Fill Out Your Cash Receipt Form

Cash Receipt - Usage Guidelines

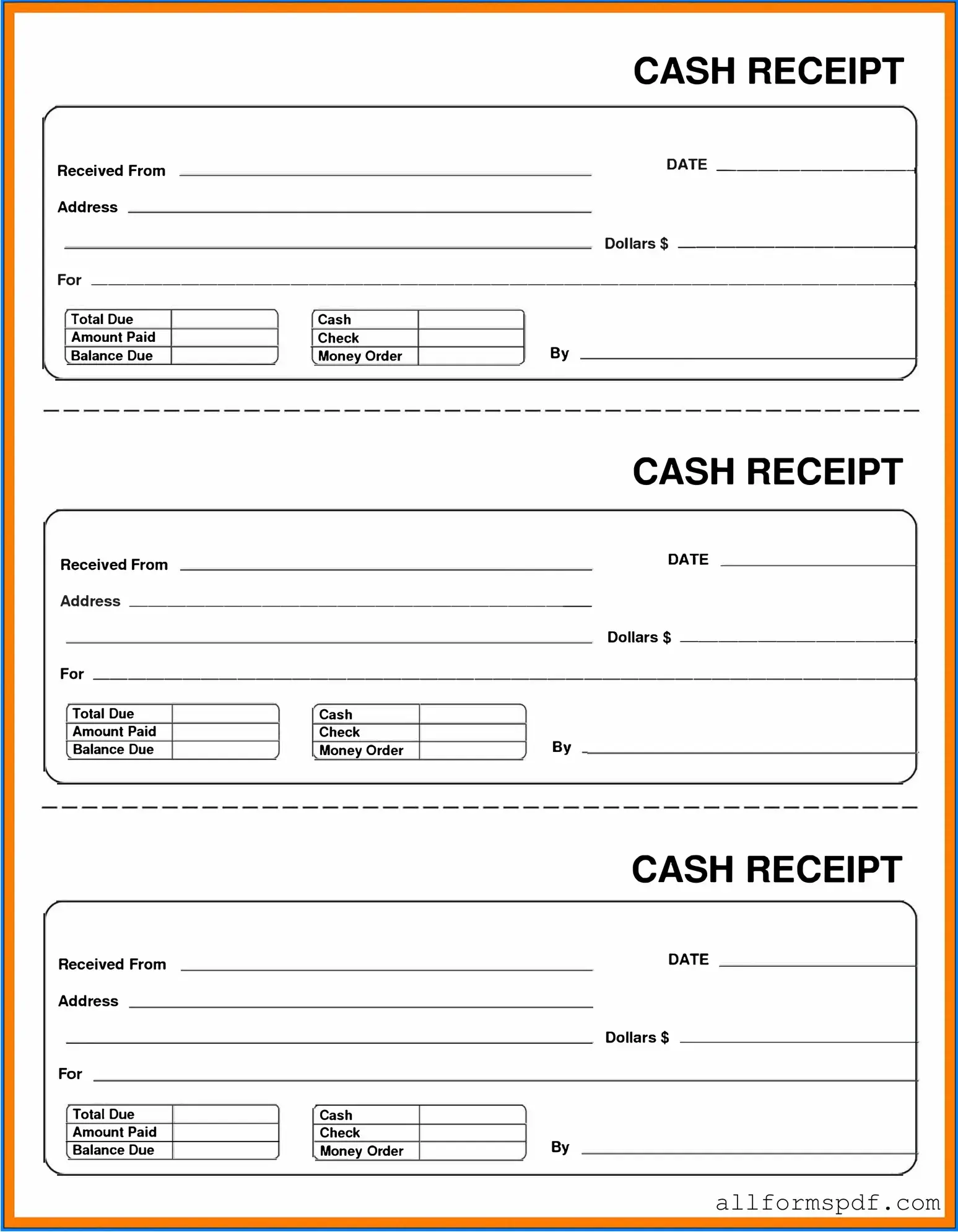

After gathering all necessary information, you are ready to complete the Cash Receipt form. This form will require specific details to ensure accurate record-keeping and processing. Follow the steps below to fill it out correctly.

- Begin by entering the date of the transaction at the top of the form.

- Next, fill in the receipt number in the designated field. This number should be unique to each transaction.

- Provide the name of the payer. Ensure the spelling is correct to avoid any confusion.

- In the next section, indicate the amount received. Use numerals and, if necessary, spell out the amount in words for clarity.

- Specify the payment method used, such as cash, check, or credit card.

- Include a description of the purpose for the payment. This helps clarify the transaction for future reference.

- Finally, sign the form in the designated area to validate the receipt.

Misconceptions

When it comes to the Cash Receipt form, there are several misconceptions that can lead to confusion. Understanding these common misunderstandings can help individuals and businesses use this form correctly and effectively. Here are five prevalent misconceptions:

-

Misconception 1: The Cash Receipt form is only for businesses.

This is not true. While many businesses use cash receipts to document transactions, individuals can also use them for personal financial records. Anyone receiving cash can benefit from this form.

