Fill Out Your California Death of a Joint Tenant Affidavit Form

California Death of a Joint Tenant Affidavit - Usage Guidelines

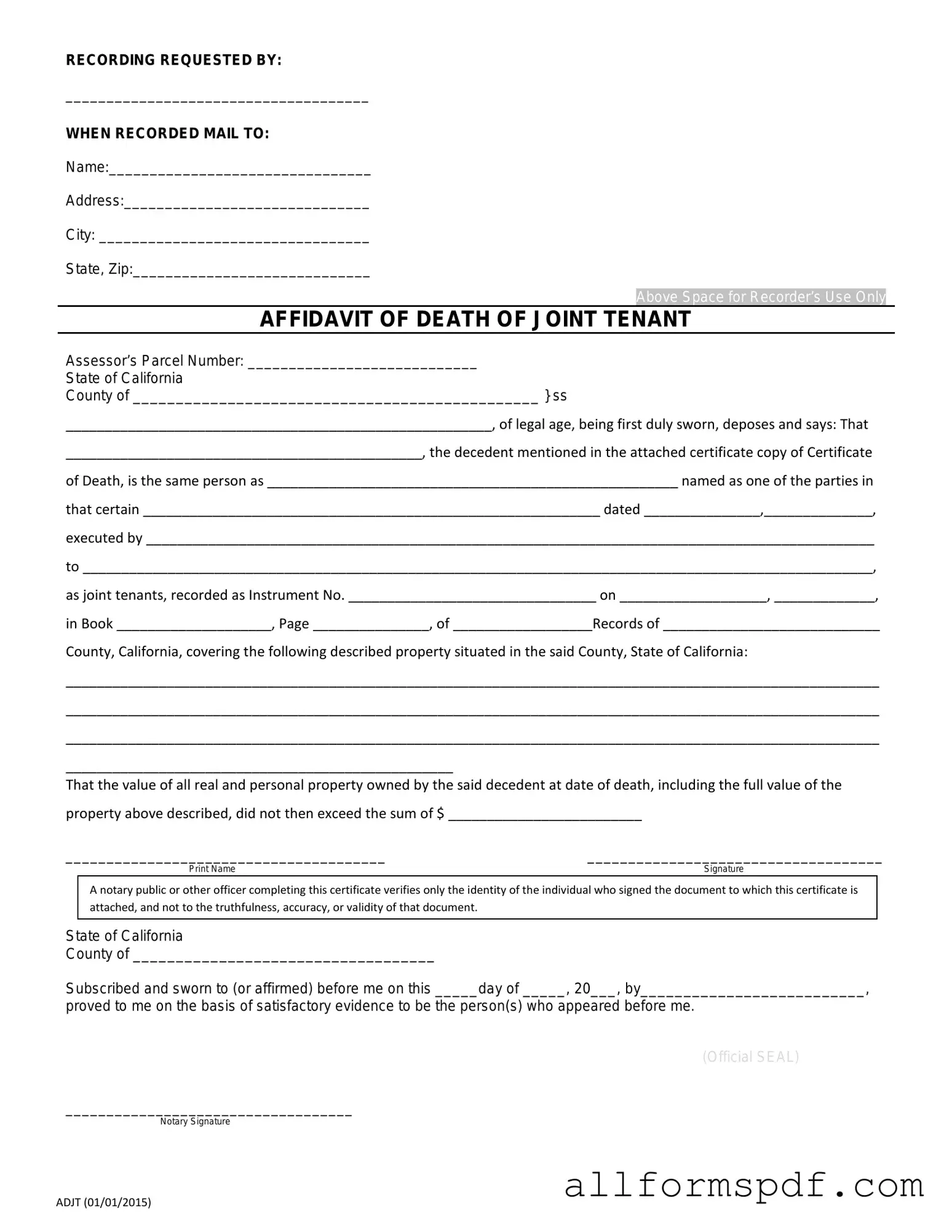

Filling out the California Death of a Joint Tenant Affidavit form is an important step in managing the affairs of a deceased joint tenant. Once completed, this form allows the surviving joint tenant to establish their ownership of the property. Here’s how to fill out the form accurately and efficiently.

- Begin by entering the name of the deceased joint tenant in the designated section. Make sure to spell the name correctly.

- Next, provide the date of death of the joint tenant. This is typically found on the death certificate.

- Fill in the address of the property that was jointly owned. Include the street address, city, and zip code.

- In the section for the surviving joint tenant, write your full name. This confirms your status as the surviving owner.

- Include your current address. This should be your residence where you can be reached.

- Next, state your relationship to the deceased. This could be spouse, sibling, friend, etc.

- Sign the affidavit in the designated area. Your signature confirms the accuracy of the information provided.

- Finally, date your signature. This shows when you completed the form.

After filling out the form, make sure to review all the information for accuracy. Once you’re satisfied, you can file it with the appropriate county office or use it as needed in legal proceedings related to the property.

