Printable Durable Power of Attorney Form

State-specific Guidelines for Durable Power of Attorney Documents

Durable Power of Attorney - Usage Guidelines

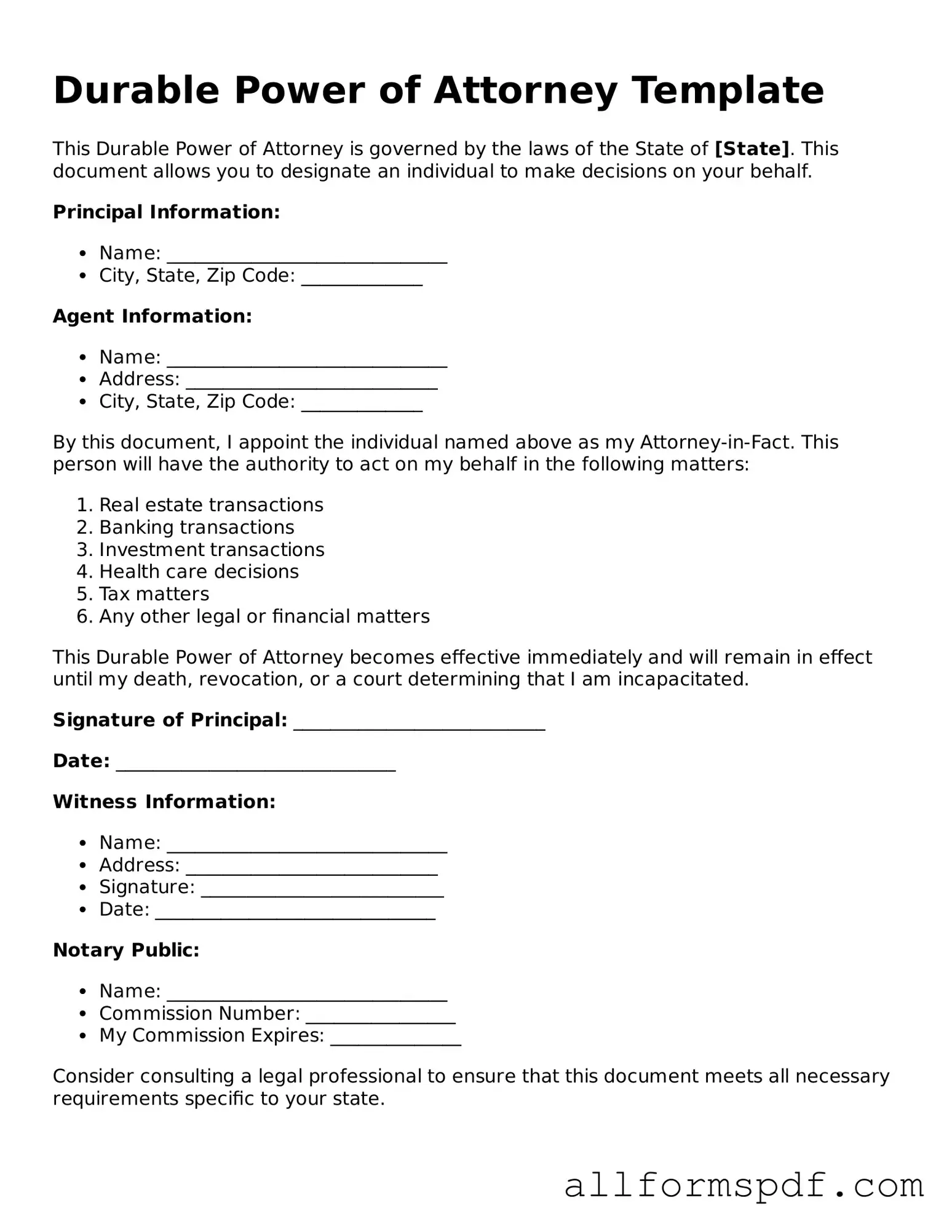

Filling out a Durable Power of Attorney form is an important step in planning for your future. This document allows you to designate someone to make decisions on your behalf if you become unable to do so. Follow these steps carefully to ensure the form is completed correctly.

- Begin by clearly writing your full name and address at the top of the form.

- Next, identify the person you are appointing as your agent. Include their full name, address, and relationship to you.

- Specify the powers you want to grant your agent. You can choose general powers or limit them to specific areas, like financial or medical decisions.

- Include any special instructions or limitations regarding your agent's authority, if applicable.

- Sign and date the form in the designated area. Your signature must be done in the presence of a notary public or witnesses, depending on your state’s requirements.

- Have your agent and any required witnesses sign the form as well, if necessary.

- Make copies of the completed form for your records and provide copies to your agent and any relevant institutions.

Misconceptions

-

Misconception 1: A Durable Power of Attorney is only for the elderly.

This is not true. Anyone, regardless of age, can benefit from having a Durable Power of Attorney. It is a proactive measure that can be useful in various situations, such as illness or travel, where one might need someone to handle their affairs.

-

Misconception 2: A Durable Power of Attorney gives unlimited power to the agent.

While this document does grant significant authority, it does not mean the agent can do anything they wish. The powers are defined within the document itself, and they must act in the best interest of the principal.

-

Misconception 3: A Durable Power of Attorney is the same as a healthcare proxy.

