Fill Out Your DD 2656 Form

DD 2656 - Usage Guidelines

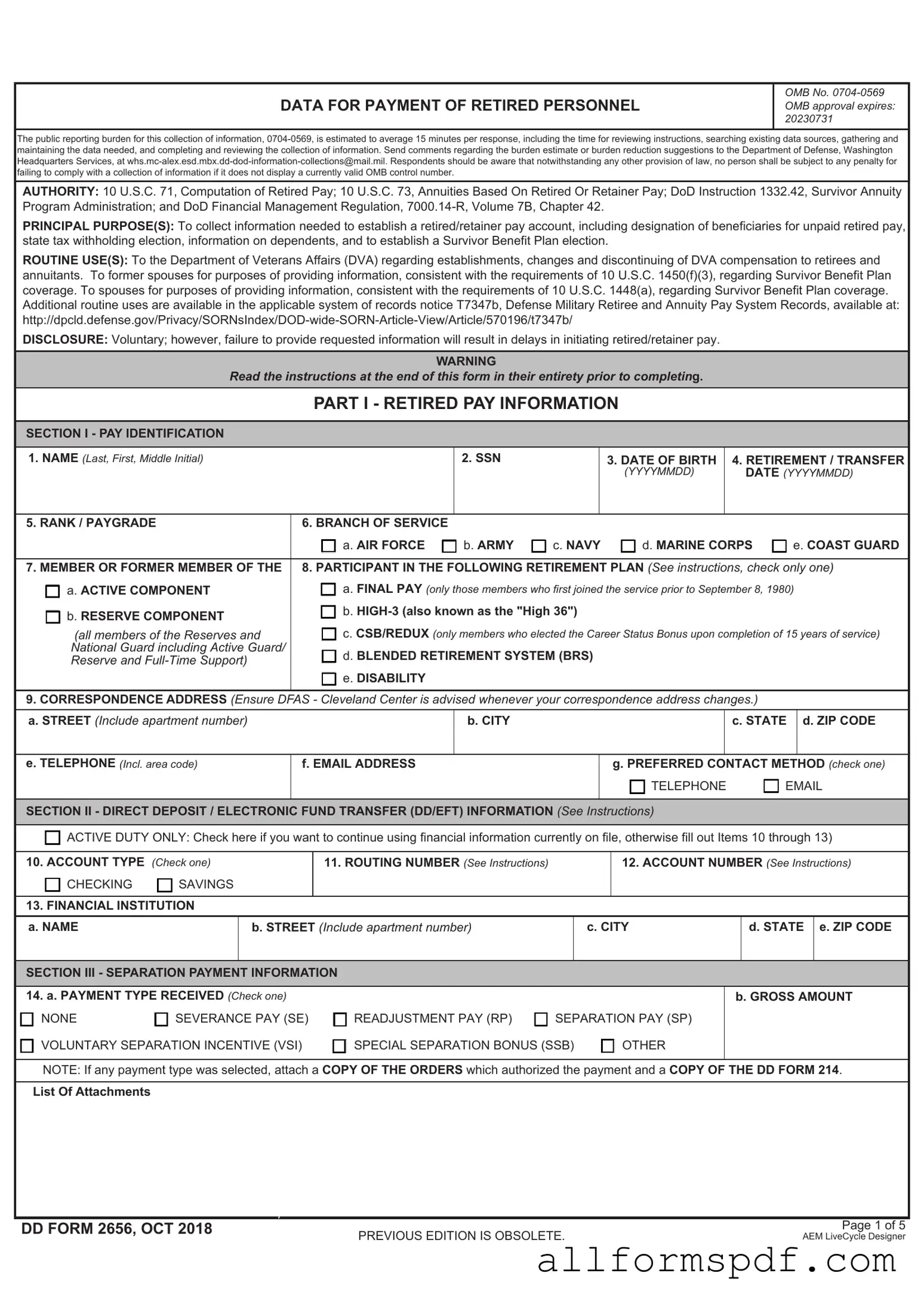

Filling out the DD 2656 form is an important step in managing your benefits. Make sure to have all necessary information handy before you start. This will help ensure a smooth process.

- Begin by entering your personal information in Section I. This includes your name, Social Security number, and date of birth.

- In Section II, provide your military service details. Include your service branch, rank, and the dates of service.

- Section III requires information about your marital status. Indicate whether you are single, married, or divorced.

- In Section IV, list your dependents. Include their names, birth dates, and relationship to you.

