Fill Out Your Childcare Receipt Form

Childcare Receipt - Usage Guidelines

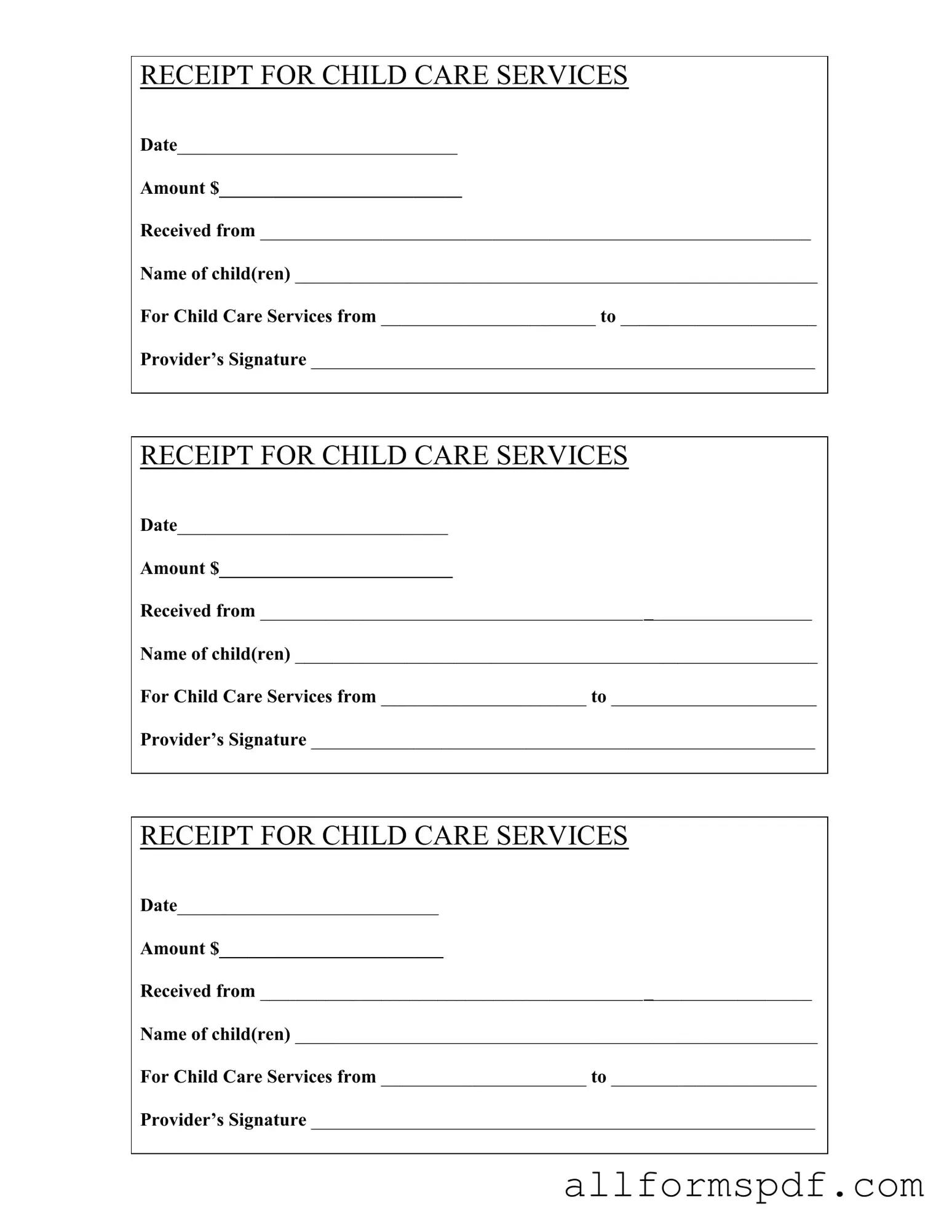

Once you have the Childcare Receipt form in hand, you'll need to complete it accurately to ensure that all necessary information is documented. This form serves as a record of the childcare services provided and the payment received. Follow the steps below to fill out the form correctly.

- Write the date on the line labeled Date. This should be the date when the payment was made.

- Enter the amount of money received in the space next to Amount. Be sure to write this amount clearly.

- Fill in the name of the person making the payment on the line marked Received from.

- List the names of the child or children receiving care in the section labeled Name of child(ren).

- Indicate the start date of the childcare services in the space next to For Child Care Services from.

- Provide the end date of the childcare services in the space next to to.

- Have the childcare provider sign the form in the section marked Provider’s Signature.

Misconceptions

When it comes to the Childcare Receipt form, there are several misconceptions that can lead to confusion. Understanding these can help ensure that you use the form correctly and get the benefits you deserve. Here are eight common misconceptions:

- All childcare providers must use the same receipt format. Not true. While the form must include certain information, providers can have their own formats as long as they meet the required elements.

