Fill Out Your Citibank Direct Deposit Form

Citibank Direct Deposit - Usage Guidelines

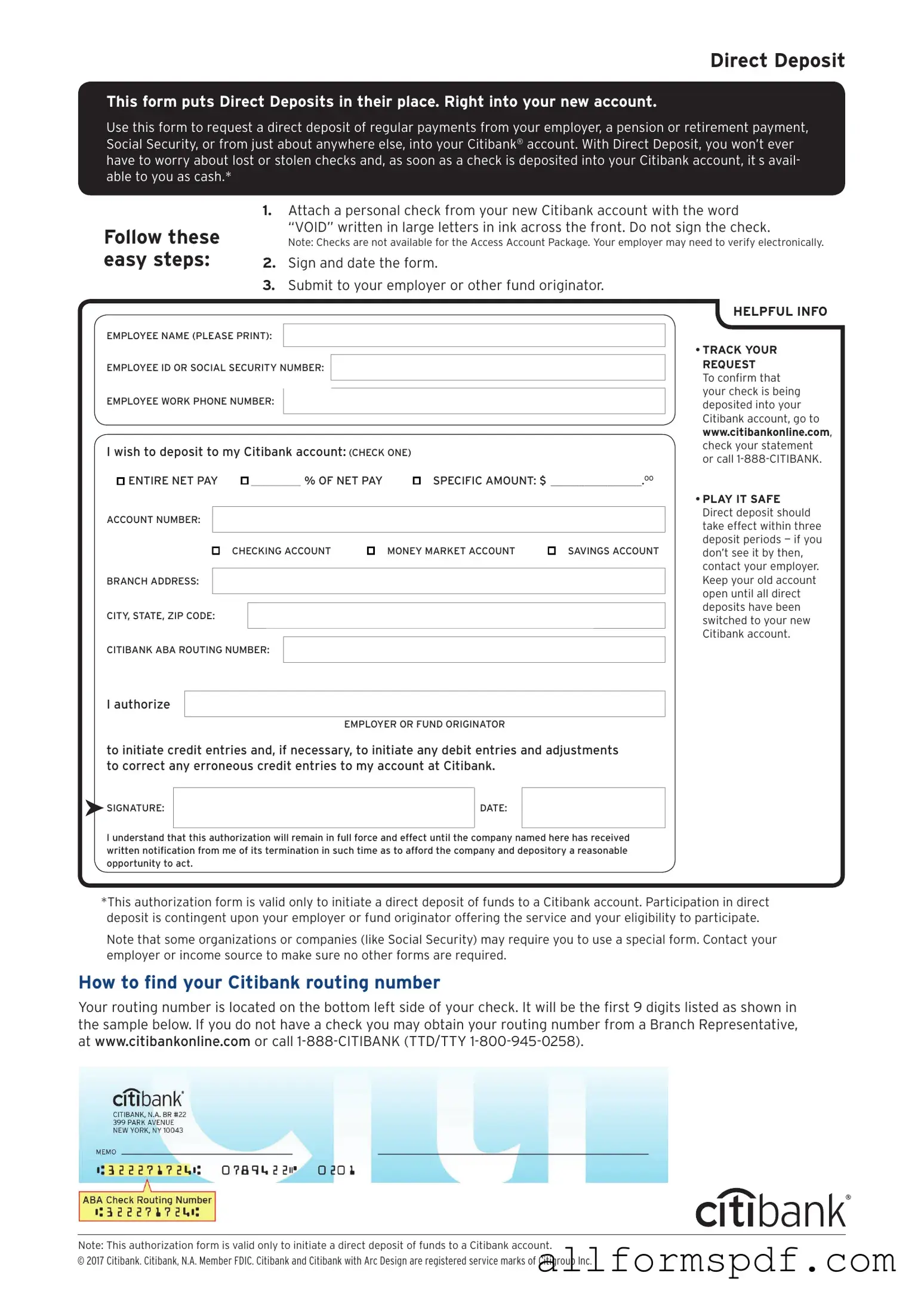

After you have received the Citibank Direct Deposit form, you will need to complete it accurately to ensure your funds are deposited correctly. Follow these steps carefully to fill out the form.

- Begin by entering your full name in the designated field at the top of the form.

- Provide your current address, including street, city, state, and ZIP code.

- Fill in your Social Security Number (SSN) in the appropriate section.

- Next, indicate your bank account type by selecting either "Checking" or "Savings." This is crucial for proper deposit processing.

- Enter your bank account number. Double-check for accuracy to prevent any issues with deposits.

- Provide the routing number for your bank. This number is typically found on your checks or can be obtained from your bank's website.

- Sign and date the form at the bottom. Your signature authorizes the direct deposit.

Once the form is completed, submit it to your employer or the designated payroll department. They will process your request and set up the direct deposit to your specified account.

Misconceptions

Understanding the Citibank Direct Deposit form is essential for ensuring smooth financial transactions. However, several misconceptions often arise. Here are nine common misunderstandings:

- Direct deposit is only for payroll. Many believe direct deposit can only be used for salary payments. In reality, it can also be used for government benefits, tax refunds, and other types of payments.

