant oversight. Always double-check that the amount aligns with your needs and is reasonable based on company policy. If you request too much, it may raise red flags.

Additionally, neglecting to provide supporting documentation is a common pitfall. If your advance is for travel or work-related expenses, include receipts or estimates. This documentation strengthens your request and makes it easier for your employer to approve it.

Many applicants overlook the deadline for submitting the form. Each company has its own timeline for processing requests. Missing the deadline can result in a denied application. Always check your company’s policy on submission timelines.

Some employees forget to sign the form. A signature is often required to validate your request. Without it, the form may be considered incomplete, causing delays in processing.

Another mistake is not following the specific instructions provided by the employer. Each organization may have unique requirements for filling out the form. Ignoring these guidelines can lead to rejection or requests for resubmission.

Inadequate communication with your supervisor or HR can also be an issue. Before submitting the form, it’s wise to discuss your needs with your manager. This conversation can provide clarity and may even expedite the process.

People sometimes fail to account for repayment terms. Understanding how and when the advance will be deducted from your paycheck is crucial. If this information is unclear, it can lead to financial surprises later on.

Lastly, not keeping a copy of the submitted form is a mistake many make. Retaining a copy for your records can be invaluable. If questions arise later, you’ll have the necessary documentation to refer back to.

Key takeaways

Filling out and using the Employee Advance form can be straightforward if you keep a few key points in mind. Here are some important takeaways:

- Ensure that all required fields are filled out completely. Missing information can delay the approval process.

- Provide a clear reason for the advance request. A well-explained purpose helps decision-makers understand your need.

- Double-check your calculations. Accurate figures will prevent any confusion and ensure you receive the correct amount.

- Submit the form as early as possible. This allows ample time for review and approval before you need the funds.

- Keep a copy of the submitted form for your records. This can be useful for tracking and follow-up purposes.

- Follow up with your supervisor or HR if you don’t hear back in a reasonable time. Communication is key to ensuring your request is processed.