- The receipt is only necessary for tax purposes. This is a misconception. While it is important for tax deductions, the receipt also serves as proof of payment for parents and can be used for record-keeping.

- Only licensed providers can issue a childcare receipt. Incorrect. Both licensed and unlicensed providers can issue receipts, but it’s essential that the receipt includes all necessary information.

- You can only claim childcare expenses if you have a receipt. This is misleading. While receipts are important, you may still need to provide other documentation to support your claims.

- The receipt must be provided immediately after payment. Not necessarily. Providers should issue receipts in a timely manner, but it doesn’t have to be instantaneous.

- Parents must keep receipts for a specific number of years. This is not always clear-cut. Generally, it’s advisable to keep receipts for at least three years, but checking with a tax professional is wise.

- Only parents can receive the childcare receipt. This is a misconception. Anyone who pays for childcare services, such as grandparents or guardians, can receive a receipt.

- Childcare receipts are only for full-time care. This is false. Receipts can be issued for part-time care, drop-in services, or even occasional babysitting.

By clearing up these misconceptions, you can better navigate the process of using the Childcare Receipt form and ensure that you’re prepared for any financial or tax-related matters that arise.

Dos and Don'ts

When filling out the Childcare Receipt form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things to do and not to do.

- Do enter the date clearly in the designated space.

- Do specify the total amount paid for the childcare services.

- Do provide the full name of the individual or entity making the payment.

- Do include the names of all children receiving care.

- Do indicate the start and end dates for the childcare services provided.

- Don't leave any fields blank; all information is necessary.

- Don't use abbreviations or nicknames for names; full names are required.

- Don't forget to obtain the provider’s signature to validate the receipt.

- Don't alter any information once it has been entered; corrections should be made clearly.

Other PDF Forms

P 45 Meaning - P45s serve as proof of income for employees moving to new jobs.

When engaging in the sale of a vehicle in Florida, it is important to utilize the proper documentation, such as the Florida Motor Vehicle Bill of Sale form. This form not only records the transaction but also provides essential details like the make, model, year, and VIN of the vehicle, ensuring clarity and legality in the agreement. For more information and access to necessary forms, you can visit All Florida Forms.

Doctor Note - Formal recognition of the patient’s health situation.

Common mistakes

Completing the Childcare Receipt form accurately is essential for both parents and childcare providers. However, several common mistakes can occur during this process. Recognizing these errors can help ensure that the form is filled out correctly, avoiding potential issues later.

One frequent mistake is leaving the date section blank. This detail is crucial as it indicates when the childcare services were provided. Without a date, it can lead to confusion regarding the timeframe of the services rendered. Always ensure that the date is clearly written and corresponds to the services provided.

Another common error is failing to specify the amount paid for the childcare services. This section must be filled out completely, as it provides a record of the transaction. A missing amount can create misunderstandings or disputes over payment. Always double-check that this information is accurate and complete.

Many people also overlook the importance of clearly writing the name of the child(ren). Incomplete or illegible names can lead to complications, especially if there are multiple children in the care of the same provider. Taking the time to write clearly can prevent future mix-ups.

Additionally, the section for the provider’s signature is often neglected. This signature serves as confirmation that the childcare provider has acknowledged receipt of payment. Without it, the form may not be considered valid. Ensure that the provider signs the form to authenticate the transaction.

Some individuals may forget to fill in the service dates, which indicate the period during which childcare was provided. This information is vital for record-keeping and tax purposes. Always include both the start and end dates to provide a complete picture of the services rendered.

In some cases, people may use incorrect or outdated forms. It is important to ensure that the form being used is the most current version. Using an outdated form can lead to missing information or discrepancies in the required details. Always check for the latest version before filling it out.

Lastly, not keeping a copy of the filled-out form can be a significant oversight. Having a copy serves as a personal record and can be useful for future reference or in case of disputes. Always make a photocopy or take a digital snapshot of the completed form for your records.

Key takeaways

When filling out and using the Childcare Receipt form, consider these key takeaways:

- Complete all sections: Ensure that every field is filled out accurately, including the date, amount, and names of the child or children.

- Provider's signature: The form must be signed by the childcare provider. This signature verifies that the services were rendered.

- Use for tax purposes: Keep these receipts for your records. They can be essential when claiming childcare expenses on your tax return.

- Record the service period: Clearly indicate the start and end dates of the childcare services. This information is crucial for both parties.

- Keep copies: Always make copies of the completed receipts for your personal records. This helps in case of any disputes or questions later on.

- Check for accuracy: Before finalizing the receipt, double-check all information for accuracy. Mistakes can lead to complications down the line.