Printable Deed in Lieu of Foreclosure Form

Deed in Lieu of Foreclosure - Usage Guidelines

After completing the Deed in Lieu of Foreclosure form, the next steps involve submitting the document to your lender and ensuring that all necessary parties are informed. It is crucial to keep copies of the signed form for your records. Once submitted, the lender will review the document and initiate the next steps in the process.

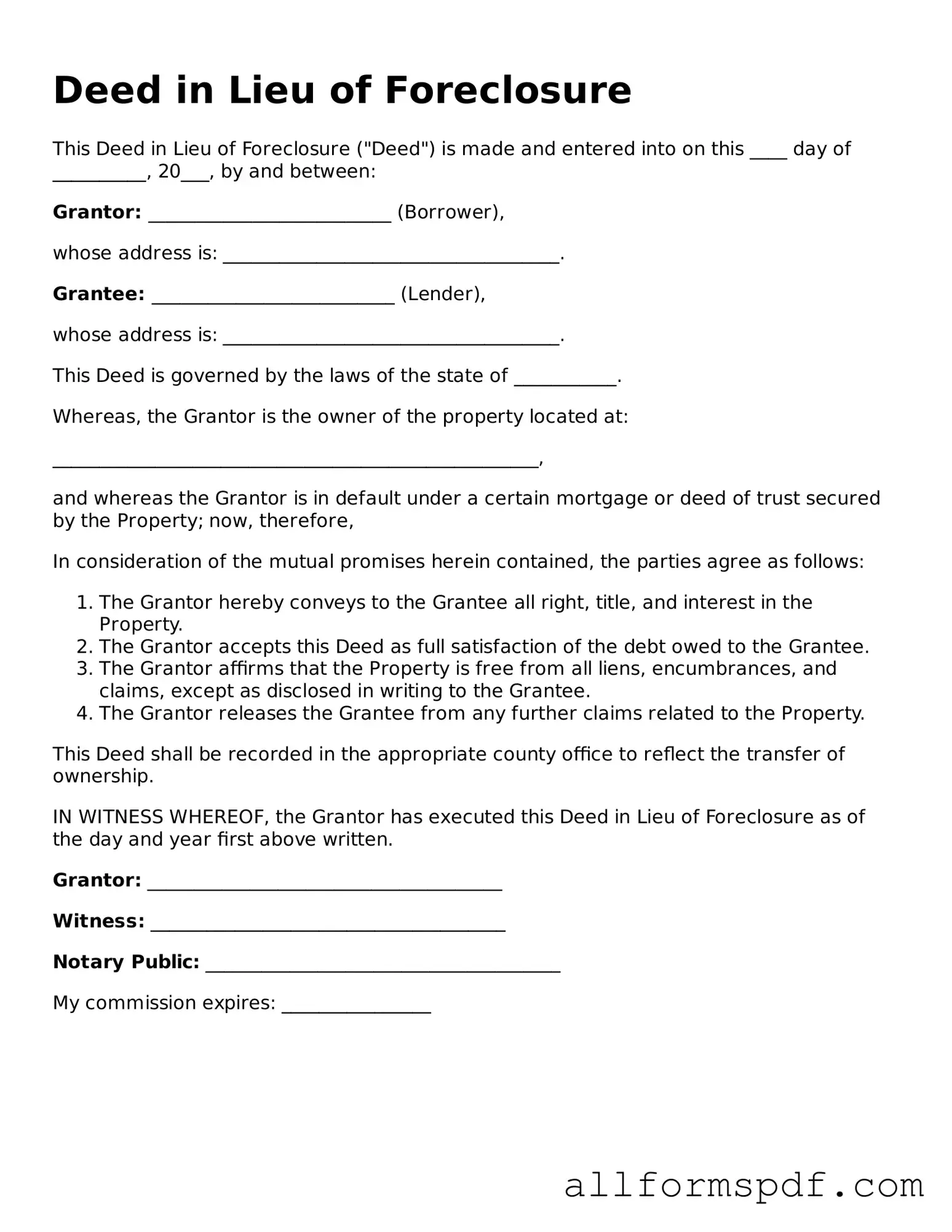

- Obtain the Deed in Lieu of Foreclosure form from your lender or a trusted legal source.

- Fill in your name and address in the designated sections as the borrower.

- Provide the lender's name and address in the appropriate fields.

- Include the property address that is subject to the deed.

- Indicate the date of the agreement.

- Sign the form in the designated area, ensuring your signature matches the name on the document.

- Have the form notarized, if required by your lender.

- Make copies of the completed and signed form for your records.

- Submit the original form to your lender and confirm receipt.

Misconceptions

When it comes to the Deed in Lieu of Foreclosure, many people have misconceptions that can lead to confusion. Here are seven common misunderstandings:

- It automatically cancels the mortgage debt. Many believe that signing a Deed in Lieu of Foreclosure means the mortgage debt is erased. However, this is not always the case. The lender may still pursue the borrower for any remaining balance, depending on state laws and the terms of the agreement.

- It’s a quick and easy process. While a Deed in Lieu of Foreclosure can be faster than going through a full foreclosure, it still involves paperwork, negotiations, and approval from the lender. The process can take time and may not be as straightforward as some think.

- It affects your credit score less than foreclosure. Both options can significantly impact your credit score. A Deed in Lieu of Foreclosure may seem less damaging, but it can still lead to a substantial drop in your credit rating, similar to a foreclosure.