- Direct deposit is complicated to set up. Some people think the setup process is difficult. In fact, it typically involves filling out a simple form and providing your bank details.

- All banks offer the same direct deposit services. While most banks provide direct deposit, the features and processing times can vary. It's important to check with Citibank for specific services.

- Once set up, direct deposit cannot be changed. This is not true. You can update your direct deposit information whenever necessary, such as when you change jobs or bank accounts.

- Direct deposit is not secure. Many worry about the security of direct deposits. However, they are generally safer than paper checks, which can be lost or stolen.

- Direct deposits are always immediate. While direct deposits are usually processed quickly, there can be delays depending on the bank's policies or the timing of the deposit.

- You need to have a specific type of account. Some believe that only certain account types can receive direct deposits. Most checking and savings accounts at Citibank are eligible.

- Direct deposit eliminates the need for bank statements. Although direct deposits simplify transactions, it’s still important to review bank statements regularly for accuracy and budgeting purposes.

- Direct deposit means you can’t access your funds until payday. This misconception suggests that funds are locked until the scheduled payday. However, once deposited, the funds are typically available immediately or within a short time frame.

Addressing these misconceptions can help individuals utilize the Citibank Direct Deposit form more effectively, ensuring timely and secure financial transactions.

Dos and Don'ts

When filling out the Citibank Direct Deposit form, it is essential to ensure accuracy and completeness. Here are four things you should and shouldn't do:

- Do: Double-check your account number for accuracy to avoid delays in deposits.

- Do: Use clear and legible handwriting or fill out the form electronically to prevent misunderstandings.

- Don't: Leave any required fields blank, as this may result in processing issues.

- Don't: Forget to sign the form; an unsigned form will not be processed.

Other PDF Forms

Ucc 1308 - Filing this form can prevent enforced compliance with unwanted contracts.

How to Write a Lien Letter - The document includes space for verification of delivery to ensure proper notification.

Utilizing a Florida Non-disclosure Agreement (NDA) form is crucial for any business or individual looking to protect sensitive information in a legally binding manner. This document is tailored to comply with Florida's specific laws, creating clarity around the sharing of confidential material. To ensure you have the appropriate paperwork in place, you can refer to resources such as All Florida Forms, which offer access to the necessary forms and guidance for proper execution.

Transfer of Shares Form - Assists in tracking any fractional shares issued or transferred.

Common mistakes

Filling out the Citibank Direct Deposit form can seem straightforward, but many individuals encounter pitfalls that can lead to delays or complications. One common mistake is providing incorrect account numbers. Each account has a unique number, and a simple typo can result in funds being deposited into the wrong account. Double-checking this information is crucial.

Another frequent error is neglecting to include the correct routing number. The routing number is essential for directing funds to the correct financial institution. If this number is inaccurate, the deposit may not occur as intended, causing frustration and potential financial setbacks.

Some people fail to sign the form. A signature is often required to authorize the transaction. Without it, the bank may reject the request, leaving individuals without their expected funds. Ensuring that all required signatures are present can prevent unnecessary delays.

Additionally, individuals sometimes overlook the need to update their personal information. Life changes, such as moving or changing jobs, can affect banking details. It is important to keep the bank informed of any changes to ensure smooth processing of direct deposits.

Providing outdated or incorrect contact information is another mistake. If the bank needs to reach out for clarification or issues arise, having accurate contact details is vital. Failing to provide a reliable phone number or email can lead to missed communications.

Some individuals may also forget to specify the type of deposit. Whether it’s a paycheck, government benefits, or other income, indicating the type helps the bank process the request correctly. Omitting this information can result in confusion and delays.

Another common oversight is not reading the instructions carefully. The form may contain specific requirements or guidelines that are easy to miss. Taking the time to review the instructions can save individuals from making avoidable mistakes.

Moreover, individuals sometimes fail to keep a copy of the completed form for their records. Having a copy can be helpful if questions arise later or if there are discrepancies in the deposit. This simple step can provide peace of mind.

Finally, some people submit the form without confirming the processing time. Understanding how long it takes for direct deposits to begin can help individuals manage their finances better. Being aware of the timeline can prevent unnecessary anxiety about when funds will arrive.

Key takeaways

When filling out and using the Citibank Direct Deposit form, there are several important points to consider. Below are key takeaways to ensure a smooth process.

- Accurate Information: Always double-check the information you provide. Incorrect account numbers or routing numbers can lead to delays or misdirected funds.

- Signature Requirement: Your signature is crucial. Ensure you sign the form to authorize Citibank to process your direct deposit.

- Employer Notification: Inform your employer that you have completed the form. They will need to process it to initiate the direct deposit.

- Account Type: Specify the type of account—checking or savings. This detail is essential for the bank to route your funds correctly.

- Deposit Amount: Decide whether you want the full paycheck deposited or just a portion. Indicate this clearly on the form if you choose the latter.

- Keep a Copy: Retain a copy of the completed form for your records. This can be helpful if any issues arise in the future.

By following these guidelines, you can ensure that your direct deposit setup is efficient and effective, allowing for timely access to your funds.