These two documents serve different purposes. A Durable Power of Attorney typically deals with financial and legal matters, while a healthcare proxy specifically addresses medical decisions when one is unable to make them.

-

Misconception 4: A Durable Power of Attorney becomes invalid if the principal becomes incapacitated.

This is a critical misunderstanding. The "durable" aspect means that the authority granted continues even if the principal becomes incapacitated. This is what makes it a vital tool for planning ahead.

-

Misconception 5: A Durable Power of Attorney can only be created by an attorney.

While it is advisable to consult an attorney to ensure the document meets all legal requirements, individuals can create a Durable Power of Attorney themselves using templates. However, legal guidance is recommended to avoid potential pitfalls.

-

Misconception 6: Once a Durable Power of Attorney is signed, it cannot be revoked.

This is incorrect. The principal retains the right to revoke the Durable Power of Attorney at any time, as long as they are mentally competent. This flexibility is an essential feature of the document.

-

Misconception 7: A Durable Power of Attorney is only useful during a medical emergency.

While it is indeed valuable in medical situations, its utility extends beyond emergencies. It can facilitate everyday financial transactions, manage investments, or handle legal matters, making it a versatile tool for various circumstances.

Dos and Don'ts

When filling out a Durable Power of Attorney form, it's important to get it right. Here are some guidelines to help you through the process.

- Do ensure you understand the powers you are granting. Be clear about what decisions your agent can make on your behalf.

- Do choose a trustworthy person as your agent. This individual will have significant authority over your affairs.

- Do sign the document in front of a notary public or witnesses, if required by your state. This adds an extra layer of validity.

- Don't leave any sections blank. Fill out all required fields to avoid confusion or legal issues later.

- Don't forget to keep a copy of the completed form. This will help you and your agent reference the document when needed.

Discover More Types of Durable Power of Attorney Documents

Power of Attorney for Child Florida - Parents can use this tool to proactively address child care issues before they arise.

When engaging in the sale of an ATV in Arizona, having a well-drafted document is imperative to avoid potential disputes, and you can find a suitable template at Legal PDF Documents, which helps ensure that all necessary details are captured accurately for both parties involved in the transaction.

Power of Attorney Document - Permits designated individual to execute contracts involving property transfers.

Common mistakes

Filling out a Durable Power of Attorney (DPOA) form is a crucial step in ensuring that your financial and healthcare decisions are managed according to your wishes in the event that you become incapacitated. However, many individuals make common mistakes that can lead to confusion or even invalidate the document. Understanding these pitfalls can help you avoid them.

One frequent error is failing to specify the powers granted to the agent. A DPOA should clearly outline what decisions the agent can make on your behalf. Without this clarity, the agent may not have the authority to act in certain situations, potentially leading to delays in necessary decisions.

Another mistake is neglecting to choose a reliable agent. It is essential to appoint someone you trust completely, as they will have significant control over your financial and medical matters. Choosing an agent based solely on convenience or familial ties can lead to conflicts and mismanagement.

Some individuals overlook the importance of signing the document in front of a notary or witnesses, as required by state law. Notarization adds a layer of legitimacy and can prevent challenges to the document's validity. Failing to follow these legal requirements can render the DPOA ineffective.

Moreover, people often forget to update their DPOA when life circumstances change. Major life events such as marriage, divorce, or the death of a previously appointed agent should prompt a review and potential revision of the document. Keeping the DPOA current ensures that it reflects your current wishes.

Another common oversight is not discussing the DPOA with the appointed agent. Open communication about your wishes and expectations can help the agent make informed decisions. Without this conversation, the agent may struggle to understand your preferences in critical moments.

In addition, some individuals fail to consider the potential for conflicts of interest. Appointing an agent who stands to benefit financially from your decisions can lead to ethical dilemmas and mistrust among family members. It is crucial to choose someone who will act in your best interest, free from personal gain.

Another mistake involves using outdated or incorrect forms. Laws governing DPOAs can vary significantly by state, and using a form that does not comply with local regulations can invalidate the document. Always ensure you are using the most current and appropriate form for your jurisdiction.

People also sometimes forget to include alternative agents in the event that the primary agent is unable or unwilling to serve. Designating a backup agent ensures that there is always someone available to make decisions on your behalf, thus preventing potential gaps in care or management.

Lastly, individuals may not understand the implications of granting a Durable Power of Attorney. It is essential to recognize that this document gives significant authority to the agent, and a thorough understanding of its scope and limitations is necessary. Misunderstanding these implications can lead to unintended consequences.

Key takeaways

Filling out a Durable Power of Attorney (DPOA) form is an important step in planning for the future. Here are some key takeaways to consider:

- Choose the Right Agent: Select someone you trust to make decisions on your behalf. This person should understand your values and be capable of handling financial or medical matters responsibly.

- Specify Powers Clearly: Clearly outline the powers you are granting to your agent. This might include managing finances, making healthcare decisions, or handling legal matters.

- Consider Timing: A Durable Power of Attorney becomes effective immediately or at a future date, depending on your preference. Decide what works best for your situation.

- Review and Update Regularly: Life circumstances change, so it’s wise to review your DPOA regularly. Update it as needed to reflect any changes in your relationships or wishes.

- Consult a Professional: While you can fill out the form on your own, consulting with a legal professional can help ensure that it meets all legal requirements and accurately reflects your intentions.

Understanding these key points can help you navigate the process of creating a Durable Power of Attorney with confidence and clarity.