- It’s only available for primary residences. Some people think that this option is only for homes that are primary residences. In reality, a Deed in Lieu of Foreclosure can also apply to investment properties, though lenders may have different criteria for each type.

- You can stay in your home after signing. Many assume that they can continue living in their home once they sign a Deed in Lieu of Foreclosure. However, most lenders will require the homeowner to vacate the property shortly after the deed is transferred.

- It eliminates the need for a real estate agent. While some homeowners may think they can handle the process alone, consulting with a real estate agent or attorney can provide valuable guidance. They can help navigate the complexities and ensure that the homeowner’s interests are protected.

- It’s the same as a short sale. A Deed in Lieu of Foreclosure and a short sale are not interchangeable. In a short sale, the property is sold for less than the mortgage balance with the lender's approval. In contrast, a Deed in Lieu involves transferring ownership back to the lender without a sale.

Understanding these misconceptions can help homeowners make informed decisions about their options when facing financial difficulties.

Dos and Don'ts

When considering a Deed in Lieu of Foreclosure, it is essential to approach the process with care. Below are some important guidelines on what to do and what to avoid when filling out the necessary form.

- Do consult with a legal professional to understand the implications of signing the deed.

- Do ensure that all information provided is accurate and complete.

- Do communicate openly with your lender about your situation and intentions.

- Do keep copies of all documents submitted for your records.

- Don't rush through the form; take your time to review each section carefully.

- Don't ignore any potential tax consequences that may arise from the deed.

- Don't assume that signing the deed will automatically resolve all financial issues.

Discover More Types of Deed in Lieu of Foreclosure Documents

Problems With Transfer on Death Deeds California - This deed is part of a broader strategy to ensure your assets are handled per your wishes.

When purchasing a motorcycle in Arizona, utilizing a well-drafted document is crucial. The important Motorcycle Bill of Sale form provides a formal record of the sale, ensuring all pertinent details are documented and legally recognized.

Free Michigan Lady Bird Deed Pdf - A Lady Bird Deed is particularly useful in protecting the homeowner’s interest in Medicaid planning.

Common mistakes

Filling out a Deed in Lieu of Foreclosure form can be a complex process, and mistakes can lead to significant consequences. One common error is failing to provide accurate property information. When the property address or legal description is incorrect, it can create confusion and potentially invalidate the deed. It's essential to double-check these details before submission.

Another frequent mistake involves not obtaining the necessary signatures. All parties involved must sign the document for it to be legally binding. Omitting a signature can delay the process and complicate the transfer of ownership. Ensuring that all required individuals are present and ready to sign is crucial.

People often overlook the importance of including all relevant documents. A Deed in Lieu of Foreclosure typically requires additional paperwork, such as a letter from the lender or proof of ownership. Failing to attach these documents may result in rejection of the form or additional delays in the process.

Additionally, some individuals neglect to consult with a legal professional. This oversight can lead to misunderstandings about the implications of signing a Deed in Lieu of Foreclosure. Legal advice can provide clarity on the potential impacts on credit scores and future homeownership opportunities.

Misunderstanding the implications of the deed is another common mistake. Some people assume that this process absolves them of all financial obligations related to the mortgage. However, this is not always the case. It's important to understand that any remaining debt may still be pursued by the lender.

Another area where errors frequently occur is in the completion of the notary section. A notary public must witness the signing of the deed, and failure to have this step properly executed can render the document invalid. Ensuring that the notary is present and that all signatures are properly acknowledged is essential.

People sometimes rush through the process without fully understanding the terms of the agreement. Reading and comprehending the entire document is vital. Misinterpretations can lead to unintended consequences and can affect the homeowner's rights.

Additionally, some individuals do not keep copies of the submitted form and related documents. This can create difficulties if there are disputes or if the lender requires additional information later. Maintaining thorough records is a best practice in any legal process.

Finally, failing to communicate with the lender can lead to misunderstandings. It is advisable to maintain open lines of communication throughout the process. Lenders may have specific requirements or changes that need to be addressed, and staying informed is key to a smooth transaction.

Key takeaways

When considering a Deed in Lieu of Foreclosure, it's important to understand the implications and processes involved. Here are key takeaways to keep in mind:

- Definition: A Deed in Lieu of Foreclosure is a legal document where a homeowner voluntarily transfers their property to the lender to avoid foreclosure.

- Eligibility: Not all homeowners qualify. Lenders typically require proof of financial hardship and may consider the property’s value.

- Impact on Credit: While it is less damaging than a foreclosure, a Deed in Lieu can still negatively affect your credit score.

- Release of Liability: This process may release you from your mortgage obligation, but it’s essential to confirm this with your lender.

- Negotiation: Homeowners can negotiate terms with the lender, including potential cash incentives or relocation assistance.

- Legal Advice: Consulting with a legal professional can provide clarity on the process and help protect your interests.

- Documentation: Gather all necessary documents, such as proof of income, hardship letters, and the mortgage agreement, to facilitate the process.

- Timeframe: The process can take several weeks to months, depending on the lender's policies and the complexity of the situation.

- Future Homeownership: After a Deed in Lieu, it may take time before you can qualify for another mortgage, so plan accordingly.

Understanding these aspects can help homeowners make informed decisions when facing financial difficulties.