- Section V is for your election of benefits. Choose the options that apply to you and provide any required details.

- Complete Section VI by signing and dating the form. Make sure your signature matches the name provided at the top.

- Finally, review the entire form for accuracy before submitting it. Double-check all entries to avoid delays.

Misconceptions

The DD 2656 form, also known as the "Data for Payment of Retired Personnel," is an important document for military retirees. However, there are several misconceptions surrounding this form that can lead to confusion. Here are four common misconceptions:

- Misconception 1: The DD 2656 form is only for retirees.

- Misconception 2: Completing the DD 2656 form is optional.

- Misconception 3: The DD 2656 form is only needed once.

- Misconception 4: The form can be submitted without supporting documents.

Many people believe that only those who have retired from military service need to fill out the DD 2656 form. In reality, this form is also used by survivors and beneficiaries to establish their eligibility for benefits.

Some individuals think that submitting the DD 2656 form is merely a suggestion. However, it is actually a required document for processing retirement pay and benefits. Failing to submit it can delay or complicate the payment process.

Another common belief is that the DD 2656 form only needs to be filled out at the time of retirement. In truth, updates may be necessary if there are changes in personal information, such as marital status or dependent information.

Some individuals assume that the DD 2656 form can be submitted alone. However, it typically requires accompanying documentation to verify information, such as marriage certificates or birth certificates for dependents.

Dos and Don'ts

When filling out the DD 2656 form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don'ts to keep in mind:

- Do read the instructions carefully before starting the form.

- Do use black or blue ink for filling out the form.

- Do provide accurate personal information, including your Social Security number.

- Do double-check all entries for spelling and numerical accuracy.

- Do sign and date the form where required.

- Don't leave any required fields blank.

- Don't use correction fluid or tape on the form.

- Don't submit the form without making a copy for your records.

- Don't rush through the form; take your time to ensure everything is correct.

Other PDF Forms

Planned Parenthood Doctors Note for Work - Patient feedback on service awareness aids in improving outreach efforts.

A New York Lease Agreement form is a legally binding document between a landlord and tenant, outlining the terms and conditions of renting property in New York. This form covers various aspects such as rent amount, payment schedule, and lease duration. Understanding this agreement is crucial for both landlords and tenants to ensure their rights are protected. For more information, you can visit https://smarttemplates.net/fillable-new-york-lease-agreement/.

How Long Does It Take for Asylum Decision - Applicants must sign and date the I-589 when submitting.

Faa Aircraft Bill of Sale - It is suggested to consult with a legal expert if questions arise about the form.

Common mistakes

Filling out the DD 2656 form can be a straightforward process, but many people make mistakes that can delay benefits or cause confusion. One common error is failing to provide complete personal information. This includes not only your name and Social Security number but also your address and contact details. Incomplete information can lead to miscommunication and delays in processing your application.

Another frequent mistake is neglecting to sign and date the form. Signatures are crucial because they verify that the information provided is accurate and that the individual agrees to the terms outlined in the form. Without a signature, the form may be considered invalid, leading to potential complications in receiving benefits.

Many individuals also overlook the importance of providing accurate beneficiary information. When designating beneficiaries, it is essential to ensure that names are spelled correctly and that the relationship to the beneficiary is clearly stated. Errors in this section can result in disputes or delays in benefit distribution.

Additionally, some people fail to review the instructions thoroughly. Each section of the DD 2656 form has specific requirements and guidelines. Ignoring these instructions can lead to mistakes that may require resubmission of the form, thereby prolonging the process.

Finally, individuals often forget to keep a copy of the completed form for their records. Having a copy can be invaluable for future reference, especially if there are questions or issues regarding the application. Without a copy, individuals may find it challenging to resolve discrepancies or provide proof of submission.

Key takeaways

The DD 2656 form is an important document for military members and their families. Here are some key takeaways to keep in mind when filling it out and using it:

- The DD 2656 is used to apply for retired pay and to designate beneficiaries.

- Make sure to fill out all required sections completely to avoid delays in processing.

- Double-check the accuracy of your personal information, including your Social Security number and service details.

- Consider consulting with a financial advisor or legal expert if you have questions about designating beneficiaries.

- Submit the completed form to your branch of service's retirement office for processing.

- Keep a copy of the form for your records after submission.

Filling out the DD 2656 form carefully can help ensure a smoother transition into retirement and secure your benefits effectively.