Misconceptions

The California Death of a Joint Tenant Affidavit form is an important legal document that allows for the transfer of property ownership upon the death of a joint tenant. However, several misconceptions surround this form, which can lead to confusion and potential legal issues. Here are six common misconceptions:

- It is only needed for real estate transactions. Many believe that this affidavit applies solely to real estate. In reality, it can also be used for other types of joint property, such as bank accounts or vehicles.

- All joint tenants must sign the affidavit. Some assume that the surviving joint tenant must obtain signatures from all joint tenants. However, only the surviving joint tenant needs to complete and sign the affidavit after the death of the other joint tenant.

- The affidavit can be filed at any time. There is a misconception that timing does not matter when filing the affidavit. In fact, it is essential to file it promptly after the death of the joint tenant to ensure a smooth transfer of ownership.

- The form is the same for all counties in California. Some individuals think that the affidavit is uniform across the state. However, certain counties may have specific requirements or additional forms that need to be submitted along with the affidavit.

- It eliminates the need for a will. A common belief is that completing the affidavit negates the necessity for a will. While the affidavit facilitates the transfer of joint property, it does not replace the need for a comprehensive estate plan.

- The affidavit guarantees the transfer of property without any issues. Lastly, some people think that once the affidavit is filed, the transfer is automatic and without complications. While it does initiate the transfer, other factors, such as outstanding debts or disputes, can affect the process.

Understanding these misconceptions can help individuals navigate the complexities of property transfer after the death of a joint tenant. Proper knowledge ensures that the process is handled smoothly and in accordance with the law.

Dos and Don'ts

When filling out the California Death of a Joint Tenant Affidavit form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are six things to do and not do:

- Do provide accurate information about the deceased joint tenant, including their full name and date of death.

- Do include details about the property, such as the address and legal description, to avoid any confusion.

- Do sign the affidavit in front of a notary public to validate the document.

- Do keep a copy of the completed affidavit for your records.

- Don't leave any sections of the form blank; incomplete forms may be rejected.

- Don't use unclear or ambiguous language when describing the property or the relationship to the deceased.

Other PDF Forms

Did I Miscarry - Regulations regarding neonatal loss are referenced for the benefit of parents.

The Florida Vehicle POA form 82053 is a legal document that allows someone to appoint another person to handle tasks related to their vehicle on their behalf. This could range from registration and titling to the sale or purchase of the vehicle. For additional information and access to necessary documents, you can visit All Florida Forms, which provides a convenient way for vehicle owners to ensure their affairs are managed even when they cannot handle them personally.

USCIS Form I-864 - USCIS thoroughly reviews the I-864 during the immigration process.

Common mistakes

Filling out the California Death of a Joint Tenant Affidavit form can be a straightforward process, but many individuals make common mistakes that can lead to delays or complications. One frequent error is failing to provide accurate information about the deceased joint tenant. It is essential to ensure that the name, date of death, and other identifying details are correct. Any discrepancies can create confusion and may require additional documentation.

Another mistake often made involves neglecting to include the correct property description. The affidavit should clearly describe the property in question, including the address and any relevant legal descriptions. Omitting this information or providing vague details can result in issues with property transfer and ownership verification.

Additionally, some individuals overlook the requirement for notarization. The affidavit must be signed in the presence of a notary public. Without this step, the document may be considered invalid, leading to potential legal challenges down the line. Ensuring that the affidavit is properly notarized is crucial for its acceptance.

Many people also fail to include all necessary supporting documents. Alongside the affidavit, it is often required to provide a certified copy of the death certificate. Neglecting to attach this document can cause delays in processing the affidavit and may hinder the transfer of property ownership.

Another common oversight is not understanding the implications of the affidavit. Some individuals may not realize that by completing this form, they are effectively transferring ownership of the property. It is vital to consider the implications of this transfer and ensure that all parties involved are aware and in agreement.

Lastly, individuals sometimes misinterpret the timeline for filing the affidavit. There may be specific time frames within which the affidavit must be submitted following the death of a joint tenant. Missing these deadlines can complicate the process and may lead to additional legal hurdles. Staying informed about these timelines is essential for a smooth transition of property ownership.

Key takeaways

Filling out and using the California Death of a Joint Tenant Affidavit form is an important process for ensuring the smooth transfer of property ownership. Here are five key takeaways to consider:

-

Understand the Purpose: This form serves to establish the death of one joint tenant, allowing the surviving tenant to claim full ownership of the property without going through probate.

-

Gather Required Information: Before filling out the form, collect necessary details such as the deceased tenant’s name, date of death, and property information. This will help streamline the process.

-

Complete the Form Accurately: Ensure that all sections of the affidavit are filled out correctly. Mistakes or omissions can lead to delays in the transfer process.

-

Obtain Signatures: The affidavit must be signed by the surviving joint tenant. It may also require notarization to validate the document.

-

File with the County Recorder: After completing and signing the affidavit, it should be filed with the county recorder’s office where the property is located. This step is crucial for updating public records.

By following these guidelines, individuals can navigate the process with greater ease and ensure that their property rights are protected.