-

Misconception 2: A Cash Receipt form is only necessary for large transactions.

Many believe that cash receipts are only needed for significant amounts. In reality, documenting any cash transaction, regardless of size, is a good practice. This helps maintain accurate records and can be useful for personal budgeting or tax purposes.

-

Misconception 3: Cash Receipt forms are only for cash payments.

While the name suggests it’s only for cash, these forms can also be used for other payment types, like checks or money orders. The important part is documenting the receipt of funds, no matter the method.

-

Misconception 4: Once a Cash Receipt form is filled out, it cannot be changed.

This is misleading. If an error is made, it is possible to correct it. Typically, a new receipt may be issued, or corrections can be noted directly on the original form, depending on the organization’s policies.

-

Misconception 5: Cash Receipt forms are not legally binding.

While they may not carry the same weight as contracts, cash receipts do serve as proof of transaction. They can be important for record-keeping and may be used in disputes or audits, so keeping them organized is crucial.

By dispelling these misconceptions, individuals and businesses can better utilize the Cash Receipt form to manage their financial transactions effectively.

Dos and Don'ts

When filling out the Cash Receipt form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are seven things to do and avoid:

- Do double-check all amounts entered to prevent errors.

- Do use clear and legible handwriting or type the information if possible.

- Do include the date of the transaction to maintain a proper record.

- Do specify the purpose of the payment for clarity.

- Don't leave any required fields blank; fill in all necessary information.

- Don't use correction fluid or tape to fix mistakes; draw a line through errors and write the correct information nearby.

- Don't forget to sign the form if required; your signature may be necessary for validation.

Other PDF Forms

Joint Tenancy in California - The affidavit provides legal documentation of the death for property management purposes.

Roof Estimate Template - Get a breakdown of potential roofing expenses through this form.

The Florida Motor Vehicle Power of Attorney form is a legal document that allows someone to appoint another person to handle matters related to their vehicle on their behalf. This can include tasks such as registration, titling, and selling. It's an essential tool for anyone who needs someone else to manage their vehicle affairs, especially when they're unable to do so themselves. For more information on this important document, you can visit All Florida Forms.

How to Make Fake Insurance Card - Check the expiration date regularly to ensure validity.

Common mistakes

Filling out a Cash Receipt form may seem straightforward, but many individuals make common mistakes that can lead to confusion or even financial discrepancies. One frequent error is failing to include the date of the transaction. Without this crucial piece of information, tracking the payment becomes difficult, and it may create issues during audits or reconciliations.

Another common mistake is neglecting to write the amount in both numeric and written form. When only one format is provided, it can lead to misunderstandings or disputes about the actual amount received. Always ensure both formats are included to eliminate any potential confusion.

People often forget to include the name of the payer. This detail is essential for record-keeping and accountability. Without a clear identification of who made the payment, it may be challenging to trace back the transaction in the future.

Additionally, some individuals overlook the importance of specifying the purpose of the payment. Providing a brief description helps clarify the nature of the transaction and can assist in categorizing it correctly in financial records.

Another mistake is not signing the Cash Receipt form. A signature serves as a verification of the transaction and confirms that the cash was indeed received. Skipping this step can lead to disputes or questions about the legitimacy of the receipt.

Many people also forget to include the payment method, such as cash, check, or credit card. This information is vital for accounting purposes and helps in reconciling the cash flow accurately.

Errors in the calculation of the total amount received are also quite common. Double-checking the math can save time and prevent future discrepancies. A simple miscalculation can lead to significant issues down the line.

Some individuals fail to keep a copy of the Cash Receipt form for their records. Retaining a copy is essential for both parties involved in the transaction. It serves as proof of payment and can be referenced in case of any future disputes.

Another mistake is not using the correct format or template for the Cash Receipt form. Using an outdated or incorrect version can lead to confusion and may not meet organizational or legal standards.

Lastly, people sometimes rush through the process, leading to incomplete or illegible information. Taking the time to fill out the form carefully ensures that all necessary details are captured clearly, making it easier for everyone involved.

Key takeaways

When using a Cash Receipt form, there are several important points to keep in mind. Here are key takeaways to ensure proper completion and usage:

- Accuracy is crucial. Always double-check the information you enter. Mistakes can lead to financial discrepancies.

- Include all relevant details. Make sure to fill in the date, amount received, and the payer's information.

- Use clear handwriting or type the information. This helps avoid misunderstandings and ensures that records are easily readable.

- Keep a copy for your records. Retaining a copy of the Cash Receipt can be helpful for future reference and audits.

- Issue receipts promptly. Providing the receipt as soon as the payment is made reinforces trust with the payer.

- Record the payment in your accounting system. Ensure that your financial records reflect the transaction accurately.

- Store receipts securely. Protecting these documents is important for both accountability and compliance.

- Understand the purpose of the Cash Receipt. It serves as proof of payment and can be used in case of disputes.

- Consult with a professional if unsure. If you have questions about filling out the form, seek advice from an accounting professional.