Fill Out Your Cash Drawer Count Sheet Form

Cash Drawer Count Sheet - Usage Guidelines

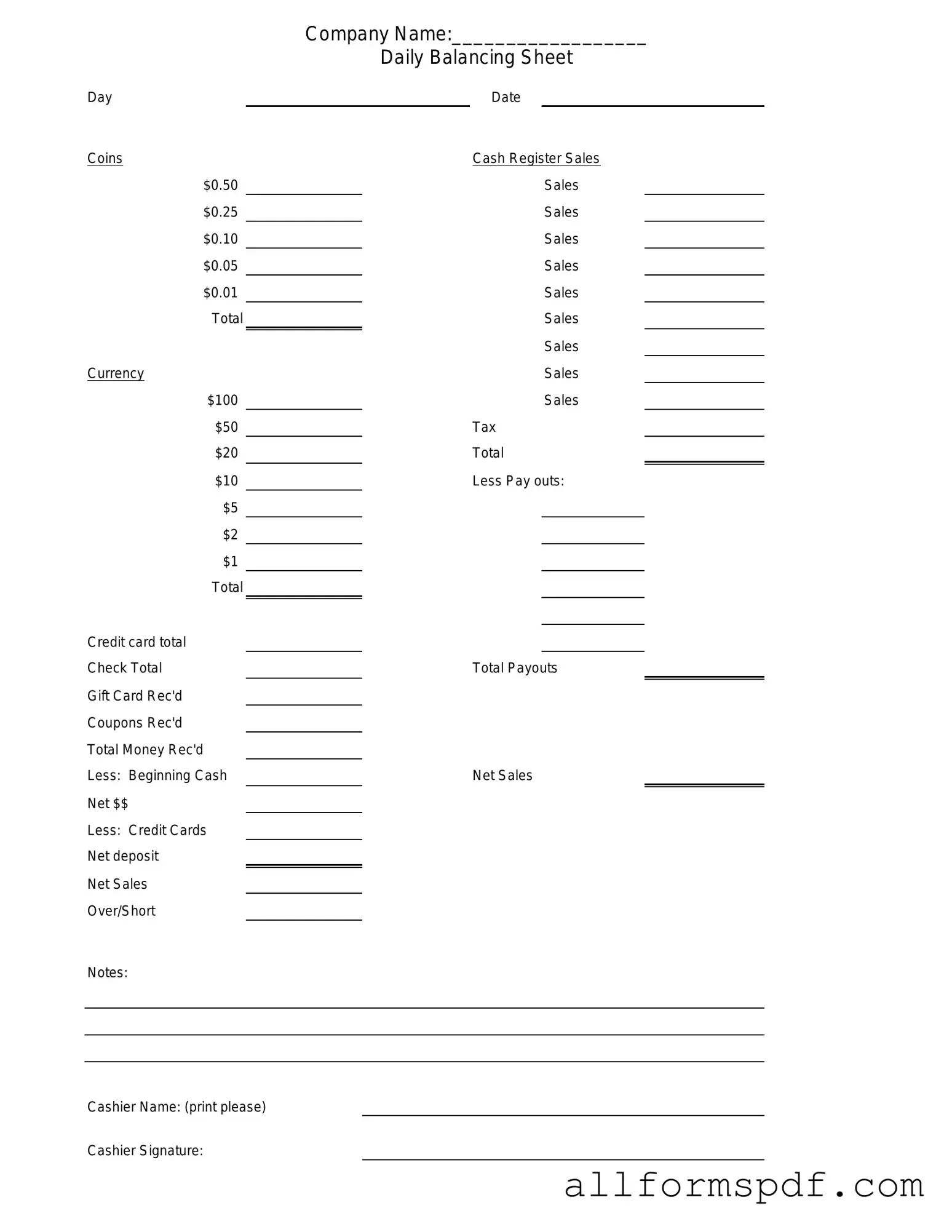

Once you have the Cash Drawer Count Sheet in front of you, it’s time to gather the necessary information to complete it accurately. This form will help track the cash in your drawer, ensuring accountability and transparency. Follow the steps below to fill it out correctly.

- Begin by entering the date at the top of the form. Make sure to use the correct format, typically MM/DD/YYYY.

- Next, write down your name or the name of the person responsible for the cash drawer.

- In the designated section, list the starting cash amount. This is the total cash that was in the drawer at the beginning of your shift.

- Count the cash in the drawer. Carefully categorize the bills and coins. Record the total amount of each denomination.

- In the appropriate section, enter the total cash counted. This should be the sum of all the denominations you recorded.

- If applicable, note any cash discrepancies in the specified area. This could include any shortages or overages compared to the expected amount.

- Finally, sign and date the form at the bottom to confirm that the count has been completed.

With the form filled out, it will be ready for submission. Ensure that it is reviewed for accuracy before handing it over to the designated supervisor or manager.

Misconceptions

Many people have misunderstandings about the Cash Drawer Count Sheet form. These misconceptions can lead to confusion and improper usage. Here are six common misconceptions:

-

It is only necessary for large businesses.

Many small businesses also benefit from using a Cash Drawer Count Sheet. It helps track cash flow and ensures accountability, regardless of the size of the operation.

-

It is only used at the end of the day.

While many businesses do use it at the end of the day, it can also be used throughout the day. Regular counts can help identify discrepancies sooner.

-

Only cashiers need to fill it out.

Management should also be involved in the process. This ensures that there is oversight and that the counts are accurate and trustworthy.

-

It is a complicated form that takes too much time.

The Cash Drawer Count Sheet is designed to be straightforward. With a little practice, completing it can be done quickly and efficiently.

-

It is unnecessary if you use a point-of-sale system.

Even with a point-of-sale system, physical cash counts are crucial. They help verify that the electronic records match the actual cash in the drawer.

-

It is only for tracking cash.

The form can also be used to track other forms of payment, such as checks or credit card receipts, providing a comprehensive view of daily transactions.

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do double-check the amounts entered to ensure accuracy.

- Do record the date and your name clearly at the top of the form.

- Don't leave any sections blank; every part of the form should be filled out.

- Don't forget to sign the form after completing it to confirm its accuracy.

By following these guidelines, you can help ensure that the cash drawer count is accurate and reliable. This not only aids in financial accountability but also fosters trust within your team.

Other PDF Forms

How to Write Daily Report Examples - Provides a framework for improving security protocols.

When engaging in a vehicle transaction, it's vital to utilize the Florida Motor Vehicle Bill of Sale form, which lays out the specifics of the sale and protects both parties involved. This document, capturing important details like the vehicle's make, model, year, and VIN, is essential for ensuring a smooth ownership transfer. For those seeking to obtain this form, you can easily find it at All Florida Forms, which provides a comprehensive resource for all necessary paperwork.

Asurion Wireless - This tool helps keep records of customer interactions for future reference.

Form I983 - The I-983 addresses compliance with federal and state laws regarding training.

Common mistakes

Filling out the Cash Drawer Count Sheet form is an essential task for maintaining accurate financial records. However, many individuals make common mistakes that can lead to discrepancies and confusion. One frequent error is failing to double-check the starting cash balance. Before recording the cash amount, it is crucial to ensure that the initial figure is accurate. This simple oversight can set off a chain of errors throughout the entire form.

Another common mistake is not counting the cash properly. People sometimes rush through the counting process, which can result in missed bills or incorrect totals. Taking the time to count each denomination carefully can prevent future issues. It's also advisable to have a second person verify the count. This extra step can catch mistakes that might otherwise go unnoticed.

Inaccurate recording of cash totals is another issue that arises frequently. Individuals may write down the wrong amounts due to misreading their calculations or simply making a typographical error. It is essential to take a moment to review the numbers entered on the form. A quick glance can help ensure that the totals match the counted cash.

Additionally, people often forget to include all cash types, such as coins or checks. Focusing solely on bills can lead to an incomplete cash count. It’s important to remember that every dollar counts, regardless of its form. Including all cash types provides a complete picture of the drawer's contents.

Another mistake involves neglecting to record discrepancies. If the counted cash does not match the expected amount, it’s vital to document this difference on the form. Failing to do so can create confusion later on when reconciling accounts. Transparency about discrepancies can help identify patterns or issues that need addressing.

Some individuals also overlook the importance of signing and dating the Cash Drawer Count Sheet. This step serves as a verification of the count and provides accountability. Without a signature and date, the document may lack credibility and could lead to questions about its accuracy.

Lastly, not storing the completed form properly can lead to issues down the line. Once the Cash Drawer Count Sheet is filled out, it should be placed in a designated area for record-keeping. Keeping these documents organized ensures that they can be easily accessed for audits or reviews in the future.

Key takeaways

When utilizing the Cash Drawer Count Sheet form, it is essential to follow certain guidelines to ensure accuracy and efficiency. Below are key takeaways to consider:

- Always start with a clean and organized cash drawer to facilitate an accurate count.

- Use the Cash Drawer Count Sheet to document all cash and checks present in the drawer.

- Clearly label each section of the form to avoid confusion during the counting process.

- Ensure that all amounts are counted twice for verification purposes, minimizing the chance of errors.

- Record any discrepancies immediately to address them in a timely manner.

- Include the date and your name on the form for accountability and record-keeping.

- Store completed forms in a secure location to protect sensitive financial information.

- Review the completed count sheet with a supervisor if required, fostering transparency.

- Regularly update and maintain the Cash Drawer Count Sheet to reflect any changes in cash handling procedures.

Following these guidelines will help ensure that the cash drawer is managed effectively, providing peace of mind and maintaining financial integrity.